The science of sanctions compliance

8 minutes read

Published 08/24/2016

Depending on their objective, sanctions can have manifold consequences. They can range from the total cessation of trade relations to restrictions for certain branches of industry (such as offshore exploration and oil drilling in regions north of the Arctic Circle).

As a rule, the aim of financial sanctions is to prevent money and other economic resources from being directly or indirectly made available to listed individuals or organisations.

Sanctions lists provide an overview

Sanctions lists provide an overview of the individual parties affected by restrictions. These official lists identify the individuals, groups, organisations or assets against which or whom economic and/or legal restrictions have been imposed. Here we have the first challenge, for the consolidated list of EU sanctions contains several hundred entries, including several with different spelling. Another problem is that the UN, the EU and the US refer to different sanctions lists and directives which are not always congruent. Moreover, the lists do not directly specify whether they refer to individual assets or branches of industry; this is something which must be established from the respective directives.

Which sanctions apply depends on a company’s corporate structures: the decisive regulations are those which apply in the country where an insurance company, for example, has its head office. However, they also affect the foreign branches and subsidiaries of major corporations, for these are part of the legal entity under company law and are therefore bound by the imposed sanctions. On the other hand, while independent foreign subsidiaries are excluded from the imposed sanctions in purely legal terms, they are still governed by the regulations of the country in which they are located. In their case too, however, the type of business can provide an indication as to whether or not sanctions apply. Attention must also be paid to the possibility of such criminal acts as evasion or aiding and abetting. Employees abroad must additionally ensure that they comply with the requirements specified for their respective nationalities. A German employee working in Singapore, for instance, must comply not only with the sanctions in force there, but also with the requirements specified by the EU.

Consequences for the insurance industry

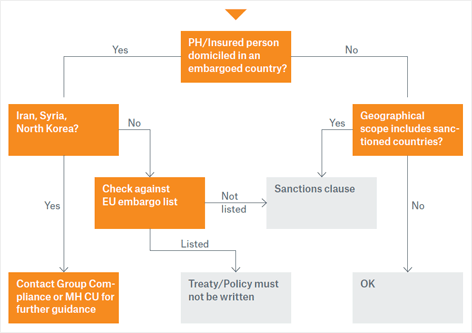

Fig. 1: Decision tree for underwriting

The diagram illustrates the procedure when checking a business deal with regard to sanctions. The actual process is even more complex in practice.

Additional diligence must be exercised if claims payments are to be made at a later date within the framework of the insurance contract. For the insurer’s claims management, this means that due diligence checks are obligatory during claims handling and above all immediately prior to settlement of the claims. This is because the sanctions regime may have changed considerably in the meantime.

The currency of the insurance contract may also play a part here. Since all payments in dollars pass through a US clearing house, US sanctions law must also be observed. The same also applies in cases in which payments are remitted in a different currency but are handled by a US bank.

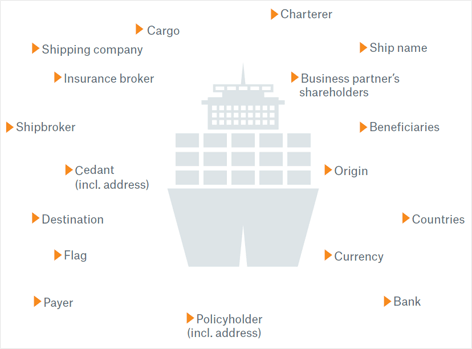

Fig. 2: Points to check in marine insurance

The underwriting team must first establish whether regulations have to be observed and, if so, which. These are then interpreted in the context of the business written and the risks covered. Since sanctions are increasingly imposed as a means of enforcing political goals, this topic will become more and more important for insurance companies.

Challenges for operative business

For a complete review within the framework of due diligence, it is not sufficient to limit the investigation under sanctions law to the cedant alone, although it is the only other party in the contractual relationship. On the contrary, the reinsurer is obliged to vet all possible beneficiaries (insofar as they are known) who might profit from a payment by the cedant in order to ascertain whether any relevant sanctions are in force. This applies in particular because the cedant is domiciled outside the EU and is therefore not bound by EU regulations. The cedant is consequently free to remit payments to individuals or organisations against whom or which the EU has imposed sanctions. Companies and individuals inside the EU, on the other hand, may neither directly nor indirectly make economic resources available to sanctioned individuals or companies.

Where possible, shareholder structures must also be considered when investigating whether or not a company is subject to EU sanctions. For instance, one or more shareholders may be named in the sanctions list, but not the company itself. If the shareholding exceeds a threshold of 50%, the company must be treated as though it was also the subject of a sanctions regime. Indemnities actually accruing to the company as a result of the loss must not be disbursed. This can be achieved by commensurately reducing payments to the cedant or alternatively by agreeing on a settlement with the cedant ensuring that the sanctioned company does not receive any payments.

Screening with special software

Individual checks are often required additionally, as sanctions lists do not contain all details relating to sanctions (such as relevant shareholdings) and the automated comparison may deliver erroneous results. Munich Re has set up the “Central Unit Sanctions” for this purpose. The unit is part of Group Compliance and is staffed by specialists who have considerable experience in analysing sanctions clauses and in operative business.

The Central Unit Sanctions investigates whether a payment order does indeed violate sanctions regulations. Another conceivable case, in addition to the aforementioned analysis of shareholder structures, would be one in which the beneficiary of the payment is not the same as the sanctioned individual – in other words, both have the same name, but a different address or date of birth. The Central Unit Sanctions is also responsible for documenting every decision for auditing purposes.

Conclusion

It is no longer enough to simply review the sanctions lists with the aid of IT-based screening tools. Specialists are needed to establish such aspects as the precise shareholding structures or the exposure of covers, and to carefully analyse the sanctions clauses. The only possibility for small and medium-sized insurance companies is to call in an external service provider if they cannot manage the task themselves. In all cases, however, responsibility for correct compliance with the regulations remains with the company itself.

1

Expert

Urs Alexander Mayer

is a compliance officer at Munich Re and advises the company on all matters related to sanctions.

He has 15 years’ experience as a lawyer in insurance and reinsurance.

- Email umayer@munichre.com

- vCard Download

Related Topics

Newsletter

properties.trackTitle

properties.trackSubtitle

0:00