Innovation for new world risk evaluation

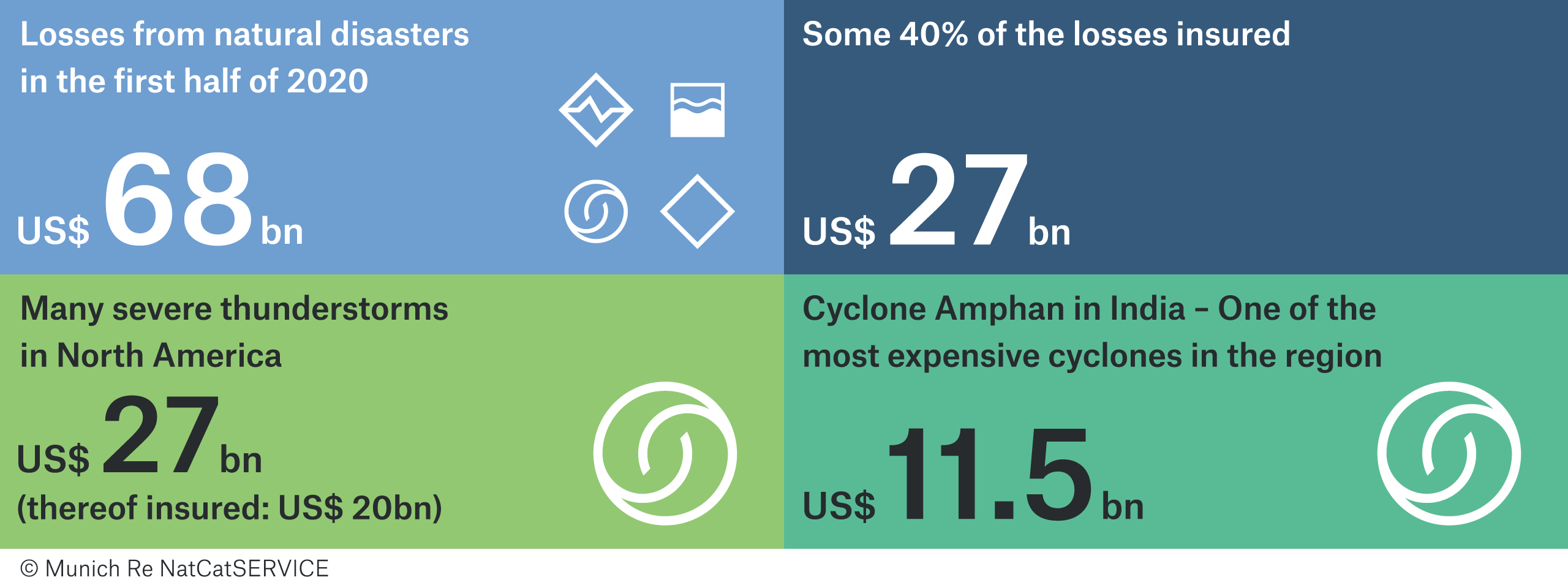

Evaluating this type of escalating risk exposure is critical to insurers in the U.S. and around the globe, many of whom are struggling to manage their portfolios, grow their business, and remain profitable. It is clear that new technology, tools, and risk strategies are not just savvy moves, they are key to a resilient and sustainable future for insurers and their clients.

Today, taking a more 360-degree view of risk, and actively developing longer-term prevention strategies, is key. Historical data alone is no longer a sufficient predictor of emerging/potential risks. Risk Managers, Underwriters, Actuaries, and Brokers all need to focus on examining more current, real-world data that is both immediately relevant as well as predictive.

Future-forward risk management

Location Risk Intelligence within the Risk Suite includes a modular set of risk assessment tools. Solutions available include a Climate Change Edition, Wildfire HD Edition, and Natural Hazards Edition. All the Munich Re assessments are based on historical data, as well as locations throughout the world, along with future-focused input from experts and clients, and factors in 50- and 100-year scenarios analyses. Single location and full portfolio reports are available, featuring Portfolio Maximum Loss (PML) curves, exposure visuals, and risk scores.

These risk assessments are based on performance indictors and are easily visualized in different, detailed map types as well as color coding. A variety of risk layers can be applied simultaneously. Downloadable and printable assessment reports are provided for all Risk Modules. The Risk Suite tools have both a web-based standalone offering that allows clients to evaluate a single location or upload their portfolios, and an API version for flexible integration into clients’ existing tools and processes.

Choosing the edition that fits your needs

Natural Hazards Edition. A wide variety of natural perils pose grave threats in North America and throughout the world. The Natural Hazards risk tool provides access to the world’s most comprehensive collection of natural hazards data spanning 40 years. It offers industry-leading filter options and geospatial services that integrate cloud-based data, IoT, and AI. Available scores include: Earthquake, Volcano, Tsunami, Wildfire, River Floods, Storm Surges, Tornado, Lightining, and Hail. The tool provides guidance for diversifying natural hazards risk – with risk hot spots and accumulation areas in a portfolio or particular market easily identified – helping clients map out areas they wish to avoid or further diversify their market locations.

Wildfire HD Edition. As wildlife hazard increases and intensifies, so does a need for better risk assessment and management tools. The size of recent losses in the U.S. and Canada highlights the large accumulation potential that can often be underestimated. The Wildfire tool currently features a zoning map for Alberta and British Columbia in Canada, and for the U.S. states of California, Colorado, and Arizona – to help support wildfire risk management. Higher resolution maps allow for better resolution of Wildland Urban Interfaces (WUI), featuring key zones for high-risk and high-value locations, with each 1.5-mile-wide WUI divided into five detailed zones.

Climate Change Edition. Climate change, largely driven by human activity, has a major influence on weather-related natural disasters and can dramatically alter a region’s risk situation. Munich Re’s innovative physical climate hazard assessment services, available through this Risk Module, are based on scientific frameworks and modelling. Short- and long-term risk assessment is possible, with scenarios possible up to 80 years. Based on the Intergovernmental Panel on Climate Change (IPCC), a United Nations body that established a framework which formed the basis for the Paris Agreement, the module services use Representative Concentration Pathway (RCP) scenarios for atmospheric greenhouse gas concentrations from the latest IPCC Assessment Report. The module features moderate, intermediate, and severe RCP scenarios that use projection years 2050 and 2100, with 20-year periods used for more robust trend estimate projections. It also includes the Climate Expert Mode, which provides more detailed information on the climatological stress indices.

Munich Re Experts

Related Topics

properties.trackTitle

properties.trackSubtitle