To win new customers today, life insurers need to offer investment linked products. But developing, producing and marketing these products is complex and poses major challenges for many insurers. Munich Re Markets offers a comprehensive package of solutions that enables innovative products: from design and capital-market risk management to the presentation to customers and sales.

A study* on the trends in life insurance in 2022 has recently confirmed it once again: investment linked pension and life products are playing an increasingly important role for brokers and insureds. Almost 40 per cent of respondents stated that they no longer provide traditional life insurance products. The main reason for this is their low profitability and flexibility.

Get to know our solutions

Today’s end customers expect more than just returns

Those who participate in the development of capital markets with their investments usually perform much better. This explains why investment linked products are so attractive. However, they are usually also more complex than traditional life insurance products.

To a large extent, this is due to the greater flexibility of investment linked product concepts. Customers have numerous options and can choose between different guarantee levels. With their choice, they also assume part of the risks associated with the investment.

Acceptance of the additional opportunity requires more explanation and advisory at the point of sale as well as over the product lifespan. A digital presentation and configuration of the product along with a comprehensive self-service offering are crucial in meeting customer requirements and enabling sales.

Investment linked life insurance products and suitable digital tools

"The partnership with Munich Re on the financial product and the corresponding digital tools have been key pillars for us to successfully launch our new index product."

Michael Kurtenbach

CEO, Gothaer Lebensversicherung AG

The advantages of this model: Both the investment participation and the financial market risks can be covered via the reinsurance treaty. In particular, life insurers benefit from the fact that they are dealing with a type of contract that does not entail any additional reporting obligations. The treaties concluded with Munich Re are considered reinsurance for supervisory purposes. For accounting purposes, however, the agreed capital market participations are treated as financial instruments.

With numerous successful product launches worldwide since 2008, Munich Re Markets has unparalleled experience in implementing and operating these client-specific solutions. What’s more, Munich Re Markets operates an own trading platform, placing it in a position to offer customised solutions in terms of investment strategy – for example, in the form of index participations for which either a strict target volatility or a budget volatility calculated over the course of the year is agreed. This guarantees a fine balance of security and opportunity.

"Modern product concepts change the way we interact with our clients and unfold their full potential through digitalisation."

Frank Neuroth

Former Member of the Board,

Provinzial NordWest Lebensversicherung

Digital tools support sales and self-service

In addition to capital-efficient and flexible design, it is crucial for the success of investment linked products to communicate their advantages in a way that makes them tangible for sales and customers. Moreover, the many product features must be quick and easy to use: These include adjustments to the guarantee level, changes to the investment strategy, flexible deposits and withdrawals and other individually adjustable parameters. For these reasons, a flexible combination of personal advice and digital support is essential.

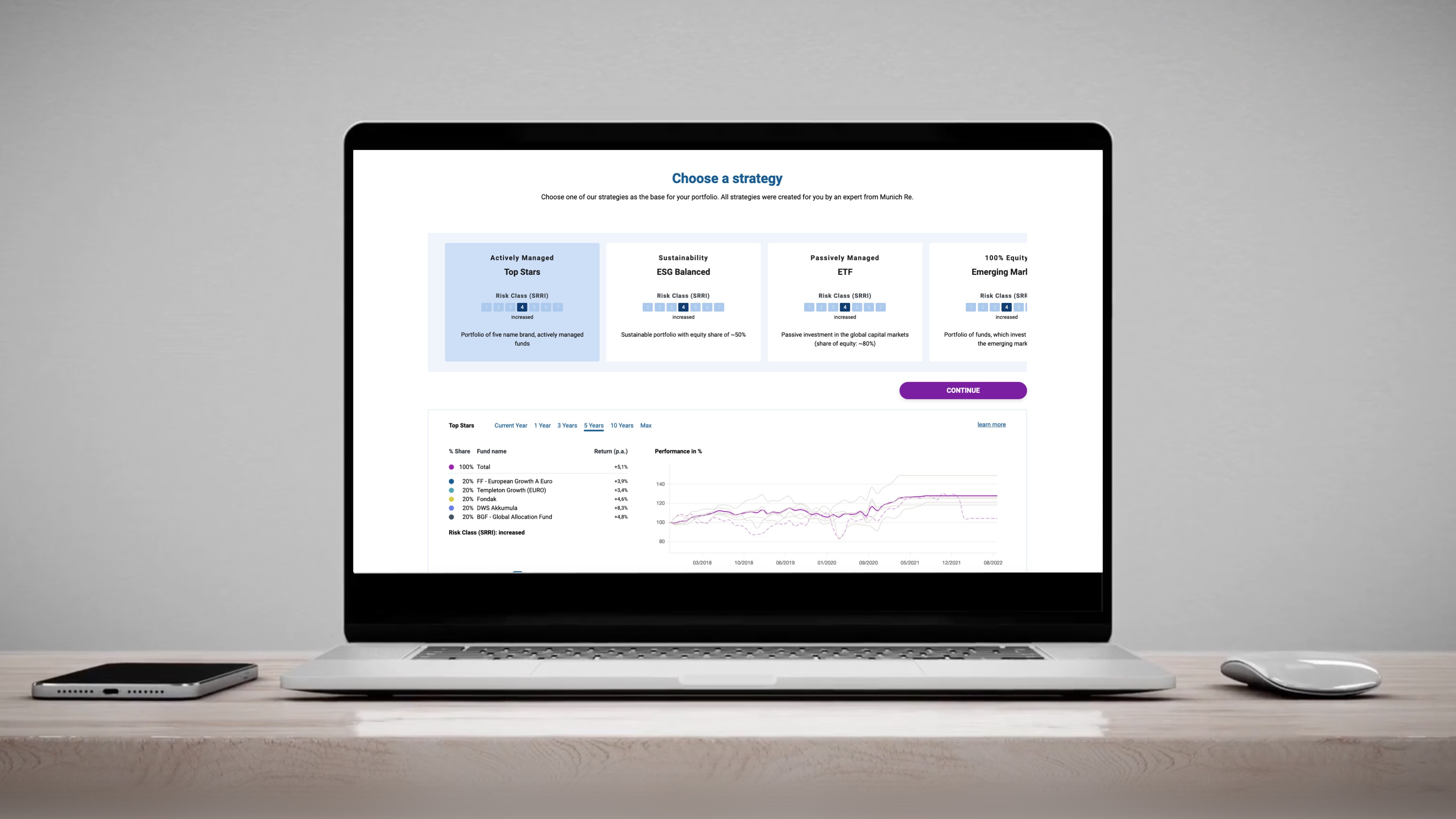

At Munich Re Markets, close cooperation with life insurance clients to develop the ideal digital product experience for sales agents and end customers is key. The services range from the presentation of products on the website to support for product configuration in sales and tools for policy adjustments in the client portal. These white label solutions fit seamlessly into existing processes and can be fully adapted to the brand identity of the primary insurer.

Our White Label Solution

One-stop shop instead of multi-party set ups

The complexity of investment linked products may have been a hurdle for many in the past. The offering of Munich Re Markets changes that. If only because the number of partners required is massively reduced.

While the development of such product concepts usually required an investment bank, an asset manager and a specialised IT service provider, clients of Munich Re Markets receive everything from a single source: capital market participation, a suitable investment solution with an individually tailored investment strategy, asset management and comprehensive sales support along the entire customer journey – all via the familiar format of reinsurance.

The study cited at the beginning also showed that life insurers’ customers today attach great importance to sustainable and fair products. Accordingly, Munich Re Markets not only enables products with guarantees and a high equity quota, but also supports life insurers in developing and implementing ESG-compliant concepts.

3 Questions for Michael Kurtenbach, CEO of life insurer Gothaer Lebensversicherung AG

Gothaer has developed various capital market-linked products with Munich Re Markets and successfully positioned them in the marketplace. What do you particularly appreciate about the cooperation?

The cooperative partnership: We work closely with Munich Re Markets in a spirit of trust. In this way, we develop a common understanding of how capital market-linked products meet customer needs in the long term. This starts with attractive return opportunities with a high level of investment security and extends to digital applications that help communicate product concepts clearly and transparently to both our intermediaries and our insureds.

What are the advantages of capital market participation via reinsurance treaty?

It’s more resource-efficient for us to participate in the capital market via the familiar format of reinsurance. But this aspect was not decisive for the cooperation. It’s far more important to us that we have a partner in Munich Re Markets that covers the entire value chain, from investment strategy and asset management to sales support with a digital customer experience.

Is the digital interface between customers and sales a “nice to have” or a must?

It makes an important contribution to the success of our capital market-linked products. Even more: it’s an important step on our way to the digital transformation of our product portfolio. Our customers expect exactly what the tools for this interface from Munich Re Markets provide – easy-to-understand and transparent presentation of the product design, service autonomy and constant product access through digital proximity.

Further Information

Our Experts

/Erichsen_Sven_v2.jpg/_jcr_content/renditions/original./Erichsen_Sven_v2.jpg)

Related Topics

Newsletter

properties.trackTitle

properties.trackSubtitle