For a long time, applicants with HIV were not eligible for occupational disability insurance as the infection led to severe immunodeficiency and consequently death in almost all cases. In the meantime, treatment has vastly improved thanks to medical progress. The same goes for insurability, which Munich Re expands in keeping with medical progress, resulting in people living with HIV now having fair access to all key insurance products.

Whether it’s life insurance, disability insurance or critical illness products, with the just-published, evidence-based review of its underwriting guidelines, Munich Re has created the conditions for applicants with HIV to be comprehensively insurable – just like applicants with other highly treatable chronic conditions.

From fatal viral infection to chronic condition

The enabler for the most comprehensive expansion of insurability of HIV‑related illnesses so far has been, and continues to be, medical progress. In the first few years following the emergence of the new viral disease, there were virtually no treatment options. By the mid-1990s, the likelihood of a 25-year-old person with HIV reaching the age of 35 was only 10%. With the development of antiretroviral therapy (ART), the life expectancy of those affected then increased significantly within a few years. By 2000, the 10-year survival probability of a 25-year-old was already about 90%. Even after that, this value has continued to improve, approaching that of the general population.

Facts and background to the HI-virus

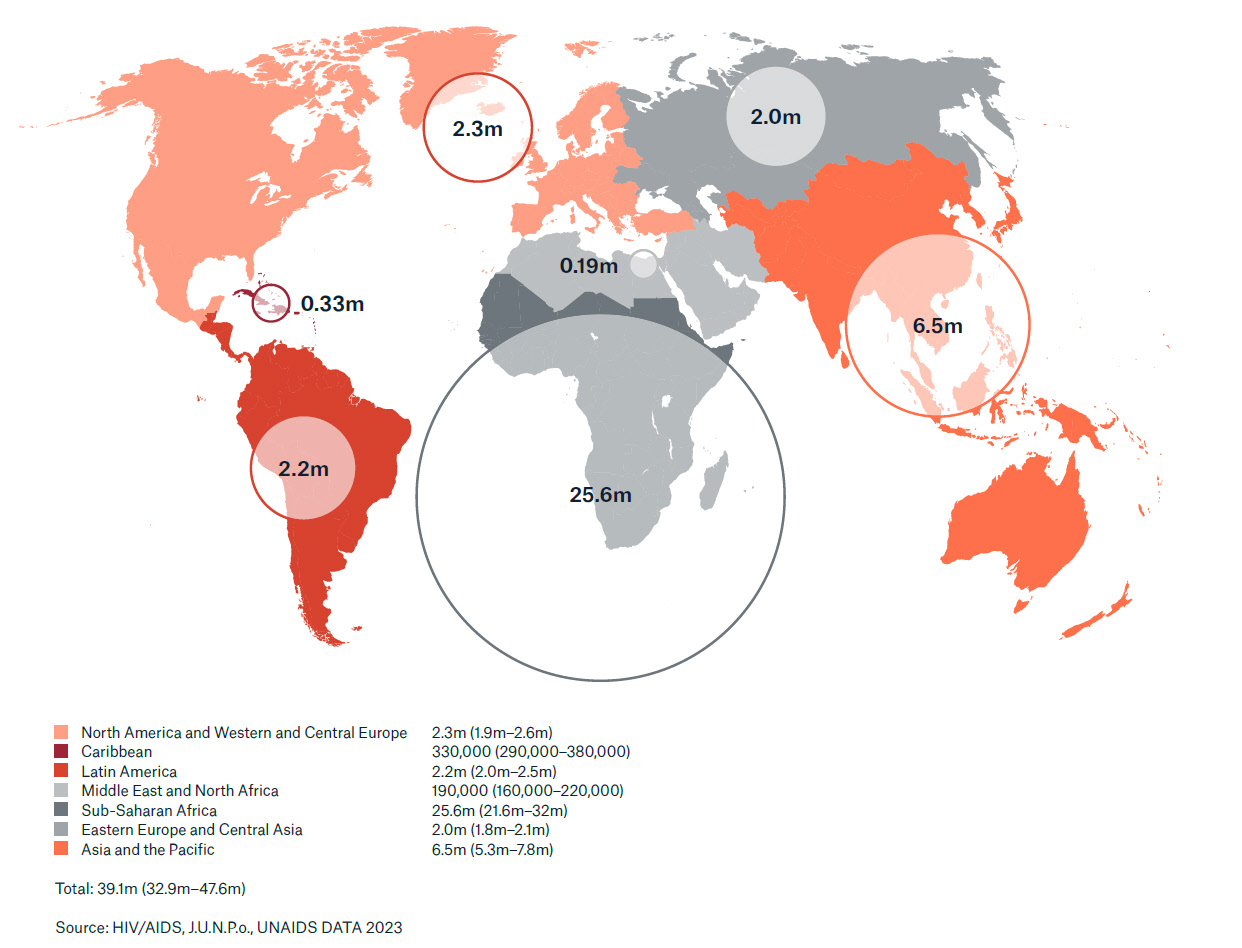

Untreated, the human immunodeficiency virus (HIV) leads to the acquired immune deficiency syndrome – AIDS. It is estimated that around 39 million people worldwide are infected with HIV. The HI-virus is transmitted through bodily fluids – for example, through unprotected sex or intravenous drug use with shared needles.

Once it finds its way into the body, the HI-virus docks onto certain white blood cells. These are known as CD4 cells (also T4 or T-helper cells) and are responsible for the immune defence system. The HI-virus destroys these CD4-cells. The CD4 cell count steadily decreases, weakening the infected individual’s immune system and allowing AIDS-defining diseases such as certain fungal infections and cancers to proliferate. The principle of antiretroviral therapy: it inhibits viral replication, the CD4 cell count increases again, the immune system recovers and remains stable.

Brief history of HIV insurability

There are three prerequisites for insurability: the risk must be calculable and adequate, and the conditions for individual evidence-based underwriting must also be met. For a long time, these conditions did not exist. HIV infections first appeared in the early 1980s. Medicine and science had no experience whatsoever with this new disease. There were neither treatment options nor was there study data. However, this was all to change quickly, with the first antiviral drugs coming into use as early as 1987. Later came antiretroviral combination therapy (ART).This was so successful that the mortality rate declined dramatically within a few years. That being the case to this day, as the consistent advancement of ART has further reduced mortality and morbidity, so most people living with HIV are now insurable.

Munich Re had a pioneering role in helping develop the actuarial bases for this. The beginnings were in 2008. “At that time”, recalls Senn, “we introduced life insurance rating guidelines for the first time for people living with HIV and were already insuring them under certain medical circumstances.” But these were still individual cases. The next step followed in 2015, when HIV infection became part of Munich Re’s regular MIRA underwriting manual. This enabled standardised risk assessments for most people living with HIV and, in principle, provided access to life insurance – even though the contract periods were still restricted, given the lack of experience data.

“With the current review, we’ve now reached the next milestone”, says Steven Wiseman, who as Senior Medical Consultant at Munich Re was responsible for the preceding development project. According to him, “the most important result from this project is the just-published, market-wide, first evidence-based disability insurance rating guidelines for people living with HIV.”

Breakthrough with HIV data from Denmark

With consistent ART, the mortality rate for people living with HIV has decreased significantly and continues to fall. The results of large-scale HIV studies have already provided ample proof of this. The situation is different though when it comes to medical and scientific evidence as to the disability risk. Here, there simply was no data base for adequate analyses. The question as to who is insurable with HIV, and with which product could not be answered due to the lack of data.

“So far”, emphasises Anne Zutavern, Medical Consultant in the Munich Re project team, “for in collaboration with the creators of the Danish HIV registry, we’ve now been able to carry out a longitudinal study to analyse the mortality and morbidity of people living with HIV compared with the general population.” The Danish HIV Registry is one of the most comprehensive and detailed of its kind worldwide. For the longitudinal study, the creators of the HIV registry made use of their access to other data pools like the Danish labour market registry, death registry and cancer registry. “With this unique data base, we were able to answer many insurance-related questions that had previously barely been addressed”, explains Zutavern, adding: “For example, questions on specific risk factors or on defined endpoints like disability.”

Destigmatisation through expanded risk assessment

The newly found answers and analysis results have been incorporated into the latest review of Munich Re’s MIRA underwriting guidelines and now allow a significantly expanded risk assessment based on the latest knowledge. Besides life insurance products, this also includes disability insurance products as of now. With the expanded Munich Re guidelines, even underwriting critical illness is now possible, i.e. people living with HIV will even be able to protect themselves even against the consequences of other serious illnesses in the future.

Therefore, the latest Munich Re review has the potential to introduce a shift in paradigm. Up to now, people living with HIV did not generally apply for disability or critical illness insurance cover, as they expected to be declined anyway. Rightly so, as previously it was virtually impossible for HIV-infected persons to take out disability policies. Hopefully, this will fundamentally change with the new scientific findings and Munich Re’s expanded acceptance guidelines. For this an HIV-infection has to be destigmatised and finally seen for what it is: a chronic condition associated with calculable risk while on ART, making it insurable.

Experts

Related Solutions

properties.trackTitle

properties.trackSubtitle