Infographic: Legal system abuse

A proactive approach to understand and address the issue of legal system abuse

1.5 minutes read

Published 07/27/2023

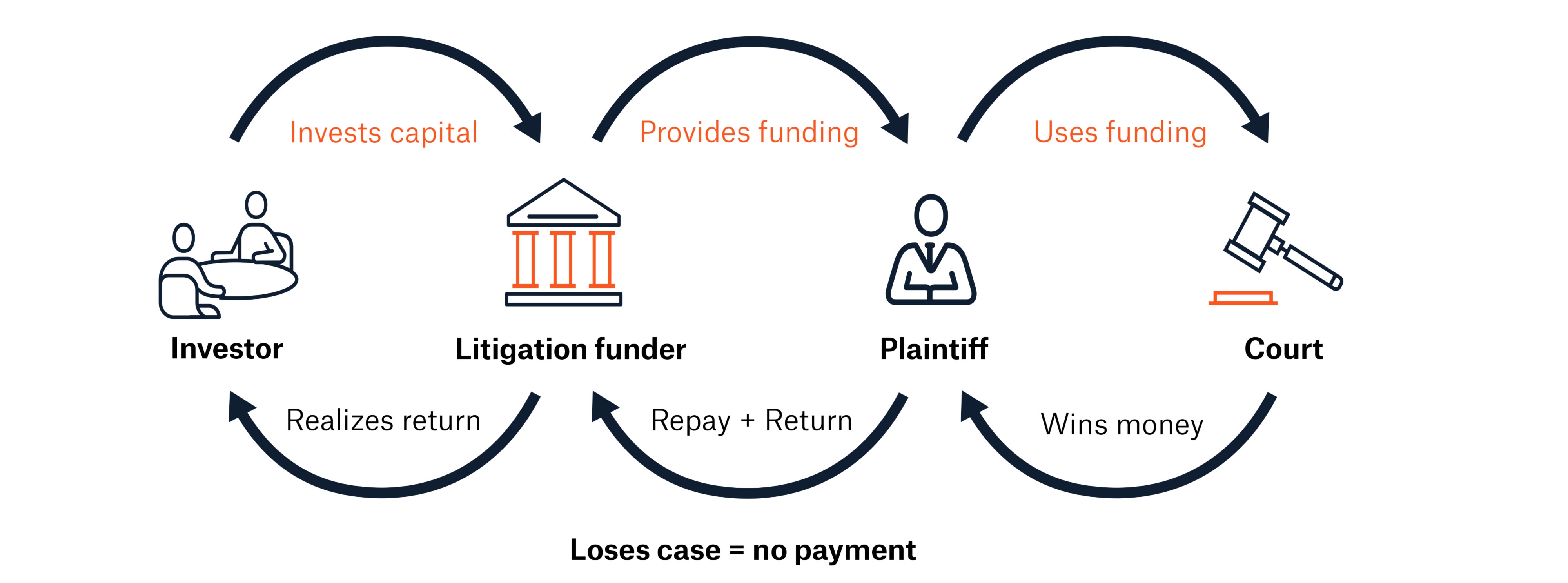

Litigation funding

This driver of legal system abuse is an arrangement where a funder that is not a party to a lawsuit provides funding to a plaintiff or law firm in exchange for an interest in the potential award in a lawsuit. Plaintiffs do not have to repay the funding if their lawsuit is not successful.

Strategies to mitigate legal system abuse

Munich Re is taking a proactive approach to understand and address the issue of legal system abuse.

The following are strategies clients can implement to help mitigate this risk:

- Require discovery of TPLF arrangements

- Enhance defense case management to offer a more effective counter to the plaintiffs’ bar

- Ensure risk management practices are optimized

- Review insurance contracts to certify appropriate coverage

- Proactively manage claims, especially in long-tail business

- Prepare for renewals to demonstrate exposures, risk management, and propensity to losses

- Prepare defendants adequately

- Evaluate higher deductibles, higher retentions, or reduced insurance policy limits

- Use data, analytics, and technology to improve exposure monitoring and analysis to identify trends early

- Analyze developments from a cross-functional perspective, pulling expertise from claims, legal, underwriting, and data analytics departments to understand and respond quickly

Munich Reinsurance America Inc. is uniquely positioned to take a broad approach using a cross-functional team with expertise in claims, legal, underwriting, actuarial, and data analytics to work with clients and brokers to better understand their business and address the changing risk landscape.

Download the legal system abuse infographic to learn more about the drivers contribute to egal system abuse and strategies you can implement to help mitigate this risk.

1

Contact us

Maura Freiwald

Head of Casualty

Newsletter

properties.trackTitle

properties.trackSubtitle

0:00