preparing for uncertain futures

Summary

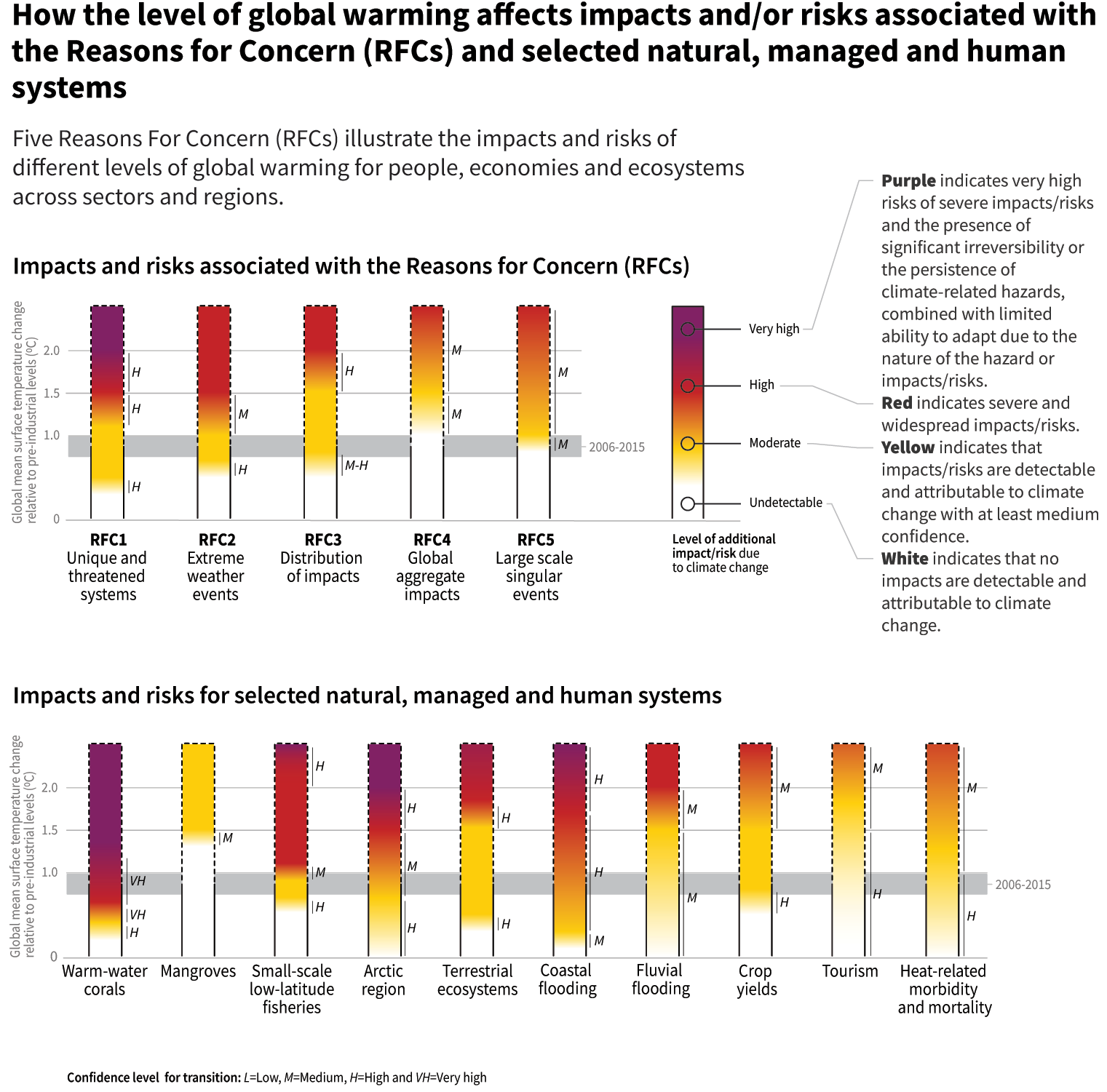

- Climate change is continuing unabated, making adaptation a strategic necessity.

- Organisations that embed climate resilience into their core strategy can protect their businesses, comply with evolving regulations, and unlock new growth opportunities.

- With advanced climate risk analytics tools such as Location Risk Intelligence, companies can identify which parts of their business are exposed to specific hazards, and through proactive risk management, transform uncertainty into measurable, long-term value.

Why adaptation matters

Adaptation finance highlights both the urgency and the potential for growth: while developing countries require hundreds of billions annually to address climate risks, current funding falls far short. Recent estimates suggest that actual flows are only a fraction of what’s needed, and private sector involvement remains minimal. Yet, the market for adaptation solutions could generate trillions in annual revenues by mid-century, signaling a major opportunity for investors and innovators.

For businesses, that means the unprepared might face supply-chain disruption and asset downtime, while first movers could capture growth in resilient infrastructure, water, and agriculture.

Business impacts: a closer look at precedents

- Supply chain fragility: In July 2024, flooding at a Swiss aluminium-alloy supplier forced a German automotive manufacturer to cut its outlook. Analysts estimated a production loss of roughly 10,000-17,400 vehicles (about 11% of H1 deliveries) and shares fell on the news (Source: Reuters). Mapping supplier exposure and setting dual-sourcing strategies are now resilience basics.

- Transport bottlenecks: Low water in the Rhine river has repeatedly constrained cargo loads, raising logistics costs, and delaying inputs across German industry. An operational risk that recurs under heat and drought. (Source: Reuters)

- Energy constraints: Heat-driven cooling-water limits have curtailed nuclear output in France in recent summer. An example of climate stress translating into power-market and industrial-load risk.

The investment case for adaptation is strong: a World Resources Institute meta-study across 320 projects finds >$10 in benefits for every $1 invested over ten years (Source: WRI).

The Corporate Climate Adaptation event

Munich Re Risk Management Partners attended Corporate Climate Adaptation (Handelsblatt Live, Düsseldorf, 30–31 October 2025) with Kai Karolin Wunsch on site where she was part of the start-up jury and moderated an Action Lap prioritizing needed action to drive adaptation forward from a clear business case for adaptation to regulatory frameworks.

The event convened decision-makers from corporates, finance, policy, and science to accelerate practical adaptation and the emerging “adaptation economy.” Key themes included climate ambidexterity (mitigation and adaptation), closing the protection gap, and moving from awareness to investment-grade action.

Main takeaways from Corporate Climate Adaptation 2025 (Germany)

- Rising catastrophe risks intersect with inflation, exposure growth, and building in high-risk areas. The insurance protection gap remains material.

- Companies showcased concrete adaptation practices such as supply-chain mapping, event monitoring, and capex hardening and illustrated how to turn data into decisions.

- Health impacts of extreme heat were framed in clear physiological terms – another lens for corporate risk and duty-of-care.

- Germany’s Ahrtal flood experience highlighted legal and rebuilding hurdles that slow recovery.

- Start-up pitches spanned heat kits, wildfire action and software, pointing to the role of innovation alongside incumbents and regulators.

- The host called for a Climate Adaptation Economy Initiative, signalling that governance, skills, and finance for resilience are coalescing across sectors.

Action-oriented: climate resilience as a strategic imperative

Extreme weather events are no longer rare; they pose real threats to infrastructure and operations. At the same time, regulatory changes and shifting customer expectations are accelerating the need for sustainable business models. This makes resilience not just about mitigating risk, but also about creating long-term value.

In short, by integrating climate adaptation into their strategy, companies are preparing for the future and aligning the business with the realities of climate change. But where to start? Implementing proactive risk management enables organisations to anticipate climate challenges and act decisively, turning uncertainty into opportunity.

Assess climate risk

Invest in resilience

Embed adaptation in strategy

The case for Location Risk Intelligence and its editions

The Climate Change Edition helps you to understand your exposure to current and future physical risks in different climate change scenarios across the globe to 2100.

The Climate Financial Impact Edition estimates potential financial losses from physical climate risks under different scenarios and supports stress-testing and prioritisation of adaptation measures.

The Reporting Edition provides structured climate risk reporting aligned with EU Taxonomy, CSRD, and TCFD requirements, simplifying compliance and transparency.

Side note: the power of an adaptation ecosystem

No organisation adapts alone. Policy frameworks such as Germany’s Bundes-Klimaanpassungsgesetz (KAnG) require risk analyses and adaptation planning across federal, state, and municipal levels, creating a consistent backbone for public-private action (Source: BMUKN).

Community-scale measures are often more efficient than isolated, site-by-site interventions. For floods, evidence shows that community-scale flood protection and land-use planning can be highly cost-effective, with property-level measures most impactful when combined with municipal defences (Source: OECD).

Wildfire risk, likewise, is shared: even a well-retrofitted building remains vulnerable if neighbouring plots are unmanaged. “Home ignition zone” guidance highlights the need for neighbourhood-level vegetation and ember-resilience practices (Source: NFPA).

Financial institutions round out the ecosystem by directing capital to resilient infrastructure and “build-back-better” projects (Source & wording: UNDRR), while analytics such as Location Risk Intelligence help target high-risk assets and sequence measures where they matter most.

A continuous journey

Contact our expert

Want to keep an eye on how climate risks affect your industry?

properties.trackTitle

properties.trackSubtitle