HSB Construction Insurance

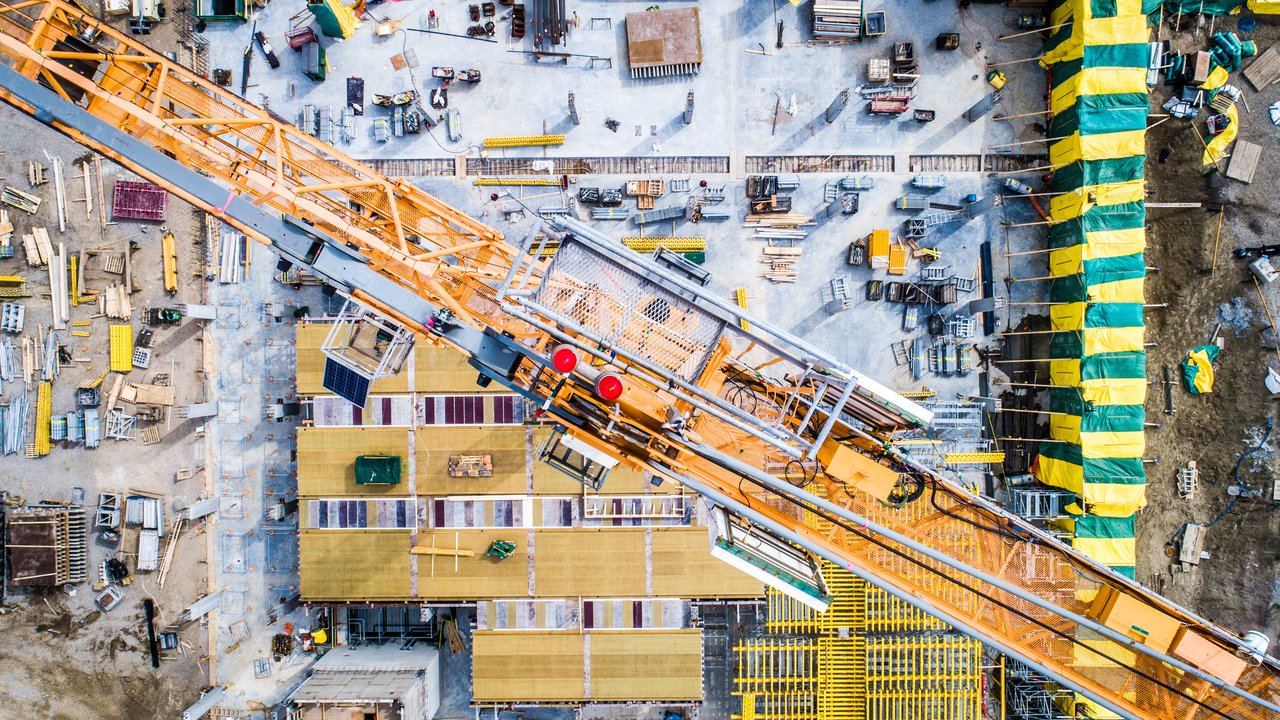

Our range of solutions designed to mitigate construction, building, and civil engineering project risks

properties.trackTitle

properties.trackSubtitle

All construction, erection, and installation work contain an element of risk

What is construction insurance?

What types of construction insurance can we provide?

Brokers and agents

E-trade products

Can HSB provide construction insurance outside of the UK or Republic of Ireland?

What is our construction insurance underwriting appetite?

Brokers and agents

E-trade products

Why should you consider construction insurance from HSB?

Our underwriters and risk engineers have extensive experience in providing construction insurance and are recognised as experts in this field. Drawing on our vast expertise in the construction sector, we are able to provide insurance products to meet the insurable risks of a specific project.

- Policy wordings specifically designed with contractors, property developers and construction plant owners in mind

- Extensive underwriting expertise

- Specialist engineering knowledge of plant and machinery

- Cover available across the UK and Ireland

- Access to experienced in-house construction loss control risk engineers

- Access to in-house claims handlers, and loss adjusters, with specialist knowledge of the construction industry

UK-based arm of

HSB Group

The equipment breakdown insurance and inspection market leader since 1866.

Part of

Munich Re

A world leader in risk solutions, consistent risk management, and financial stability.

Rated A++ (Superior) by

A.M. Best Company

Financially strong and stable.

Member of the Institute of

Customer Service

Demonstrating our commitment to continually improving customer service performance and professionalism.

HSB is committed to providing a superior customer experience through our specialist claims service

Frequently asked questions

What is Contractors' All Risks Insurance/Contract Works Insurance (CAR)?

Contractors' All Risks Insurance (also known as 'Contract Works Insurance' or CAR Insurance') provides cover for any damage that occurs during construction projects. Available on a single risk or annual basis, our policy can be arranged in the name of the contractor, the principal or joint names depending on the project requirement.

HSB's policy can be extended to include advance loss of profits, owned contractors' plant and hired-in plant, and employees' tools and personal effects.

What is Erection All Risks Insurance (EAR)?

Erection All Risks Insurance provides cover for construction and non-construction mechanical and electrical machinery installation and refurbishment across projects; available on a single risk or annual basis. HSB's policy can be arranged in the name of the contractor, the principal, or joint names depending on the project requirement.

What is Contractors' Plant Insurance?

Contractors Plant Insurance provides cover for unforeseen loss or damage to owned or hired-in plant and machinery; for the construction industry's commercial and residential projects, and non-construction manufacturers and businesses.

What is Machinery Movement Insurance?

Machinery Movement Insurance is an element of cover for the loss and damage caused to plant and machinery during the transit and installation process across commercial, residential, and civil engineering projects; for one-off moves or on an annual basis.

What is our construction insurance underwriting appetite?

Our construction all risks/contract works and erection all risks insurance policies can be arranged in the name of the contractor, the principal or joint names depending on the project requirement.

Our contractors’ plant insurance, available for owned or hired-in plant, is targeted at equipment owners, hirers, and construction industry contractors/sub-contractors. However, it is also relevant for manufacturers and businesses that often need to hire in machinery and equipment.