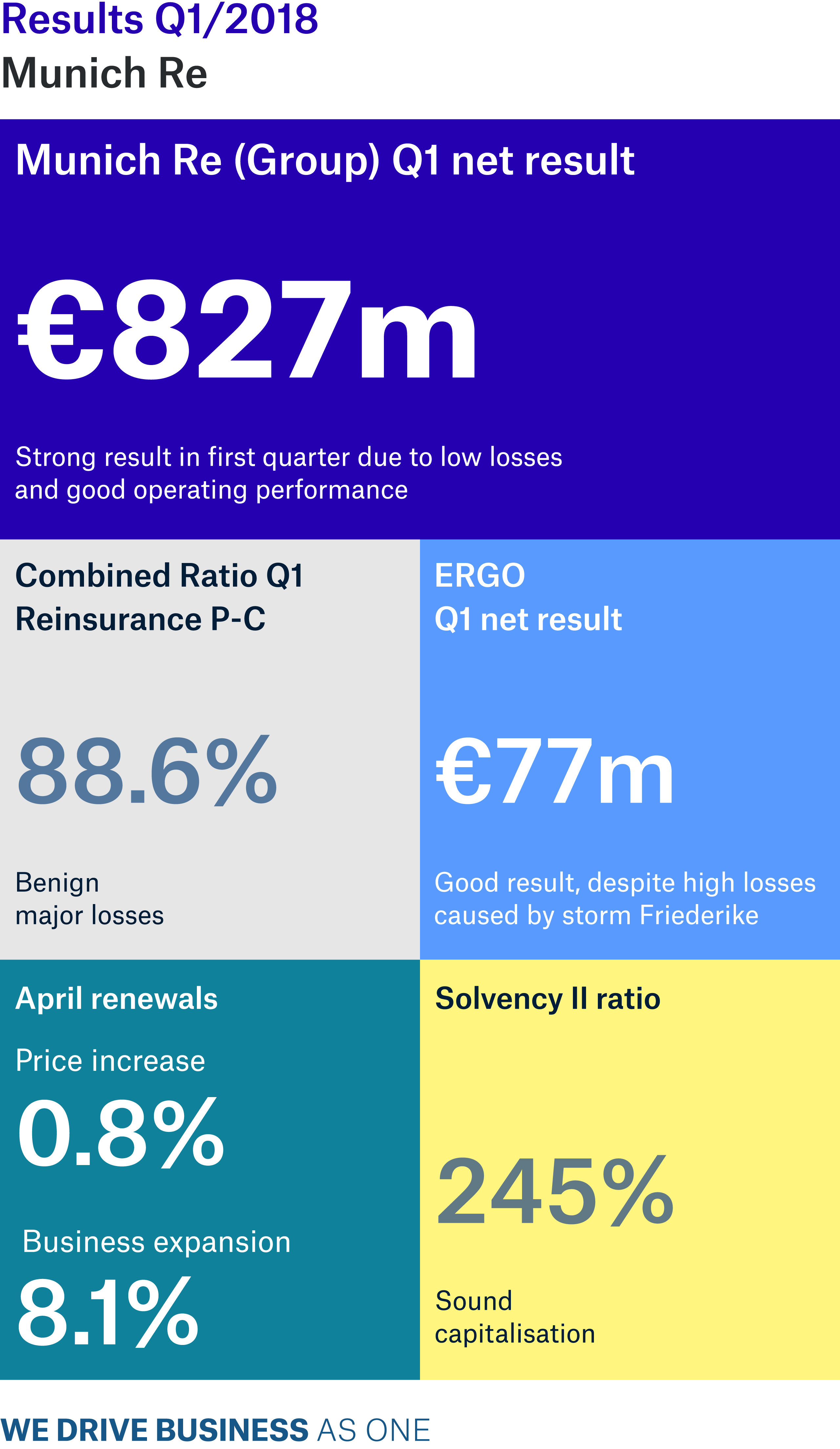

High quarterly profit of €827m

05/08/2018

Group

properties.trackTitle

properties.trackSubtitle

The first quarter was mainly influenced by low major losses in property-casualty reinsurance. We also achieved a good quarterly result in life and health reinsurance and at ERGO. We can be very satisfied with the start to the year.

Summary of the results for the first quarter

Year on year, the operating result increased to €1,283m (952m). The other non-operating result totalled –€194m (–153m), of which –€68m (–57m) was attributable to the currency translation result. Taxes on income totalled €212m (188m). At €27,191m, equity capital was lower than at the beginning of the year (€28,198m), given that the good quarterly result was offset by negative currency translation effects, share buy-backs and, in particular, the decrease in unrealised gains due to developments in the capital markets.

Gross premiums written increased by 1.6% to €13,126m (12,925m). If exchange rates had remained the same, premium volume would have risen by 7.8% year on year.

The annualised return on risk-adjusted capital (RORAC) amounted to 13.2%. The return on overall equity (RoE) totalled 11.9%.

At 245%, the solvency ratio at the end of the first quarter was somewhat higher than at the beginning of the year (244%).

Reinsurance: Result of €750m

The reinsurance field of business contributed €750m (466m) to the consolidated result. The operating result was €1,059m (683m). Gross premiums written increased by 1.7% to €8,183m (8,046m).

Life and health reinsurance business posted a profit of €159m (126m). Premium income declined to €2,865m (3,488m) owing to the termination of a large-volume treaty and negative currency translation effects. At €155m, the technical result – including the result from business not recognised in the technical result owing to insufficient risk transfer – was almost as good as in the same quarter last year (€158m).

Property-casualty reinsurance contributed €591m (340m) to the consolidated result for the first quarter. Premium volume rose significantly to €5,317m (4,558m), benefiting from organic growth. The combined ratio amounted to a very good 88.6% (97.1%) of net earned premium.

The expenditure from major losses of over €10m each was only €62m (403m); at 1.4% of net earned premium, it was thus significantly below our major-loss projection of 12%. Man-made major losses amounted to €112m (247m). In the first quarter of the year, major-loss expenditure from natural catastrophes was overcompensated by reserve releases for prior-year major losses, resulting in a positive balance of €49m (–156m).

As claims notifications for basic losses from prior years remained appreciably below the expected level overall, Munich Re was able to release reserves (adjusted for commissions) in the amount of around €180m, corresponding to 4.1 percentage points of the combined ratio. Munich Re still aims to set the amount of provisions for newly emerging claims at the very top end of the estimation range, so that profits from the release of a portion of these reserves are possible at a later stage.

In the renewals at 1 April 2018, the trend that had begun to be observed in January continued, with prices increasing in the markets affected by natural catastrophes, but otherwise remaining stable given the still-high capacity levels in the markets. Overall, prices increased by 0.8% in the April renewals. Premium volume rose by 8.1% to around €1.6bn. Select opportunities were taken advantage of in some markets, for instance in India and Japan.

At 1 April 2018, a volume of around €1.4bn was up for renewal, versus €8.3bn in January. Approximately 15% of this business was attributable to the Japanese market, a further 28% to North America and global business, and about 40% to Europe.

ERGO: Result of €77m

In the first quarter of 2018, Munich Re generated a profit of €77m (91m) in the ERGO field of business. A decline in the results for the German business segments, mainly owing to lower realised capital gains and high storm losses, was largely compensated for by an improved result in the ERGO International segment. The operating result was down slightly to €224m (269m).

The combined ratio in the Property-casualty Germany segment deteriorated to 101.7% (99.1%), in particular on account of high claims expenditure for Winter Storm Friederike. By contrast, the combined ratio in the International segment improved to 95.3% (96.3%).

In the first quarter, total premium income across all lines of business was up by 0.8% to €5,156m (5,114m), and gross premiums written climbed by 1.3% to €4,943m (4,879m). In the Life and Health Germany segment, gross premium volume remained almost constant at €2,321m (2,324m). In the Property-casualty Germany segment, gross premium was up by 2.1% to €1,266m (1,240m). In the ERGO International segment, premium income increased by 3.1% to €1,356m (1,315m).

Investments: Investment result of €1,796m

The investment result represents a return of 3.1% on the average market value of the portfolio; the running yield was 2.6%, and the reinvestment yield was 1.9%. Munich Re’s equity-backing ratio (including equity-linked derivatives) at

31 March 2018 decreased marginally to 6.5% (31 December 2017: 6.7%).

The Group’s asset manager is MEAG, whose assets under management as at 31 March 2018 included not only Group investments, but also a volume of €15.5bn (15.9bn) for third parties.With a carrying amount of €216,201m (market value of €229,781m), total investments (excluding insurance-related investments) as at 31 March 2018 were down on the year-end 2017 figure of €217,562m (231,885m at market value). The Group’s investment result (excluding insurance-related investments) fell to €1,796m (2,151m). Regular income from investments declined to €1,493m (1,634m). The net balance of derivatives improved to –€17m (–362m). The balance of gains and losses on disposals excluding derivatives fell to €584m (1,048m). Munich Re also posted higher net year-on-year write-downs of €115m (26m) on non-derivative investments during the past quarter.

The investment result represents a return of 3.1% on the average market value of the portfolio; the running yield was 2.6%, and the reinvestment yield was 1.9%. Munich Re’s equity-backing ratio (including equity-linked derivatives) at

31 March 2018 decreased marginally to 6.5% (31 December 2017: 6.7%).

The Group’s asset manager is MEAG, whose assets under management as at 31 March 2018 included not only Group investments, but also a volume of €15.5bn (15.9bn) for third parties.

Outlook for 2018: Profit guidance of €2.1–2.5bn

In property-casualty reinsurance, Munich Re has lowered the projected combined ratio for the full year by two percentage points to 97% on account of low major-loss expenditure in the first quarter of 2018.

Besides that, expectations for 2018 have scarcely changed in comparison with the figures given in the 2017 Annual Report that was published in March. Munich Re is still expecting to post gross premiums written of €46–49bn for 2018, and is not changing its forecast consolidated result in the range of €2.1–2.5bn.

Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. The group consists of the reinsurance and ERGO business segments, as well as the capital investment company MEAG. Munich Re is globally active and operates in all lines of the insurance business. Since it was founded in 1880, Munich Re has been known for its unrivalled risk-related expertise and its sound financial position. It offers customers financial protection when faced with exceptional levels of damage – from the 1906 San Francisco earthquake to the 2017 Atlantic hurricane season and the California wildfires in 2018. Munich Re possesses outstanding innovative strength, which enables it to also provide coverage for extraordinary risks such as rocket launches, renewable energies, cyberattacks, or pandemics. The company is playing a key role in driving forward the digital transformation of the insurance industry, and in doing so has further expanded its ability to assess risks and the range of services that it offers. Its tailor-made solutions and close proximity to its customers make Munich Re one of the world’s most sought-after risk partners for businesses, institutions, and private individuals.

Disclaimer

This media information contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of Munich Re. The Company assumes no liability to update these forward-looking statements or to conform them to future events or developments.