After hitting a low in 2016, property-casualty insurers can expect to see a notable recovery of premiums in the next few years. At the same time, digitalisation offers significant opportunities to improve efficiency, the portfolio and, in particular, distribution and sales.

But it is customer experience that is tipped to benefit the most from the digital transformation: underwriting and claims settlement can be automated and thus speeded up, and big data makes it possible to tailor products more closely to clients, such as covers for diabetics and on-demand and telematics products. This will also make it easier to close the very large insurance gap found in Latin America and many other developing regions.

Above-average growth in Latin America’s insurance markets

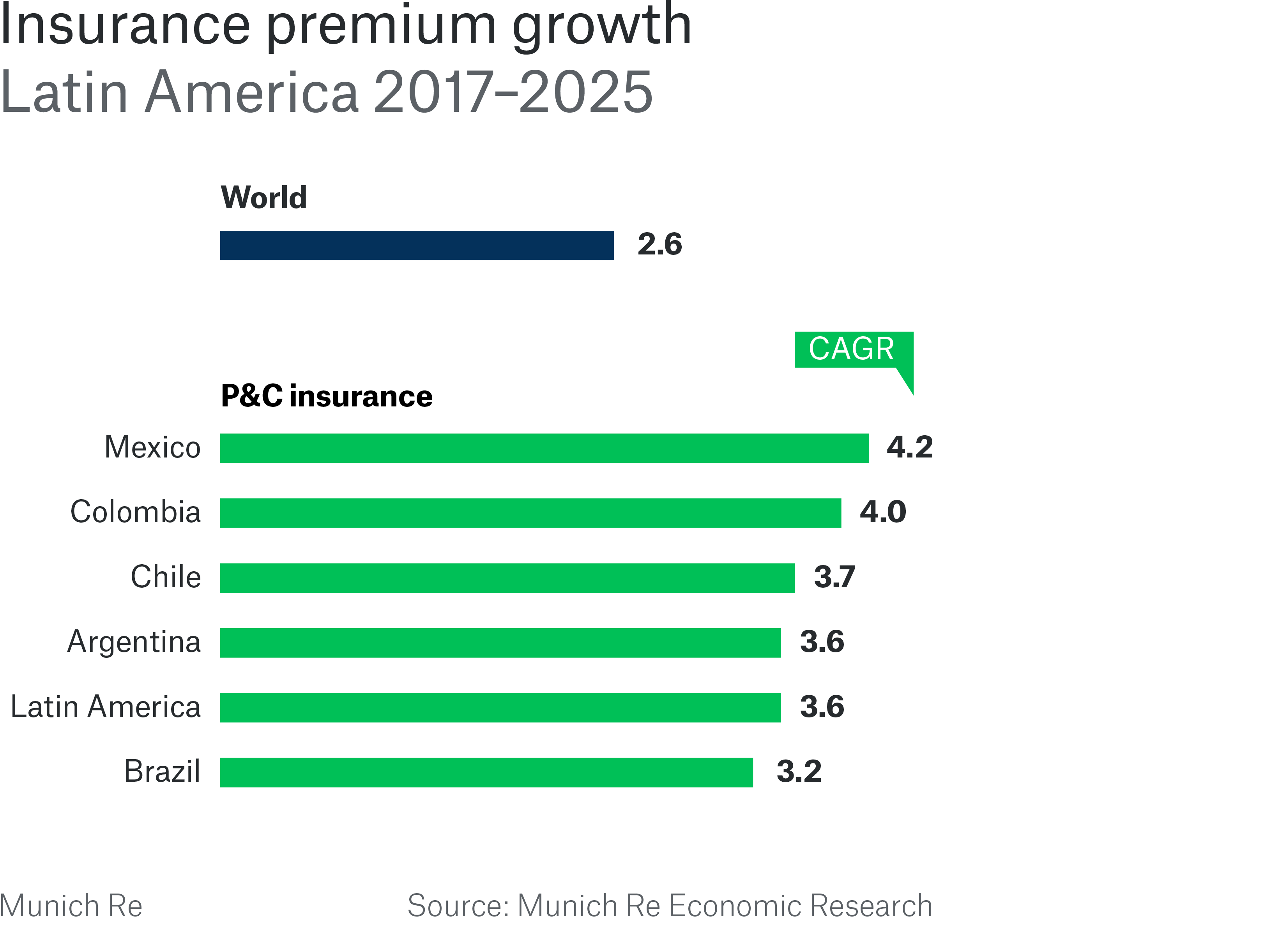

By 2025, countries in the region are likely to be home to some of the world’s fastest-growing insurance markets. In property-casualty, average annual premium growth could reach around 3.6% in real terms, much higher than the global average of 2.6%. The future therefore looks much brighter than what we have seen in the past year.

Although the picture is largely positive for Latin America, there are currently two outliers. Venezuela is not included in our forecasts, as political upheavals in the country render predictions impossible. And in Brazil, long-overdue reforms and a lack of consolidation combined with a series of corruption scandals have significantly dampened the prospects for insurers and the wider economy. Latin America’s biggest economy, single-handedly accounting for over a third of the entire region’s GDP, has been in recession for the past two years. While slight economic growth is a real possibility in 2017, it is unlikely that any significant reforms will be tackled before the next elections due in autumn 2018. Life insurance in Brazil is still growing rapidly as a result of catch-up effects. The growth prospects for property-casualty, however, are significantly bleaker.

In 2016, premium income of property-casualty insurers fell by around 3% in total in Latin America. With falling commodity prices and devaluations posing particular challenges for a number of countries, Latin America experienced a 0.5% reduction in real economic output (GDP) and found itself in recession. Now that the worst is over, many countries are now reaping the benefits of reforms and financial consolidation. The rising per capita income of a growing middle class with its increasing need for insurance, coupled with relatively low insurance penetration, offer significant catch-up potential.

The digitalisation megatrend offers opportunities

- Sales and distribution: Completely new sales channels are being opened up which can be used to reach smartphone-savvy client groups. Established insurers may initially feel threatened by this development, as InsurTech companies can act much more quickly and more innovatively. But large insurers can also benefit hugely if they embrace the digital transformation. Thanks to improved analysis of client data, upselling opportunities become available. And, as is so often the case, forerunners have the best chances.

- Client satisfaction: Automation in claims settlement and new business brought about by big data makes communication with insurers much more convenient and reduces response times. It opens up opportunities for new products right at the edge of the boundaries of insurability. At the same time, it improves portfolio quality. It is also possible to combine internal and external data, such as data from satellites and drones. And use can also be made of data taken from the internet – in particular social media – and from third parties.

- The availability of data also facilitates new kinds of rating methods, using telematics in motor insurance or special tariffs for diabetics.

The above demonstrates clearly that digitalisation can help to improve efficiency and underwriting results, tap new business potential, speed up business processes, and make these more efficient. The initial investment is of course significant. It is necessary to redesign IT infrastructure – which is often extremely complex. Business processes need to be rethought. A new type of employee will become indispensable for insurers: data specialists. Mindsets in a company must change if it is to be successful in the digital world, but this is a major challenge.

Digitalisation requires large investments

Many large insurers in Latin America have already set out a digitalisation strategy for their entire value chain. Management awareness of the subject is high across the board, and many companies are making significant investments to develop new IT systems, services, tools and products. But in some cases, investments are not being made because it remains unclear how many end customers will actually purchase insurance products via their smartphones. That is because in many countries in Latin America, smartphones are primarily used for social media, and people are less likely to conclude an insurance policy via their phones.

But a glance at the statistics on smartphones suffices to see their potential as a sales channel. According to Ernst & Young (EY 2017 Latin American insurance outlook), at least twice as many people use smartphones than fixed-line internet. It is therefore simply a question of time before large numbers of insurance products are being sold via smartphones and social networks.

Higher level of insurance aids disaster response

Can digitalisation actually help to close the insurance gap? I think so. This means that insurers have the critical task of raising awareness about risks, their possible development and impact, using loss trends for natural catastrophes, for example. In addition, awareness is raised of the positive impact of insurance, and clients are offered insurance solutions.

Studies show that higher insurance densities benefit the economies of developing countries in particular. Economies enjoying a high insurance density recover more quickly from disasters than countries with a lower level of insurance penetration. The same is true for people with insurance coverage, since insurance helps to reduce the financial burden of a disaster and therefore enables them to resume their normal lives sooner.

Thanks to digitalisation, insurers can interact with their clients more quickly, more directly, and in a more targeted manner – and they are able to offer their clients better, tailor-made products, thus closing the insurance gap sooner. Pioneers will have a significant competitive edge. We contribute here by applying our know-how and best-practice experience as a development partner and risk carrier for our clients.

Expert

Related Topics

Newsletter

properties.trackTitle

properties.trackSubtitle