Consumer Duty Regulations

What we are doing at HSB

properties.trackTitle

properties.trackSubtitle

On 27 July 2022, the FCA published its final rules and guidance relating to the introduction of the new Consumer Duty regulations, which sets clearer standards of consumer protection across financial services.

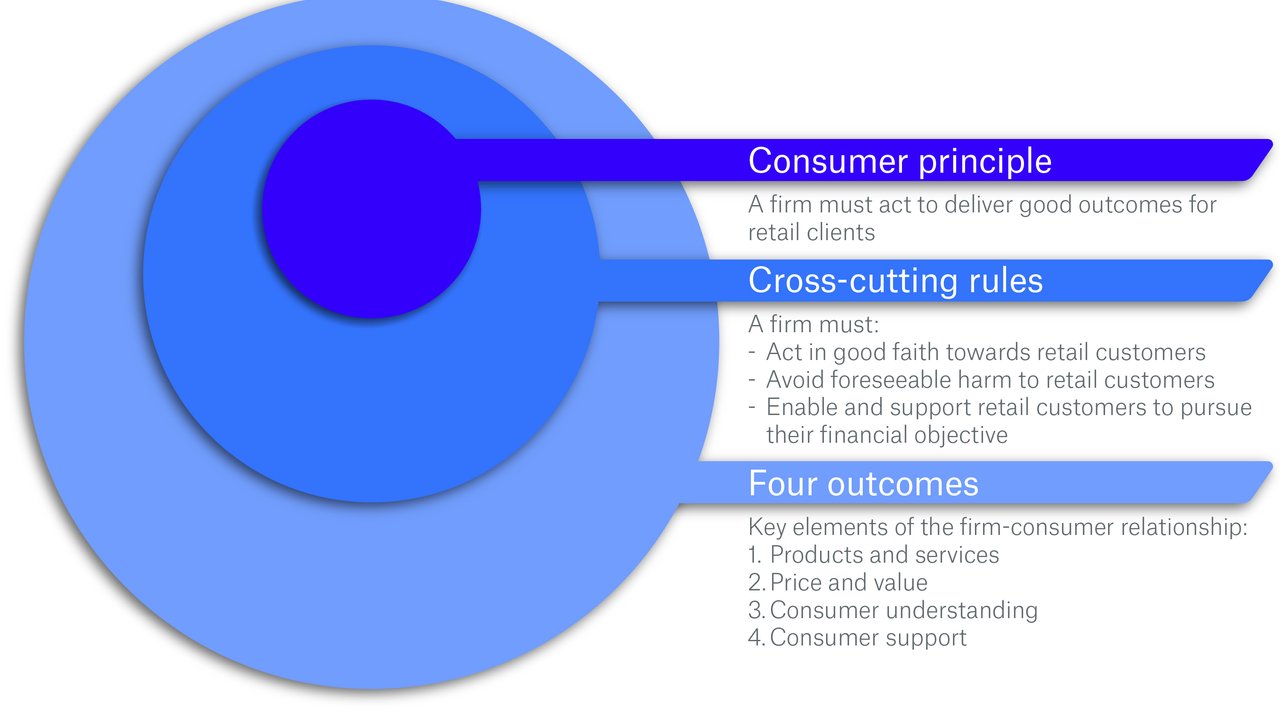

The Consumer Duty introduces a new Principle (Principle 12), which requires that "a firm must act to deliver good outcomes for retail customers". The principle is supported by three cross-cutting rules (applicable to all areas of conduct) requiring firms to:

- act in good faith towards retail customers

- avoid causing foreseeable harm to retail customers

- enable and support retail customers to pursue their financial objectives

The rules are also intended to inform and help put customers' needs first; ensuring they are considered at every stage of the insurance process. These good customer outcomes relate to four key areas:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

The four outcomes represent key elements of the relationship between a firm and its customer, and provide us with a suite of rules and guidance to enable us (as a firm) to meet consumers' financial and wellbeing needs.

At HSB, we’ve been working to meet the FCA's requirements and implementation timetable. So what have we been doing?

It is important to HSB that we embed the duty across our strategy, business objectives and wider culture of the company, and are on track for compliance with the Consumer Duty by 31 July 2023.

We've undertaken a detailed gap analysis across all business areas, and an implementation plan has been put in place to ensure we meet the deadlines given by the FCA and further support our compliance with the new duty.

We've appointed a Consumer Duty Champion at Board level to ensure that delivering good customer outcomes is integral at every level of HSB. And we are ensuring our employees have the appropriate training to understand the customer journey, and how to deliver good customer outcomes.

As part of the FCA Pricing Practices Regulations, we've already implemented PROD 4 into our business, with fair value assessments in place for our products. We're now using these assessments and enhancing the process to consider the good customer outcomes we've identified as important. We will continue to engage with other parties in the distribution chain to meet the requirements of the duty and better understand how the products we distribute are providing fair value to customers.

Frequently asked questions

1. Is HSB aware of the Consumer Duty and how it applies?

At HSB, we continuously conduct horizon scanning to ensure we are meeting our regulatory responsibilities. When the FCA published the Consumer Duty final rules and guidance in 2022, an implementation plan was created and approved by the Board for the 31 October 2022 deadline.

We are aware all reviews must be completed by 30 April 2023 and implementation finalised by 31 July 2023 and have plans in place to comply with these deadlines.

2. What key information will be available following the 30 April 2023 FCA deadline?

In addition to a general overview of the work we are completing on Consumer Duty, documentation under each of the four areas (1. Products and Services; 2. Price and Value; 3. Consumer Understanding; 4. Consumer Support) will be available. This documentation and support includes:

- Insurance Product Information Documents (IPID)s or Product Summaries (where applicable)

- Product approval process information

- Distributor Product Information document (DPI) - information covering key product characteristics, target market, who the product is suitable and unsuitable for and key exclusions.

- Fair Value Assessment Outcomes

- Policy Documentation

- Direct contact details for Business Development and underwriting teams to enable direct access to support

- Claims contact information readily available on the website and within policy documentation

- Complaints contact information readily available on the website and within policy documentation

- Product training available on request

3. What key information will be available following the 31 July 2023 FCA deadline?

In addition to the documentation available at 30 April 2023, we will provide:

- Documentation setting out the good customer outcomes and the management information used to assess whether they have been delivered at a product level for key areas 1 and 2 above.

- Documentation setting out the good customer outcomes and the management information used to assess whether they have been delivered at a more general level for key areas 3 and 4 above.

- A refreshed Vulnerable Customers Policy and additional material relating to vulnerable customers.

- Further details of the training provided to all staff.

4. Have you had any difficulty in identifying which of your customers the Consumer Duty applies to, and if so how have you overcome this/what actions have you taken?

5. What does "act to deliver good outcomes for retail customers" mean to you?

For each of the four key areas, we have assessed what we understand the customer would consider a good outcome. These identified outcomes are:

Product and Services

- Customers are provided with a product that meets their needs

- Customers are provided with a product where the policy limits are appropriate and sufficient

- Customers are provided with a product where the policy coverage meets their expectations

- Customers are provided with clear and easy to understand policy and associated documentation

Price and Value

- Customers are provided with a product where the cost price is fair

- Customers are provided with a product where the distribution costs do not adversely affect the product's value

Consumer Understanding and Consumer Support

- Customers view marketing content that is clear, fair and not misleading

- Customers deal with intermediaries that are well informed and understand our product

- Customers that are vulnerable are identified and appropriate adjustments made

- Customers are provided with all the necessary information to make an informed decision

- Customers receive relevant documentation in a timely manner

- Customers individual needs are considered when they need to use their policy

- Customers can understand all of the terms and conditions of their policy and understand their obligation

- Customers are responded to a timely manner in an appropriate way

- Customers clearly understand how to make any adjustments to their policy and what happens next

- Customers clearly understand how to make a claim and what happens next

- Customers have easy access to making a claim and are well informed throughout the claims process

- Customers are satisfied how they are dealt with when making a claim

- Customers clearly understand how to make a complaint and what happens next

- Customers have easy access to making a complaint and are well informed throughout the complaint process

6. What factors do you take into consideration when assessing whether a ‘good outcome’ has been delivered for a customer?

To assess whether a good outcome has been delivered, we look at both qualitative and quantitative information. We have identified key management information that is relevant for each of the outcomes listed above, this management information includes, but is not limited to:

- Customer satisfaction surveys/market research

- Broker feedback

- Service delivery data

- Product reviews including testing of the customer journey

- Fair value assessments

- Retention rates

- Cancellation rates

- Complaints data

- Claim acceptance rates

- Declinature rates

- Frequency of claims

- Loss ratios

- Call handling data

7. When assessing Outcome 1 (Products and Services) and Outcome 2 (Price and Value), how has the Consumer Duty changed your approach since the FCA Pricing Practices requirements introduced last year?

8. What is your understanding of the customer journey and how you can avoid causing reasonably foreseeable harm?

9. How have you considered vulnerable customers and how this might change your approach?

10. Have you appointed a ‘Consumer Duty Champion’ at Board level who, along with the Chair and the CEO, ensures that the Duty is being discussed regularly and raised in all relevant discussions?

11. How are you embedding Consumer Duty principles into your business?

The Consumer Duty principle "a firm must act to deliver good outcomes for consumers" is being embedded into our product management lifecycle, to enable us to:

- Act in good faith toward retail customers.

- Avoid foreseeable harm to retail customers.

- Enable and support retail customers to pursue their financial objectives.

Fair Value Assessments and product reviews will be updated to ensure that we’ve taken into account the good customer outcomes we’ve identified as critical. As with the FCA regulations stated in PROD4, Consumer Duty will be at the forefront of our design, testing, approval, distribution and monitoring.

Alongside the Board oversight, we’ll be tracking Consumer Duty within our management review meetings. We'll regularly review performance against the identified good customer outcomes using the management information we've identified as relevant for each area. Training will also be provided to all our employees to ensure they are knowledgeable and informed.