Photovoltaic

Warranty Insurance

Protect your long-term solar investment

properties.trackTitle

properties.trackSubtitle

Planning security for PV manufacturers and investors

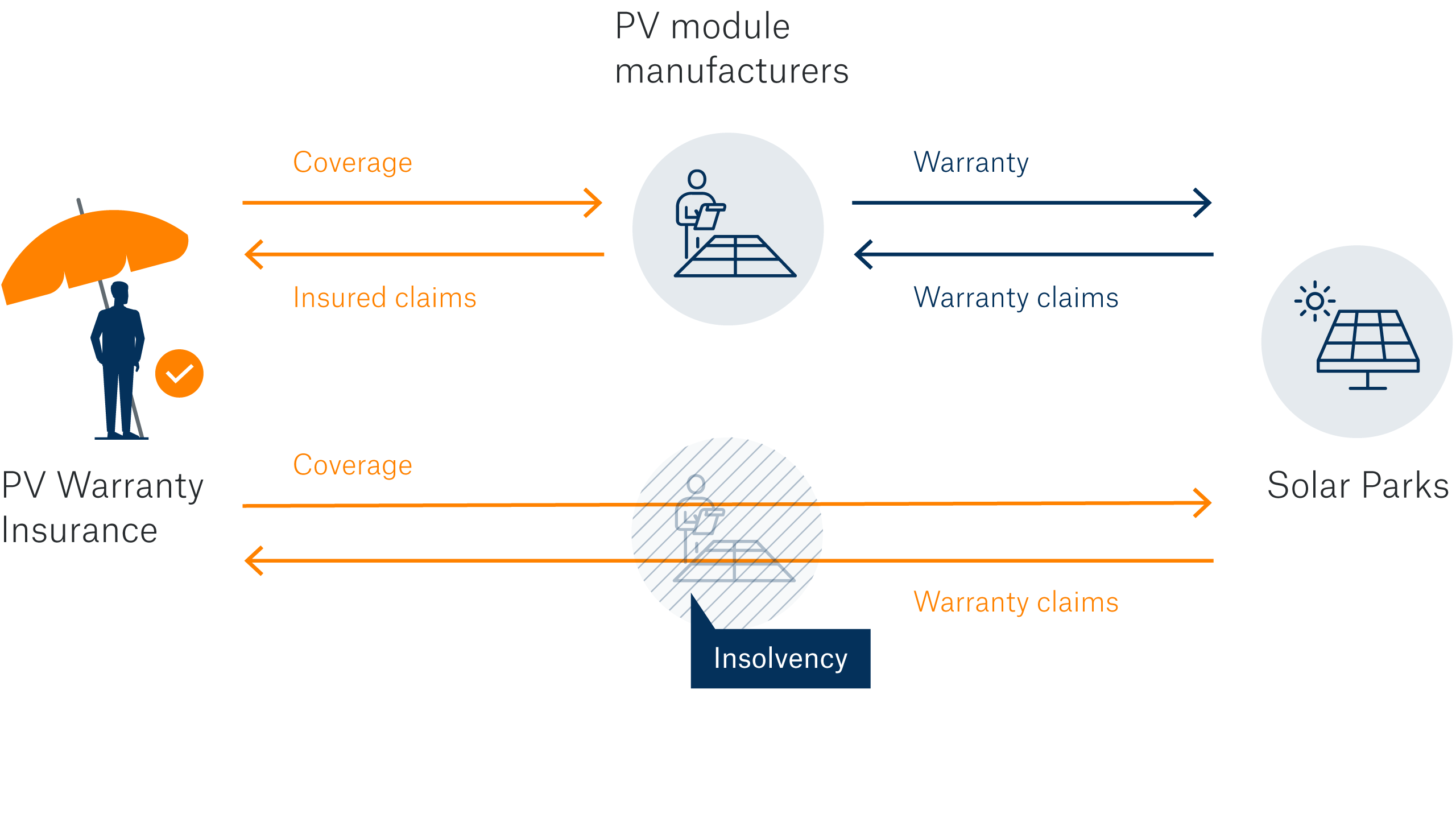

Even in turbulent times, the photovoltaic industry offers great opportunities. Yet, with rising material, energy and transport costs, high price pressure and constantly changing regulatory frameworks, manufacturers, investors and park owners alike are facing uncertainty and risks.

To remain competitive manufacturers need to convince their clients of their products’ long-term reliability. At the same time investors and park owners are often bearing the full risk for module performance jeopardising the overall long-term profitability of their solar investment.

PV Warranty Insurance helps your business grow

Benefits for manufacturers:

- Optimizes your liquidity and financial stability, even in case of underperformance or high warranty claims

- Creates confidence in the performance of your products: insurance covers warranties for all modules for up to 30 years

- Positions you as a reliable business partner and supports your sales efforts

- Differentiates you from yours competitors and provides great benefits for your customers

- Improves bankability of your modules and establish you as tier 1 manufacturer

- You are named as approved manufacturer on our PV Warranty Partner List

Benefits for investors, developers and solar parks:

- Bankability of modules for more attractive financing terms

- Additional quality assurance as insured modules have passed Munich Re technical due diligence

- Long-term profitability of your solar investment

- Protects you against insolvency and insufficient performance of the modules

- Strategic planning security

Learn more about our Photovoltaic Warranty Insurance portfolio:

Do you want to know more?

The who’s who in PV panel manufacturing:

Munich Re’s PV Warranty Insurance Partners

For your sustainable procurement this means:

- A performance guarantee on modules insured by Munich Re

- Protection against the insolvency of your module supplier

- Bankability for more attractive financing terms

- A network of independent research partners like

VDE Renewables, KIWA and Sinovoltaics:

- A globally experienced and locally responsive team

Do you want to know more?

Our Top-Up Cover:

extra protection for investors and park developers

Further improve the bankability of PV projects + increase their future transfer value

Limit of indemnity up to 100%

Tailored solutions to include risks such as costs of labor, transportation or loss of revenue

We ensure that your PV project investment is still profitable two decades from now.

Whitepaper:

Learn how linking quality assurance and insurance can bridge the certainty gap

It’s crucial for investors and park owners to trust, that PV systems will operate safely, reliably and profitably for 30+ years. Long-term performance guarantees with tailor-made insurance solutions are aiming to strengthen the necessary confidence of the banking, finance and insurance sectors in solar investments. Download our free whitepaper and learn how linking quality assurance and insurance can bridge the certainty gap.

Whitepaper:

Enhancing the quality standard for PV module manufacturing

All manufacturers of PV modules seeking cover have to go through Munich Re’s thorough due diligence process. For the first time, we detail the criteria used in Munich Re’s quality assessment and how manufacturers have performed so far in terms of insurability. Download our free whitepaper to get the answers and learn more about Munich Re’s quality assessment of PV modules.

Contact our experts

.jpg/_jcr_content/renditions/crop-16x9-1280.jpg./crop-16x9-1280.jpg)