Weather risks

Volatile weather can significantly affect

your costs and profits

properties.trackTitle

properties.trackSubtitle

Lack of wind, too much sun – at least you can rely on weather insurance

Weather risks have a substantial financial impact on businesses in all economies. Affected sectors include energy and agriculture, as well as construction, real estate, transportation, hospitality, leisure, and many more.

Worldwide, the recent past has shown that unfavorable weather conditions are becoming more frequent. This applies over short timescales as well as seasonally and is evident in exceptionally mild winters, cool summers, and periods of sustained drought or low wind.

The increasing volatility of weather has seen pro-active risk management of extreme events gain more attention worldwide.

While corporate and public entities have long used insurance to manage the risk of catastrophic weather events, weather and commodity linked price covers have grown to become an important risk management tool.

>two-thirds

of the global economy is more or less dependent on weather conditions

The most relevant weather risks

Summer

Lower demand for energy

Cooler summers than expected reduce demand for cooling, resulting in lower power consumption. Less demand translates to falling power sales and lower spot prices on average.

Heat

On extremely hot days, additional spot power purchase may be required, at high cost.

Hot summers push up NG fuel prices

Maintaining a balance between power generation and electricity consumption is essential to ensuring a stable power supply. Additional power needs may also be met, in part, by increased production of electricity in natural gas plants.

Winter

Cold winters increase expenses

Extremely cold days in winter may require additional spot purchases of energy offered at higher than normal prices.

Warm winters reduce revenues

Mild winter seasons reduce the demand for heating, which results in lower gas prices and revenues.

Cold winters hurt energy suppliers’ margins

Cold winters can lead to a surge in demand, forcing utilities to purchase additional fuel at peak prices. To offset this risk, some utilities go beyond purely financial hedging contracts to include physical provision of energy commodities, such as natural gas.

Freezes damage crops

Frost damage in agriculture is largely the result of damage during the growing period.

Hydropower is the most important renewable energy source worldwide. Although the investment costs for hydroelectric power plants are relatively high, their low long-term operating costs, extremely low emissions, high efficiency of almost 90%, and a lengthy service life of up to 100 years make them a truly sustainable renewable energy source.

Almost 60% of water use in high-income countries is industrial, which makes many businesses particularly vulnerable to the adverse effects of arid periods.

What would happen to the KPIs of your hydro business if next year is unseasonably dry? Does a poor year for hydropower production influence your credit rating?

Consider some hydro risk examples:

- Too little rain impacts electricity generation

Hydraulic power production is impaired by lower rainfall, as rivers carry less water and water levels in reservoirs are low. Thermal power plants require large amounts of cooling water, and reduced availability leads to a reduction in power generation. - River inflow risk disrupts supply chains

Lack of precipitation in a river basin inevitably reduces streamflow, especially in times of high temperature. In extreme cases, this can lead to waterways becoming inaccessible to commercial barges and other forms of water borne transportation. - Too much rain slows construction

Risk awareness and the implementation of suitable precautions minimizes the risk of physical damage as well as the negative financial effects of a construction process prolonged by rain.

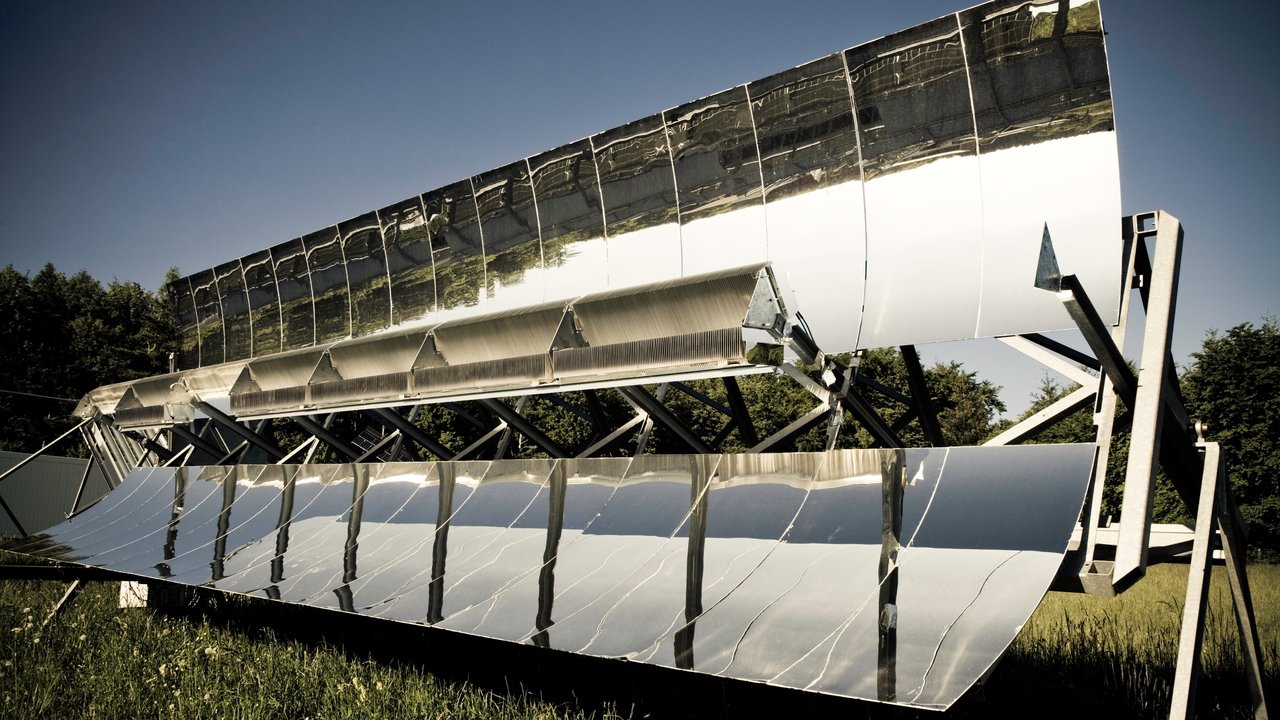

The variability in solar irradiation has a direct impact on the output of solar farms, causing financial pain for solar farm owners. The consequences for your business:

- Lost revenue – energy and renewable credits

- Replacement cost of power – market or cost of alternative generation

Solutions for smoothing revenues are therefore an essential component of state-of-the-art project risk management.

Consider some additional solar irradiation risk examples:

- Solar producers rely on sun hours and NG price protection

Subsidies for green power generation are being cut back in many countries and, as a result, the volatility and uncertainty of solar investments, solar projects can struggle to deliver the returns necessary to attract new capital. - Investor risk

Delay in start-up, reduced technical performance or unexpectedly low annual solar radiation can result in a loss of profits not covered by “classic” insurance.

Are you sure that the key figures of your solar business will still shine brightly?

Can you be sure of meeting your operating costs, financing obligations, and generating profits even in relatively windless years?

Experience over the last ten years has shown time and time again that the strength and duration of wind in individual regions and individual years or months can sometimes fall short of expectations. The concomitant decrease in power generation results in reduced turnover - yet operating costs, financing, and return targets still have to be met.

Wind volume risk examples

- Lack of wind

Since “lack of wind” cover can be in force for several consecutive years, our products offer investors maximum protection against loss of income due to lack of wind. In this way, the cover helps investment planning, secures profits and facilitates the financing of new products. - High wind speeds

The wind turbine operates at maximum capacity and the production output remains constant. At winds speeds of more than about 90 km/h, the turbines must be shut down.

Relatively small organizations operating on a thin capital base such as school districts, municipalities, and even snow removal companies – rely on snowfall hedging solutions.

By serving both sides of the market, the Weather & Commodity unit places cities and schools in a position to manage the otherwise very challenging expense of clearing snow during a severe winter. Additionally, snow removal companies are given support to ensure business continuity if a mild winter causes a sharp drop in their revenues.

These articles may also interest you:

Our weather risk solutions

Industry solutions

Contact our weather risk experts in Zurich and Houston

/New_Re_19_Reif_Marcel-Steffen_18666_rgb_1-1.png/_jcr_content/renditions/original./New_Re_19_Reif_Marcel-Steffen_18666_rgb_1-1.png)