Talaria Solutions

Empowering digital trade credit insurance and financing

properties.trackTitle

properties.trackSubtitle

Easy and seamless access to liquidity

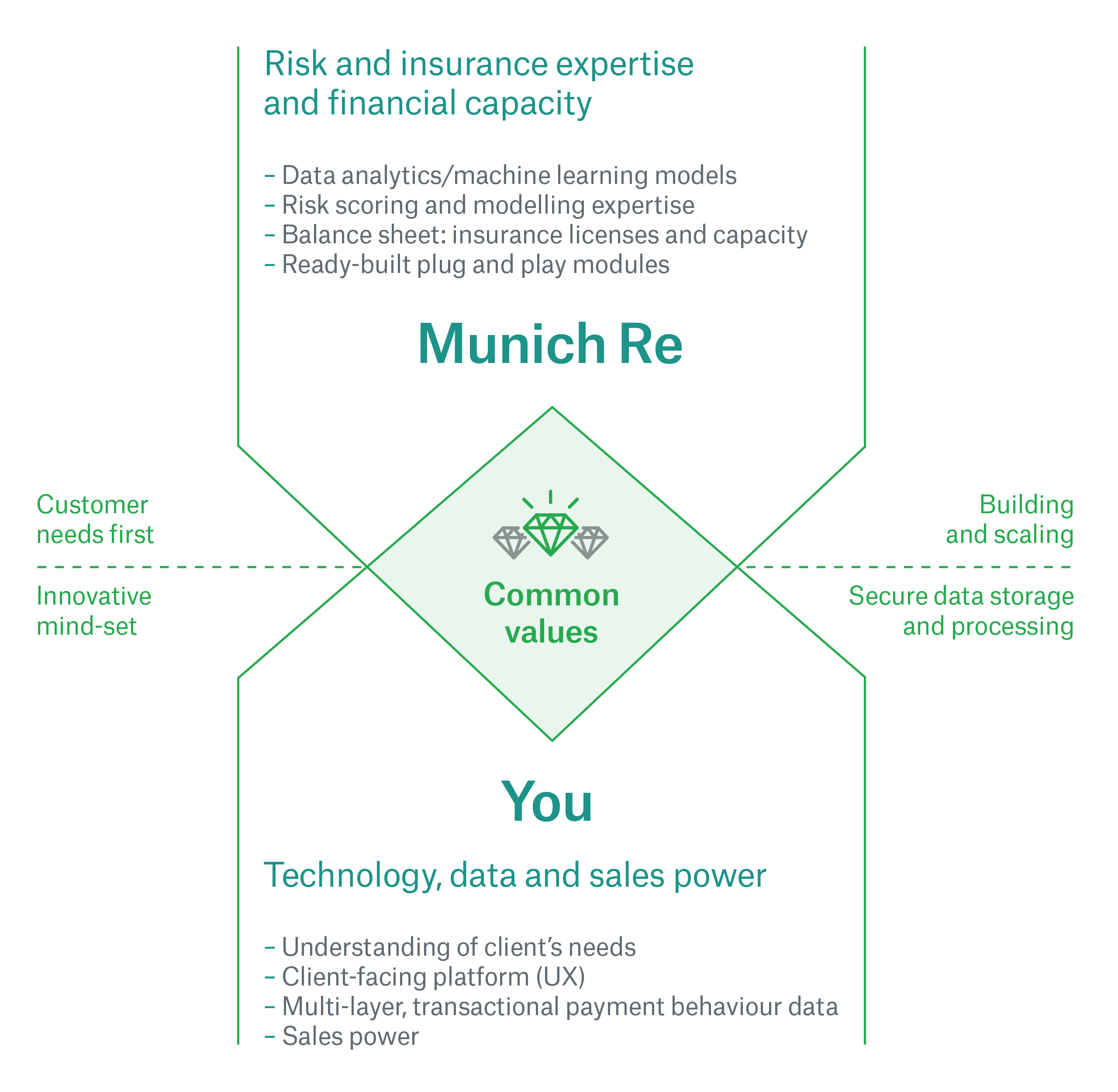

Talaria provides B2B2B financial solutions developed for but not limited to small and medium-sized enterprises (SMEs). The team offers a range of products, including Trade Credit Insurance (TCI) and Receivables Finance, which are aimed at providing SMEs with easy and seamless access to liquidity through receivables-based financing. The business model of Talaria is based on platform partnerships, where SMEs are on the platform of a distribution partner. Talaria uses a proprietary risk engine that combines real-time data on payment behavior, machine learning approaches, and expertise in risk management to provide a risk-intelligent pricing solution.

The innovative core of Talaria is its seamlessly embedded, convenient, customer-centric, fully automated, and risk-intelligent design. This creates a win-win-win situation for customers, distribution partners, and Talaria. Customers benefit from easy and seamless access to liquidity, while distribution partners gain access to an additional financing offering, increased stickiness, and the ability to tap into additional revenue potential. Talaria focuses on its core capabilities, such as regulatory compliance, risk, funding, and operations, and has smooth access to the existing SME customer base.

Your benefits at a glance

Plug and play white-label solution

Immediate risk assessment and cover decision

Fully compatible API

100% GDPR-compliant

AI-based superior scoring model using actual trading data

Automatic management of limits

How we work together

Our experts