Parametric Risk Management Solutions

Building Resilience in Agriculture

properties.trackTitle

properties.trackSubtitle

Agricultural Risk Management in a Changing Climate: Building Resilience

Agriculture, as one of the most weather-dependent sectors, faces increasing risks from adverse weather, crop-yield volatility, natural catastrophes, and price related exposures. Rising temperatures and shifting rainfall patterns challenge food production, causing economic uncertainty. Munich Re's AgRisk Partners offer tailored agricultural risk management solutions to enhance the sector's resilience and sustainability.

With extensive experience, our team provides efficient strategies to mitigate the financial impacts of adverse weather and climate events. Whether you are a farmer, an agribusiness, or food producer, our expertise helps safeguard your operations and secure a stable future.

Weather and Price Risks Affect the Entire Agricultural Supply Chain

How Parametric Risk Transfer Works

Parametric solutions offer fast, innovative, and data-driven alternatives to traditional insurance and hedges by using predefined triggers and trusted, third-party for swift settlement. Here's how it works:

- Event Definition: Events such as adverse weather, crop-yield levels, natural disasters, or commodity price movements are contractually defined.

- Event Occurrence: When the predefined event occurs, the payout can be determined quickly utilizing trusted, third-party data.

- Streamlined Settlement: Using data circumvents traditional claims processes, securing liquidity faster and minimizing the operational burden on clients.

Parametric products are providing new solutions to previously unmanageable risks, faster settlement, and greater transparency, pioneering a new future in financial stability.

We Deliver Solutions Along the Entire Value Chain

Area Yield Index

Adverse Weather Index

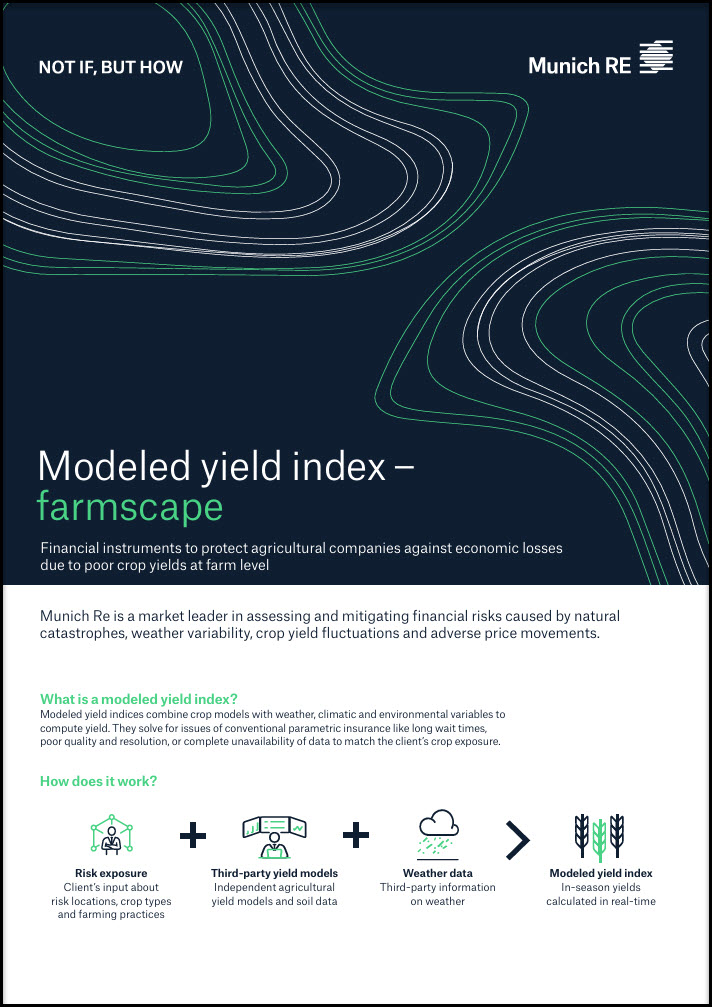

Modeled Yield Index

Munich Re’s Modeled Yield Index (MYI) offers an alternative to public yield statistics when governmental data is unavailable, untrustworthy, or lacks the desired resolution. The MYI achieves client goals by creating a digital replica of the underlying cropland yields, and maintains objectivity by utilizing a third-party provider.

- MYI FarmScape is designed for large producers who want to protect their whole farming operation.

- MYI GeoScape is designed for aggregators along the agricultural value chain.

Contingent Price Index

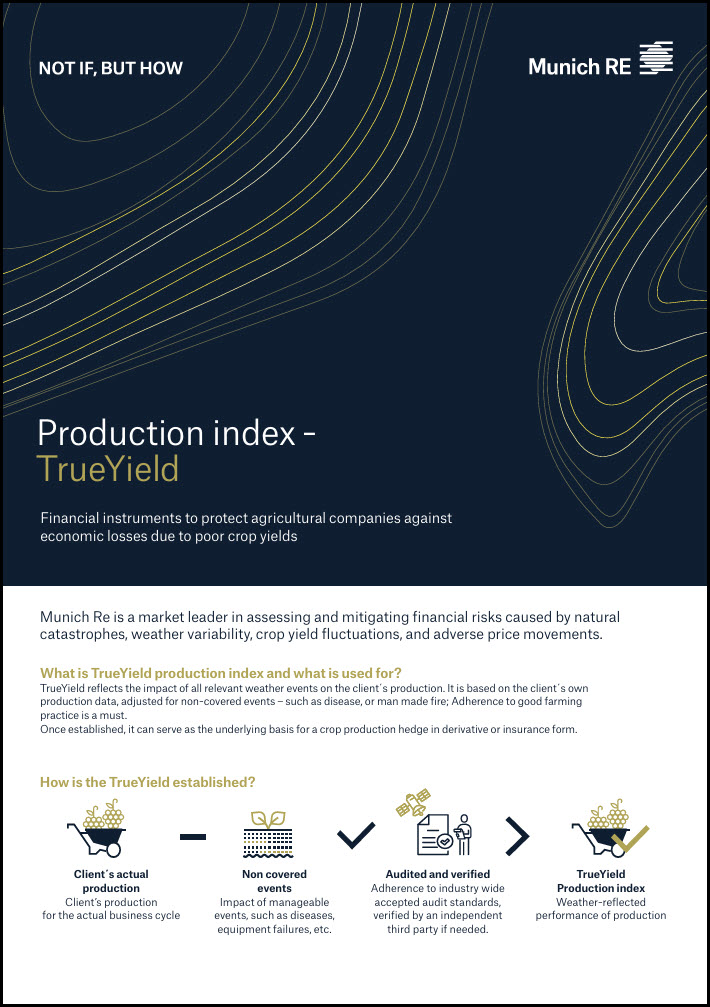

TrueYield Index

Your Benefits of Partnering with Us

Stay ahead of yield risks: Download the Servisur use case and learn how a real producer handles yield risk using Modeled Yield Indices.

Download Whitepapers to Get Expert Insights

Unlock Agricultural Potential with DSSAT

Discover how DSSAT delivers precise yield forecasts and supports smarter decisions across the value chain. Download the whitepaper now!

Stay ahead of market volatility with our latest paper on the Contingent Price Index (CPI).

Find out how you can enhance your price risk management using targeted, cost-effective hedges. Download the paper to explore the advantages of CPI for your operations.

Contact us

/newre_20_artiushyn_oleksandr_0051_final.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)