Natural catastrophes dominate in third quarter – Significant market recovery expected

11/09/2017

Group

properties.trackTitle

properties.trackSubtitle

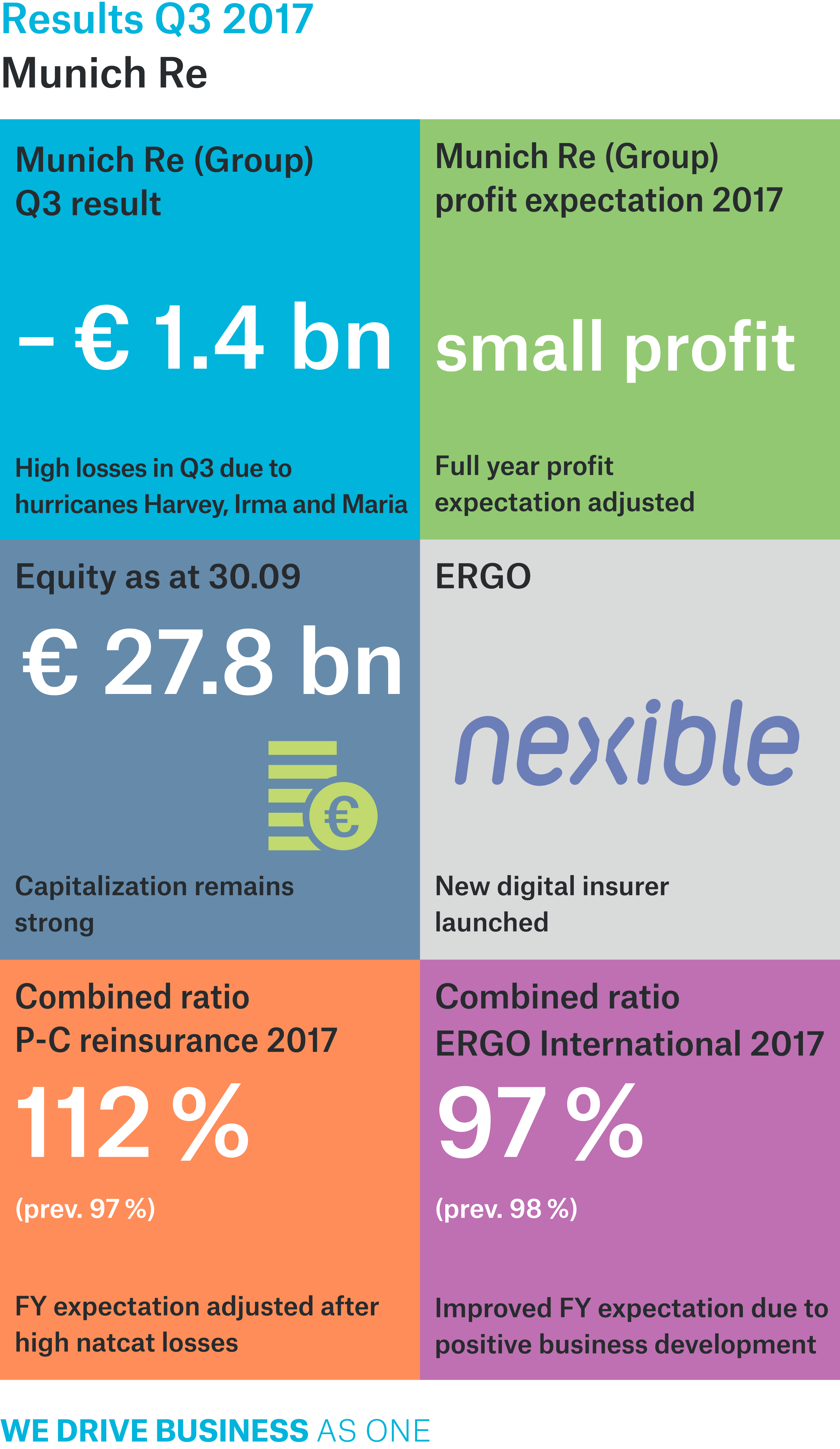

Munich Re has posted a high loss for the third quarter, but is expecting a significant market recovery. The Group is also counting on profitable growth in new business areas, and is pressing ahead with corresponding initiatives. The digital insurer “nexible” went live in October.

Jörg Schneider, Chief Financial Officer of Munich Re, explained: “The major losses from natural catastrophes in the third quarter have had a substantial impact on our result. Despite business being otherwise good, this means that we can only post a small profit in 2017. But our capitalisation is strong, and we are able to take full advantage of opportunities arising from the likely market recovery. We expect prices to rise again in the forthcoming negotiations – particularly in the markets that have been hardest hit by recent natural catastrophes. But, regardless of this, we are continuing to press ahead with our initiatives for profitable growth – especially in connection with digitalisation.”

Munich Re is improving its existing range of products and services with digital solutions, and is also developing new digital business models. With “nexible”, ERGO has successfully launched a purely online insurer.

As already reported on 26 October, major losses in the third quarter (after retrocession and before taxes) have had a negative impact of €3.2bn on the result. Of this figure, Hurricanes Harvey, Irma and Maria caused losses of €2.7bn.

Munich Re has posted a loss of €1.4bn in the third quarter, and a loss of €146m for the first nine months of the year. The Group is expecting to generate a small profit for the full year 2017.

Summary of the figures for the third quarter of 2017

The operating result saw a significant year-on-year deterioration in the third quarter to –€1,732m (1,014m). The other non-operating result was –€243m (–112m), of which currency effects amounted to –€74m (+6m).

Equity fell to €27.8bn in comparison with the year-end 2016 figure (€31.8bn). The annualised return on risk-adjusted capital (RORAC) amounted to –0.7% in the first nine months, and the annualised return on overall equity (RoE) totalled –0.6%.

Since the Annual General Meeting at the end of April, shares with a volume of around €491m had been repurchased by the end of October as part of the share buy-back programme announced in March.

Gross premiums written remained roughly stable year on year at €12,279m (12,344m). If exchange rates had remained the same, premium volume would have increased by 1.6%.

Reinsurance: Result of –€1,465m

In reinsurance business, the operating result for the third quarter came to –€2,029m (889m). The reinsurance field of business accounted for –€1,465m (704m) of the consolidated result for the third quarter, and –€370m (2,144m) for the period from January to September.

The technical result for life and health reinsurance – including the result from reinsurance treaties with insufficient risk transfer – amounted to €37m (170m) in the third quarter. It was affected by the recapture of a loss-producing portfolio in the USA, resulting in expenditure of over €100m. Including losses from a similar recapture from the second quarter, the total losses for 2017 in this area amount to €170m. Both transactions will relieve Munich Re of the risks of a run-off over many decades, and will benefit our results going forward.

Property-casualty reinsurance accounted for a loss of €1,525m in the third quarter (Q3 2016: gain of €558m), mainly driven by high major losses from natural catastrophes. The combined ratio totalled 160.9% (92.5%) of net earned premiums; the figure for the first nine months was 117.3% (93.7%). As claims notifications for "basic losses" from prior years remained appreciably below the expected level overall, Munich Re was able to release reserves totalling around €250m in the third quarter, which was equivalent to 6.0 percentage points of net earned premiums in the third quarter. For the first nine months, Munich Re thus released reserves totalling around €740m, or 5.9% of net earned premiums. Munich Re still aims to set the amount of provisions for newly emerging claims at the very top end of the estimation range, so that profits from the release of a portion of these reserves are possible at a later stage.

Overall loss expenditure for major losses (after retrocession and before taxes) totalled €3,165m (277m) in the third quarter, and €3,821m (920m) for the first nine months of the year. Natural catastrophe losses in the third quarter amounted to €2,965m (145m) and man-made major losses to €200m (132m), representing 70.3% (natural catastrophes) and 4.7% (man-made) of net earned premiums respectively. The largest natural catastrophe losses in the third quarter were caused by Hurricanes Harvey, Irma and Maria, which together accounted for losses totalling €2.7bn. Munich Re expects that together the three hurricanes will have caused insured market-wide losses totalling approximately US$ 100bn, although claims settlement, and thus uncertainty about loss estimates, will continue for many months.

Gross premiums written in reinsurance decreased by 1.4% year on year in the period from July to September (at unchanged currency translation rates: +1.6%) to €8,065m (8,179m). Gross premiums written in the life and health reinsurance segment fell by 6.8% (at unchanged currency translation rates: –3.4%) to €3,322m (3,563m) in the third quarter. Premium volume in property-casualty reinsurance increased overall by 2.8% (at unchanged currency translation rates: +5.5%) to €4,743m (4,616m).

ERGO: Result of €29m

The operating result for the ERGO field of business was €297m (125m) for July to September. The consolidated result increased to €29m (–19m) in the third quarter. As expected, the quarterly result was less positive than in the previous two quarters, mainly due to lower gains on disposals. Thanks to a one-off tax effect and an especially good technical result in the second quarter, this field of business posted a positive result of €224m (–49m) in the period from January to September – thereby improving the year-on-year result in all segments for the first nine months. Overall, the ERGO Strategy Programme is well on track.

The combined ratio in the Property-casualty Germany segment amounted to 98.1% (96.1%) for the third quarter; in the International segment, the figure improved to 91.5% (95.8%).

Total premium income across all lines of business remained largely the same year on year in the third quarter, and amounted to €4,410m (4,399m); gross premiums written were up slightly by 1.2% to €4,214m (4,164m) in the same period. In the Life and Health Germany segment, gross premiums amounted to €2,297m (2,302m), whilst in the Property-casualty Germany segment they were up on the previous year at €722m (700m). In the International segment, they increased by 2.9% to €1,195m (1,161m).

Investments: Result of €1,589m

With a market value of €229.1bn, total investments (excluding insurance-related investments) as at 30 September 2017 were down on the year-end 2016 figure of €236.2bn. This was due to the strong euro and a slight rise in interest rates.

For the period from July to September 2017, the Group's investment result (excluding insurance-related investments) showed a year-on-year decline of 1.9% to €1,589m (1,619m). Changes in the value of derivatives had a positive impact of €37m (–446m) in the third quarter, with gains from interest-rate derivatives offsetting losses from equity hedging. The balance of gains and losses on disposals excluding derivatives came to €259m (696m). The investment result represents an overall return of 2.8%.

Munich Re's equity-backing ratio (including equity-linked derivatives) at 30 September 2017 increased to 6.5% (31 December 2016: 5.0%). Fixed-interest securities, loans and short-term fixed-interest investments continued to make up the largest portion – around 86% at market value – of Munich Re's holdings.

The Group’s asset manager is MEAG, whose assets under management as at 30 September 2017 include not only Group investments, but also third-party investments totalling €15.5bn (19.2bn).

Outlook for 2017: Small profit expected for the full year

Munich Re stands for exceptional solution-based expertise, consistent risk management, financial stability and client proximity. This is how Munich Re creates value for clients, shareholders and staff. In the financial year 2016, the Group – which combines primary insurance and reinsurance under one roof – achieved a profit of €2.6bn. It operates in all lines of insurance, with over 43,000 employees throughout the world. With premium income of around €28bn from reinsurance alone, it is one of the world’s leading reinsurers. Especially when clients require solutions for complex risks, Munich Re is a much sought-after risk carrier. Its primary insurance operations are concentrated mainly in ERGO, one of the leading insurance groups in Germany and Europe. ERGO is represented in over 30 countries worldwide and offers a comprehensive range of insurances, provision products and services. In 2016, ERGO posted premium income of €16.0bn. Munich Re’s global investments (excluding insurance-related investments) amounting to €219bn are managed by MEAG, which also makes its competence available to private and institutional investors outside the Group.

Disclaimer

This media information contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of our Company. The Company assumes no liability to update these forward-looking statements or to conform them to future events or developments.