Emerging risks

The risks of tomorrow

properties.trackTitle

properties.trackSubtitle

A high potential for loss but difficult to quantify

Emerging risks can go unrecognised for a long time, until they manifest themselves as serious trend developments or spontaneous risk events. Highly dynamic and complex areas in particular are characterised by new or changing risks. Examples of these are:

- Increase in cyber attacks due to global digitalisation

- Climate change and extreme weather events

- Increase in political crises

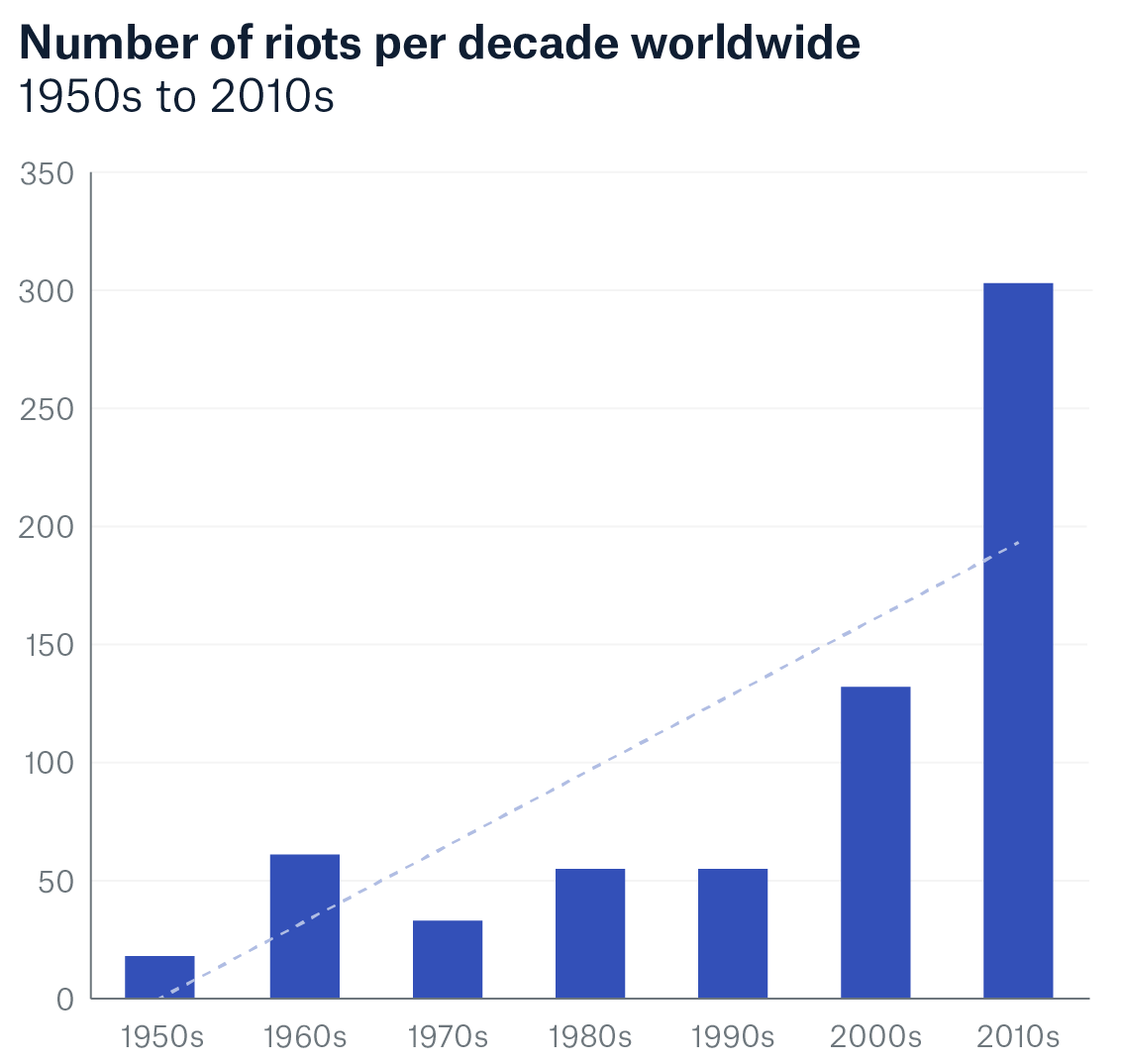

200%

Data from the Global Peace Index 2021 shows that civil unrest has increased by more than 200% in the last ten years.

What all emerging risks have in common is that their occurrence probability, loss amount and potential impact are exceedingly difficult to quantify. Not least, because cases of this kind have never happened before – or only rarely. When emerging risks do materialise, they tend to come with devastating consequences for people and assets.

Emerging risks can have a substantial impact on the insurance side and investment. They often materialise as long-tail risks, with the losses being settled over a medium- to long-term period. Conventional risk management is ineffective without a clear understanding of risk factors. Growing global interconnectedness, increasing complexity and geopolitical risks make these factors increasingly difficult to identify in a rapidly changing risk landscape. But emerging risks also offer new business opportunities. Munich Re is working intensively on the early identification of emerging insurance-related risks and supports its clients in developing effective coverages and innovative insurance concepts.

Thanks to our years of experience with identifying and managing emerging risks, we are a safe partner, even in uncertain times.

Emerging risk trends

Cyber

200

billion €

According to a recent estimate, in 2023 companies in Germany lost altogether 200 billion euros through cybercrime. Companies also spent almost 30 billion euros on legal disputes.

Digital technologies are fast transforming our lives, from how we experience the world to how we interact. As our dependencies on connectivity and instant data access proliferate, so do security vulnerabilities. Cyber attacks on IT systems and the data they hold are among the most significant security risks today.

Threats can be physical or electronic, or stem from technical failures or human error. And they are everywhere.

Insurers support society’s rapid technological development with appropriate, comprehensive insurance solutions and corresponding services. They use the latest technology – from AI to cloud computing to big data – to help businesses mitigate IT and cyber risks. Insurers and reinsurers raise risk awareness, contribute to the definition of security standards, model cyber risks, and create new risk transfer solutions. The goal is to develop robust risk solutions able to evolve as the pace of technological advance accelerates.

Climate change

- Overall losses from natural disasters in 2023 stand at around US$ 250bn, with insured losses of US$ 95bn.

- 2023 was the hottest year since weather records began, with a large number of regional temperature and storm records being broken.

- Severe thunderstorms in North America and Europe were more destructive than ever in 2023, with overall losses of US$ 76bn, of which US$ 58bn was insured

Climate-related risks are both physical risks and transition risks, with both types of risks being interrelated. Physical risks include extreme weather events (heat, drought, storm, hail etc.), which can become more powerful or more frequent as a result of climate change. Transition risks arise from the political or economic measures of the transformation towards decarbonisation of the economy, or from responses to changes in living conditions in certain regions.

For five decades, Munich Re has been analysing the effects that global warming and natural climate variations have on weather-related natural disasters. We make use of long-term meteorological and loss data to understand changes in risk and to adjust our risk models accordingly.

Political risks

Political risks have increased considerably in recent years. Social inequalities, populist and nationalist tendencies, and economic upheavals in the wake of the COVID-19 pandemic have led to a significant increase in riots in many parts of the world. In industrialised countries in particular, the losses are often covered by property insurers. Only through understandable policy wordings, suitable sublimits and clear event definitions do these local events remain insurable.

Political upheavals at a national level are also reflected in increasing international conflicts. The big global challenges like climate change can only be solved through joint efforts. Increasing political disintegration, trade wars and military conflicts are undermining effective progress. For insurance companies and their customers, it is essential to follow these developments with corresponding expertise and promptly respond to changing framework conditions. Accumulations from wars or warlike acts in particular are not generally insurable.

Tech Trend Radar 2023

Raising awareness of possible technological risks is also part of our popular Tech Trend Radar. In the annually updated Radar, we provide information on technology-driven trends that are relevant for insurance companies. The Radar points out possible risks and aims to encourage discussion, as well as initiate new business opportunities that are attractive for the insurance sector.

Experts from Munich Re and ERGO have collected and analysed the most important technology trends in the insurance sector for 2023.