Global Cyber Risk and Insurance Survey 2024

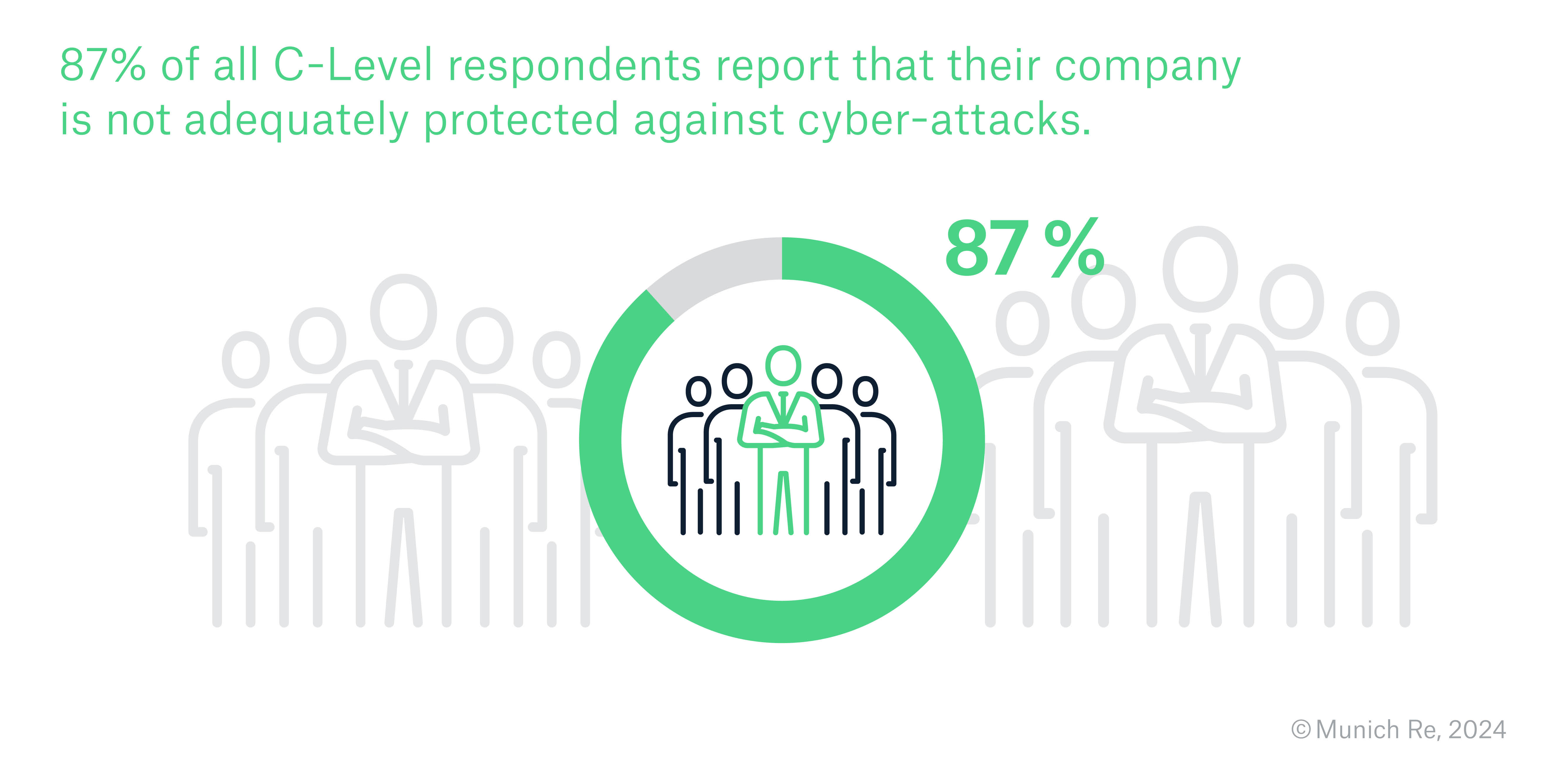

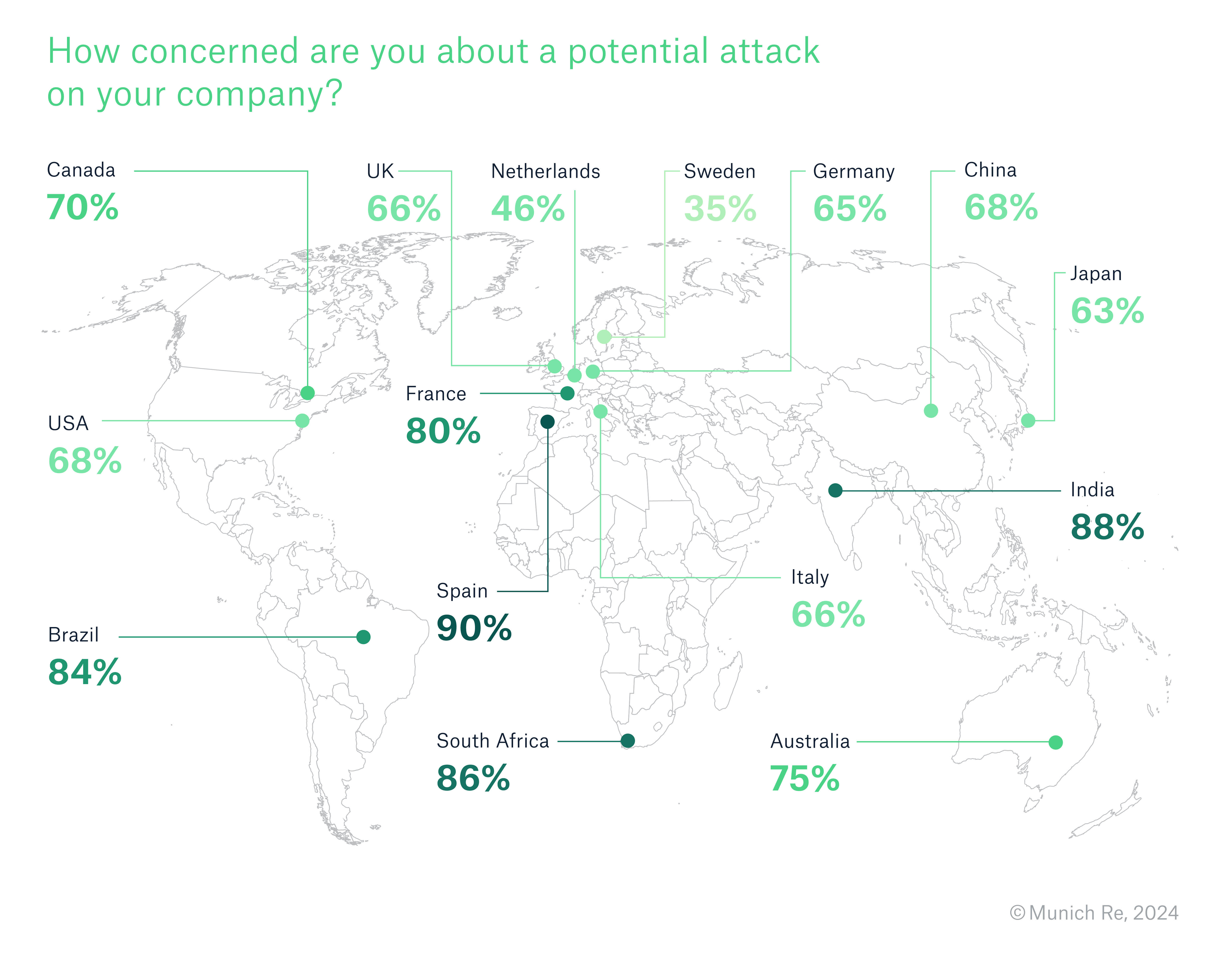

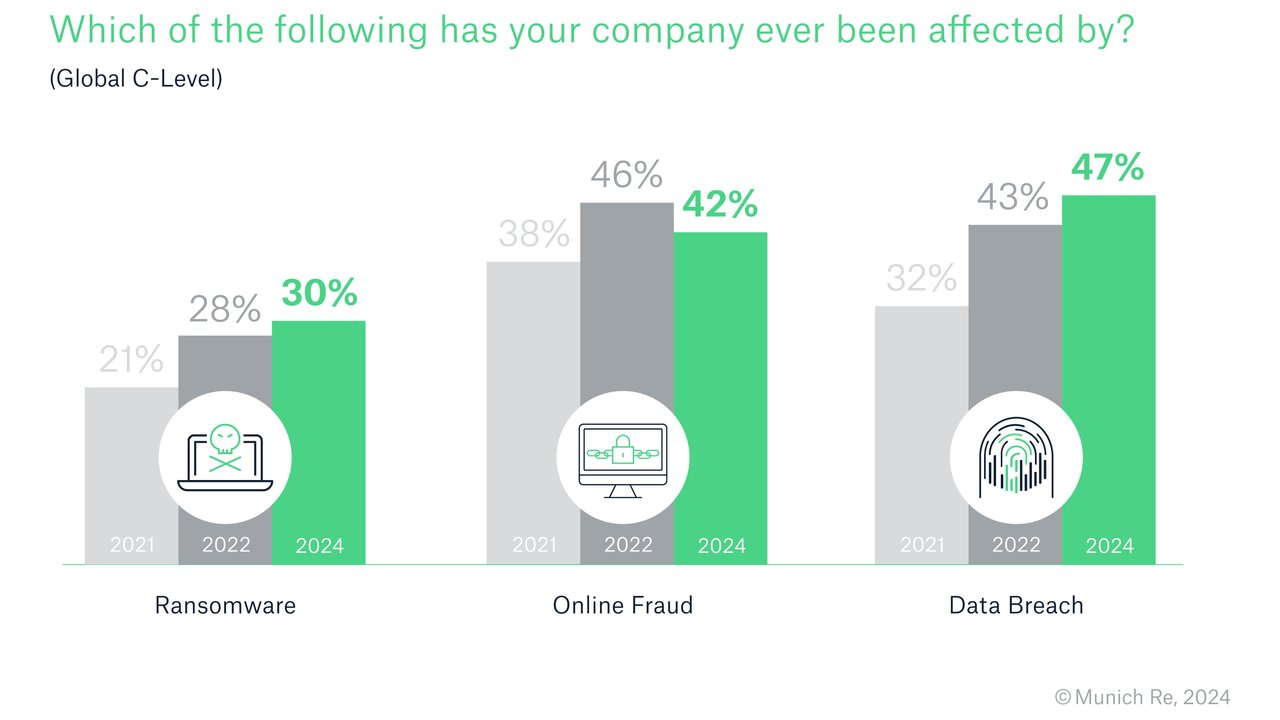

Rising concerns are justified by the relentless surge in cyber-attacks, with incidents such as ransomware and data theft on the rise globally. These threats not only jeopardize sensitive data but also inflict significant financial and reputational damage on businesses of all sizes. It is evident that the protection gap remains disproportionately large, underscoring the urgent need for comprehensive cyber insurance solutions.

Munich Re estimates global cyber insurance premiums to be around US$14 billion in 2023, with projections soaring to approximately US$29 billion by 2027. While the numbers indicate a growing recognition of the importance of cyber insurance, there is still a long way to go in bridging the gap between insured losses and economic losses.

One of the survey's key findings is the increasing relevance of technology trends such as AI (Artificial Intelligence), cloud services, and data analytics across industries. Nearly all corporate decision-makers surveyed are embracing these innovations, highlighting the critical role of technology in driving business growth and efficiency. However, with technological advancements come heightened vulnerabilities and security gaps, necessitating proactive measures to safeguard against cyber threats.

41% of decision-makers surveyed are considering cyber insurance, reflecting a cross-sectoral interest in leveraging insurance solutions to mitigate cyber risks.

For the insurance industry, the survey results underscore the importance of enhancing cyber risk transparency, simplifying policy conditions, and offering more accessible products. Munich Re, as a leading cyber reinsurer, is at the forefront of innovation, providing clients with unparalleled expertise and sophisticated solutions.

In conclusion, as digital transformation continues to reshape global industries, the need for robust cyber security measures and insurance protection cannot be overstated. The findings of the Global Cyber Risk and Insurance Survey serve as a wake-up call for organizations to prioritize cyber resilience and adopt comprehensive insurance solutions to safeguard against evolving threats.

For organizations seeking country-specific insights and information on Munich Re's cyber insurance products and services, we encourage you to reach out to your Client Manager or local team of cyber experts. Together, let us navigate the complex cyber risk landscape and build a more secure digital future.

Experts

Related Articles

properties.trackTitle

properties.trackSubtitle