Dynamic Risk Calculator Pro

Turn every risk into a confident decision.

Building on strong adoption across the Indian market, the Dynamic Risk Calculator enters its next chapter. Introducing Dynamic Risk Calculator Pro – designed for life and health insurers, it expands data access to enable faster, more precise financial underwriting decisions.

properties.trackTitle

properties.trackSubtitle

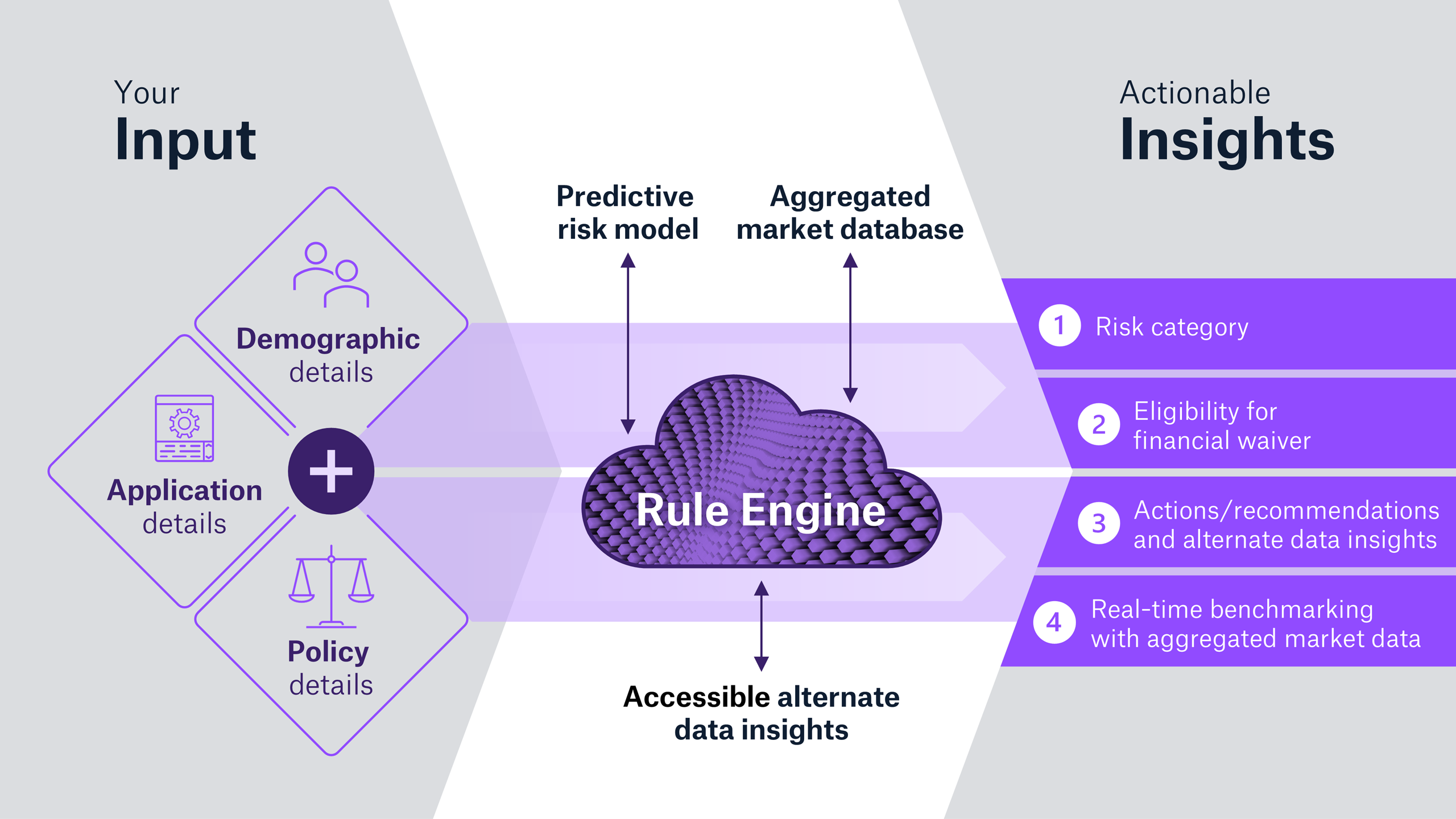

Introducing the Dynamic Risk Calculator Pro – from inputs to actionable insights

Input: Only key applicant, demographic and policy details are required, keeping the process simple and efficient.

Rule engine: Accessible alternate data sources, Munich Re’s aggregated market insights, and our advanced risk assessment model together power the rule engine behind the Dynamic Risk Calculator Pro.

Actionable insights: This setup classifies profiles by risk level, identifies cases for financial check exemptions or closer examination and recommends next steps. Integrated data sources and real-time benchmarks from Munich Re’s database provide deeper insights to guide every decision.

Why Dynamic Risk Calculator Pro?

Smarter segmentation, better customer experiences

Enhance your customer onboarding experience. Fast-track low-risk profiles and tailor the journey for higher-risk ones to deliver a superior customer experience.

Seamless workflows, better decisions

Connects directly to accessible third-party intelligence – minimising the need for manual document checks and allows for more accurate and consistent risk assessment.

Trusted by the market, powered by scale

With broad adoption across India’s insurance landscape, processing over 1.5 million policies in 2024 alone, the Dynamic Risk Calculator Pro draws from a uniquely large data pool.

Dynamic Risk Calculator Pro – what is new?

Financial waivers for better risk profiles

Integrated third-party intelligence

Improved fraud detection model

Streamline the customer journey with automated financial waivers for low-risk applicants – enabling faster decisions and reducing documentation requirements.

Find out how the Dynamic Risk Calculator is reshaping underwriting processes and what our clients are saying:

Combine the Dynamic Risk Calculator Pro and Medical Decision Platform to give underwriters a single, streamlined view of financial and medical insights for better decisions.

> 10

Customers

> 1.5 million

Policies per year

Contact us to learn more about the Dynamic Risk Calculator:

Contact our experts