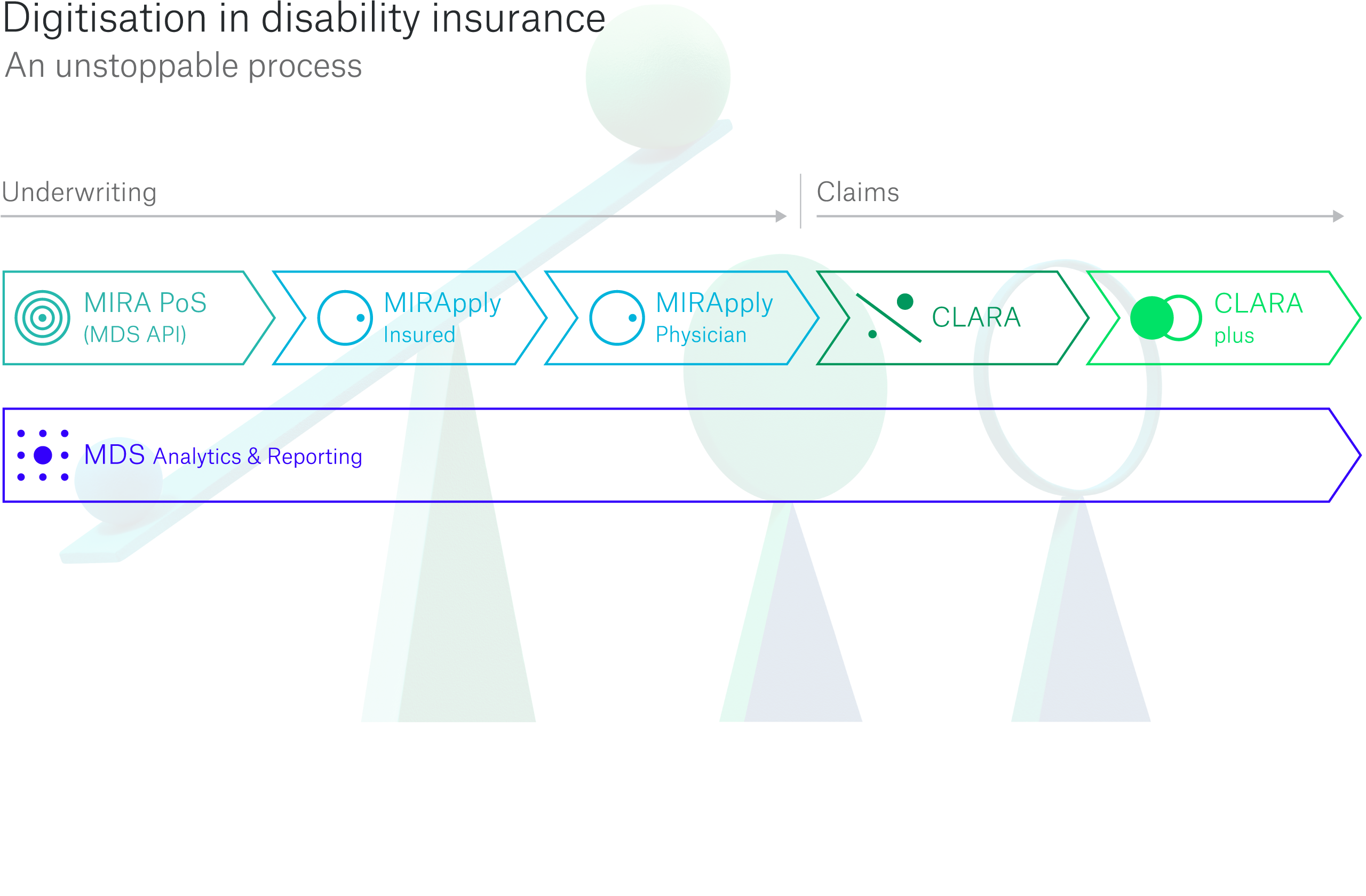

Fully digitalised value chain

CLARA plus automatically calculates the degree of disability

In disability insurance, the result of the claim assessment is always expressed as a percentage reflecting the degree of disability. Up to now, the degree of disability has had to be calculated manually and laboriously by qualified claims handlers. The process takes time, is individually managed, and consequently produces results that leave much to be desired in terms of consistency and transparency.

“We are making the most of this room for manoeuvre with CLARA plus,” explains Dr. Petra Robertson, who as an occupational physician in the Medical Research & Development team at Munich Re, assisted in the development of the service. “Our new service calculates the degree of disability using highly standardised queries that are adjusted to reflect the individual case – and includes questions about both the professional profile and the medical diagnosis.”

Suitable for up to 80 per cent of all benefit claims

CLARA plus already covers around 100 different occupational profiles and all frequent medical diagnoses – including mental illnesses. The latter category is extremely important, because most mental illnesses are complex and difficult to assess manually. At the same time, they are now the most frequent cause of disability in Germany, accounting for more than 37% of all cases. And this is a rising trend.

In particular, CLARA plus gives less experienced claims handlers greater confidence when assessing mental illnesses, or when accompanying conditions are involved. Pilot clients such as Swiss Life agree with this estimation. “In many cases, insureds are receiving psychological support, but no medical treatment. CLARA plus actively draws attention to contradictions like this,” says Philipp Greiner, head of the claims department at Swiss Life. “It is also very helpful that CLARA plus can arrive at a consistent assessment based on just limited medical information,” he adds. In light of this, CLARA plus should also significantly increase the competitiveness of future users.

The Munich Re development team is currently expanding the database, feeding CLARA plus with additional information on frequent comorbidities. In future, this will allow the service to achieve a very high automation rate. Robertson predicts that it will be possible to fully process up to 80 per cent of all disability insurance benefit claims using CLARA plus.

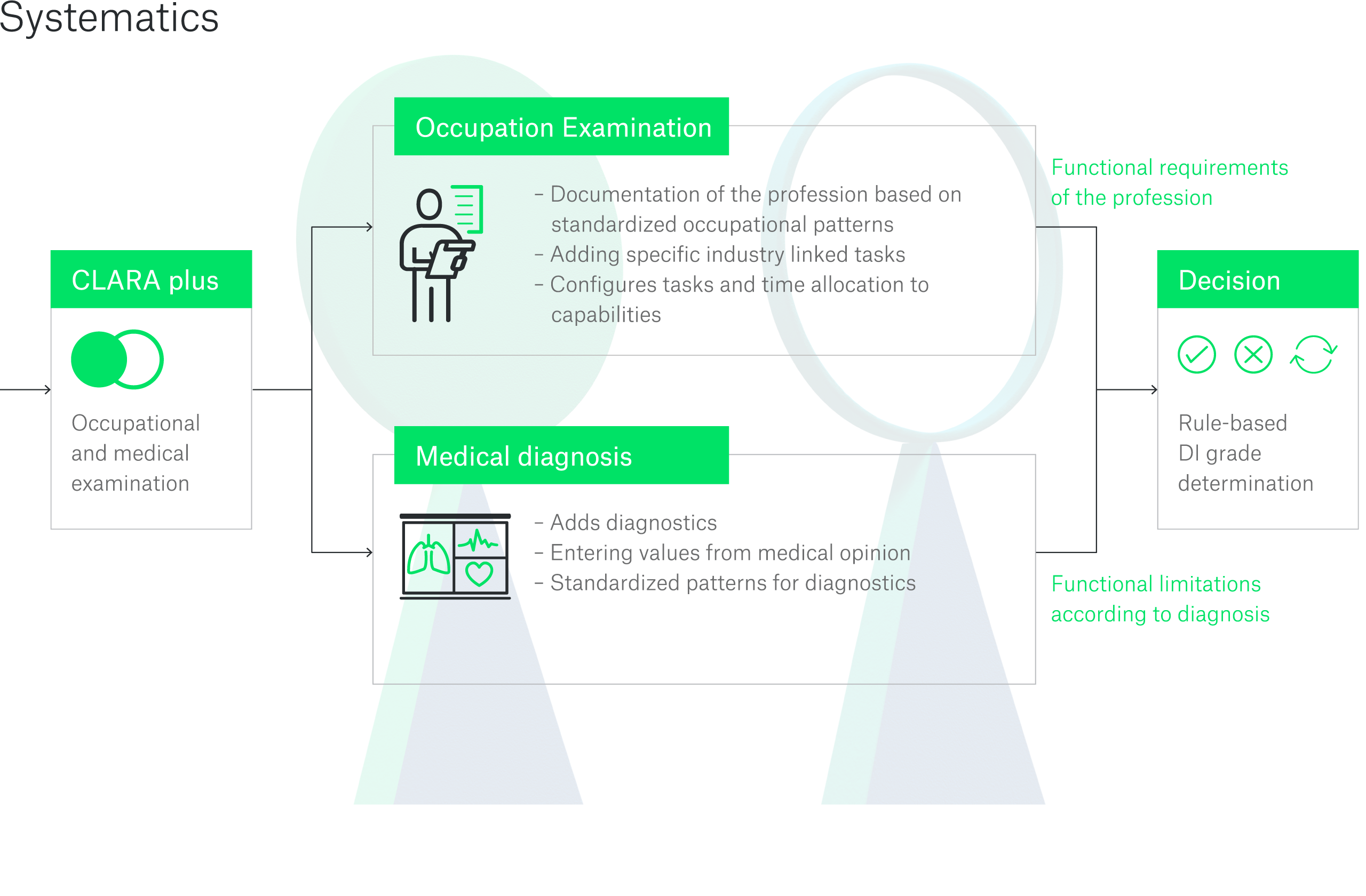

Operating principle

The CLARA plus methodology immediately looks clear and appropriate (cf. Figure 2). In essence, the service uses algorithms to carry out a structured claim assessment. To begin with, the applicant’s occupation is broken down. The system initially assumes a typical activity profile for the specified occupation. It then asks about any relevant part-time activities and links these with the associated functional requirements for physical and mental well-being. The part-time activities are additionally weighted based on a typical working day.

In this way, CLARA plus creates an individual occupational profile that takes into account all the functional requirements for performing the activity, and then compares these with the relevant health parameters and prognostic factors. The available medical documents form the basis for the medical assessment. CLARA plus guides the claims handler through the documents based on the guidelines stored in the system, allowing a claim to be processed in a consistently reflexive manner by asking questions to obtain only the information that is relevant.

A number of plausibility checks automatically run in the background. For example, the system ensures that the available documents are appropriate for the seriousness of the illness. If this is not the case, CLARA plus highlights the inconsistency. It also checks the coherence of diagnostic and therapeutic relationships. For example, if there is no evidence of an applicant with a diagnosis of back pain having received physiotherapy, the system flags the discrepancy.

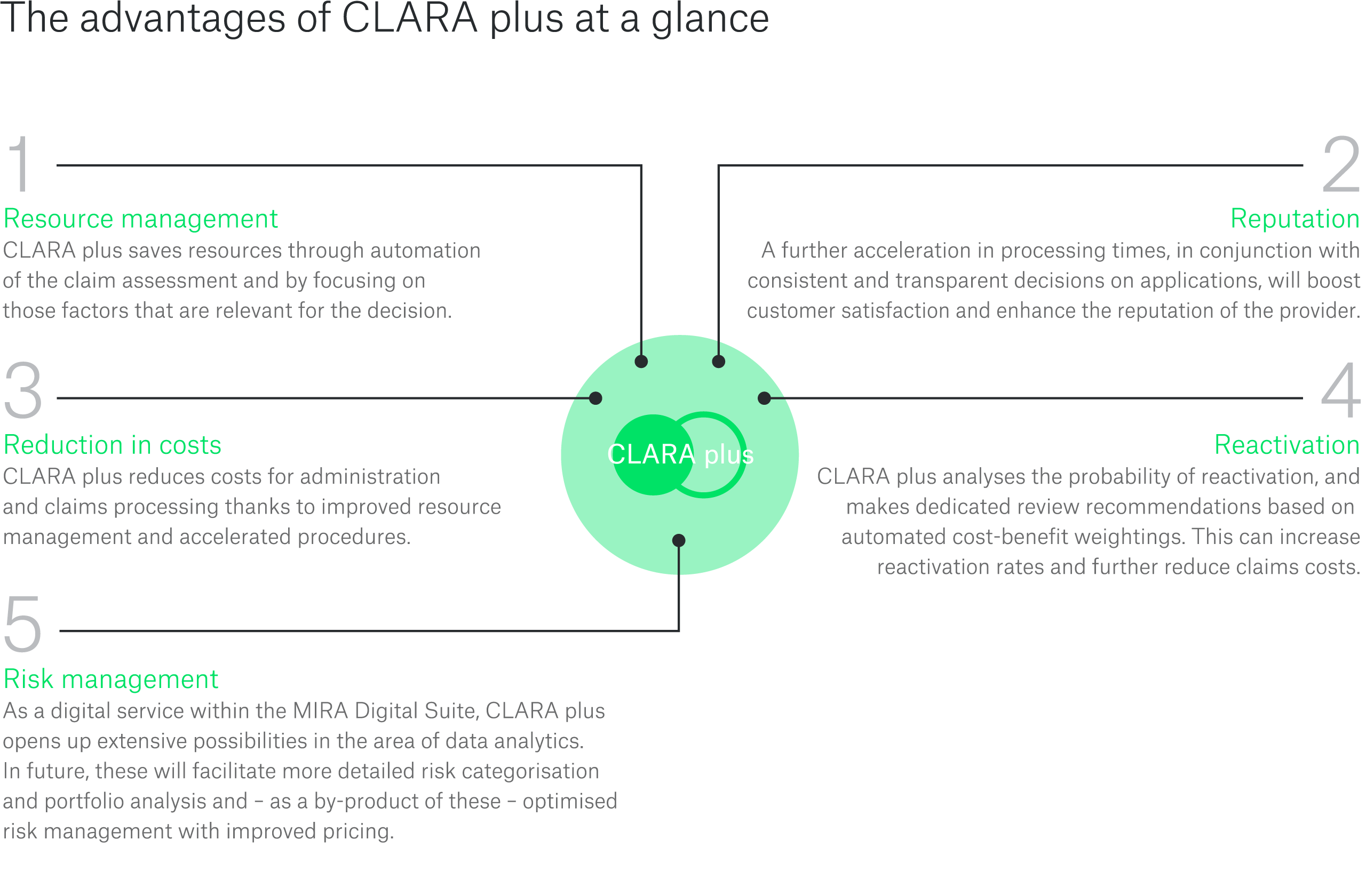

Advantages

The outlook

The pilot phase has now been successfully completed. “We will be introducing CLARA plus for regular operations until further notice,” says Philipp Greiner of Swiss Life, “because the system already offers us advantages now, particularly in connection with mental illnesses and as a support for less experienced claims handlers.” Munich Re is offering CLARA plus for insurance clients on the disability market in Germany with immediate effect. It is planned to extend the service to international disability markets as well. All that will be needed for this step are modifications to the CLARA plus guidelines and some legal parameters, without any changes to the automated claim assessment system itself being required.

Munich Re also sees great potential for expansion in terms of data analytics. The database available for this will expand dramatically over the coming months and years, since every case processed in CLARA plus provides additional data points. The MDS services for reporting and analytics will open up entirely new knowledge opportunities for users, and along with them, new marketing and product development options.

Expert

Related Topics

Newsletter

properties.trackTitle

properties.trackSubtitle