How evolving working trends are impacting computer-related risks

HSB research report

properties.trackTitle

properties.trackSubtitle

Foreword

The Covid-19 pandemic was the catalyst for significantly changing the future of where we work, heralding a cultural shift for employees to divide their time between on-site and remote home-based settings.

About HSB's research

HSB commissioned a survey of employed or self-employed workers to understand the opportunities and challenges arising from modern day working practices in relation to computer insurance.

Our research has formed the basis for this research report, ‘How evolving working trends are impacting computer-related risks’. Within it, we examine the growth of hybrid work in the UK, its risks and benefits for employees and organisations, and its implications for UK businesses and the insurance sector. We explore the diverse preferences of employers implementing hybrid work policies, the impact on commuting patterns and technology usage, and the potential business continuity risks related to the UK’s increasing reliance on imported computing hardware.

Our research findings also suggest some misconceptions about computer insurance cover which could leave some businesses exposed, and underline the crucial role that brokers can play in supporting their clients in the new hybrid working landscape.

Is hybrid working here to stay?

The seismic shift towards hybrid working has revolutionised the way we think about offices and remote working. Research by Slack revealed that an overwhelming 98% of business leaders were rethinking their physical office usage and investing in hybrid work technology based on fewer employees coming into the office during the pandemic1. In contrast, amid continued economic instability, 2023 has seen a minority of companies attempt to backtrack on flexible working patterns and mandating more office in-person days2.

What is clear though is that the era of the five days-a-week, nine-to-five office schedule is over. There is no longer a ‘one-size-fits-all’ solution which will dictate a ‘standard’ way of working due to the diverse preferences of employers implementing hybrid working policies.

Hybrid working: the impact on computer insurance

Hybrid working has sparked a fundamental change in how we work, combining the best benefits of working from home and going into an office. But these emerging trends must be balanced with understanding the potential risks for businesses as employees increasingly work from home, particularly regarding insurance for computer equipment.

1. Evolving working trends

Key findings

64%

of UK workers are presently engaged in hybrid working

24%

remain in traditional office-only settings

72%

rate the importance of hybrid or remote work at seven or higher (out of 10) when considering future job prospects

Pre and post-pandemic working trends

Prior to the Covid-19 pandemic, the appeal of remote and hybrid working was gradually on the rise. In 2019, 12% of the UK workforce worked from home at least one day per week, with the most popular remote working areas being London, the South East, and South West England3. The introduction of national lockdown measures and other social distancing restrictions from late March 2020 saw remote work adoption peak in June 2020, which led to 38% of the UK’s 33 million workforce at this time reverting to being predominantly home-based (up from 5% in 2019)4.

Having become accustomed to the greater flexibility of working from home, many employees appear reluctant to return to their previous office routines following the lifting of all Covid-19 restrictions in February 2022 - either because of safety or financial concerns, or an unwillingness to sacrifice the increased flexibility and convenience they’ve become accustomed to enjoying in remote settings.

A new era of hybrid working trends

Hybrid working: Before, during, and after Covid-19 lockdown measures

Before Covid-19 lockdown measures

During Covid-19 lockdown measures

After Covid-19 lockdown measures were lifted

Current

We asked respondents: How important is hybrid or remote working?

Businesses' plans to implement hybrid working

Tips

Businesses should check that they are covered by their insurance policy

Always keep your insurer informed of any changes to your business circumstances

Check whether the insurance covers computer equipment and other hardware away from the office location.

2. Risky business - accidental damage and theft

Key findings

55%

of UK workers have dedicated home offices or studies

20%

work in shared living spaces

52%

experienced lost or damaged computer equipment, with laptops and mobiles accounting for almost two-thirds of these incidents

54%

of incidents occurred whilst commuting

The hybrid working landscape – what does this mean for computer equipment and insurance requirements?

Undisputedly, hybrid working is here to stay. Whilst the initial focus has been on transitioning IT equipment and employees, many businesses may have not considered the potential risks and impact on computer equipment over the longer term.

Our research findings suggest that UK businesses need to consider how they manage their computer insurance risks to minimise the challenges and costs associated with damaged and lost equipment.

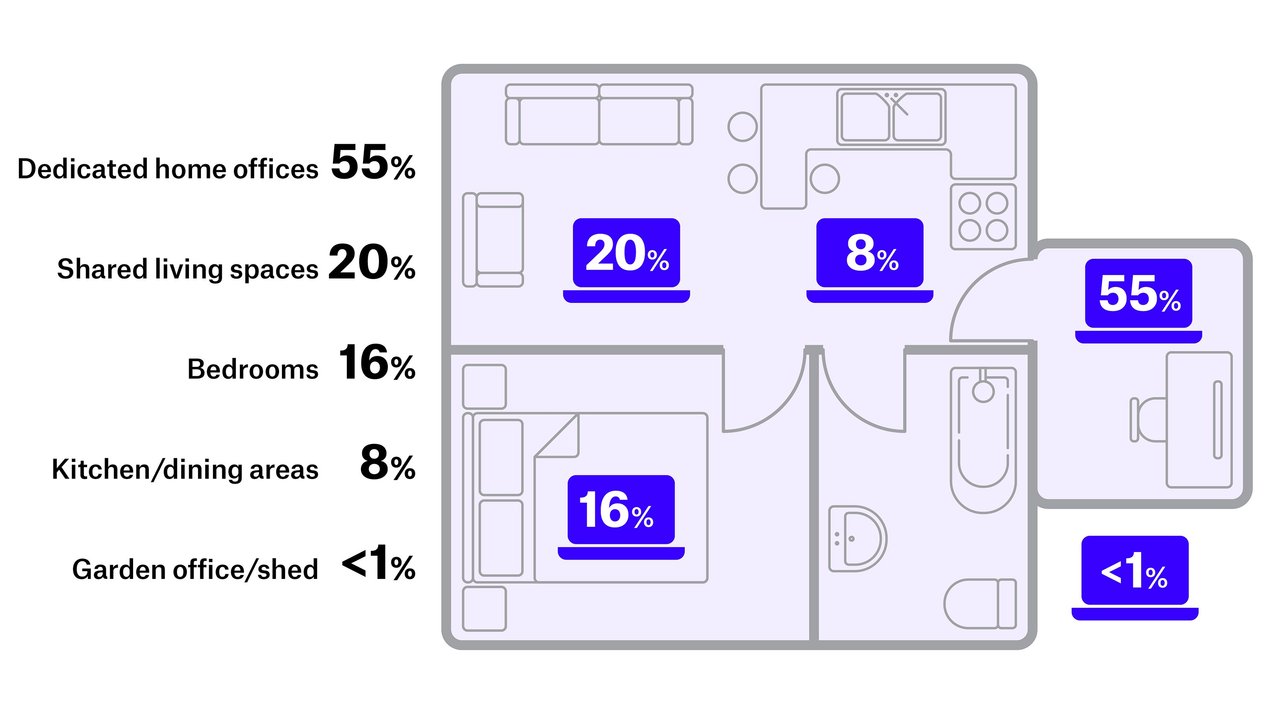

Adapting to hybrid work - We asked respondents: Where in your homes are you working?

Most hybrid workers (55%) now have dedicated home offices or studies. However, 1 in 5 (20%) work in shared living spaces such as living rooms or dining rooms. Meanwhile, bedrooms serve as the workspace for 16%, whilst 8% work in kitchen/dining areas.

Despite the pandemic creating a surge in popularity for ‘garden rooms’ as people sought to create extra living space, less than 1% of the respondents in HSB’s survey use outdoor spaces such as garden offices or sheds for work purposes.

An increasing reliance on laptops and mobile devices

A large majority of hybrid workers have been provided with a laptop

Laptop devices have arguably become the most important piece of equipment in our professional lives. Not only do they boost productivity by enabling employees to work from anywhere, they also allow remote workers to access collaborative applications online via the cloud.

However, as more businesses transition to hybrid working, home-based accidental damage incidents to computer equipment have risen.

HSB's survey revealed that 46% experienced lost (14%) or damaged (32%) computer equipment, with laptops and mobiles accounting for 60% of these incidents; with typical causes including theft, physical damage from trips or falls, drinks spillages, and wear and tear.

Whilst a large proportion (63%) sought professional help for repairs, 17% opted to repair it themselves or asked a friend for help. Surprisingly, 10% of respondents didn't report the loss or damage to their employer, which may suggest they feared being reprimanded or believed they could fix the issue themselves.

Accidents can happen anywhere, but are commuters more at risk?

54%

of loss or damage incidents occurred during commuting

Similarly, as more employees transport computer equipment between their home and work premises, the risk of theft or them misplacing equipment during their journey also appears to be increasing.

A more significant proportion (54%) of loss or damaged incidents occurred during commuting, with laptops and mobile phones cited as the most vulnerable items, with 42% admitting computer equipment was stolen from their bags.

Assess evolving computer risks

Tips

An up-to-date hybrid working policy

Transporting computer equipment to/from work premises

Policy’s coverage wide enough to replace damaged or lost equipment?

Laptops and smartphones more vulnerable to accidental damage and theft

The policy should provide clear guidelines about when and where company laptops and mobile devices are to be used.

3. The real cost of computer equipment to a business’s bottom line

Key findings

50%

increase in the average value for a single laptop between 2018 and 2022

55%

of those who damaged their computer equipment had their issues resolved within one week

19%

had to wait up to four weeks for their issue to be resolved

Rocketing laptop values could lead to underinsurance

Impacts of inflation

Delays for replacement equipment could hinder business continuity

A global shortage of semiconductor chips – a critical component in most computer equipment products – has led to shortages of computer hardware. The Covid-19 pandemic, and the transition to hybrid working practices, was the primary factor for the computer chip shortage. The knock-on effect of more people working from home meant that sheer demand for technology skyrocketed.

The UK increasingly relies on importing computer and laptops. According to the Observatory of Economic Complexity, in 2021 the UK was the sixth largest importer of computers in the world5. Furthermore, between January 2022 and 2023, UK imports of computers increased by £281m (35%) from £791m to £1.07bn, with the majority of imported equipment coming from the Netherlands, Germany and Hong Kong.

Worldwide computer chip shortages have impacted the availability of computer equipment and parts; causing delays for repairs and replacements.

Tips

Adequate cover for repairs and replacements

Businesses should review where all of their assets are and ensure valuations are up to date

Businesses need to be fully aware of what their exposure is

Consider switching from annual valuations to conducting mid-term valuations of computer equipment for insurance purposes.

4. Confusion reigns as almost half may not be insured for their computer equipment

Key findings

54%

said their computer equipment is covered by their business insurance policy when working from home, but 46% can't confirm it does

38%

said their home insurance policy covers work equipment, but 62% can't confirm it does

Are businesses scaling back insurance?

For businesses hampered by crippling expenses and tighter margins, insurance premiums may seem like an added cost they could do without. There is evidence to suggest that the cost of living crisis has led to some businesses scaling back their insurance cover, or in some instances even cutting it completely.

Statistics published in BIBA’s 2023 Manifesto, 'Managing Risk – Delivering Stability', state that 51% of businesses have stopped buying at least one insurance cover6. Before contemplating a similarly risk averse approach, businesses should carefully consider their exposures and the implications of the worst case scenario due to being uninsured.

Covered or not? Survey reveals uncertainty around computer equipment used at home

Given these statistics, many businesses may not have updated their insurance cover following the pandemic and, as a result, could be underinsured to some degree for computer equipment.

HSB's own research highlights a significant need for better communication around insurance between businesses and employees to ensure appropriate coverage for their computer equipment at home.

Despite 54% reporting that their business insurance policy covers computer equipment used at home, 46% couldn’t confirm that it does (13% of respondents specified it doesn’t, while 33% were unsure).

These figures indicate that almost half of the survey’s respondents could be left exposed if they are not adequately covered. Meanwhile, 38% of respondents indicated that their home insurance policy covers computer equipment, 30% said it doesn’t, and 32% were unsure.

Computer insurance – common misconceptions addressed

Your policy today no longer guarantees you are covered for tomorrow

Combined policies do not always provide specialist computer cover

The bare minimum cover doesn’t provide adequate protection in volatile trading environments

Almost half of the survey's respondents could be left exposed if they are not adequately covered

Tips

Businesses should seek the advice of insurance brokers

Businesses would benefit from having a fresh pair of eyes on their operations

Consider the implications of employees ferrying laptops, smartphones and other specialist computer equipment between home and office.

Conclusion

The pandemic forced many businesses to reinvent their operating models, but the shift towards new working trends poses unique challenges in relation to computer insurance. Whilst the initial focus has been on transitioning equipment and employees, some businesses may not have considered their insurance policies and the potential risk exposures of remote working over the longer term.

Although many businesses have willingly adapted to modern working trends, some have been slower to understand the insurance implications of new working practices to protect against accidental damage, loss and business continuity disruption. Those transitioning to remote working should review their existing policies to identify potential gaps and changing exposures in coverage that should be addressed. For example, property policies normally restrict cover to the business premises. This means that laptops, smartphones and other portable equipment which are used away from on-site premises may not be covered, and a specific computer policy may be required.

As employees increasingly divide their time between working from home and designated offices, the varying demands of the hybrid working environment is placing more pressure on businesses to counterbalance emerging risks. Laptops and portal equipment devices are more essential than ever, but as more employees move to hybrid working, accidental loss incidents and the risk of them misplacing computer equipment during commuting between their home and office could also rise.

By reviewing existing policies, enhancing coverage and seeking specialist advice, now is the time for businesses to take a fresh look at their insurance cover in the new working environment. Here, the role of insurance brokers to support their customers by making sure they have appropriate and adequate cover in place for their computer equipment cannot be understated.

How HSB can help

HSB's computer insurance policy provides comprehensive cover for commercial computer hardware, data losses, increased costs, and virus, hacking and denial of service. Our policy is split into sections, providing customers with the flexibility to choose the level of cover they need.

Our product is also accessible to BIBA members.

HSB's survey sample

HSB’s survey was conducted during April 2023 with a sample of 346 respondents as a representative sample of UK working adults. Purposive sampling was used. Please note that we cannot guarantee that the views of the survey sample are the same as the wider population, however, they are a representative sample.Sources:

1. It's official: Even bosses think the era of the physical office is over | TechRadar 2. The companies backtracking on flexible work | BBC Worklife 3. Characteristics of homeworkers, Great Britain | Office for National Statistics 4. The impact of remote and hybrid working on workers and organisation | UK Parliament Post 5. Computers in United Kingdom | OEC - The Observatory of Economic Complexity6. British Insurance Brokers' Association: BIBA Manifesto 2023 | Publitas 7. SMEs cut back on insurance spend amid Covid-19 financial struggles | Insurance Age

8. UK inflation falls to 8.7% in April but food prices still rising | The Times