Quarterly Statement: Profit guidance for 2021 still attainable – despite hurricane and flash floods

11/09/2021

Group

properties.trackTitle

properties.trackSubtitle

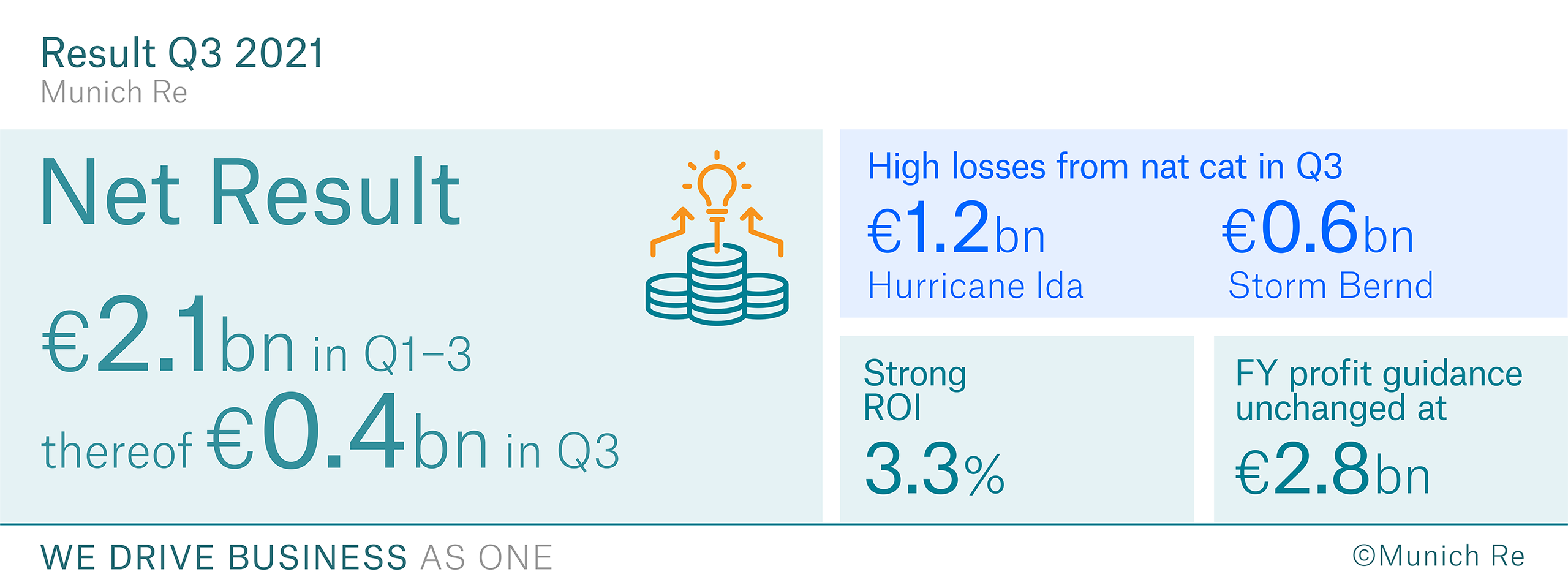

- With business and financial performance remaining strong, Munich Re delivers a profit of approximately €2.1bn for Q1–3, and €0.4bn for Q3

- Hurricane Ida and Storm Bernd cause losses of €1.2bn and €0.6bn respectively

- COVID-19 gives rise to losses of around €170m in life and health reinsurance for Q3, but generates virtually no additional expenditure in property-casualty reinsurance

- High gains on investments and currency translation effects

The horrific images of the devastation wreaked by Hurricane Ida and Storm Bernd remain vivid in our minds. Business, government and individuals need to make every effort towards achieving the Paris climate goals in order to slow the pace of climate change and prevent the likelihood of natural catastrophes from increasing any further. It is imperative that the Climate Change Conference (COP26) in Glasgow be followed up with immediate action. Munich Re will rigorously implement its ambitious CO₂ reduction targets in its investments, insurance business and own operations. Together, the two weather events – Ida and Bernd – are expected to cost Munich Re €1.8bn. Nevertheless, our annual target of €2.8bn remains within reach, thanks to a gratifying operational performance and high investment results.

Summary of Q3 figures

Munich Re posted a profit of €366m (199m) for Q3 and €2,061m (999m) for Q1–3. High natural catastrophe claims made their mark on the quarter. Hurricane Ida caused losses amounting to €1.2bn, while Storm Bernd resulted in losses amounting to €0.6bn, of which €0.1bn was attributable to ERGO. The quarterly result was impacted by higher than expected expenditure totalling around €170m on COVID-19-related losses in life and health reinsurance business. High losses were incurred again in particular in the USA, India and South Africa. In property-casualty reinsurance, by contrast, COVID-19 losses were significantly below expectations, with virtually no pandemic losses incurred in Q3. In the ERGO field of business, COVID-19 expenditure had an adverse earnings impact of €12m in Q3. Overall, Iosses attributable to COVID-19 totalled €680m in the reinsurance field of business for Q1-3, with around €470m attributable to life and health reinsurance and around €210m to property-casualty reinsurance. Nine months into 2021, ERGO posted only minor losses related to COVID-19.

For the reinsurance field of business, Munich Re now expects around €800m in COVID-19 losses in the whole of 2021 (previous estimate approximately €700m), with around €600m ascribable to life and health reinsurance (previous estimate approximately €400m) and about €200m to property-casualty reinsurance (previous estimate around €300m). In the ERGO field of business, the negative earnings impact anticipated from COVID-19 for the full year amounts to around €20–30m.

The operating result fell to €204m, compared with €353m for the same quarter last year. The other non-operating result amounted to –€18m (–31m). Furthermore, the currency result totalled €242m (–100m), mainly owing to currency gains against the US dollar and in several emerging markets. The effective tax rate was 4.7% (–19.4%). Gross premiums written rose notably – by 9.4% to €15,480m (14,150m) in Q3, and by 8.3% to €44,673m (41,261m) in Q1–3.

Equity was slightly higher at the reporting date (€30,055m) than at the start of the year (€29,994m). The solvency ratio stood at around 231% (208% as at 31 December 2020) and was thus above the optimum range (175–220%).

In Q3 2021, annualised return on equity (RoE) amounted to 6.3% (3.6%); the RoE for Q1–3 was 12.1% (5.9%).

Reinsurance: Result of €232m

The reinsurance field of business contributed €232m (63m) to the consolidated result for Q3 and €1,594m (619m) for Q1–3. The operating result totalled €13m (55m) in Q3. Gross premiums written saw a significant increase to €11,160m (9,926m).

Life and health reinsurance business generated a profit of €94m (86m) in Q3. Premium income amounted to €3,164m (3,127m). The technical result, including the result from reinsurance treaties with non-significant risk transfer, was €9m (56m).

Property-casualty reinsurance contributed €138m (–23m) to the result in Q3. Premium volume grew robustly to €7,997m (6,798m). The combined ratio amounted to 112.8% (112.2%) of net earned premiums for Q3, and 100.9% (106.1%) for Q1–3.

Major losses of over €10m each were up in Q3 and totalled €1,974m (1,518m). As usual, these figures include gains and losses from the settlement of major losses from previous years. Major-loss expenditure corresponds to 29.6% (26.7%) of net earned premiums, and was thus significantly higher than the long-term average expected value of 12% both for Q3 and for Q1–3 (17.6%). Man-made major losses dropped to €245m (1,045m), mainly owing to an appreciable decline in COVID-19 losses. By contrast, major-loss expenditure from natural catastrophes rose significantly to €1,729m (474m), especially as a consequence of Hurricane Ida.

In Q3, reserves of €265m (226m) were released for basic losses from prior years; this figure corresponds to 4.0% (4.0%) of net earned premiums. Munich Re continually seeks to set the amount of provisions for newly emerging claims at the very top end of the estimation range, so that profits from the release of a portion of these reserves are possible at a later stage.

ERGO: Result of €134m

Munich Re generated a profit of €134m (136m) in its ERGO field of business in Q3 and €467m (381m) in Q1–3. The operating result for the ERGO field of business amounted to €191m (297m).

The good Q3 result benefited primarily from ERGO Life and Health Germany, which posted a result of €80m (31m) thanks to its continued good operational performance in health, low losses in travel insurance, and high investment and currency translation results. ERGO International generated a result of €32m (57m). The impact of COVID-19 in India and major losses in the Baltic states and Austria were partly offset by the continued strong development of operations, above all in Poland and Spain. ERGO Property-casualty Germany saw its result fall to €21m (48m). Natural catastrophe losses were largely cushioned by continued growth, robust operational development, and a higher investment result.

Despite major losses, the combined ratios remained at a good level. Natural catastrophe losses, particularly from Storm Bernd, were responsible for the rise in the combined ratio for Property-casualty Germany to 95.6% (90.9%) for Q3 and 94.1% (92.2%) for Q1–3. In ERGO International, the combined ratio for Q3 remained almost constant at 92.3% (92.5%) for Q3 and 92.8% (92.6%) for Q1–3.

Total premium income increased to €4,539m (4,418m) in Q3, and gross premiums written rose to €4,319m (4,224m).

Investments: Investment result of €2,107m

The Group’s investment result (excluding insurance-related investments) increased to a high €2,107m (1,691m) in Q3. Regular income from investments was down slightly to €1,507m (1,536m). Net gains and losses on disposal excluding derivatives amounted to €881m (644m). Gains on disposal resulted from the sale of fixed-interest securities and equities, also following on from the outsourcing of individual activities to external asset managers, and from normal portfolio restructuring in the current environment of low interest rates. The net balance of derivatives amounted to €61m (–65m). The balance from write-ups and write-downs improved to –€168m (–265m).

Overall, the Q3 investment result represents a return of 3.3% on the average market value of the portfolio. The running yield was 2.4% and the yield on reinvestment was 1.4%. By means of acquisitions in primary insurance and reinsurance – and aided by the positive market development – Munich Re increased its equity-backing ratio, including equity derivatives, to 7.2% as at 30 September 2021 (6.0% as at 31 December 2020).

The investment portfolio (excluding insurance-related investments) as at 30 September 2021 increased compared with the 2020 year-end figure, with the carrying amount moving up to €236,668m (232,950m); the market values amounted to €252,883m (252,789m).

Outlook for 2021: Annual target unchanged at €2.8bn

For life and health reinsurance, Munich Re projects a technical result (including the result from reinsurance treaties with non-significant risk transfer) totalling €200m (previously: €400m) for the full year. Munich Re had already communicated in its statement of 19 October 2021 that it would fall short of its original guidance for the full year owing to the increased loss expectation due to COVID-19.

For property-casualty reinsurance, Munich Re expects a combined ratio of around 100% (previously 96%) of net earned premium on account of the high natural catastrophe losses that occurred in Q3.

Munich Re is still aiming for a combined ratio of around 92% of net earned premium for ERGO Property-casualty. Depending on further major-loss development, there is increased uncertainty as to whether Munich Re will be able to reach that target.

All other sub-targets specified in the Half-Year Financial Report for 2021 remain unchanged. In particular, Munich Re is still aiming for a consolidated profit of €2.8bn for the 2021 financial year.

All forecasts are made more difficult by the pronounced volatility of the capital markets and exchange rates, and by the increased uncertainty with regard to potential claims in connection with the coronavirus pandemic. As always, the projections are subject to major losses being within normal bounds, and to the income statement not being impacted by severe fluctuations in the currency or capital markets, significant changes in the tax environment, or other one-off effects.

Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. The group consists of the reinsurance and ERGO business segments, as well as the asset management company MEAG. Munich Re is globally active and operates in all lines of the insurance business. Since it was founded in 1880, Munich Re has been known for its unrivalled risk-related expertise and its sound financial position. It offers customers financial protection when faced with exceptional levels of damage – from the 1906 San Francisco earthquake through to the 2019 Pacific typhoon season. Munich Re possesses outstanding innovative strength, which enables it to also provide coverage for extraordinary risks such as rocket launches, renewable energies or cyberattacks. The company is playing a key role in driving forward the digital transformation of the insurance industry, and in doing so has further expanded its ability to assess risks and the range of services that it offers. Its tailor-made solutions and close proximity to its customers make Munich Re one of the world’s most sought-after risk partners for businesses, institutions, and private individuals.

Disclaimer

This media release contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of our Company. The Company assumes no liability to update these forward-looking statements or to make them conform to future events or developments.

Further information

For media inquiries please contact:

/Straub_Stefan.jpg)

/Ziegler_Frank.jpg)

/Faith_Thoms.jpg)

/Ashleigh-Lockhart.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)