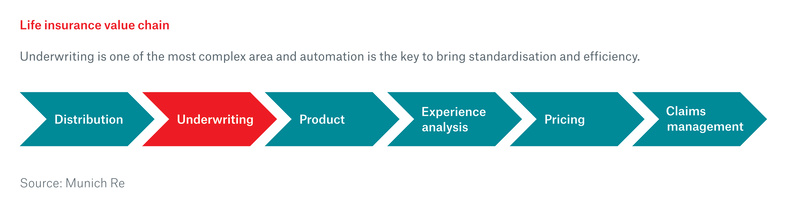

The global life insurance market is becoming more competitive and challenging. By implementing automated underwriting processes and analytics as the foundation of a lean and agile organization, one can focus on strategy and growth. Lisa Chen, Vice President for Asia Pacific ex Japan of Munich Re Automation Solutions Pte Ltd. examines the future of life underwriting in the region and share some of the major trends and development going forward.

The future of life underwriting is clear - automation and analytics are key for future growth. Imagine, underwriters will be able to focus on strategy, portfolio analysis and more complex cases instead of the large volume of standard cases, their administration and case management. Operations will achieve better performance metrics including high straight through processing (STP) rates and quick turnaround times, reduce error rates/rework and not taken up (NTU) rates and ensuring an overall high performance operation that can easily handle large and increasing volumes of cases. Distribution will be more productive and achieve more sales due to higher product penetration per customer and higher premiums with cross- and up-sell strategies. Effectively, most, if not all, stakeholders working in a life insurance organisation will win. Sounds like a future fantasy? In fact this automation and analytics wave in Asia is gaining momentum.

Current market situation spurs automation

The global life insurance market is becoming more competitive, with many of the more ambitious players turning to innovative technology solutions in specific parts of the insurance value chain to help them create a competitive advantage in the market, and be able to outperform the rest. Asia, with many of its markets achieving record growth over the recent years, is a diversified multichannel distribution marketplace - including agents, brokers, bancassurance, direct sales, telemarketing, eChannel and digital sales. With the current race to be a digital insurer, the region is well placed to adopt the latest technology and tools rapidly. This is the foundation for future growth based on increased efficiency in processing, freed resources to explore new business and generally underwrite cheaper and faster.

Automation supports lean and agile organisations

Life insurers in Asia are aggressively moving from paper to electronic new business processes. Some new entrants are going digital from inception. The primary reason for this investment in new business and underwriting automation and analytics is to develop a platform for growth characterised by:

Learn processes

- Quick (point of sales) underwriting decisions and high straight-through-acceptance (STA) rates

- No manual reworking – i.e. a “once and done” data input process, eliminating application errors

State-of-the-art working enablers

- A customer experience based buying process, which attracts key distribution partners and technologically savvy agents, making them more professional, loyal and dynamic with higher productivity, higher retention and higher satisfaction rates

- The ability for agents to use mobile devices and to still process applications while working offline

Quick time-to-market advantage

- The ability of the insurer to quickly and cost effectively launch new products and deploy new channels, without undertaking significant IT and business process reengineering projects each time

- The ability to reshape the insurance product mix towards more profitable protection products

Built-in intelligence with scale up potential

- Built-in intelligence that prompts and enables the sale of more protection riders / up-sells at the point of sale

- Greater risk management and control in the move towards offering more protection products

- The ability to cost effectively scale the business for growth, without growing the employee base / cost

Consistency and concentration on the essentials

- Consistency in underwriting decision making and accuracy, and

- No need to find additional underwriters to cope with growth as the majority of the cases can be taken care of by the sophisticated electronic underwriting engine, allowing underwriters to focus on complex cases that require manual underwriting

Post automation is where Big Data and advanced analytics come into play

Investment in an electronic new business system should enable all of the above. Encouragingly in Munich Re’s view, many life insurers have recognised that the key to success and a rapid return on investment is not just about capturing application information electronically. Key success factor is to go the important extra mile from the outset and offer real value to distributors and customers via immediate decisions on applications and a fundamental transformation of the business. Many experienced players, who have been through automation programs, will attest that significant benefits become evident only after an automated underwriting solution is introduced, and advanced analytics is embraced to deliver data driven insights for better decision-making across the business including distribution, underwriting and operations. A leading life insurer in Australia, for example, has formed a small specialist team to use data driven statistical models to outline intermediaries behavioral trends, customer demographics and risks insights in order to implement control measures and to improve risk management. With this in place, an optimal STA rate was achieved in reference to the average number of disclosures.

Point of Sale integrated with automated underwriting to get compelling value

Despite the current digitalisation wave, in Asia, most business is still submitted via paper applications completed by the agents or the bancassurance channel. This is clearly expected to change in the nearest future. As a first step distributors will have the option of making an eSubmission at the Point-of-Sale (POS) and, according to former implementation processes, usually sales force will choose to submit some or all of their business electronically, where the e-service proposition is compelling. Any automated underwriting system however, should handle both electronic new business as well as paper applications in a batch processing mode (i.e. Back-Office underwriting mode). This will ensure that data originating from all channels will be available for further analytics.

Data is the basis for management and steering

With an automated underwriting system, data is available in fine-grained electronic form for detailed analytics. An important feature of an electronic new business solution is the ability to deliver actionable intelligence to decision makers in order to help them manage and improve business performance and entire value chain in their operation. This could be underwriters to improve rules performance, management of bancassurance or agents to improve sales performance and heads of operations to improve business processes. As a result the whole operation will gain almost real-time insights to enable ongoing improvements which will be key to ensuring long term sustainable success.