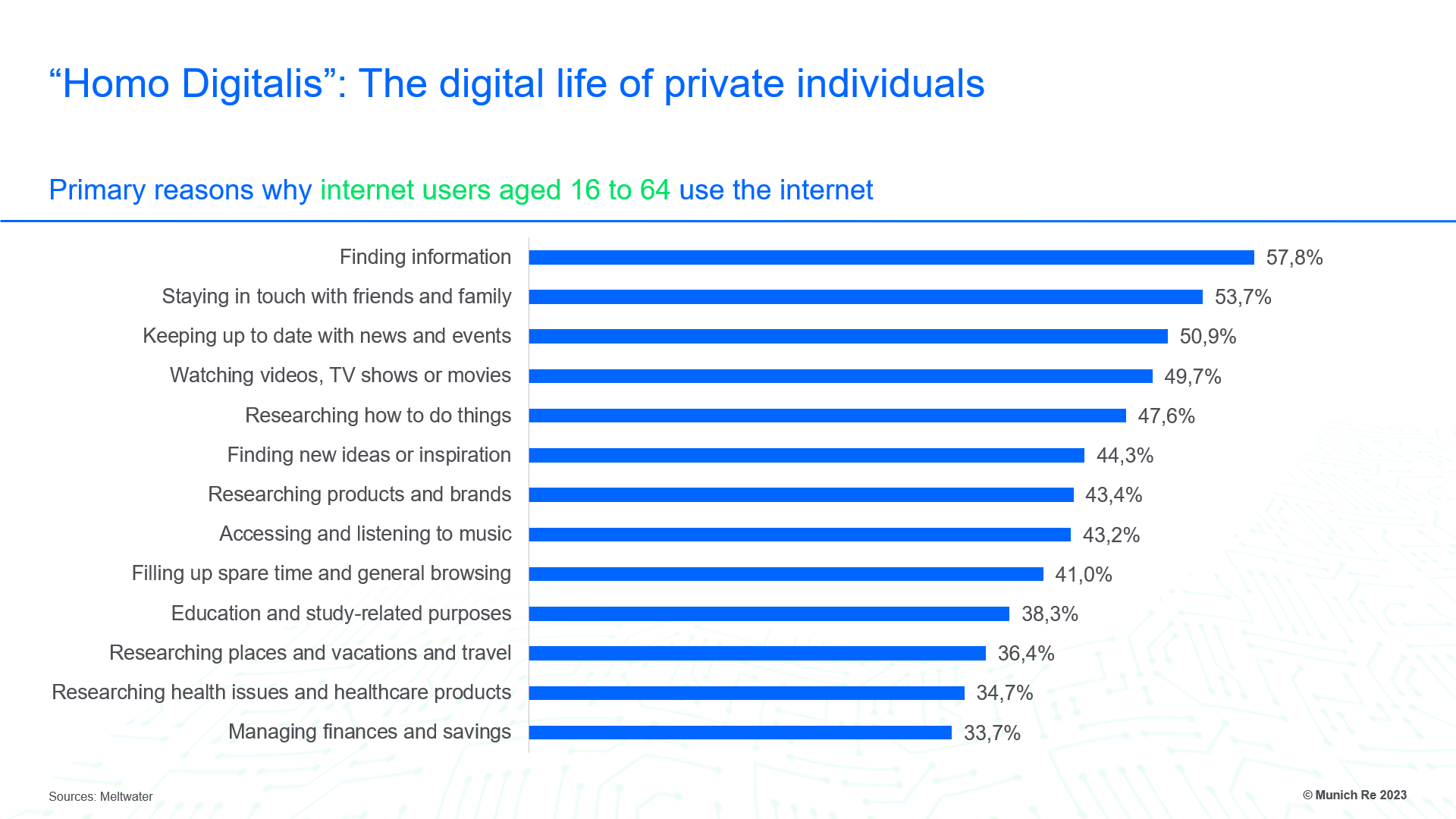

Personal cyber insurance makes life safer and more carefree. Yet despite the continued growth in cyber-crime only a very few people have so far addressed their own personal risk. Online fraud, identity theft, malware and fraudulent financial transactions can cause major losses with long-term consequences for private individuals and their families. Following, we will take a look at demand, coverage options and the advantages of personal cyber insurance.

On the way to Homo digitalis

Identifying cyber risks and preventing online fraud

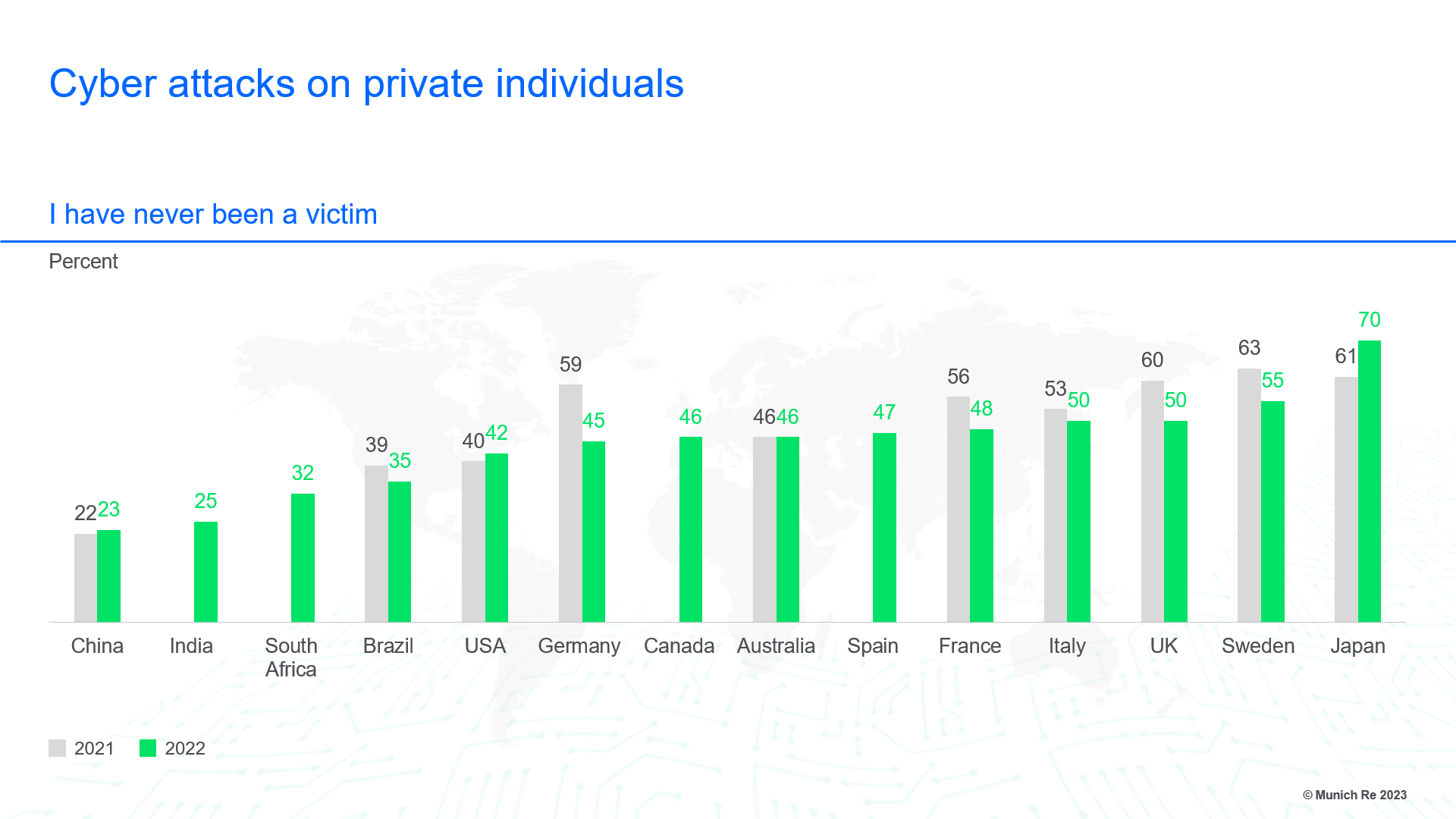

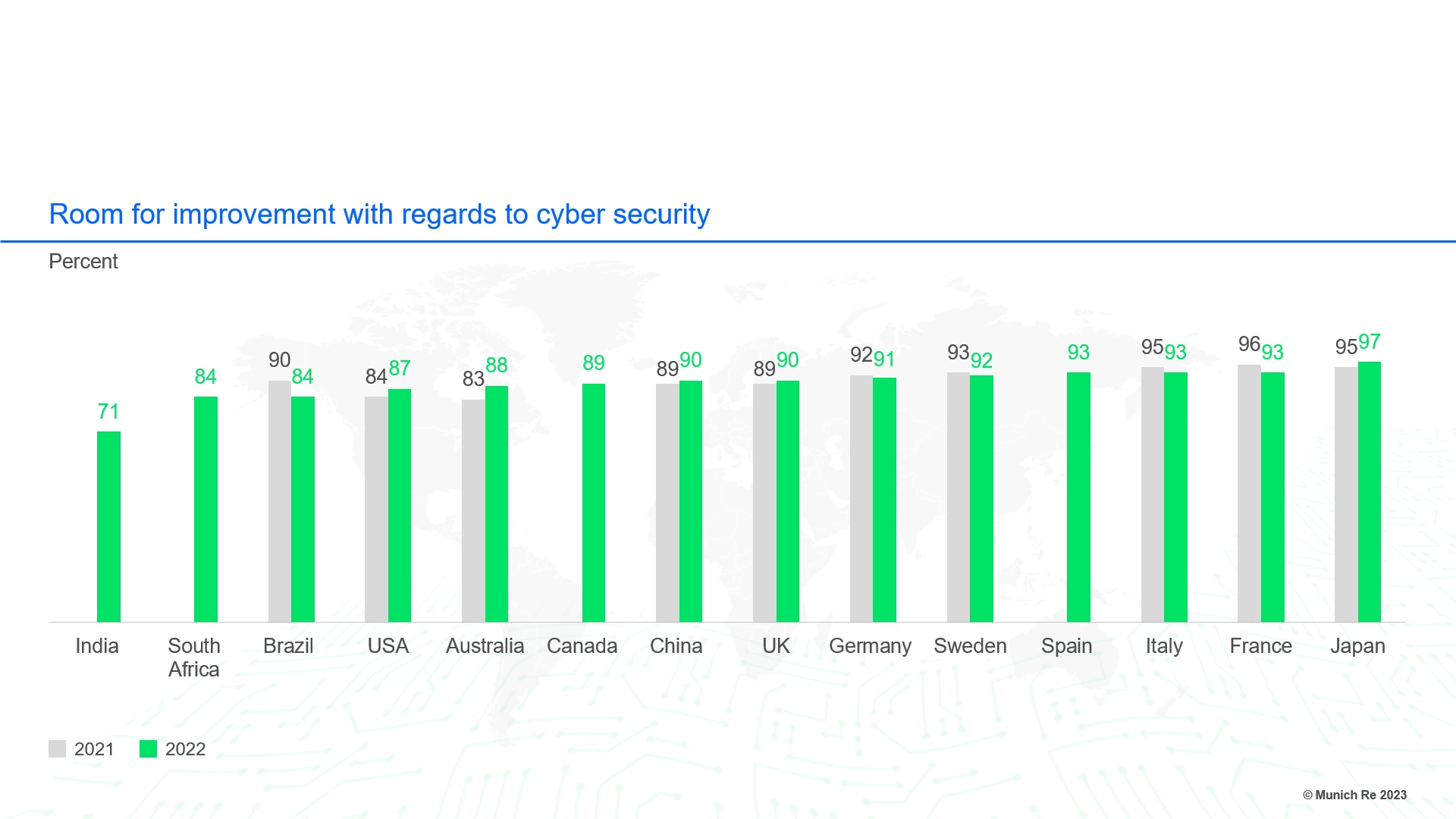

Many individuals continue to underestimate the cyber threats that affect them and their families directly. The risk of cybercrime targeting private individuals is more imminent than many realize. While cyber insurance and related services cannot entirely eliminate these risks, they can provide an additional level of reassurance to individuals.

From the criminals point of view the cyber-attack business is not confined to targeting companies; Private individuals are increasingly being attacked, sometimes with severe consequences.. Therefore, the following question arises: How can we deal with cyber risks in our personal lives?

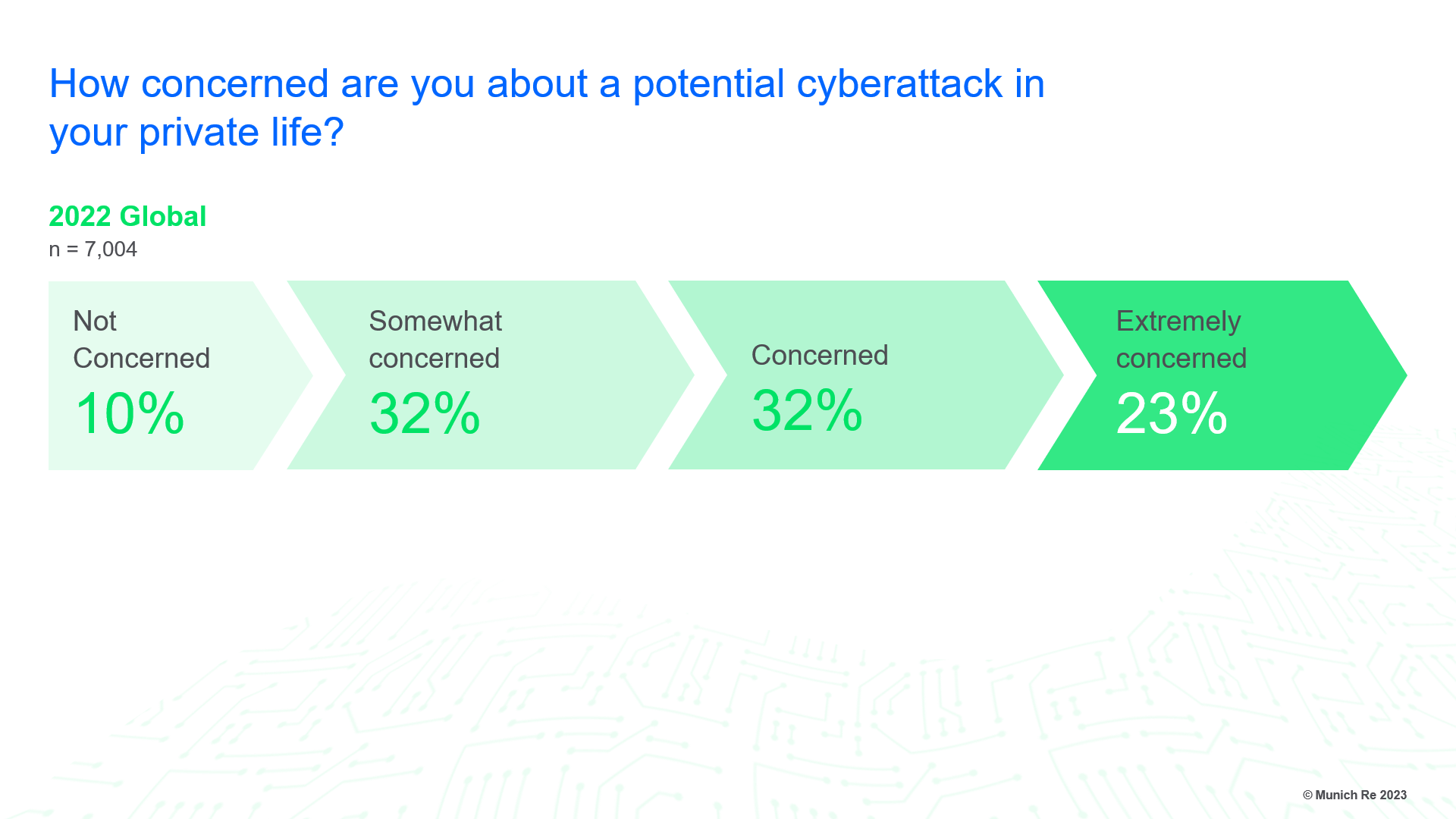

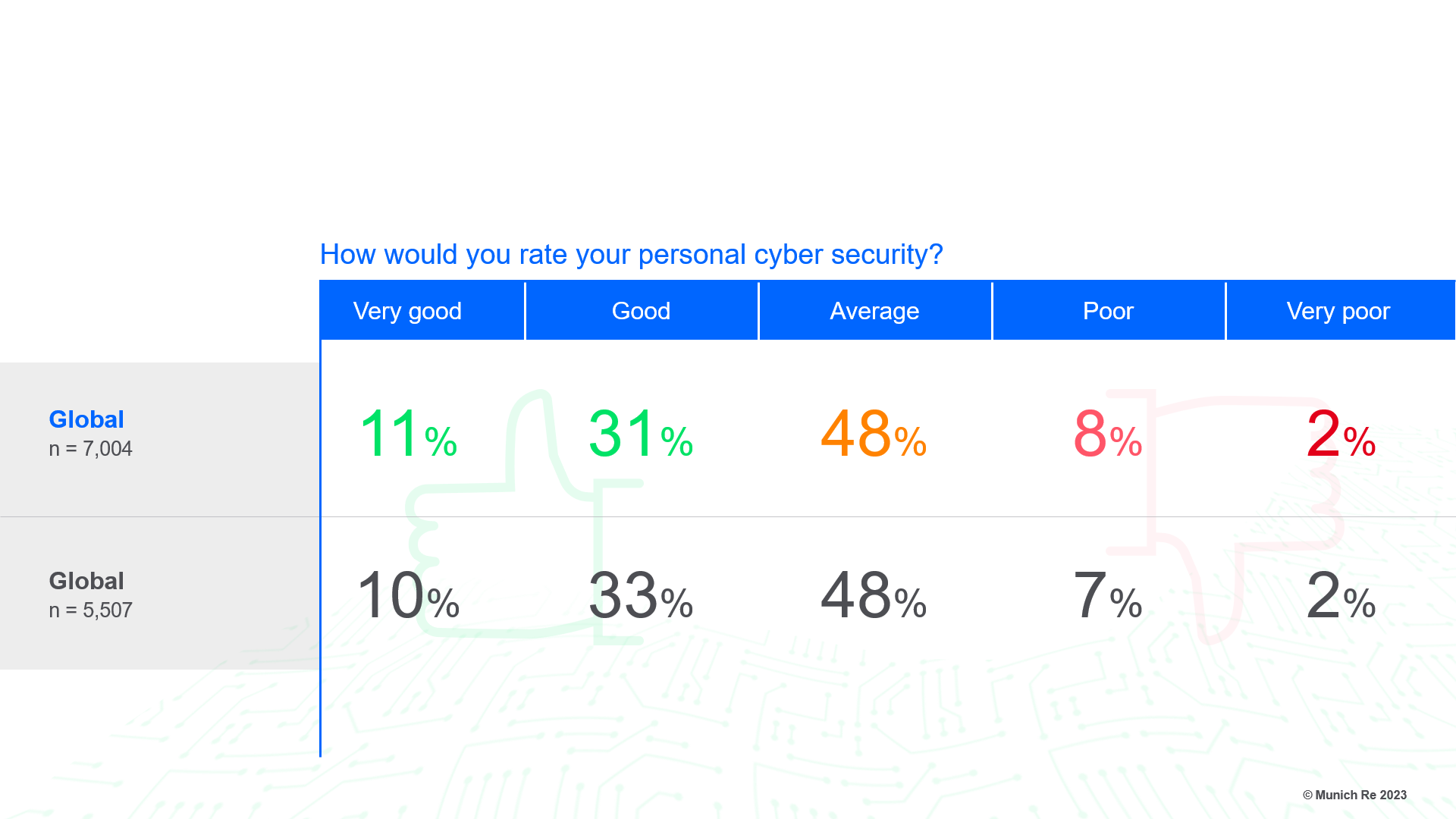

According to the Munich Re Global Cyber Risk and Insurance Survey 2022, only 10% of the more than 7,000 respondents from 14 countries said that they weren’t concerned at all about their digital security, whereas 55% of those surveyed were concerned or even extremely concerned.

Averting cyber-attacks and protecting against losses

To prevent anything happening in the first place, 86% favour pre-incident services.

The key components of protection against cyber-attacks include appropriate anti-virus/anti-malware programs, a firewall, regular software and system updates, strong passwords, multi-factor authentication, secure network configurations, safe browsing behaviour, proper handling of emails, data back-ups and data encryption systems. Most of the respondents (86%) of our Global Survey expect personal cyber insurance to include pre-incident services such as back-ups of sensitive data (56%), firewalls (55%) and anti-malware tools (55%).

84% of those surveyed felt that personal cyber insurance should include post-incident services.

However, despite all care and precaution, with increasing professionalisation of cyber criminals and growing complexity for individual users, it has become virtually impossible to completely rule out a successful cyber-attack. Therefore, appropriate support and after-care measures have become all the more important.

While only 16% of the respondents claimed that they did not need post-incident services, 60% would require data recovery services, 53% would value support via a 24-hour hotline, and 48% for legal advice. These three services were seen as most important, followed by advice in the case of extortion, aid with restoring the reputation, and psychological counselling.

Flexible cyber insurance solutions for private individuals

Personal cyber insurance solutions are available on the market and, according to Munich Re’s survey, have developed positively over the year. The number of people who were offered personal cyber insurance increased from 13% to 17%. The number of people taking out cyber insurance for themselves and their family (6% compared to 4% in 2021) was also a positive development. Furthermore, an additional 34% of those surveyed were planning to take out such insurance. There are a variety of insurance offerings, ranging from special individual policies to combined insurance products and services. These can be e.g. credit cards, telecommunications contracts or home insurance policies.

Cyber insurance is a good step towards ensuring the secure enjoyment of internet usage.

/Topsch%20Carsten_square.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)

Anyone who owns a laptop, tablet, smartphone or smart speaker, who uses social media or buys and sells things online is well advised to take out a personal cyber insurance policy. Personal cyber insurance can help, for example, in dealing with online fraud, cyber extortion, identity theft and data loss, by compensating for financial losses and providing expert support.

Possible coverage modules in the area of personal cyber insurance:

Munich Re has established a leading global position in the cyber insurance market through know-how, modelling, expert networks and client focus. We support insureds in building the resilience and responsiveness necessary to combat cyber risks.

Therefore we are actively initiating exchange and collaboration with our clients and partners to promote a sustainable, transparent and demand-oriented cyber insurance market for business and also for private individuals with their families.

The survey was conducted in December 2021 on behalf of Munich Re by the global market research company Statista and evaluated in January and February 2022 with internal experts from Munich Re. Further information on the countries and the participants surveyed can be found in the PDF file: Munich Re Global Cyber Risk and Insurance Survey 2022.

Experts

Related Solutions

Newsletter

properties.trackTitle

properties.trackSubtitle