In many cases, the financial consequences of an epidemic outbreak have not been covered by insurance, but retained by companies, leading to significant losses or even to bankruptcy in some cases. The current outbreak and its unparalleled consequences have served as a wake-up call for risk managers not to underestimate the potential impact of epidemics or pandemics on the balance sheets of their companies.

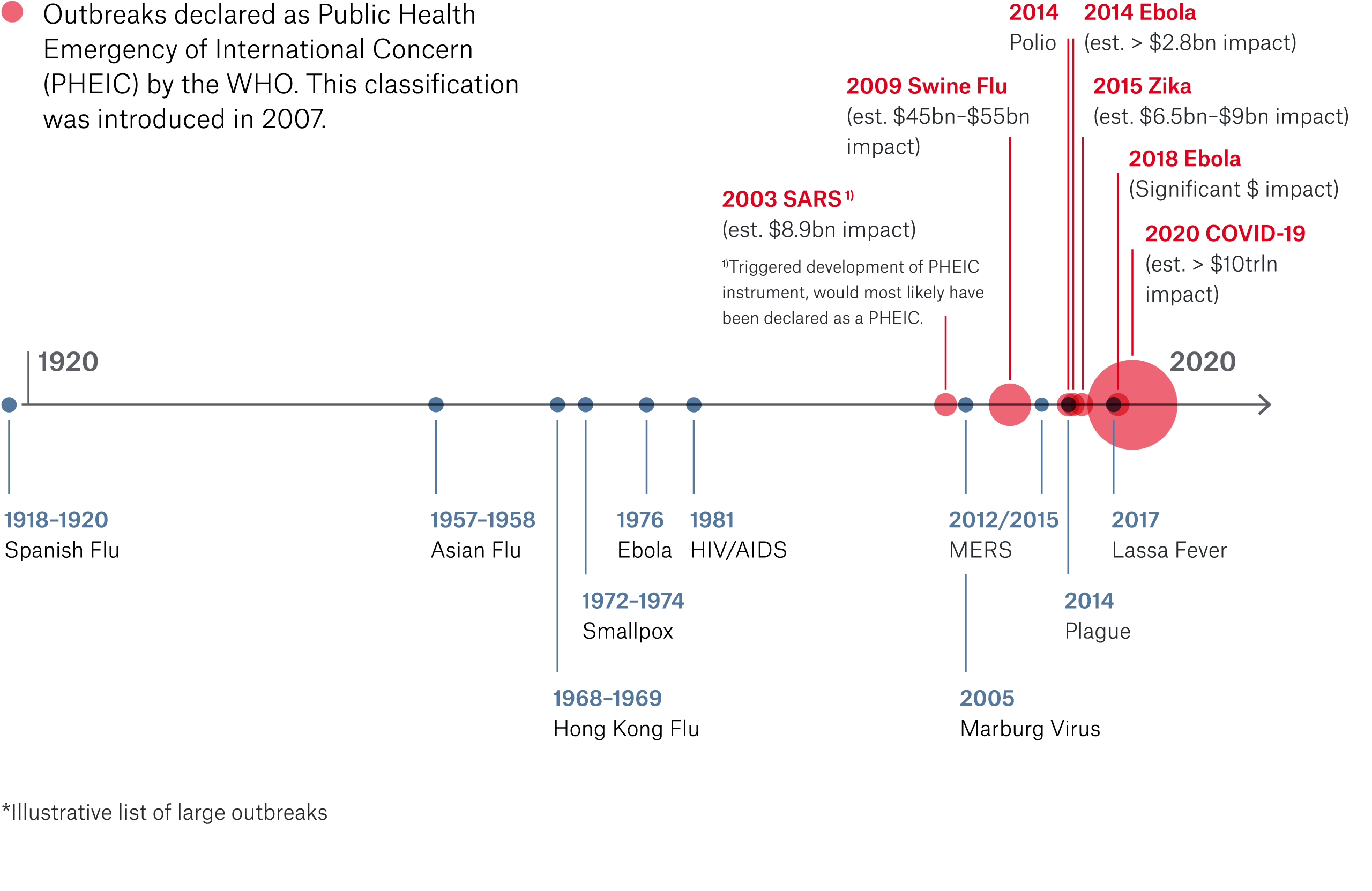

Munich Re is committed to making societies and economies more resilient against epidemic outbreak risk. We invest significant resources in developing what is a relatively nascent market. Evidence suggests that outbreaks are occurring with ever greater frequency as a result of environmental shifts such as deforestation, urbanisation and global mobility.

Finding solutions

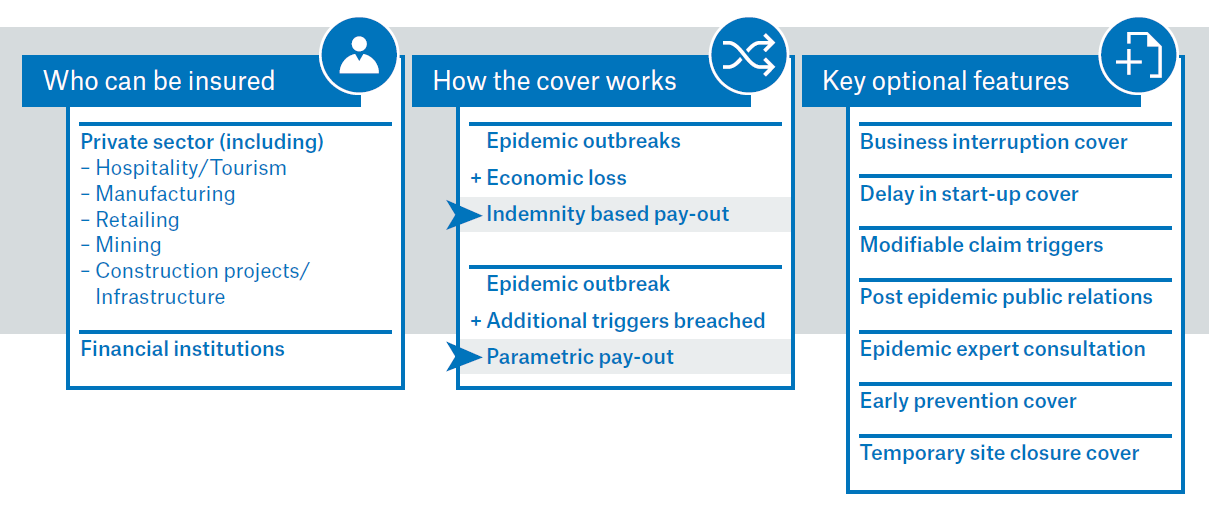

In 2017, Munich Re set up Epidemic Risk Solutions – a dedicated global team with deep expertise in epidemiology, statistics, risk modelling, finance and claims management to provide capacity for public institutions and private sector businesses such as hospitality, manufacturing, retail, mining and construction. Products cover specific risks associated with epidemics, including business interruption and temporary site closure.

Munich Re’s Epidemic Risk Solutions team is addressing a significant coverage gap that traditional insurance has not been able to solve: non-damage business interruption as a result of an epidemic. For example, most standard property damage policies require a business interruption to be due to physical damage and also typically exclude communicable diseases. Coverage may be extended to include communicable diseases by endorsement, but only limited capacity has been available and with restrictive terms.

“Based on our own proprietary models for the purpose of modelling pandemic and epidemic exposure, supplemented with data sets provided by external providers, we have created a range of innovative tailor-made risk transfer solutions for all lines of business covering epidemic risks”, says Gunther Kraut, Head of Munich Re’s Epidemic Risk Solutions team.

Finding the right pricing and risk management approach is paramount. Munich Re therefore taps into partnerships with companies who have unique expertise. Strategic co-operations place us at the forefront to ensure that even challenging cases can be covered.

The idea is fairly simple – and actually not too far removed from our expertise in risk managing natural disasters. To find the right price tag for a politically and economically sustainable risk-transfer solution, the ERS team gathers consistent historical data – for example frequency and severity.

Strengthening the resilience of companies and societies

Munich Re’s strategic approach involves working with the private and public sector. When it comes to translating our data knowledge into concrete statements regarding the potential economic loss, our technical underwriting is required to understand the very specific needs of our clients.

The advantage of an insurance mechanism to protect against epidemic outbreaks stems from an ex-ante financing of the necessary response measures geared to rapidly contain the outbreak itself. The benefits are obvious as the course and severity of an epidemic can – unlike in the case of an earthquake – be influenced while it is ongoing. A well designed insurance mechanism is conducive to the emergence of reliable prevention plans, standardised emergency preparedness, up-to-date public information, swift response and containment, enhanced cooperation and accountability for results.

As a consequence the overall human suffering and cost burden for societies can be largely reduced. And this is our very motivation. We are happy to work with individual companies, development organisations and governments alike.

Munich Re contact

Related Topics

properties.trackTitle

properties.trackSubtitle