Developing countries are increasingly affected

Expenditures for diabetes expected to rise

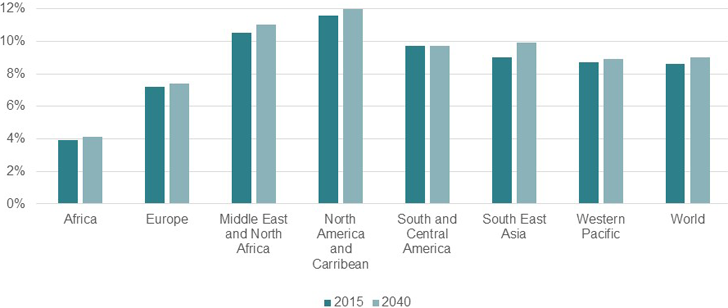

Diabetes is an expensive disease because of its chronic nature and the serious complications that accompany it: According to the IDF, an estimated US$ 673bn was spent on the disease in 2015 – this is equivalent to 12% of total healthcare expenditure for adults worldwide. In 2040, the total cost is likely to be in excess of US$ 802bn. Adding to the direct medical costs are indirect costs, estimated to be on at least the same scale, that are incurred from missed working hours and loss of productivity.

Prevention pays

Prevention and early identification play a key role in combating this disease. This is a task for the whole of society, and the insurance industry can play its part too. According to a study, lifestyle change can reduce the risk for diabetes by 49.4%, hence represent a good value for money (source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3985133/). Insurers have had positive experience with special programmes for diabetics in Abu Dhabi. The rate of hospital admissions there among the participants in the programme has dropped by 60% in recent years. Provided they are properly set up, programmes like this are definitely worthwhile, not least because a change in lifestyle lowers the risk of contracting a number of other diseases. The positive knock-on effects have been demonstrated, for example with regard to developing lung, breast and bowel cancer, depression, high blood pressure, back pain, and even dementia.

The insurance industry can help spread such programmes by incorporating them as integral components in innovative insurance products. The approach is to enroll diabetics for insurance at an early stage of the disease, and to ensure that accompanying health programmes bring about an alteration in lifestyle and behaviour. The policy design can include out of pockets to provide further incentives for health-conscious behaviour. In addition, tailored products are required for countries with low or medium income levels.

As a reinsurer with global experience in managing health risks, Munich Re provides support for innovation from the analysis and conception stages through to implementation. This was the case, for example, with a new product at Apollo Munich Health Insurance in India that is tailored to meet the needs of diabetes patients. Sophisticated methods of structuring and evaluating big data are important in this context for setting up the right programmes for the right target groups.

Our expert

Related Topics

Newsletter

properties.trackTitle

properties.trackSubtitle