Investment security

In the wake of the financial and economic crisis, banks and private equity funds have become uneasy about providing the required loans for energy efficiency projects. They do not necessarily understand the technical aspects of the risk, but see it strictly in terms of credit risk. This is where HSB can deliver real value by presenting a realistic picture of projected performance and inherent risks.

To gain more transparency and make this risk insurable, HSB has developed an asset performance model specifically designed for energy-efficiency projects. The model assesses all the individual energy conservation measures deployed in a building and how they interplay (see page 3 for more details on the performance model).

Energy Efficiency Insurance

This cover is focused on providing up to five years of protection for all aspects of the project, ranging from material damage (equipment breakdown) of the installed systems to business interruption (protecting against loss of revenue in the event of equipment failure). The final element, which makes this product unique, is the asset performance insurance covering a shortfall in energy savings.

Energy Efficiency Insurance is aimed mainly at energy services companies (ESCOs). ESCOs assume responsibility for managing a building’s energy efficiency, including negotiating better deals with utilities, installing technologies to reduce energy consumption and in many cases guaranteeing a minimum level of savings. Typically, they set up a separate subsidiary, termed a special purpose vehicle (SPV), to run a given project. The SPV purchases required equipment, delivers services and guarantees performance according to the contract. The business interruption cover is especially attractive for such an entity, as it protects income from service fees charged for managing energy consumption and revenue derived from local green energy incentives.

At the same time, large-scale facility owners such as major companies or government institutions seeking to optimise their energy management will also find Energy Efficiency Insurance attractive.

Interacting technologies

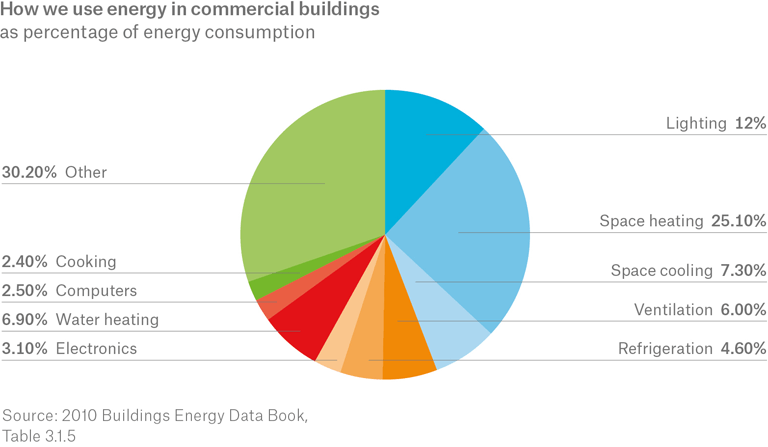

Technologies available to reduce energy consumption include LED lighting, sensors to switch lights on and off as required, insulation to prevent the escape of heat, and better coordination and management of the various systems within a building. A less obvious solution is voltage optimisation, measures to ensure that systems, for example at a production facility, are not operating at unnecessarily high voltage and consuming excessive power. The same approach can also be applied to heating and air conditioning. Also, energy efficiency initiatives often involve the adoption of cleaner, more renewable technologies, such as switching from fossil-fuel heating to biomass or ground-source heat pumps.

The key to achieving maximum results is to gain an understanding of how all of these components interact. Old incandescent lighting, for example, generates heat. Replacing it with efficient LED lighting will reduce electricity costs but may cause a slight increase in heating usage.

The HSB asset performance model

How does Energy Efficiency Insurance work?

A typical example: a ten-storey building where around 400 people worked had annual energy costs of €326,000. It had been constructed in the 1980s, when energy efficiency was not usually high on the agenda, so the owners believed there was room for improvement. They began exploring ways to cut down consumption and brought in an energy services company, which calculated that with an investment of approximately €1.8m, up to €100,000 in energy expenditure could be saved annually – a possible reduction in costs and CO2 footprint of about 30%.

Eleven energy conservation measures were implemented, including new thermal windows, heating and ventilation equipment, an upgrade of the air- conditioning system, variable frequency drives on all pumps and fans, LED lighting and lighting controls. HSB assessed the project, ran its calculations and designed a policy guaranteeing minimum annual energy savings of €80,000 over a period of five years.

Considering that in many European countries more than half of buildings are over 50 years old, the potential for improvements to reduce energy consumption and emissions is vast. Realising that potential requires substantial spending, but the payoff is more than convincing – provided the retrofitting project is successful, HSB’s innovative Energy Efficiency Insurance can help take out the guesswork and give all stakeholders the planning security they need.

Energy Efficiency Insurance is available for periods of up to five years and provides cover for the following:

- Material damage

Covers physical damage, including breakdown, to equipment and materials installed as part of an energy-saving project with the aim of saving or generating energy. Replacement of equipment is on a new- for-old basis. - Material damage

Covers physical damage, including breakdown, to equipment and materials installed as part of an energy-saving project with the aim of saving or generating energy. Replacement of equipment is on a new- for-old basis. - Asset performance

Covers the annual shortfall in energy savings com- pared to the amount of savings insured by the policy. It covers shortfall caused by deficiencies in the design or implementation of energy-saving measures and does not require damage to have occurred to the equipment. The cover is subject to a project audit.

Related Topics

Newsletter

properties.trackTitle

properties.trackSubtitle