Covers for satellites in commercial space flight

Munich Re Specialty brings an entrepreneurial and innovative approach to the modern day space industry.

properties.trackTitle

properties.trackSubtitle

Tailor-made prelaunch, launch and in-orbit insurance covers for commercial satellites

Covering satellite projects from pre-launch to operation in orbit

Prelaunch insurance

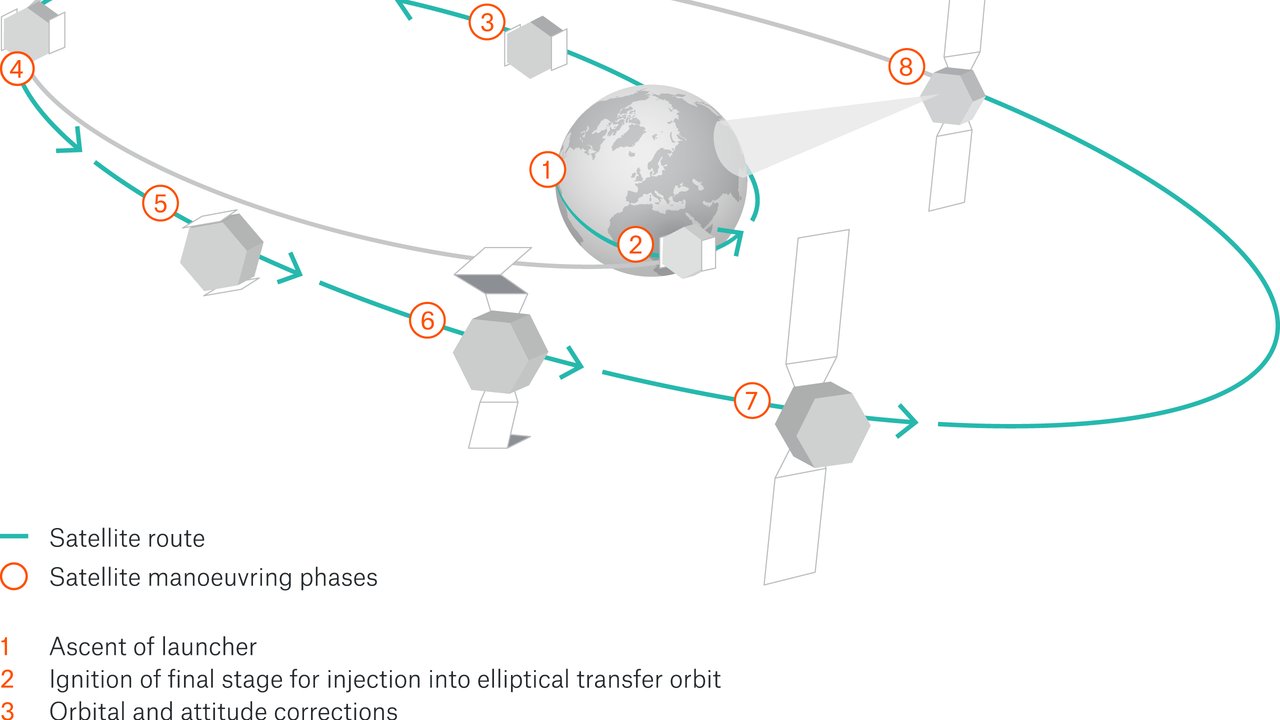

Pre-launch insurance provides all-risks coverage for material damage in the pre-launch phase. This phase comprises the satellite’s move from the manufacturer’s premises to the launch site; the satellite’s launch configuration, integration into the launch vehicle; and all launch preparations.

The coverage generally terminates when the ownership of the satellite – and hence the risk – passes from manufacturer to purchaser. At the latest, the risk transfers when the launch can no longer be aborted – often a few seconds after ignition. In such cases, pre-launch insurance covers – if only for a very short time – the risk that the launch vehicle will fail to operate. If the cover has terminated at an earlier point in time, it may reattach if the launch is aborted (post-abort coverage).

We offer pre-launch insurance not only for satellites but also for launch vehicles.

Launch insurance

Launch insurance provides all-risks coverage for material damage and malfunctions occurring at any time between the beginning of the launch phase and the end of the positioning phase, i.e. until in-orbit testing has been completed. To accommodate policyholders in their wish for longer coverage period, launch insurance nowadays is usually granted for up to 365 days after launch.

A partial loss is to be assumed if the satellite has become only partially operational or if its service life has been curtailed. If the impairment caused by a partial loss exceeds a certain limit, we speak of a constructive total loss.

The amount of compensation payable in the event of a total loss is specified in advance (agreed value). It is usually derived from the replacement value of the satellite – essentially the cost of a new satellite, the cost of launching it, and the cost of launch insurance. In other words, the launch vehicle is not subject to a separate cover but is included as an additional cost factor in the insured replacement value.

In-orbit insurance

In-orbit insurance offers protection against the risk of a satellite’s complete or partial failure during the operating phase. As with launch insurance, the insured value is an agreed value, which at the beginning of the satellite’s service life is based on the replacement value. The sum covers the whole value of a satellite.

Physical destruction or complete inoperability results in a total loss, while a partial loss or a constructive total loss results if the performance or service life of the satellite is only partially impaired.In-orbit insurance offers protection against the risk of a satellite’s complete or partial failure during the operating phase. As with launch insurance, the insured value is an agreed value, which at the beginning of the satellite’s service life is based on the replacement value. The sum covers the whole value of a satellite.

Physical destruction or complete inoperability results in a total loss, while a partial loss or a constructive total loss results if the performance or service life of the satellite is only partially impaired.

Launch plus Life insurance

Launch plus Life is the unique combination of launch insurance and in-orbit insurance. Launch plus Life provides all-risk coverage for material damage and malfunctions causing a complete or partial failure during all phases of a satellite life. In addition Launch plus Life insurance gives the operator full certainty with regard to market price changes restrictions over the satellite life and coverage restrictions introduced at in-orbit renewals.

A careful analysis of the satellite’s heritage, margins and redundancy is necessary to commit up to 15 years.

4 reasons why to choose Munich Re Specialty space insurance covers

40+

years of experience

Munich Re started insuring space projects as early as the mid-70s. In 1980, Munich Re created a unit exclusively dedicated to facilitating space exploration – the Space Department.

Cross-disciplinary expertise: Our lawyers, telecommunications and satellite technology engineers, rocket specialists and underwriters are as committed to tackling challenges in space as satellite operators and their brokers.

We are thorough in assessing even the most complex risks in space projects. We tailor covers to customer needs and make prompt and fair claims payments.

Our focus is on service. Maintaining close ties to our clients and brokers is important to us. Building trust is crucial for new types of cover in commercial space flight.

Would you like to know more?

Get in touch with us right away

Contact our experts