On the way back to the top (1946–1969)

properties.trackTitle

properties.trackSubtitle

At the end of the Second World War, Munich Re faces the most difficult economic period in the Company’s history to date. Initially, its very survival is threatened by criminal proceedings against members of its Board of Management, the loss of assets abroad, the prohibition of any business with foreign partners, and the complete devaluation of all German government bonds.

The situation does not improve until 1950, when the Western Allies revoke the prohibition on foreign business. Munich Re is then able to return to the global market in a very short time. The Company establishes new subsidiaries and offices abroad in the USA, Canada, Asia and South Africa. In Germany too, the economy recovers, bringing about steady growth until well into the 1960s.

1946 – Criminal proceedings against Munich Re managers

In June 1946, the US military government opens criminal proceedings against all the Board of Management members and directors who had signed the declaration on the Company’s assets abroad in July 1945. Kurt Schmitt and Alois Alzheimer do not face charges, since they had already been suspended and dismissed by the military government. The verdict is announced on 8 August: two directors and the Board of Management members Gustav Mattfeld, Hans Oldenburg and Georg Paul are arrested and given prison sentences. Munich Re also has to pay a fine of 4 million reichsmarks. The prisoners are granted early release in 1947.

1947 – Complete ban on activity outside Germany

Control Council Law no. 47, dated 10 March, prohibits any activity by German reinsurers outside Germany.

1948 – Currency reform

With the currency conversion from reichsmarks to deutschmarks (DM), the Company’s shareholders’ equity drops from approximately 40 million reichsmarks to DM 26 million. Factors such as the devaluation of all German government bonds, the loss of Company assets abroad, and the currency reform result in a shortfall of approximately DM 36 million on 21 June, the date of the opening balance sheet in DM. This shortfall is covered in the balance sheet by equalisation claims against the Bank deutscher Länder.

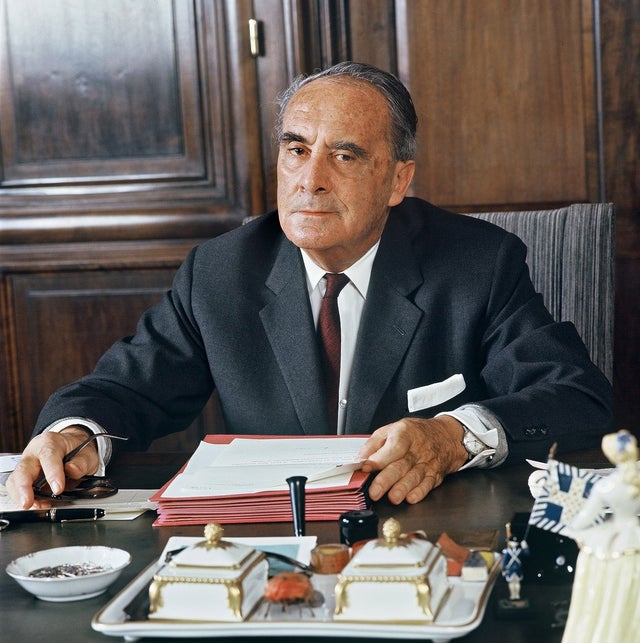

1950 – Alois Alzheimer takes over as Chair of the Board of Management

Alois Alzheimer rejoins the Board of Management in August 1948 following his denazification process. After the death of Eberhard von Reininghaus in October 1950, he takes over as Chair of the Board of Management and directs Munich Re’s business operations until the end of 1968.

1950 – Resumption of foreign business

In 1949, the Western occupying powers permit German reinsurers to conclude treaties with foreign clients again, albeit to a restricted degree. All restrictions are then removed in September 1950, allowing the return to the international insurance market. Within a single year, Munich Re concludes treaties with insurers in Finland, France, the United Kingdom, Italy, the Netherlands, Austria, Portugal, Sweden, Switzerland and Spain, as well as with clients in India and Pakistan.

1953–1954 – Return to profitability

For the first time since the war, the 1950–1951 business year produces a relatively modest profit of around DM 1 million. Over the following months, the earnings situation improves rapidly. By the 1953–1954 business year, gross premium income, at DM 274million, already exceeds the record premium volume set in 1943–1944.

1959 – US subsidiary established

Because institutional separation applies under United States law for the reinsurance of life and property insurers, Munich Re founds a life reinsurance subsidiary in the USA in December 1959: the Munich American Reassurance Co., based in Atlanta.

1960 – Canadian subsidiary established

A life reinsurance subsidiary, the Munich Reinsurance Company of Canada, is established in Montreal.

1962 – Storm surge in Hamburg

The Hamburg storm and flood catastrophe in February 1962 hits Munich Re's balance sheet hard, with the largest loss amount since the San Francisco earthquake. Net payments come to just under DM 18 million.

1962 – Munich Re reinforces its presence in Asia

To expand its presence in Southeast Asia, from 1961 Munich Re considers several regions for the opening of offices abroad. Hong Kong is decided on in 1962, and a licence is issued in December 1962.

1967 – First representative office in Japan

Munich Re opens a liaison office in Tokyo, whose staff assist clients on all matters relating to property and life insurance. The new office gives Munich Re a stronger presence in the Japanese market than any other foreign reinsurer.

1968 – Munich Re in Africa

With the aim of expanding business in Africa, Munich Re establishes an independent subsidiary in 1968 in apartheid South Africa: the Munich Reinsurance Company of South Africa in Johannesburg. At that time, South Africa is the continent’s leading economy. This is the argument for establishing a subsidiary, but there were apparently no misgivings because of the apartheid policy.

1969 – Horst K. Jannott becomes Chair

At the age of 40, Horst K. Jannott succeeds the 67-year-old Alois Alzheimer as Chair of the Board of Management, remaining at the helm of Munich Re until his death in 1993.