In early 2025, a series of earthquakes in the Asia-Pacific region raised widespread concerns. On 28 March, a 7.7-magnitude earthquake struck Myanmar, causing casualties and extensive infrastructure damage, with post-disaster relief efforts still ongoing. Two days later, a 7.3-magnitude earthquake hit the Tonga Islands, over 12,000 kilometres away. These events have sparked a public discourse on the earthquake activity period and prompted various sectors to focus more on earthquake prevention and disaster reduction.

However, from a global perspective, the frequency of earthquake activity in 2025 has not shown a significant increase compared to previous years, and it is still unclear whether or not we have actually entered a period of increased earthquake activity. Nevertheless, the frequent occurrence of earthquakes has prompted us to consider their impacts on tech industries such as the semiconductor sector. This article will chiefly explore how the semiconductor industry can respond to these “core” challenges posed by geological disasters, and how the insurance industry can improve its risk management mechanisms to address these challenges.

The impacts of earthquakes on the semiconductor industry

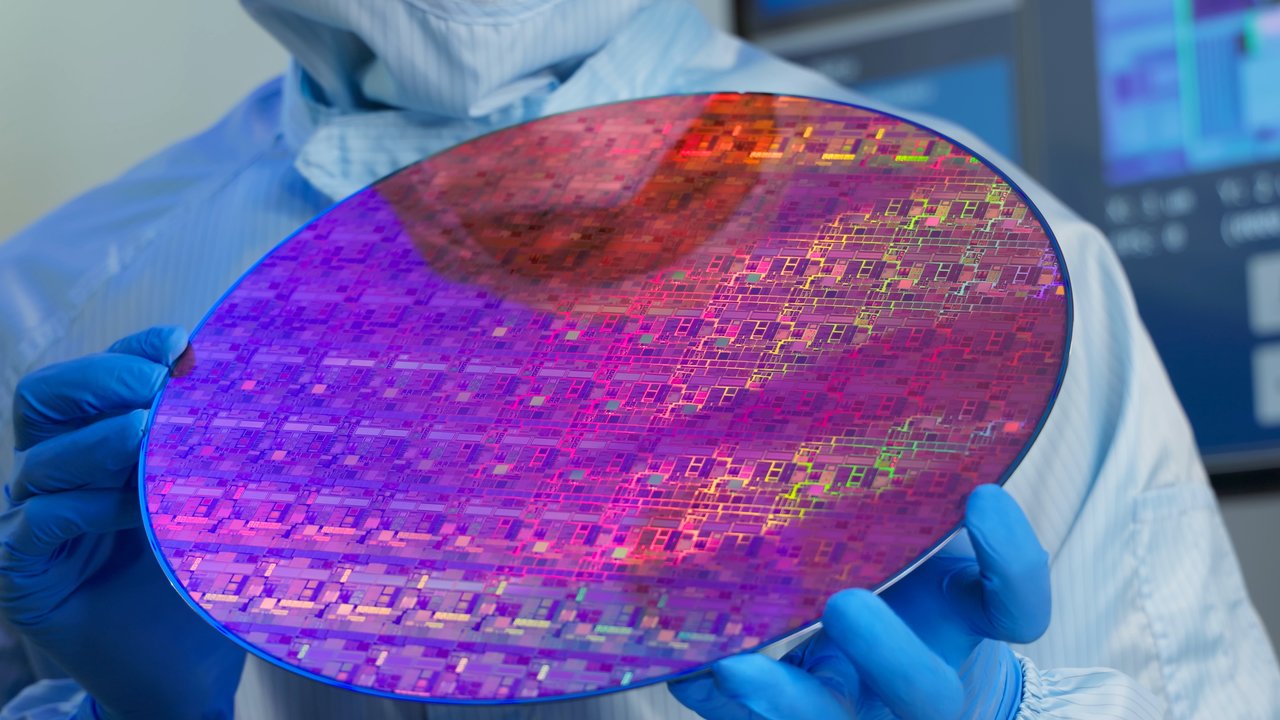

In the semiconductor industry, earthquakes can cause significant direct impacts, including structural cracks in or even the total collapse of facilities, as well as damage to critical equipment – resulting in substantial property losses and business interruptions. Given the industry’s heavy reliance on high-precision instruments, cutting-edge semiconductor plants are typically built with careful consideration of the local geological conditions and are subject to stricter seismic construction standards to enhance their structural resilience. Additionally, wafer production lines are designed with anti-seismic features to withstand a certain degree of environmental vibration. However, due to the extreme sensitivity of semiconductor manufacturing processes, even facilities with robust seismic protection measures in place may still experience considerable damage and operational disruptions during a major earthquake.

Despite strict seismic protection standards, earthquakes can still significantly disrupt semiconductor operations due to the industry’s aforementioned reliance on high-precision equipment. Key impacts include:

- Facility and Equipment Damage: Structural damage and disrupted utilities (water, power, gas) can stop production.

- Production Losses: Emergency shutdowns often lead to wafer scrapping and extended downtime due to equipment recalibration.

- Precision Equipment Failure: Sensitive components can become misaligned due to vibrations, leading to defects or equipment malfunctions.

- Supply Chain Disruptions: Damage to upstream raw material facilities may lead to shortages or contamination.

- Secondary Hazards: Compromised hazardous material storage can result in fires, explosions, or toxic leaks.

Major recent losses

| Date | Location | Magnitude | Impact |

|---|---|---|---|

| 11 March 2011 | Japan (Tohoku) | M9.0 | Major disruption of global chip supply, international price volatility |

| 6 February 2016 | Taiwan (Kaohsiung) | M6.7 | Plant shutdowns, supply shortages, price spikes |

| 14 April 2016 | Japan (Kumamoto) | M7.3 | Plant damage, production stops, disrupted global semiconductor supply |

| 15 November 2017 | South Korea (Pohang) | M5.5 | Minor impact, production resumed quickly due to buffer stock |

| 6 February 2018 | Taiwan (Hualien) | M6.4 | Raw material shortages, downstream supply affected |

| 16 March 2022 | Japan (Honshu) | M7.3 | Automotive and chip industry shutdowns, global supply chain disruptions |

| 3 April 2024 | Taiwan (Hualien) | M7.4 | Widespread equipment damage, plant shutdowns, significant economic and insurance losses |

| 21 January 2025 | Taiwan (southern) | M6.0 | No major structural damage but equipment shutdowns and large-scale wafer scrapping |

The crucial role of the insurance industry

The insurance industry should help the semiconductor sector strengthen risk control

Get involved in project development early on to lay a solid foundation for risk prevention

Apply both domestic and international standards to achieve multi-layer protection

Manage risk accumulation to address cluster exposure

Strengthen resilience to support business continuity

To ensure operational continuity during disasters, insurers should encourage and actively help insureds develop comprehensive risk control frameworks and strengthen their Business Continuity Management (BCM) and Disaster Recovery Planning (DRP) systems. Key strategies include:

- Redundant configurations for critical equipment

- Flexible utility connections and seismic isolation systems

- Remote backups for IT infrastructure

- Comprehensive emergency response planning and regular drills

- Resilience assessments across key supply chain nodes

Amid rising risk challenges, the insurance industry is advised to adopt a more collaborative model. By encouraging semiconductor clients to implement local seismic standards and integrate advanced international practices early in project planning, primary insurers can promote the development of safe, reliable, and resilient manufacturing systems.

As a reinsurer, Munich Re leverages its global and local expertise, along with decades of experience in the high-tech sector, to help primary insurers identify and manage catastrophic and semiconductor-specific risks.

Experts

Related Insights

properties.trackTitle

properties.trackSubtitle