Commercial motor insurance

Profitable growth for your fleet business

properties.trackTitle

properties.trackSubtitle

Boost your commercial motor insurance with Munich Re’s consulting support and receive a market-leading offer for a commercial insurance proposition.

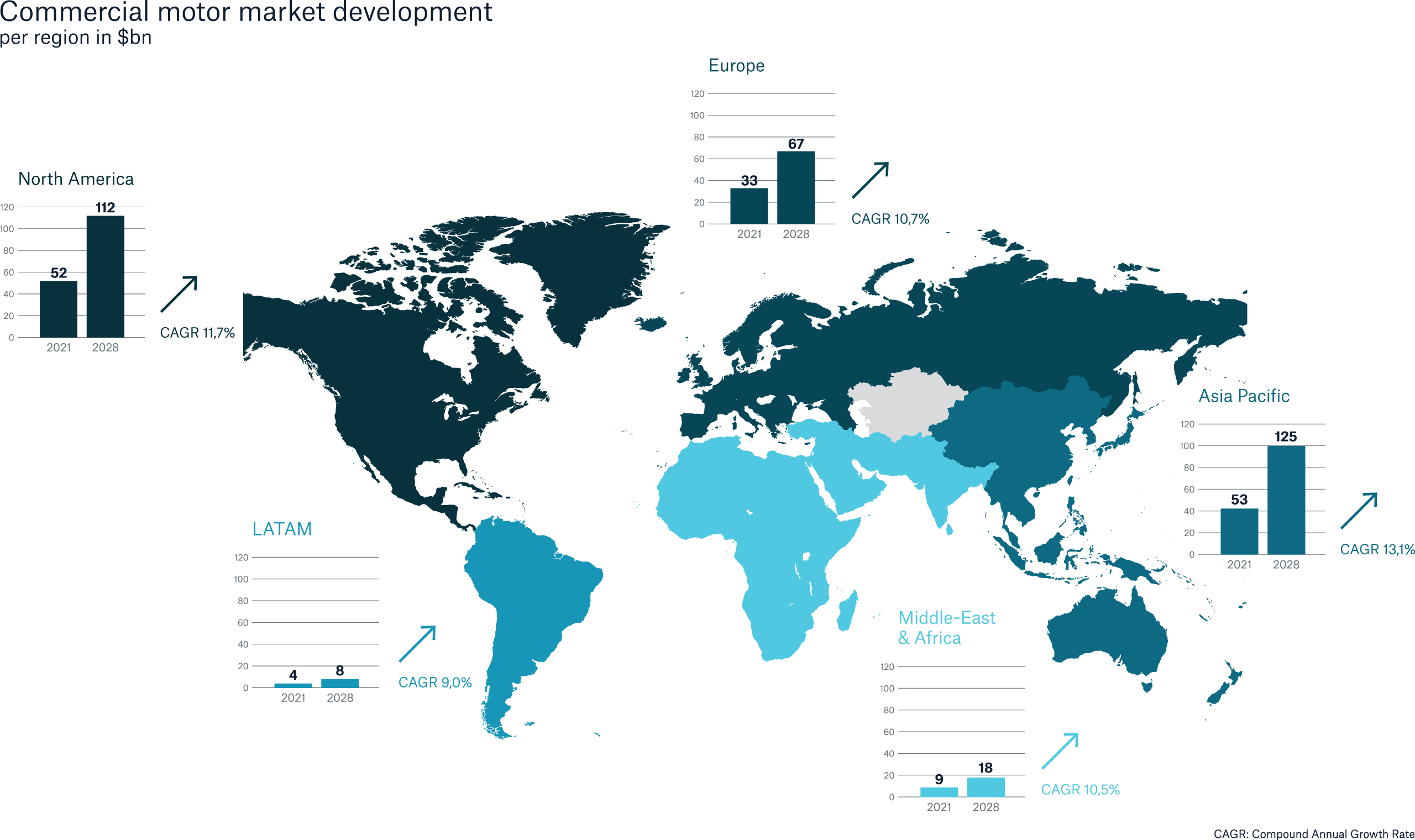

The global GWP generated by commercial motor vehicle risks will increase from $150 billion in 2021 to more than double by 2028.

A proportion of the growth is driven by a shift from retail to commercial motor insurance. Whilst the market is still dominated by business-owned fleets, new transformative fleets such as car subscriptions and car sharing continue to emerge and an increase in direct-to-consumer business models fuels this growth further.

Your challenges

- Profitability – Struggling to deliver consistent results across your fleet portfolio? Are particular market segments creating challenges for you? Do you have robust control mechanisms in place and market-leading underwriting knowledge to deliver on your goals?

- Sustainable growth – Are you able to confidently identify your desired growth segments? Do your products and services meet the needs of your target customer base? Do you have the tools to actively steer and control your book?

- Adapting to transformative market trends – Are you familiar with the new mobility landscape in your market and the impact this could have on your business model? Do your business and operating models address the demands of new mobility fleets and providers?

Our team of commercial motor underwriters, actuaries, strategic consultants, all with in-depth primary insurance domain knowledge, work hands-on with our clients on site.

Commercial motor slide deck: download now

What's in it for you?

- Market outlook 2040

- How to gain a competitive edge by leveraging vehicle connectivity, technology and new data sources

- A structured journey towards pricing and underwriting sophistication

- Client case studies

Download the slide deck after providing your contact information.

Please note that we will contact you once to ask for your consent for further communication according to our privacy policy.

Benefit from our service delivery and consulting

The commercial motor insurance market is currently undergoing transformational changes. It is crucial for insurers to fully comprehend the forces at play and the opportunities and challenges these changes will bring. Now is the time to ensure your strategy addresses the needs of your customers – both today and tomorrow.

At Munich Re we have a clear understanding of how these changes will impact commercial motor insurers. We work with our clients to provide strategic guidance to help realize their long term ambitions, whether they are new to the market or an established commercial motor insurer.

Commercial motor insurers who consistently outperform the market all have one thing in common: best-in-class underwriting and pricing capabilities.

Our commercial motor pricing and underwriting experts work with your teams to embed the best global underwriting and pricing practices within your business.

New technologies can play a pivotal role in improving the fortunes of commercial motor insurers – both via enhanced value propositions and via mitigation of risk.

Our clients benefit from our extensive experience with the world’s leading technology providers. We support you in the design and implementation of new technology-enabled products, such as telematics, that allow you to attract new customers, improve your pricing and underwriting processes and ultimately reduce claims costs.

Insurers sometimes have difficulty in identifying the key forces that are having a detrimental effect on their performance or stopping them from taking their portfolio to the next level.

Our team of commercial motor experts conduct a detailed analysis of your portfolio and operations across the entire commercial motor value chain to highlight pain points and provide actionable insights on how to improve identified issues or maximize under-exploited opportunities.

In order to protect profit margins whilst also capitalizing on growth opportunities, it is crucial for commercial motor insurers to have a transparent overview of their portfolio as well as the ability to take decisions quickly and decisively.

We provide state-of-the-art tracking and monitoring solutions to help our clients steer their commercial motor portfolios in conjunction with portfolio steering reviews and technical underwriting guidance to enable continuous enhancements and support you along the value chain.

Commercial motor insurance – Case studies

Would you like to know more?

Get in touch with our experts

Munich Re experts