MIRA PoS

Brings our know-how to your point of sale

properties.trackTitle

properties.trackSubtitle

MIRA PoS digitizes the processes at the point of sale

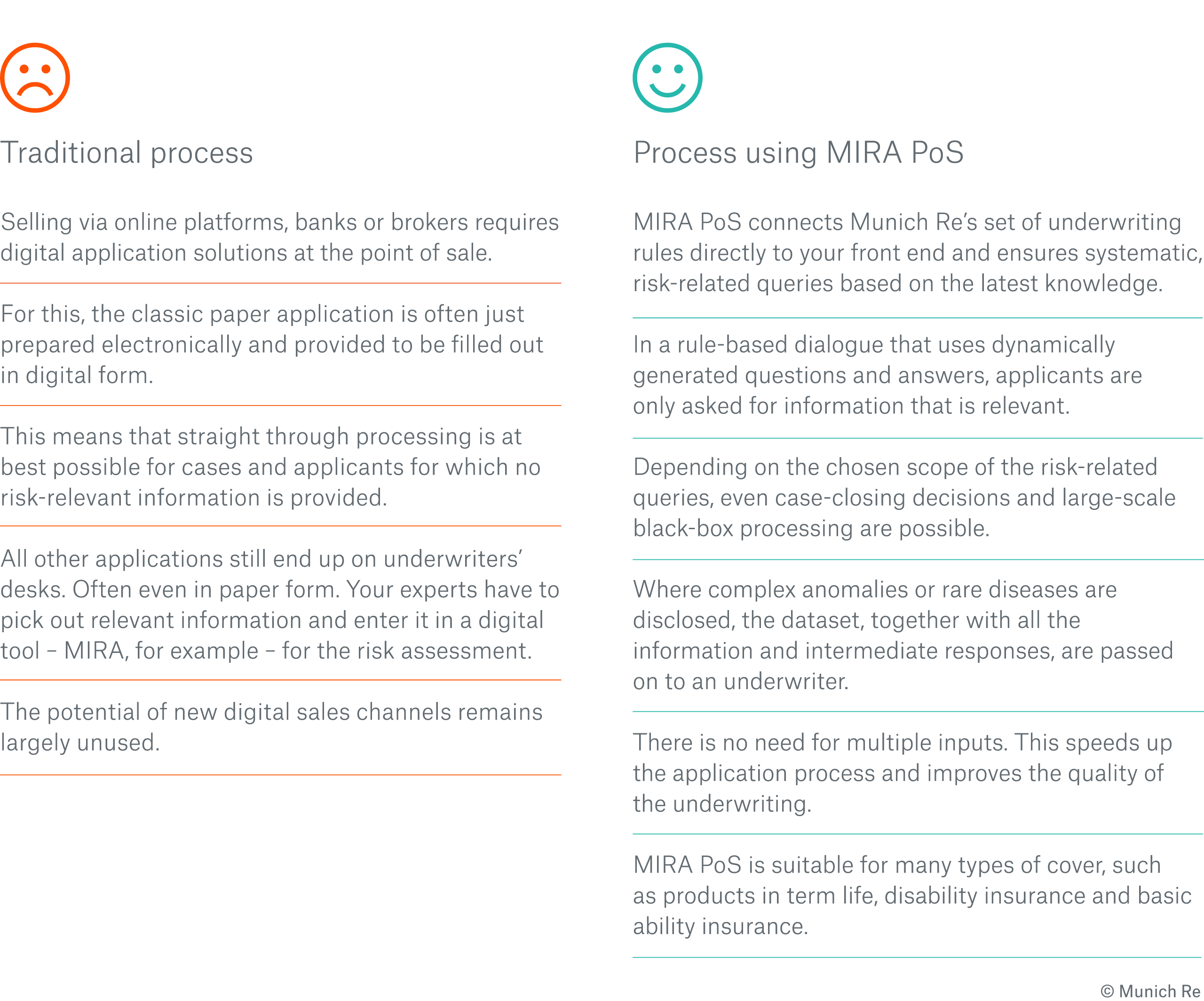

Your point of sale with and without MIRA PoS

Benefits of MIRA PoS

Brand-compliant image: MIRA PoS is integrated into your application environment. The “software as a service” connects your front end with Munich Re’s set of underwriting rules and remains invisible to applicants.

Flexible and customisable: You can individually specify the scope of the risk-related queries and automated assessment with MIRA PoS. You can also be flexible with the opening questions, in terms of structure, scope and strategy.

Rule-based and dynamic: MIRA PoS speeds up and simplifies risk-related queries. This is due, in particular, to dynamically generated and easily understandable reflexive questions and response options.

Up to date and data protection-compliant: The set of rules and rules engine are centrally maintained and continuously updated by Munich Re. What’s more, as “software as a service”, MIRA PoS meets the highest data protection requirements.

New potentials for data analytics: MIRA PoS is another component in your digitally networked business architecture. The module enriches your central database with further information and opens up additional potentials for data analytics.

What clients say

MIRA PoS is a powerful recommendation for insurers seeking to pioneer digital transformation in the insurance sector. Its efficiency, compliance, and customizability significantly boosted our sales strategy, proving its 'overall package' delivers tangible results.

Find out how Eurolife is pushing ahead the next phase of its digital transformation.

Further Information

Get in touch with MIRA PoS

Speak to our experts

/Wolfgang-Demmerich.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)