Ratings and Solvency

properties.trackTitle

properties.trackSubtitle

Ratings of group and Subsidiaries

Insurance Financial Strength Rating

Assessment of an insurance company's ability to meet its obligations towards policyholders. For many years Munich Re has been one of the reinsurers with excellent ratings.

Ratings of Munich Re

| Rating agency | Rating | Outlook | Last rating change | Reports | |

|---|---|---|---|---|---|

| A.M. Best¹ | A+ (Superior) | stabil | 07.12.2017 | Download (A.M. Best, 7/2024, PDF, 280 KB) | |

| Fitch | AA (Very strong) | stabil | 21.07.2015 | Download (Fitch, 7/2025, PDF, 1.1 MB) | |

| S&P Global Ratings | AA (Very strong) | stabil | 7/26/24 | Download (S&P, 5/2025, PDF, 145 KB) | Download (S&P, 11/2025, PDF, 1.3 MB) |

Insurance financial strength ratings of Munich Re’s subsidiaries

Subsidiary of reinsurance group

| A.M. Best | Fitch | S&P | |

|---|---|---|---|

| American Alternative Insurance Corporation | A+ | AA | |

| American Modern Insurance Group | A+ | ||

| Bridgeway Insurance Company | A+ | ||

| Digital Advantage Insurance Company | A+ | ||

| Great Lakes Insurance SE | A+ | AA | AA |

| Great Lakes Insurance UK Ltd. | A+ | AA | |

| Munich American Reassurance Company | A+ | AA | |

| Munich Reinsurance America | A+ | AA | AA |

| Munich Re America Corporation (counterparty credit rating) | a | AA- | A |

| Munich Reinsurance Company of Australasia Ltd. | AA | ||

| Munich Reinsurance Company of Canada | A+ | AA | |

| Munich Re of Bermuda, Ltd. | A+ | AA | |

| Munich Re of Malta p.l.c. | AA | ||

| Munich Re Trading LLC | AA- | ||

| New Reinsurance Company Ltd. | A+ | AA | |

| The Hartford Steam Boiler Group | A++ | AA | |

| The Princeton Excess and Surplus Lines Insurance Company | A+ | AA | |

| Temple Insurance Company | A+ | AA- |

Subsidiary of primary insurance group

| A.M. Best | Fitch | S&P | |

|---|---|---|---|

| DKV Deutsche Krankenversicherung AG | AA | ||

| ERGO Insurance Pte. Ltd. (Singapore) | A+ | ||

| ERGO Versicherung AG | AA | ||

| ERGO Group AG (counterparty credit rating) | AA- | A+ | |

| ERGO Forsikring A/S (Denmark) | A+ | ||

| ERGO Vorsorge Lebensversicherung AG | AA | ||

| Next Insurance US Company | A+ | ||

| Sopockie Towarzystwo Ubezpieczeń ERGO Hestia SA | AA |

Solvency Ratios

Solvency II

The solvency ratio under Solvency II is the ratio of the eligible own funds to the solvency capital requirement.

Solvency II ratio1

| 31.12.2024 | Prev. Year | Change | ||

|---|---|---|---|---|

| Eligible own funds² | €m | 54,254 | 47,979 | 6,275 |

| Solvency capital requirement | €m | 18,915 | 17,974 | 941 |

| Solvency ratio under Solvency II | % | 287 | 267 |

The eligible own funds as at the reporting date take into account a deduction for the dividend of €2.6bn agreed by the Board of Management and proposed to the Annual General Meeting for the 2024 financial year.

1 Eligible own funds and solvency capital requirement excluding the application of transitional measures for technical provisions; including the application of transitional measures for technical provisions, the own funds amounted to €54.3bn (52.5bn); solvency capital requirement: €18.9bn (18.0bn); Solvency II ratio: 289% (292%). 2 Driven by economic earnings of €9.3bn and the issue of a subordinated bond with a volume of €1.5bn, the eligible own funds increased as at the reporting date. The following factors had a reducing effect on eligible own funds: the dividend of €2.6bn agreed by the Board of Management and proposed to the Annual General Meeting for the 2024 financial year; the share buy-back programme with a volume of €1.5bn; the adjustment to the opening balance amounting to –€0.3bn; and other measures totalling –€0.1bn.CDS Spread

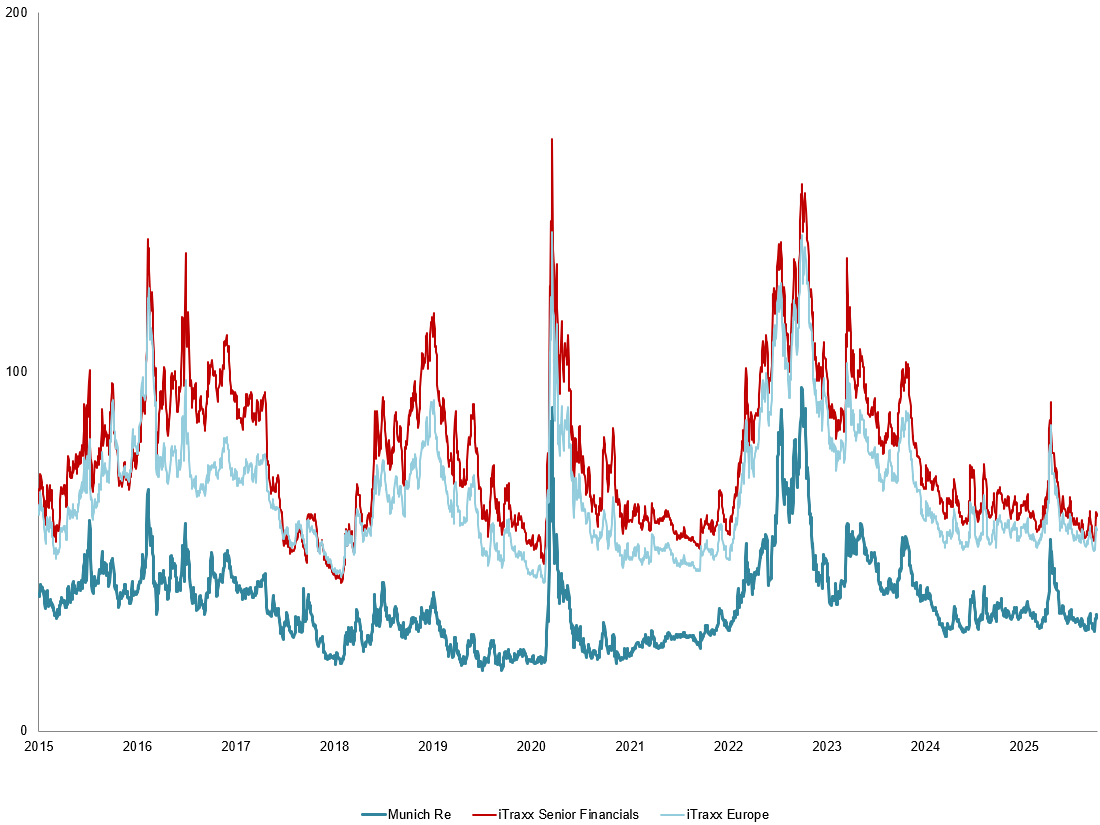

CDS Spread

A Credit Default Swap (CDS) is a tool for hedging credit risk. By buying a CDS, a market participant hedges certain risks arising from credit relationships in exchange for a premium, which is referred to as a CDS Level. The higher the level, the higher the default risk estimated by the market for the issuer.

Status: 31.12.2025