FIVE – investment indices for savings and retirement products

The rules-based approach for the financial success of consumers and insurers

properties.trackTitle

properties.trackSubtitle

Savings and retirement planning – multiple needs, no compromises

Consumers benefit from:

- Access to a broad investment spectrum

- Efficient implementation in liquid markets

- Combination with guarantees

Insurers benefit from:

- Bundling investment and guarantee component via reinsurance to increase cost-efficiency

- Well-defined set of rules to ensure robust product expectations – and thus consumer retention

- Deliberately selected range of indices and funds – ready-to-invest or tailor-made

FIVE Pension investment strategy

Five guiding principles for investment success

Rules-based

FIVE links your investments to proven investment and risk management strategies.

Diversified

FIVE follows a diversified investment approach aimed at maximizing returns while reducing risk.

Cost-efficient

FIVE pays attention to costs – the lower the fees the higher the returns.

Disciplined

FIVE focuses on producing attractive returns in the long run. Our strategies don’t get distracted by short-term noise or emotions.

Aligned

FIVE emphasizes a client-oriented performance culture – Munich Re invests proprietary capital in FIVE’s investment strategies.

Want to learn more?

A single source of solutions for multiple financial needs

You can benefit from our FIVE investment indices in different formats – accessible via reinsurance with Munich Re. This ranges from index-linked solutions to investment funds, all perfectly fitting into your product offering, your individual reporting as well as your local legal and regulatory requirements. Thus we can leverage cost savings and process efficiencies by bundling the investment and guarantee component in one single treaty. Due to our reinsurance DNA we comprehensively understand the risks associated to your financial needs and provide compelling risk transfer solutions. That makes our investment suite a one-stop-shop for savings and retirement products.

Our assorted selection of proven and ready-to-invest strategies enables you to provide sustainable investment returns deliberately addressing the demands of long-lasting retirement planning. Either ready-to-invest, tailor-made or both – the FIVE tool kit covers it all.

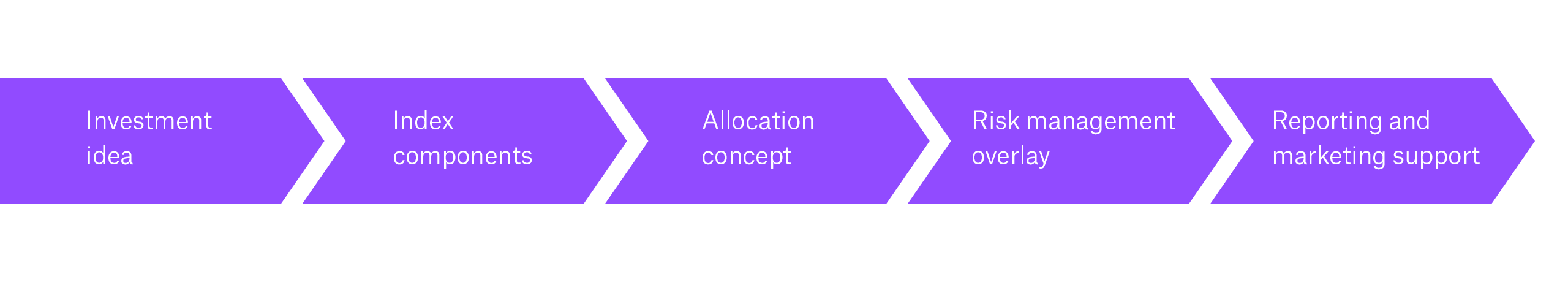

Only FIVE steps to your tailored index

How we support our clients – selected cases

FIVE BEST Index

What was the client‘s challenge?

- Design fund management strategy for new single premium JPY savings product

- Investment strategy should have fair equity exposure and always maintain a certain bond exposure

- Simple, explainable and effective investment strategy

- Investment strategy design should support the guarantee commitment of the savings product

How did we help the client?

- Designing our recommendation on the basis of the classic balanced fund approach

- Differentiating element: regime-based mechanism controls bond/equity allocation (BEST = “Bond + Equity Strategy”)

- Bond (major global government bonds) weight always above a certain threshold

- Long/neutral positions in individual equity markets (major global equity index markets) according to trend-signals in line with identified equity market trends

Multi Asset Strategie IP

What was the client‘s challenge?

- Need for new index-linked savings product marketable to retail customers

- Innovative investment to differentiate in the market:

- Providing a "safety net" by construction

- Offering an attractive return expectation

- Showing reliable risk behavior in order to stabilize upside participation

How did we help the client?

- Offering the client our large investment universe across a global and very diverse asset-space

- Advising on how return requirement and risk appetite are best reflected in the investment strategy

- Client chose a diversified multi-asset index applying sophisticated risk management techniques

Download more on FIVE indices

Do you want to launch an index-linked life insurance product?

Arrange a personal meeting with our experts right away and check out how you can benefit from FIVE investment indices.

Talk to our experts

/Ege_Michael_n306372_X11_500x500px.jpg/_jcr_content/renditions/original./Ege_Michael_n306372_X11_500x500px.jpg)