Better understanding of our client’s needs

In order to hear these needs first-hand and understand them even better, as well as to survey the general level of knowledge on contemporary cyber insurance solutions in the market, Munich Re conducted a global and representative cyber risk and insurance survey. The survey covers awareness, cyber threats for companies and private individuals and the role of cyber insurance with its cover elements and services.

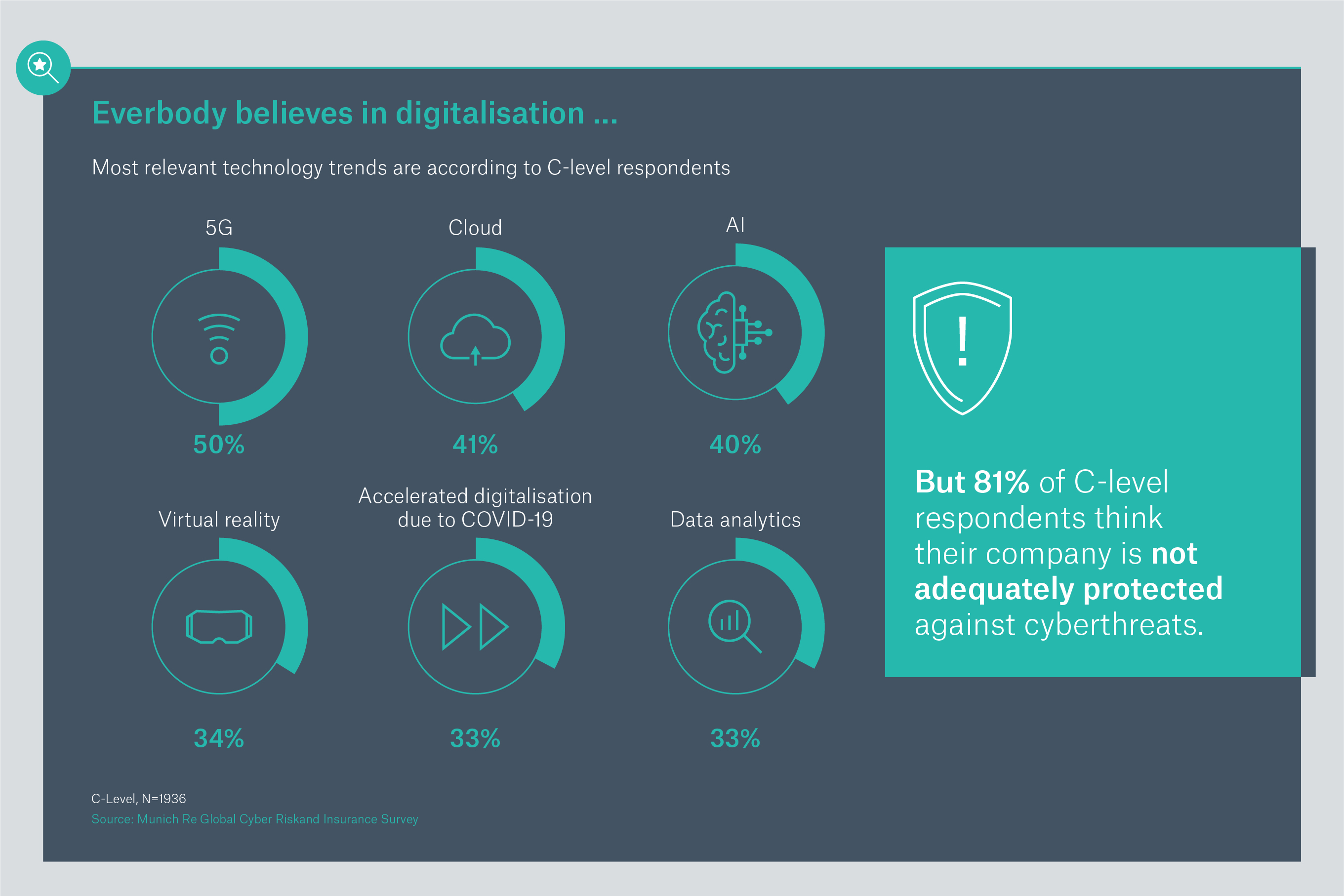

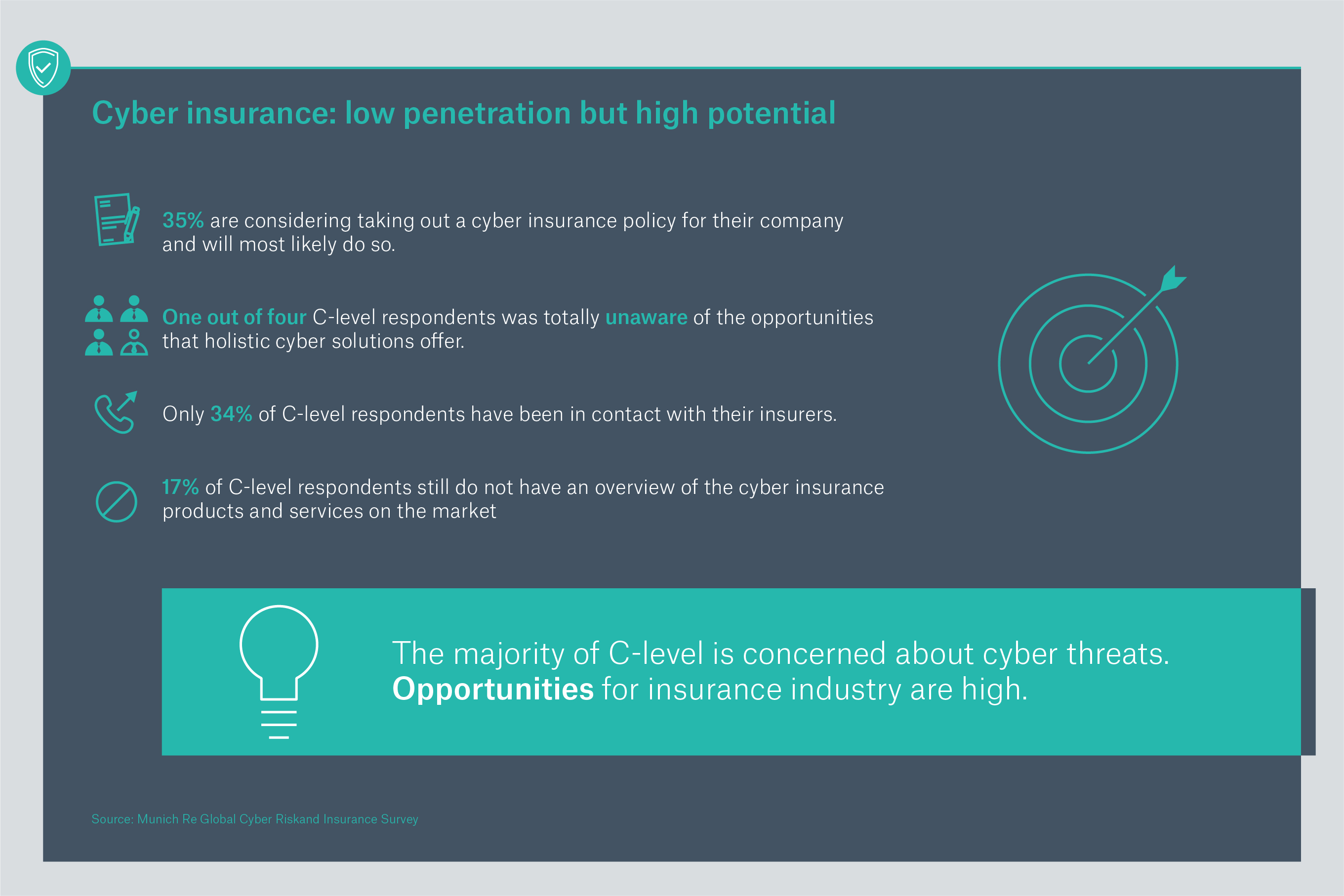

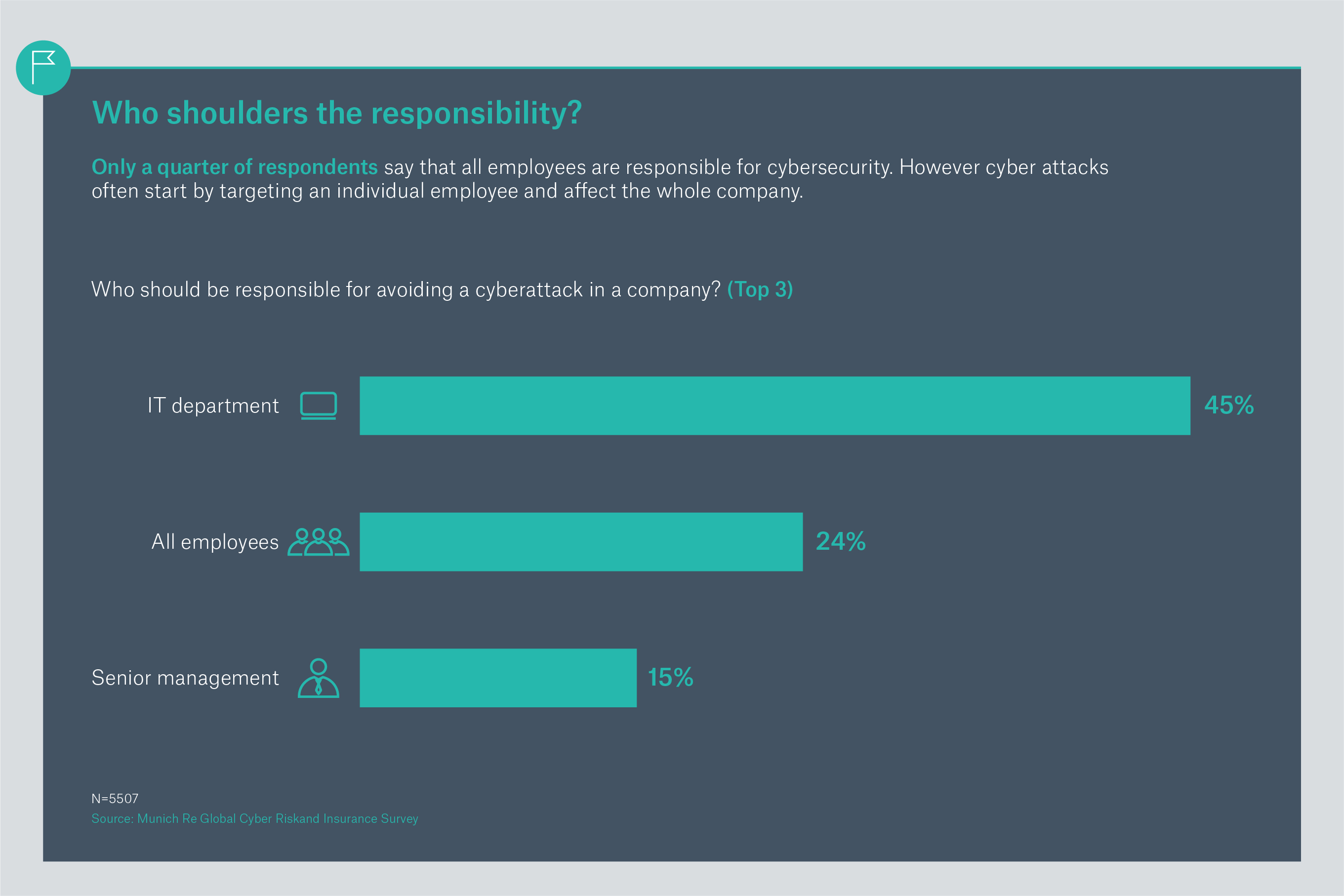

The responses to the comprehensive questionnaire in our survey underscore the need for our global efforts to make cyber risks more visible, understandable, and assessable. Adequate risk management presents significant challenges to participants across the board. Perception of the threat and who in the organization should be responsible greatly differs by geography. However, all respondents agree the future of business lies in digitalisation and new technologies. While acknowledging the sharply increasing threats posed by cyber attacks, the insurance penetration remains low in the face of increasingly drastic effects of cyber incidents at a low level. Surprisingly, even in more developed cyber markets such as the U.S., many respondents had no contact with an insurance provider, either in a professional or private context, to protect themselves against potential cyber incidents

Here are our main findings of the Global Cyber Risk and Insurance Survey:

Digitalisation is the future

Risk awareness

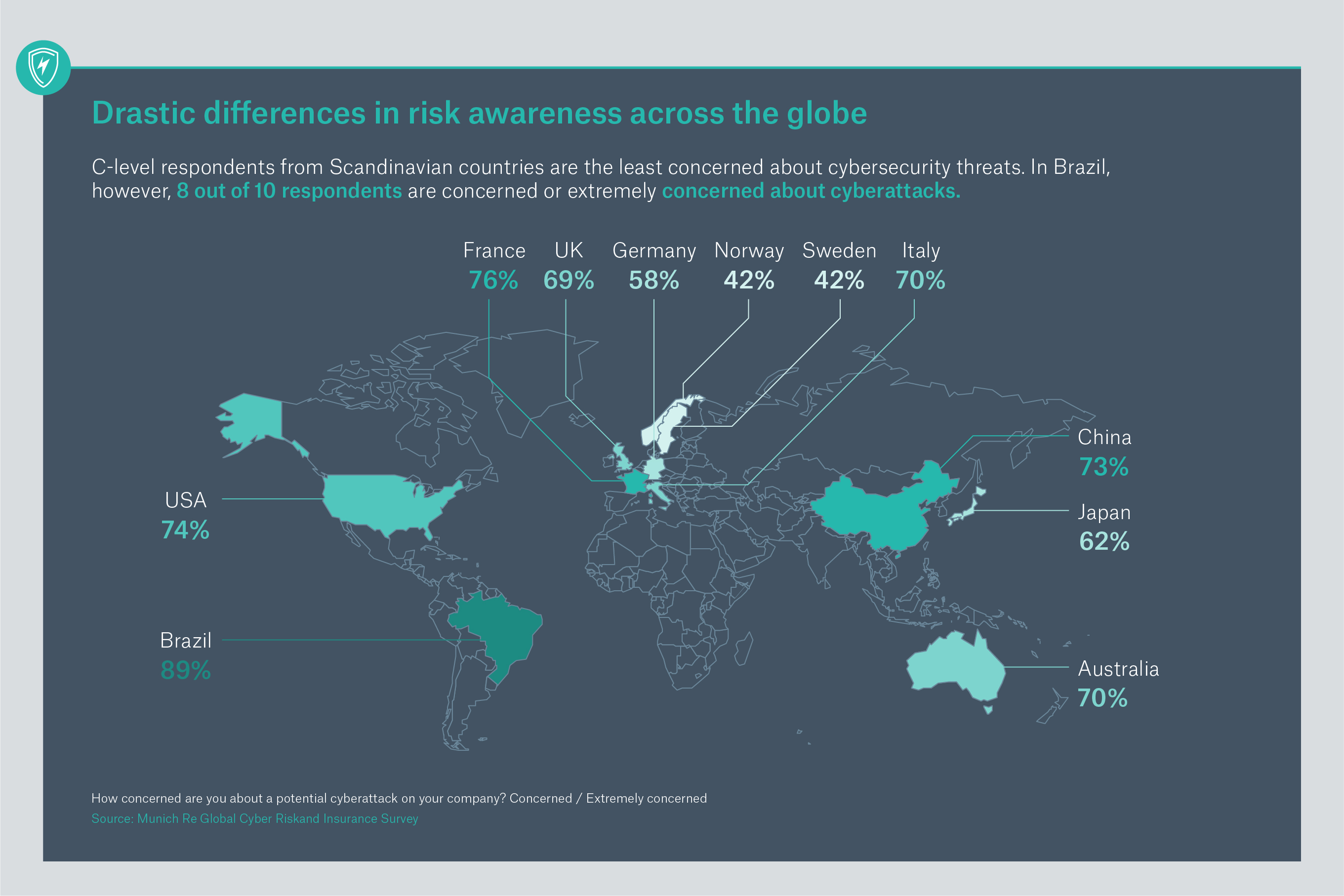

The second important finding is, that there are drastic differences in cyber risk awareness across the globe. While in particular the Scandinavian markets seem to be the most relaxed with only around 40% of the C-level respondents being concerned about a potentially successful cyberattack on their company, rest of the European and North American markets as well as Australia and high-tech Asian markets such as Japan and the industrialised parts of China are at a higher concern level with between 62 and 76 %. Latin American markets top the list of most concerned respondents with Brazil.

A basic awareness nowadays is inevitable. This refers to all employees up to management but also for private individual and their families.

Insurance penetration

Protection measures

Private cyber security

In terms of private cybersecurity, Brazil, France and China were the most concerned. The Scandinavian countries were more relaxed than average, analogous to cyber security in the professional context.

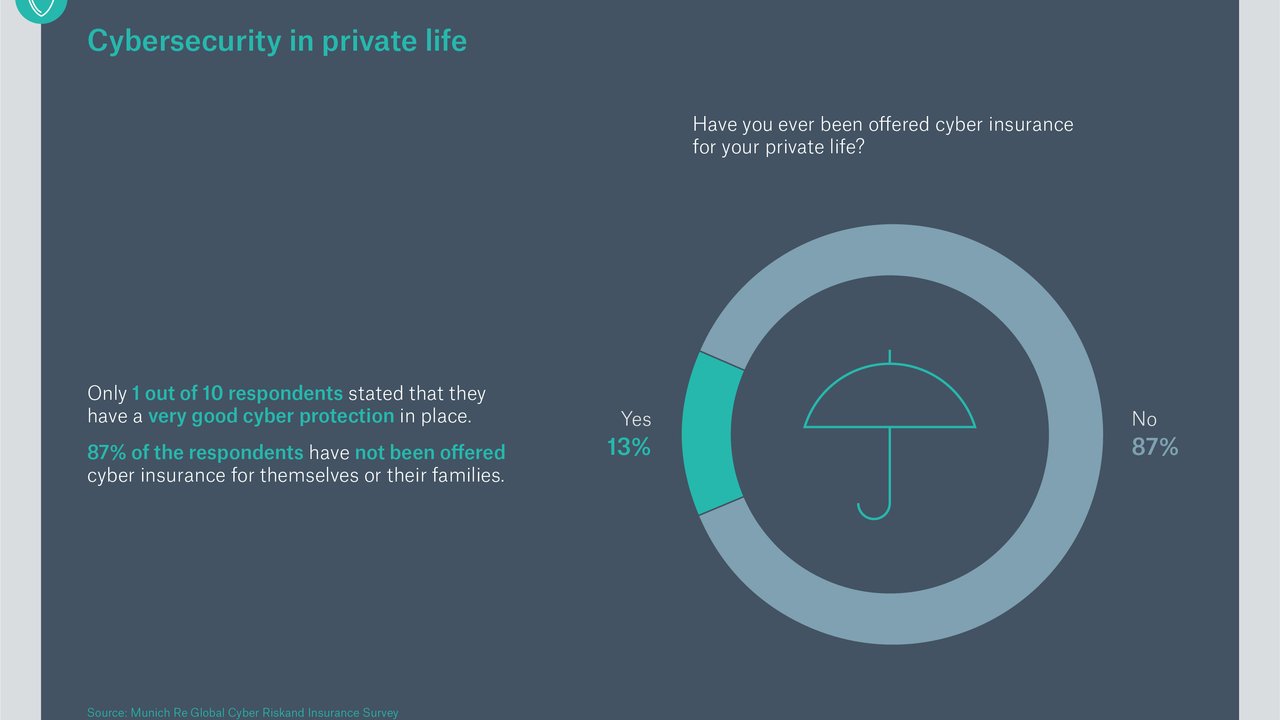

It is worth mentioning that Brazil and China were most concerned about online fraud and misinformation in terms of the respective threat to private cybersecurity. Across all attack vectors, 50% of participants said they had already fallen victim to a cyberattack. China tops the list of private cyber victims with 78% and Sweden is the lucky last with just 37% of cyber victims. And while on average half of the respondents believe they are sufficiently protected from cyber threats in their private lives, respondents from Japan believe by far that they are rather poorly protected in their private lives. Across the board, the potential for professional cyber insurance protection is extremely high. 87% of all respondents said they had never been offered cyber insurance for themselves or their family.

In a nutshell

In summary, it can be concluded that awareness of cyber threats is increasing, but that insurance solutions - especially with a holistic approach such as those offered by Munich Re - are not sufficiently well known. It is up to the insurance industry to better inform its clients and develop appropriate solutions for their respective client segments. Because one thing is clear on a global level: digitalisation is advancing in leaps and bounds and does not take into account those who are not yet sufficiently prepared. The insurance industry has proven that it can provide real value-add for its clients with comprehensive solutions that adapt to the rapidly changing risk landscape. Munich Re constantly innovates as a leading cyber reinsurer, offering primary insurers and corporates long-standing knowledge, sophisticated solutions and adequate coverage from a best-in-class ecosystem. Together with our clients we are creating cyber solutions that go far beyond traditional risk transfer.

For detailed information on the results of our global cyber security and insurance survey, as well as on our products and services, please contact your client manager or our cross-divisional team of cyber experts.

Downloads

Munich Re Experts

Related Solutions

Newsletter

properties.trackTitle

properties.trackSubtitle