Epidemic and pandemic risk solutions

Risk transfer and investment solutions for protection against catastrophic communicable disease outbreaks

properties.trackTitle

properties.trackSubtitle

What is driving the increased risk of pandemics?

One of our epidemiologists explains in this short video.

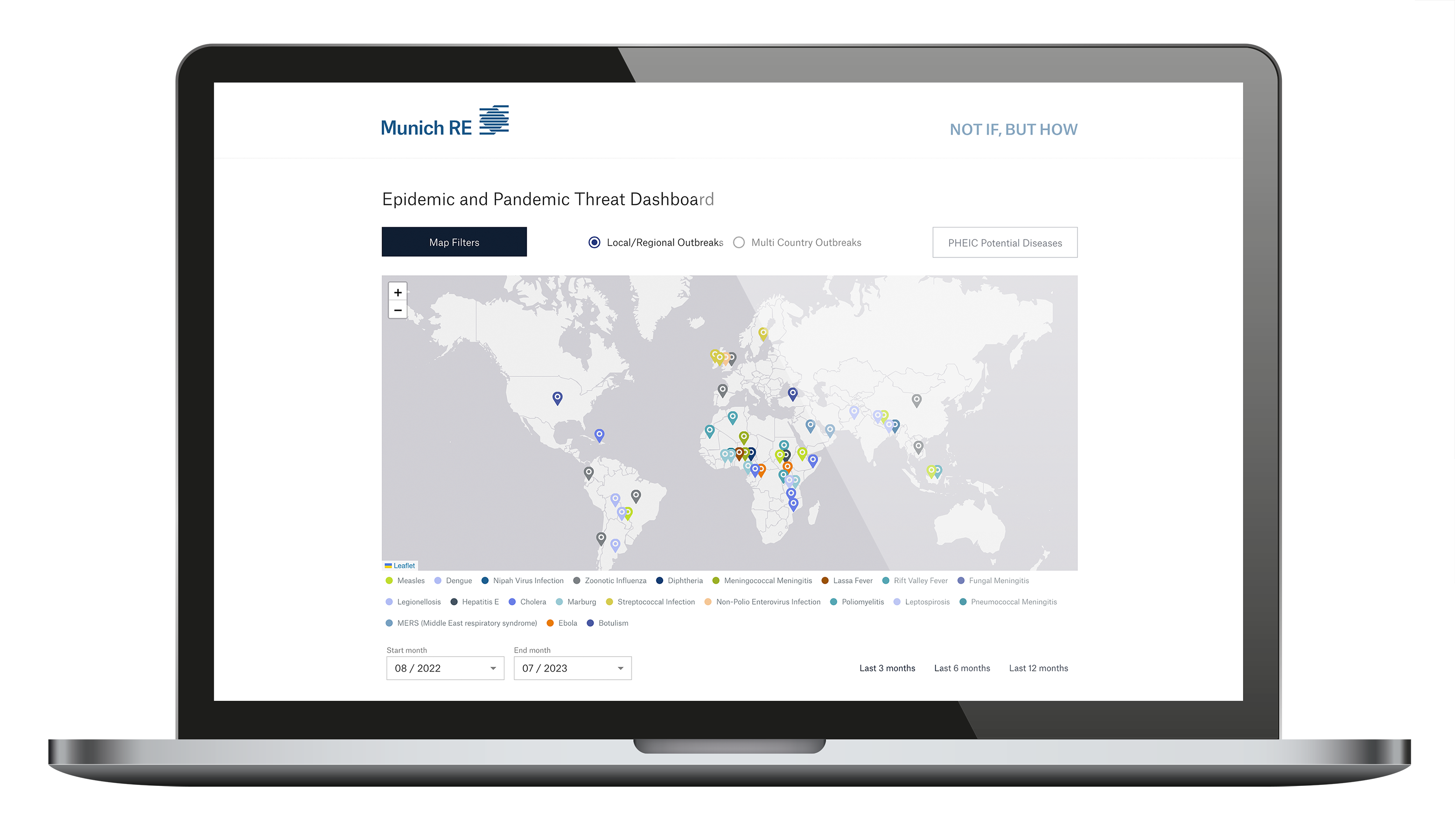

Epidemic and pandemic threat dashboard

Pandemic and epidemic threats constantly occur. This dashboard is a visualization of data from Disease Outbreak News (DONs) published by the World Health Organization (WHO), which report outbreaks that could cause serious public health impact and spread internationally or disrupt international travel or trade.

Filtering functionality allows searching by world region, disease or on communicable diseases that have been assessed by the WHO as presenting the greatest epidemic and pandemic threat where there are no or insufficient vaccines or treatments.

Please note that not all cases of communicable disease or outbreaks are reported in DONs.

100

The World Health Organization (WHO) publishes on average around 100 DONs per year reporting significant outbreaks.

>5

On average, >5 new diseases emerge in people every year some of which have the potential to become a pandemic.

75%

75% of emerging infectious diseases have their origin in animals. Viruses that jump from animals to humans present the greatest threat.

6.7%

Human activity has accelerated the pace of emerging infectious diseases at an annual rate of 6.7%.

>US$10trln

The estimated financial impact of previous pandemics range from single-digit US$ bn to > US$10trln for COVID-19 and rising.

+1.5°C

Global warming is likely to reach 1.5°C between 2030 and 2052 if it continues to increase at the current rate.

(Source: IPCC)

+46.5%

Between 2000 and 2050, the proportion of world’s population living in urban areas will increase by 46.5%.

(Source: United Nations)

+137.7%

The propensity to travel will increase by 137.72% from 2019 to 2042.

(Source: Airbus)

22-28%

22-28 % likelihood of another pandemic in the next 10 years.

(Source: Metabiota)

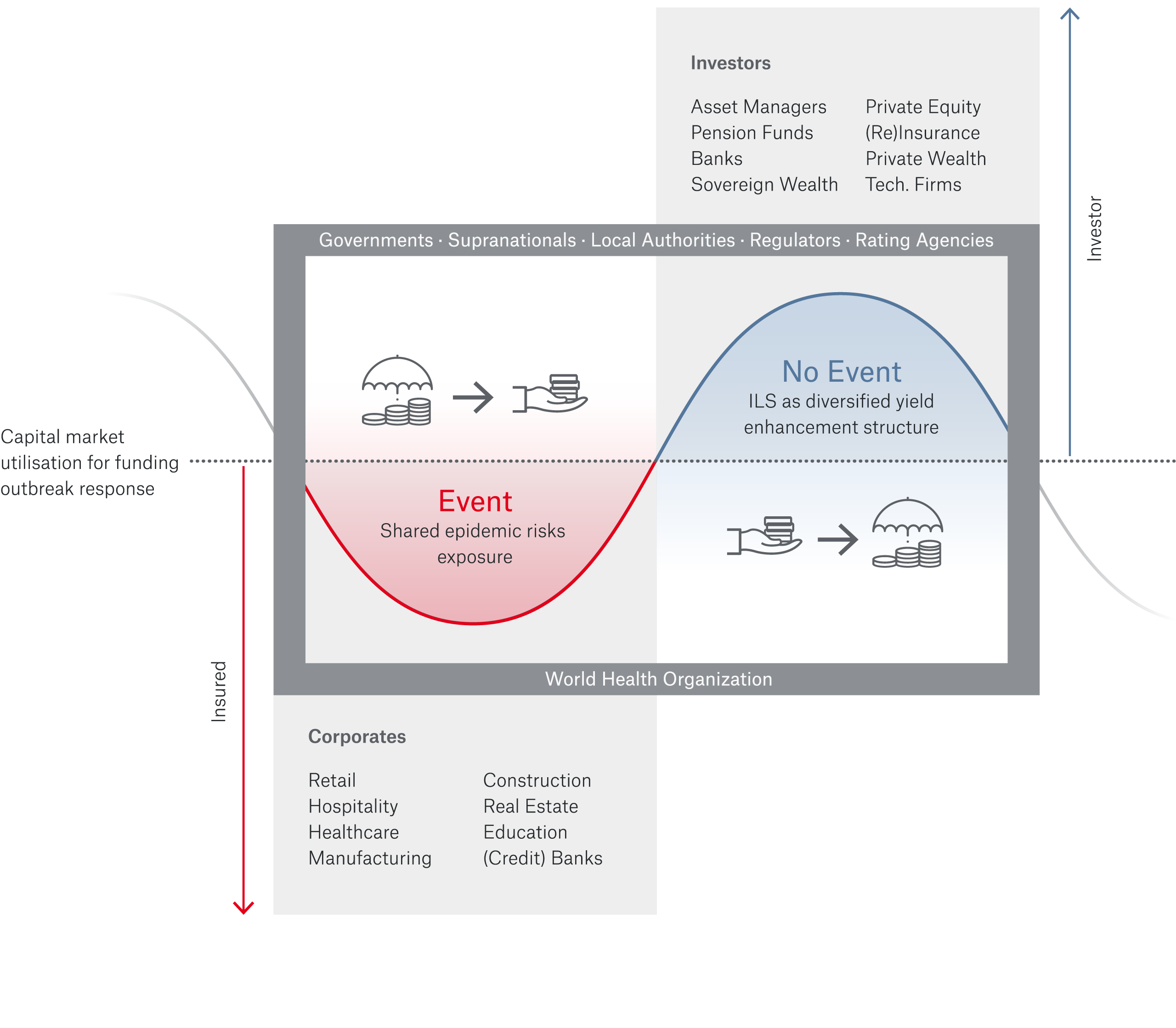

Transferring and distributing epidemic and pandemic risk

To better address the severe impact of epidemics and pandemics, risk exposure needs to be efficiently reallocated across a variety of stakeholders – including capital market participants.

The ability of Munich Re’s Epidemic Risk Solutions (ERS) unit to price, structure and transact epidemic and pandemic risks, as well as actively manage risk exposure, is key to help closing a significant insurance gap. As an industry thought leader and market maker, providing professional investors with the opportunity to participate in a new premium paying asset class with attractive yields.

With the balance sheets of the whole insurance industry being by far not large enough to bear all economic losses resulting from global pandemic events such as COVID-19, the creation of an Epidemic Risk Markets platform is key to providing innovative risk transfer solutions.

Together we help to close epidemic and pandemic insurance gaps

Non-life segment:

severe financial impact to corporates

Life segment:

mortality stop loss risk profiles

Public sector segment:

outbreak response financing

Financial protection and management assistance for pandemic risks

Our portfolio of risk transfer and investment solutions

Key benefits of epidemic and pandemic covers

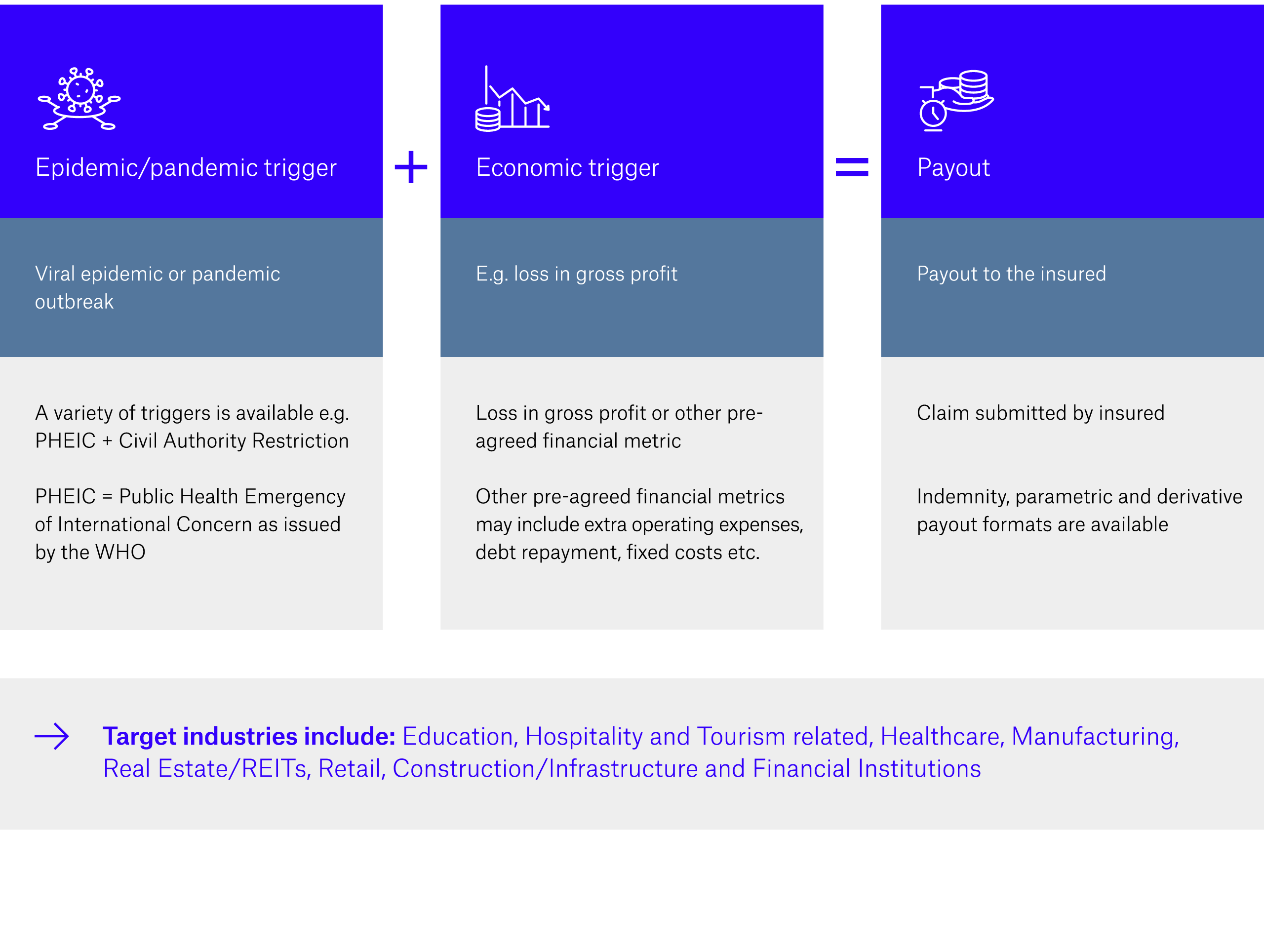

- Risk transfer: financial coverage for viral epidemic and pandemic outbreaks

- Customisation: policy defined depending on the client's individual exposure and the financial capabilities

- Transparency: pre-defined triggers and geographical scope

- Liquidity: improve cash flow management with faster access to liquidity

- Expert knowledge / advice: access to epidemiological and specialised risk management expertise

Triggers of the risk transfer solution in the insured event

Interested? Let's help closing protection gaps.

The approach of Epidemic Risk Solutions is to transform the risk into a transferable, premium-paying asset class that can be exchanged with the capital markets at a fair price. This increases the availability of capacity and rewards participants at the same time. This new asset class is based on proven risk distribution techniques which enable the risk transformation from insurance markets to capital markets.

The creation of a fixed premium-paying asset class can bridge the gap between an insurance need and a latent investor demand for diversified return enhancement. Insureds and investors can exchange risks to manage potential risk concentrations that could negatively impact financial ecosystems and societies. Thus, an Epidemic Risk Markets platform is created to broaden available risk transfer options, in particular for non-damage business interruption insurance risk. The platform enables risk transfer in different formats and is also open for public sector participation.

Key benefits of this new asset class compared to conventional investments

- Low correlation

- Low mark-to-market volatility

- Short maturity

- Yield pick-up

Epidemic risk transfer – platform and actors

Interested? Let's create a resilient financial ecosystem.

The Epidemic Risk Solutions team of Munich Re provides specialist structuring, pricing and underwriting expertise to Captives – enabling it to robustly offer broader cover and retain or transfer separately. Insurance is available for almost all known and unknown viral diseases.

Our collaborative approach allows us to address your specific needs. For you, this means that we can underwrite tailor-made solutions, including new risks.

Key benefits for Captives

- Coverage for viral epidemic and pandemic outbreaks

- Cost-effective risk transfer

- Strategic risk management

- Compliance with regulations

- Liquidity and cost control

- Access to specialised risk management expertise

Combine your strengths with ours

| Requirements and challenges | Captive | Munich Re | Together | How a joint solution could work |

|---|---|---|---|---|

| Creating an insurance policy for this new Non Damage Peril is complex and requiring epidemiological expertise. | Х | ✓ | ✓ | Munich Re has spent many years creating solutions to fit differing risk profiles and can structure/price products. |

| Policy structure must meet regulator’s approval. | Х | ✓ | ✓ | Munich Re is a globally regulated, rated and trusted reinsurance partner since being founded in 1880. |

| Premiums and limit must be justifiable and reasonable and “arms length”. | Х | ✓ | ✓ | Munich Re uses Big Data and epidemiological expertise to justify premiums and limits. |

| Policy should cover all aspects of parent’s loss resulting from the epidemic or pandemic. | ✓ | Х | ✓ | If Munich Re’s participation in all aspects of parent’s loss is not desired or feasible, these exposures nevertheless can be modelled for the captive. For example coverage for liability. |

| Policy should cover COVID-19 losses. | ✓ | Х | ✓ | If the captive has appetite to cover COVID-19 losses (including further waves), Munich Re can model this exposure for the captive. |

| Licencing for all covered areas is challenging and expensive for a captive. | Х | ✓ | ✓ | Munich Re has licensed fronting arrangements in most jurisdictions including all US states. |

Interested? Let's enhance your Captives' capacity.

Risk distribution for global sustainable development and resilience

Why work with Munich Re’s Epidemic Risk Solutions

Would you like to know more?

Get in touch with Epidemic Risk Solutions

Epidemic Risk Solutions