flowin

Smart underwriting for SMEs with just a few clicks

properties.trackTitle

properties.trackSubtitle

Small and medium-sized enterprises are the backbone of the economy, and yet they are often underinsured as the buying process is usually lengthy and cumbersome. Smart underwriting is now changing the game ...

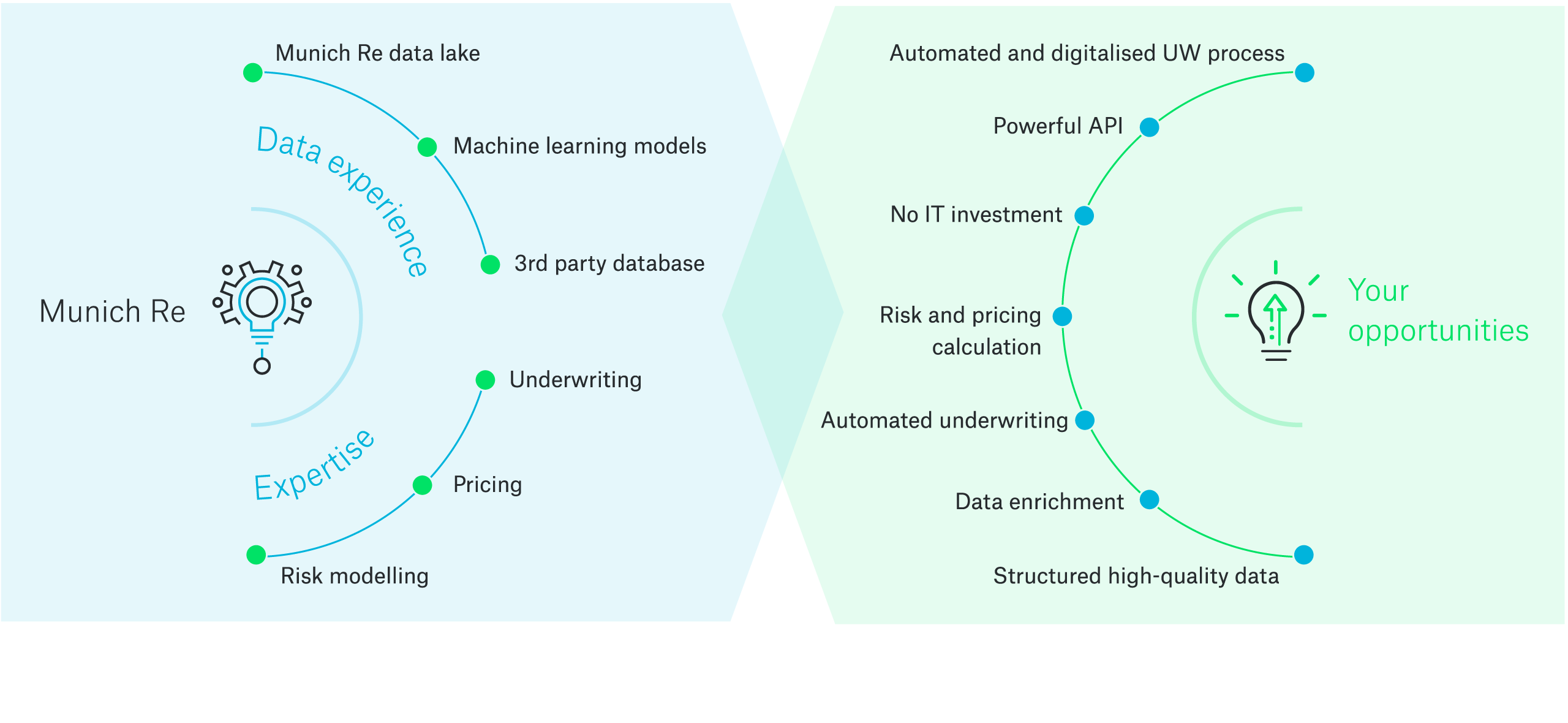

... by merging data science and insurance expertise speeding up the quoting process, enhancing the client journey and ultimately expanding insurability and developing tailored solutions. This is creating new opportunities for insurers to tap into this profitable market.

To benefit from this, insurers and brokers in the SME or commercial sector must move fast to hit the expectations of all in one products in combination with digital services.

Get started with flowin

Look how it works

significantly faster

more cost effective

better client journeys

This new solution helps you and your clients underwrite SME (and commercial) business more efficiently, from your PC or mobile phone.

Requesting quotes can be cumbersome due to the uploading of numerous documents and extensive sets of questions. flowin makes this process much easier. As a web-based application for the underwriting process, it creates an online “one-stop-shop” for underwriting SME (or commercial) business giving you exclusive access to Munich Re’s data lake and analytics, expertise in risk modelling and pricing.

To support you to develop innovative insurance products, the following services are available via the flowin web app or API (with more to come):

- Company information

- Satellite imagery recognition

- Nat Cat assessment

- Cyber risk assessment

- Market anticipation

- Pricing

Benefit from Munich Re’s expertise to grow your business

Why Munich Re is the right partner to get easy access to high quality data, digital expertise and analytics power

The online store for SME (and commercial) business

Your benefits at a glance

- Added value to insurance companies and distributors by simplifying and enriching the underwriting process

- Profit from our data excellence and innovative user experience

- Easy implementation combining multiple API and data sources into one

flowin is available in selected EU markets.

Get in touch to learn more

Our experts