HSB Equipment Breakdown Insurance

Embedded cover

properties.trackTitle

properties.trackSubtitle

Comprehensive equipment breakdown cover for modern equipment and systems

At HSB, we're focused on providing you with a comprehensive breakdown solution for your customers' modern equipment and systems.

Our embedded equipment breakdown insurance solution can enable you to increase customer retention, revenues, and enhance your market penetration, whilst also providing your customers with wider cover and lower costs to help protect their bottom line.

Benefits include:

Partners

- Risk-free income

- Competitive differentiation

- Low incremental cost

- Increased retention; enabling a more inert product, limiting alternative markets

- Speed to market

Brokers

- Reduced errors and omissions exposure

- One single policy

Policyholders

- Wider cover; catering for changing technologies and associated risks

- Low incremental premium due to the removal of selection

- Enhanced protection of their bottom line by insuring previously uninsured events

- A dedicated, specialist engineering claims service

What is HSB Equipment Breakdown Insurance?

HSB's equipment breakdown policy protects the key assets of a business by providing cover for damage to machinery and equipment caused by unforeseen risks (including power surges, electrical or mechanical derangement, and electrical arcing).

Our solution provides businesses with cover for equipment that can often be overlooked and under insured compared to standard insurance products. By automatically including the cover within a commercial property policy, not only are repair costs covered, but also loss of business income, loss of rent and increased costs of working.

What equipment is covered?

- Electrical systems (e.g. control panels, switchgear, emergency generators, distribution networks)

- Heating, ventilation and air conditioning (HVAC) systems

- Computer systems, communication systems and office equipment

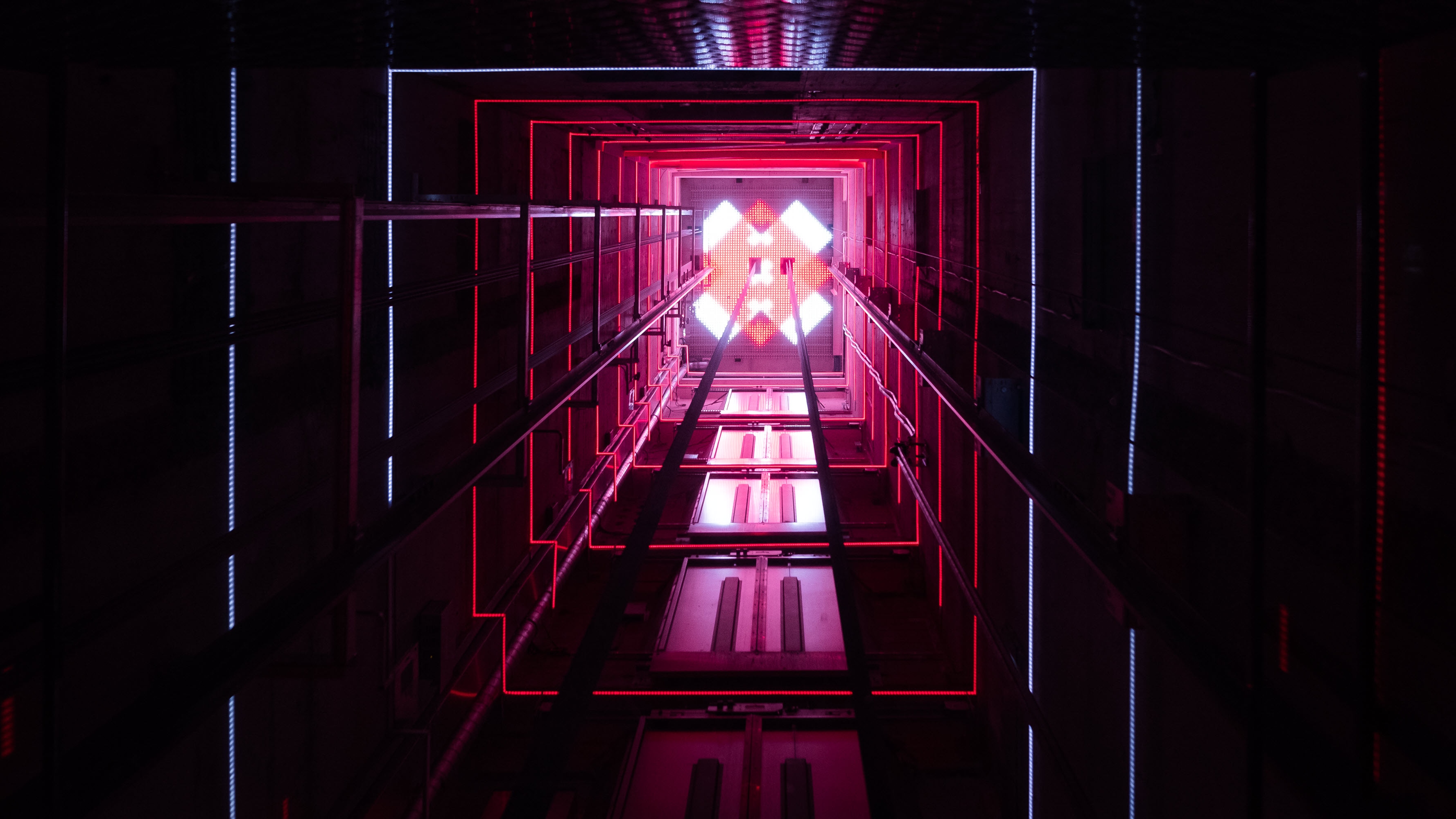

- Lifts, escalators and moving walkways

- Forklift trucks

- Compressed air and steam generation systems

- Security and access control systems

- Fire detection and protection systems

- Building management systems (BMSs) and maintenance units (BMUs)

What is not covered?

Which industries/sectors do we cover? [REPLACE SOME ICONS]

Comprehensive cover and a specialist engineering claims service

HSB Equipment Breakdown Insurance in action:

The following are examples of the types of claims that are covered under the HSB Equipment Breakdown Insurance policy.

IT server failure

Lift breakdown

This is an overview of the HSB Equipment Breakdown Insurance product. For full details of the cover and further information, contact our team.

For distribution channel use only.