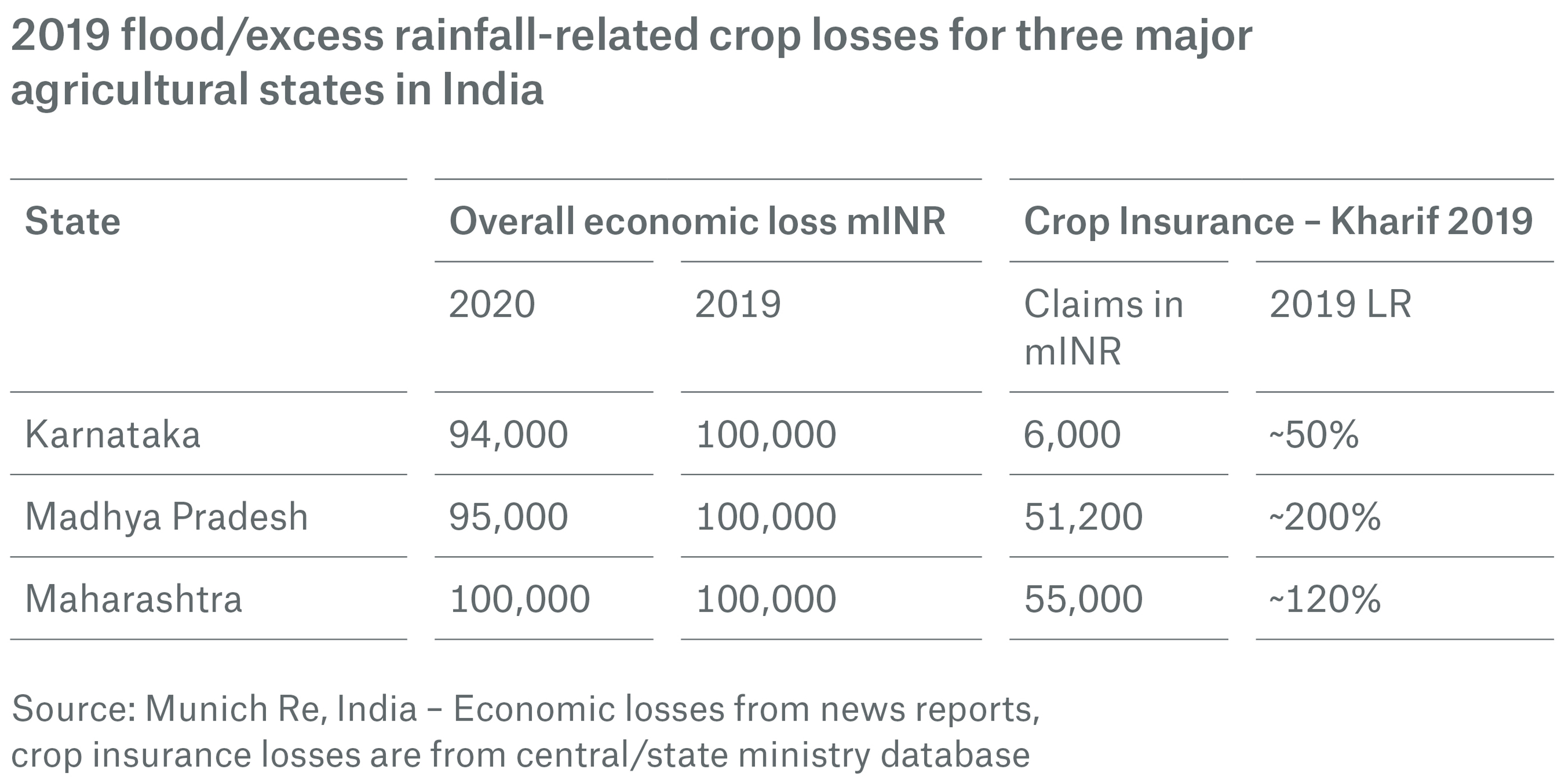

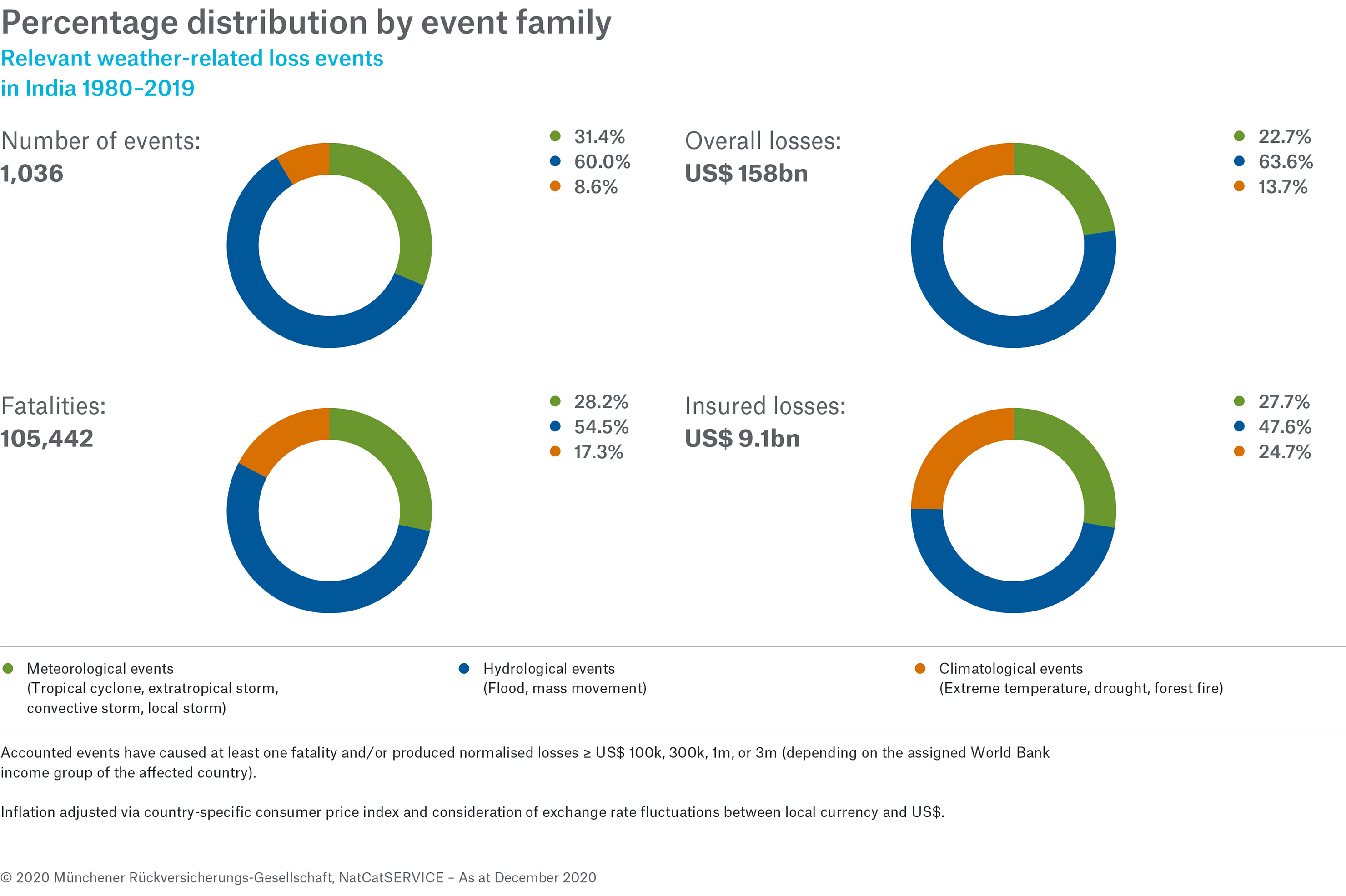

Major floods and landslides killed over 700 people and caused US$ 11bn worth of damage in India over the course of 2018 and 2019. It is an unfortunate fact that climate change will make events of this kind increasingly likely. Insurers and their clients have little choice but to consider this in their risk management strategies.

Munich Re’s ability to assist in this regard goes well beyond providing traditional covers or even alternative insurance solutions. We enable insurers to better service agriculture, property owners, governments and public private partnerships in a number of ways. They include helping to structure capital to meet growing demand, building greater climate risk awareness in the marketplace, and not least by sharing the experience we have gained in catastrophe modelling and catastrophe risk management over 40 years.

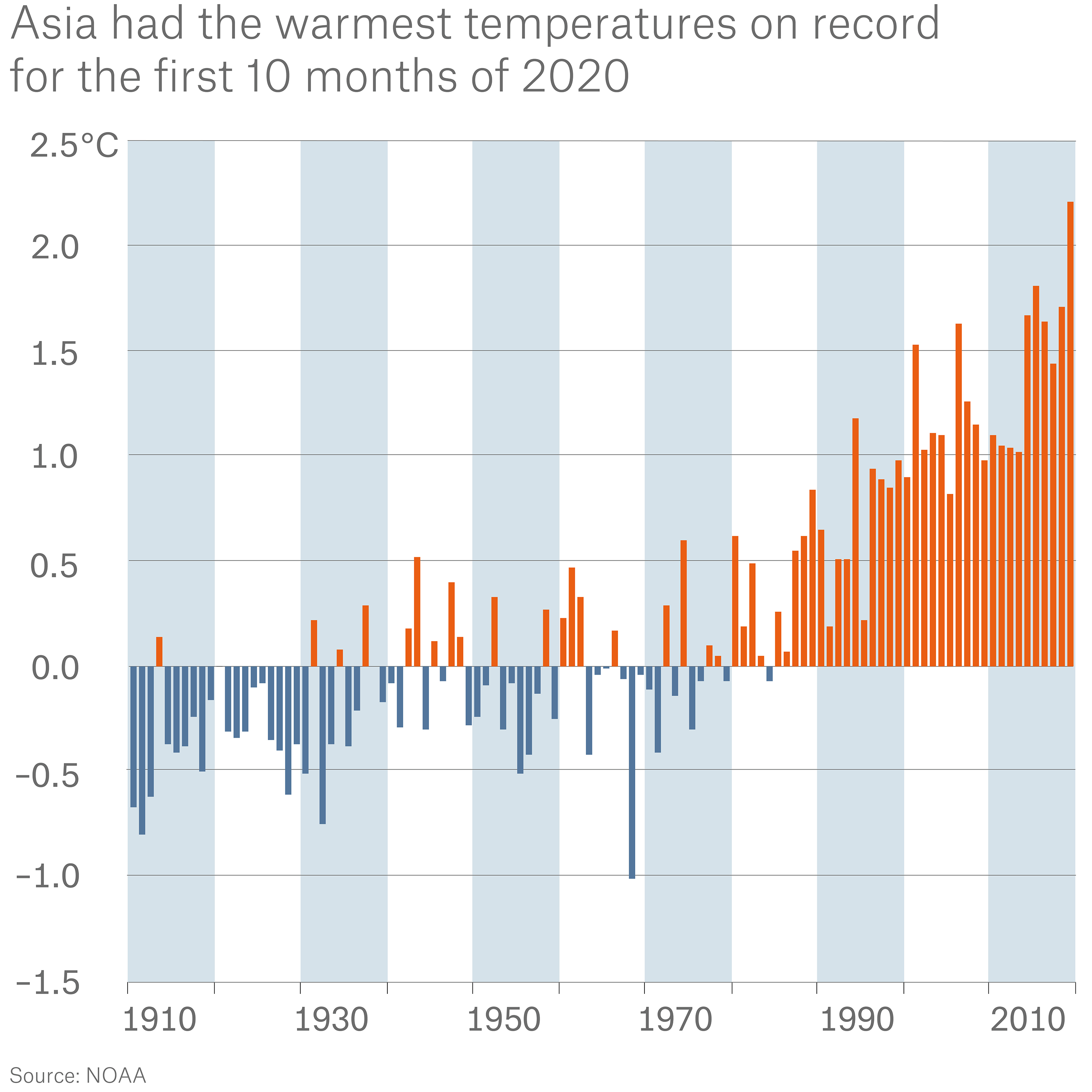

Storms, flooding and drought are the key weather perils for the Indian region and will likely become more severe in the future. Since they are unpredictable and extreme, these weather events are driving ever greater loss volatility, which makes structuring reinsurance solutions all the more challenging.

The all too real impact of extreme weather

There is no shortage of examples that demonstrate the effect of extreme weather in India: “The central part of the country is historically a dry area, but it has had consistently heavy rainfall for the last three years. The water holding capacity of the soil being low in this region, the crops in the area are destroyed year after year due to the rains and resultant inundation,” explained Ajeet Phatak, Munich Re’s regional head of agriculture for India, Japan, South Korea and Southeast Asia. “We are also seeing very high cyclonic activity on the Indian subcontinent,” he added. “We are seeing regular cyclonic hits, and quite a few of them. Unfortunately, with climate change, severe cyclones may become more likely, rather than the exception.”

Recent weather events in Thailand, which also falls under Ajeet Phatak’s area of responsibility, provide a particularly stark example of the effects of extreme weather. The country, a major rice producer, was struck by a one-in-50-year event in 2019. “It was the result of drought followed by a pest infestation, followed in turn by excessive rainfall and then another one-in-40-year drought, a very unusual combination of events in a single year, the cumulative effect of which resulted in huge losses,” said Phatak. “One of these events would be rare enough on its own, but no government could reasonably have anticipated four in the same year,” he pointed out. “Roughly 10 to 12% of the country’s overall rice production was affected, which resulted in a loss ratio of over 200% for us in one year. It was unprecedented,” he added.

The challenge extreme weather poses for the region is clear. The only question is how best to tackle it? “We can add most value where the overall agri-value chain is exposed to floods, unseasonal rainfall and droughts,” said Phatak. "These are the three main areas under immediate and growing exposure to extreme weather events.”

Attempting to narrow the insurance gaps

Making a difference with reinsurance solutions

Parametric insurance

Capital relief solutions

The role of public private partnerships

Munich Re engages with insurers and governments to discover the best ways to support them in both India and Thailand. “In India we have one state-owned company, the Agriculture Insurance Corporation, and it plays a big role in supporting the country. But there's also a group of private insurance companies that are equally important, and support more than 50% of capacity for the Indian Agri scheme,” Phatak explained.

“I think our partnership approach with the government and the insurance community works well with regard to public private partnerships. However, I believe all stakeholders could benefit from better natural catastrophe-related data collection and analysis. And we should look at factors such as the risk of state default, the opportunity cost of neglecting risk prevention and before-the-event risk-financing tools. In addition, there should be more discussion and contact between the public and private sectors. They need to intensify their partnership, and we are doing what we can to facilitate this,” he said.

Improving awareness of risks and solutions

As is the case in most developing markets, there is a lack of awareness of insurance capabilities and benefits. “It is certainly necessary to educate our market about the real need for extreme weather cover and for people to understand the changing risk landscape due to climate change, especially in this region,” said Ajeet Phatak. “Indeed, the crucial factor in coping with flood risk is awareness on all levels, and much flood risk can be mitigated up front. For example, proper selection of the site where a house or plant is to be built has a major bearing on the risk – flood plains are inherently risky, no matter what measures are taken,” he explained.

Ultimately, risk and loss minimization call for an integrated course of action. Flood and other extreme weather risks should be shared between government, communities, the enterprises concerned and the financial sector, in particular the insurance industry. “Only if we all cooperate with each other in a finely tuned relationship and in a spirit of risk partnership can extreme weather prevention be truly effective,” said Phatak. “As always, I invite insurers and government to join us on a journey to shared success. We're all in this together.”

Munich Re Experts

/benny_zhou.jpg/_jcr_content/renditions/original./benny_zhou.jpg)

Related Topics

properties.trackTitle

properties.trackSubtitle