Claims Management & Consulting

Improve portfolio performance and reduce loss ratio with expert consulting services for claims management solutions, strategy, and analytics

properties.trackTitle

properties.trackSubtitle

What Does the Munich Re Claims Consulting Team Do?

Munich Re’s Global Claims Consulting team delivers unique expertise in primary insurance claims via tailor-made consulting services provided by experienced multinational experts. We help our clients enhance their portfolio performance, reduce loss ratios, increase customer satisfaction and improve claims operational excellence.

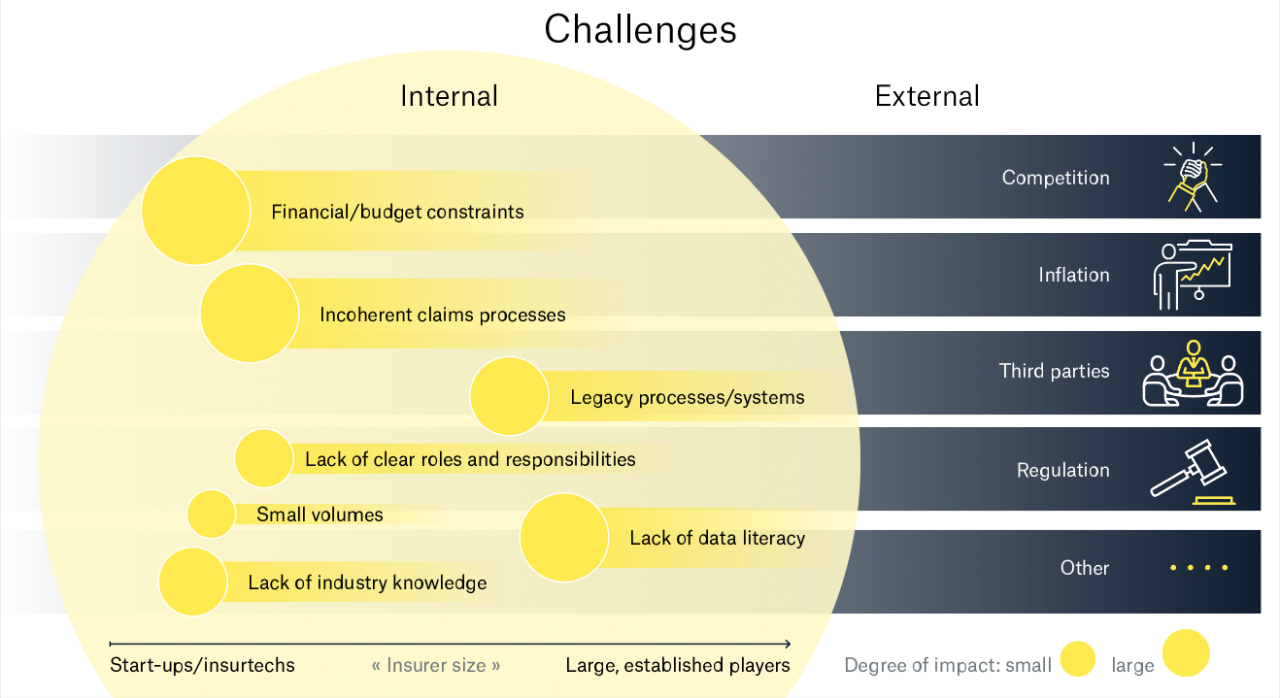

Claims organisations though often having excellent technical claims management expertise, face a variety of challenges in their daily work, such as legacy IT systems, incoherent claims processes, lack of clear roles and responsibilities and more.

Start-ups and insuretechs offer excellent digital platforms, but may lack the overall insurance expertise needed to set-up a proper claims function.

Slide deck: Claims inflation

The following challenges were identified in various projects our team was involved in:

Complications Claims Departments Face

Constant internal and external pressure is a claims department’s daily life. From internal stakeholders asking for costs and operational efficiency to externals, like the regulator and policy holders, expecting digitalisation and more and more transparency.

Preoccupied in solving immediate issues, claims departments often hold off the development of medium or long-term measures to reach the next level of organisational sophistication.

Our Claims Management & Consulting Services

Our 4Ds framework to approach projects with our clients:

We assist you in identifying and mapping your individual pain points, setting and achieving short, medium and long-term goals for your claims organisation.

We identify your areas of opportunity and advise on how to capitalise on them, it could be with new LoBs, new markets, as part of an expansion or growth journey.

Insurers who consistently outperform the market have one thing in common: best-in-class claims processes.

We understand how claims processes and operations are set-up and designed. Together we will implement tailor-made processes, guidelines or organisational structures in your claims team.

Across the globe, an estimated 10% of all claims are fraudulent. This rate may increase further during economic downturns and in specific regions.

We help our clients to set-up or improve their anti-fraud strategy by implementing the right guidelines, operational measures and digital tools.

Fast time-to-market, flexibility and lean internal structures have prompted insurers, insurtechs and MGAs to increasingly enter into partnerships with external TPAs. Clearly, selecting the right TPA and setting up the right structure and processes are essential to achieve excellent claims portfolio performance. It requires experts know-how to select the best TPA, carry out due diligence, establish the right processes, digital connections, and later, once the business is up and running, to provide oversight and control to prevent unnecessary claims leakage.

Our team of claims and consulting experts provides support with end-to-end third party management, from on-boarding to run-off.

Claims departments deal with vast amounts of claims data, which can offer new insights not just on the claims organisations’ performances but also for the insurance company as a whole to improve its bottom line.

We not only help our clients structure their data, but also, with a variety of descriptive and predictive analytics use cases, enable data-driven decision making throughout the insurance value chain.

Want to learn more?

Use Cases

Would you like to know more?

Get in touch with our experts right away