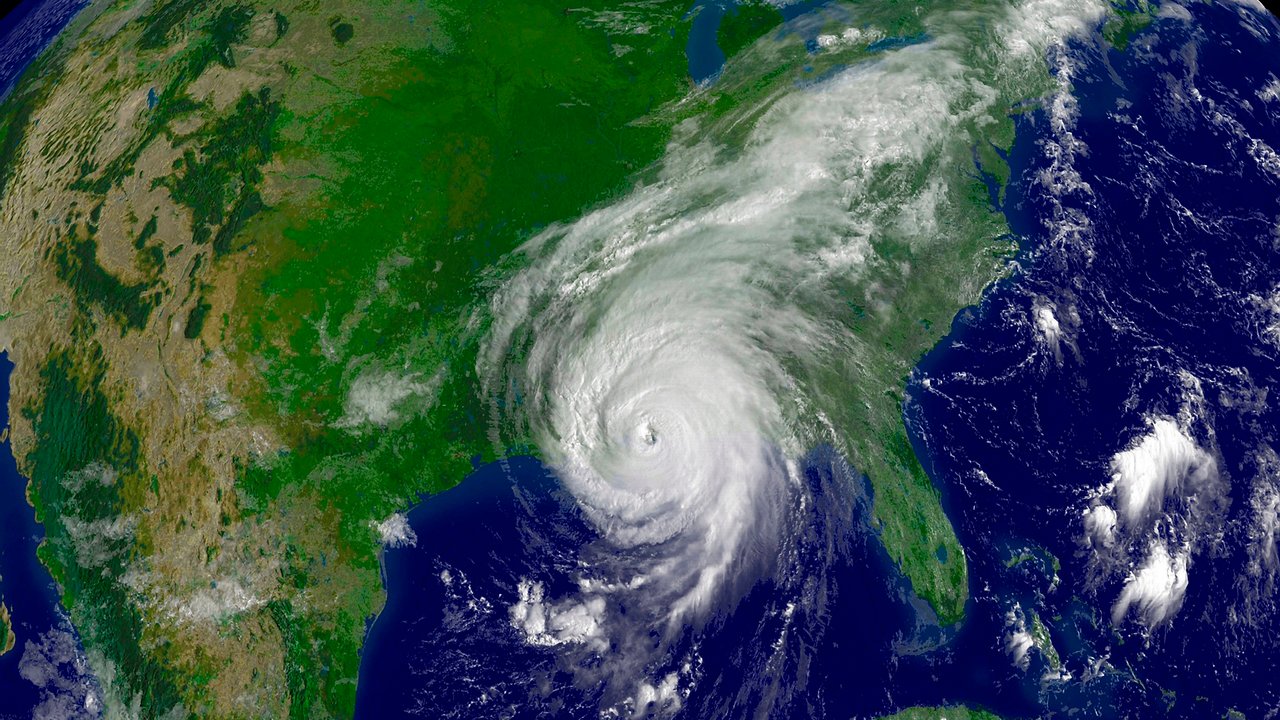

© Nilang Kachare / Getty Images

Weather Derivatives

Reduce your financial exposure with innovative weather risk transfer solutions.

properties.trackTitle

properties.trackSubtitle

0:00

Over two-thirds of the world's economy is impacted by meteorological conditions. As climate change progresses, unpredictable weather events such as exceptionally mild winters, cool summers, and periods of sustained high or low wind are becoming more frequent.

Managing weather risks made simple

Our tailored weather-related risk management solutions help companies in all industries that are affected by non-catastrophic weather. With weather derivatives, you receive financial compensation in the event of adverse or suboptimal weather conditions. This also applies if no damage occurs. Plus, there is no need for a lengthy claims settlement process.

Using weather derivatives is the frictionless, practical way to target weather-related risks as part of the overall risk management strategy.

Benefits of Weather Derivatives

Key elements of Munich Re's weather derivatives

- Predefined parameters – A “weather index” is defined to represent the underlying weather risk exposure. The weather index can be based on various meteorological variables, such as temperature, wind speed, precipitation, streamflow, solar irradiation, etc. Weather derivatives can be structured to offset a specific portion of the overall weather risk exposure, e.g., protection against a 1-in-4 year event versus a 1-in-10 year event.

- Individual structuring – There are various risk management tools/strategies available, including all “standard” derivative products (Swaps, Calls, Puts, Collars, etc.). Dual Trigger products are also available. Generally, these would incorporate a commodity price component along with the weather-based component.

- Payout – Like a regular (price-based) derivative, a weather derivative payout is triggered if the specified weather index is above (or below) the pre-determined threshold. Example: You will be paid X euros for every degree Celsius that the temperature is above threshold Y.

Transfer your weather risks to a trusted expert

FAQ (Frequently Asked Questions)

I do not know how to assess the extent to which my business is affected by the weather. What can I do?

What is the difference between a weather derivative and an insurance contract?

What are the geographical restrictions?

Are these products standardized?

Under which contracts are weather derivatives traded?

How much does a weather derivative cost?

Who provides the weather data (for analysis and settlement purposes)?

Would you like to know more?

Access our factsheets

Access our factsheets

Get in touch with our experts

Get in touch with our experts

3

Contact us

Matthew Jimenez

Americas / Australia

Luca Zambon

Europe / Asia

Carlos Espinosa

Lat Am