HSB Contractors' Plant

Brokers and Agents

Cover for unforeseen loss or damage to owned or hired-in plant and machinery; for the construction industry’s commercial/residential projects and non-construction manufacturers and businesses.

properties.trackTitle

properties.trackSubtitle

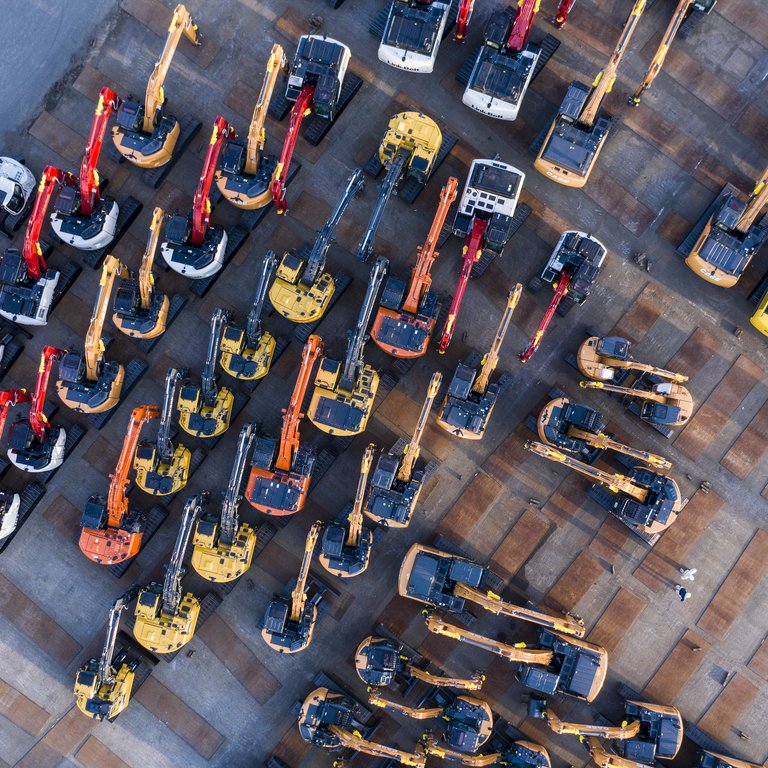

The construction industry depends upon a wide range of plant and equipment; from tower cranes and large mobile cranes, to excavators, generators and hand tools. Non-construction industry manufacturers and businesses also often need to hire in machinery and equipment.

Due to the nature and use of these types of plant, they are susceptible to risks such as damage on site, damage in transit, fire and theft.

What is contractors' plant insurance?

Contractors' plant insurance can provide comprehensive cover for unforeseen loss or damage to owned or hired-in plant and machinery; for the construction industry's commercial, residential, and civil engineering projects, and non-construction manufacturers and businesses.

HSB Contractors' Plant Insurance is targeted at equipment owners, hirers, and construction industry contractors/sub-contractors, and provides:

- cover on a specified or blanket basis for owned plant

- broad description of plant cover covered with owned plant insurance on a reinstatement (new for old) basis up to 24 months old

- legal liability cover for hired-in plant under the terms of the hire agreement

- cover for plant whilst hired out

HSB Contractors' Plant Insurance contains no security conditions as standard. However, premium discounts are available for customers who install quality security systems (such as Thatcham-approved devices) and register with the Construction Equipment Security and Registration scheme (CESAR).

Cover extends to include:

- repair investigation costs

- debris removal

- recovery of immobilised plant

- theft of fuel from insured plant

- damage to unmanned aerial devices whilst not being operated

- CPA contract lifts

- Fire Brigade charges

- loss of keys

- transit by roll on/roll off ferry

- temporary removal outside of the territorial limits but within the European Union

What is our contractors' plant insurance underwriting appetite?

In appetite

- Airside plant

- Building contractors

- Demolition contractors

- Groundworkers

- Internal and secondary fix traded, such as plastering, joinery, painting, glazing, and flooring

- Mechanical and electrical installers

- Mobile plant associated with manufacturing

- Plant hirers

- Plumbing, heating, and ventilation

- Rail-adapted plant

- Residential, commercial, and educational building projects

- Steel erectors

- Warehousing, distribution, and haulage

Territorial limits

UK, Republic of Ireland, Isle of Man, and the Channel Islands.

Fringe appetite

- Bridgework

- Drain and land surveyors

- Drilling contractors

- Forestry/logging

- Sawmills

- Scrap metal

- Timber processing

- Waste transfer, landfill, recycling

- Wet civil engineering

Territorial limits

UK, Republic of Ireland, Isle of Man, and the Channel Islands.

Outside appetite

- Mining

- Offshore/wet risks

- Rolling stock

- Shaft sinking

- Tunnelling

Can HSB provide construction insurance outside of the UK or Republic of Ireland?

Why consider contractors' plant insurance from HSB?

Our underwriters and risk engineers have extensive experience in providing construction insurance and are recognised as experts in this field. Drawing on our vast expertise in the construction sector, we are able to provide insurance products to meet the insurable risks of a specific project.

- Policy wordings specifically designed with contractors/sub-contractors, property builders and developers, and construction plant owners in mind

- Extensive underwriting expertise

- Specialist engineering knowledge of plant and machinery

- Cover available across the UK and Ireland

- Access to experienced in-house construction loss control risk engineers

- Access to claims handlers and loss adjusters with specialist knowledge of the construction industry

UK-based arm of

HSB Group

The equipment breakdown insurance and inspection market leader since 1866.

Part of

Munich Re

A world leader in risk solutions, consistent risk management, and financial stability.

Rated A++ (Superior) by

A.M. Best Company

Financially strong and stable.

Member of the Institute of

Customer Service

Demonstrating our commitment to continually improving customer service performance and professionalism.

Trading options

Non e-trade

Supported by our customer-centric team of underwriting and business development professionals.

E-trade

Access our e-trade products via our online solutions: HSB Fast Track or Acturis; fully supported by our E-Trade Team.

HSB is committed to providing a superior customer experience through our specialist claims service

HSB Construction Insurance in action

Accidental damage to an excavator

£27,779

Claim paid

Accidental damage to a hired-in surveying station

£3,201

Claim

Theft of a hired-in digger

£8,000

Claim

Product documentation

Insights

Contact a HSB broker team

These may also interest you

Frequently asked questions

What is Contractors' Plant Insurance?

Contractors Plant Insurance provides cover for unforeseen loss or damage to owned or hired-in plant and machinery; for the construction industry's commercial and residential projects, and non-construction manufacturers and businesses.

What is Machinery Movement Insurance?

Machinery Movement Insurance is an element of cover for the loss and damage caused to plant and machinery during the transit and installation process across commercial, residential, and civil engineering projects; for one-off moves or on an annual basis.

What is our contractors' plant insurance underwriting appetite?

HSB Contractors' Plant insurance can provide comprehensive cover for unforeseen loss or damage to owned or hired-in plant and machinery; for the construction industry's commercial and residential projects, and non-construction manufacturers and businesses.

HSB Contractors' Plant Insurance is targeted at equipment owners, hirers, and construction industry contractors/sub-contractors,