Climate Ambition & Reporting

properties.trackTitle

properties.trackSubtitle

Since 2008, Munich Re has had a holistic climate strategy in place that has continuously evolved. Our Group-wide objective is to contribute to achieving the goals of the Paris Agreement.

Our strategy is based on the following three core elements:

- decarbonisation targets

- comprehensive climate risk management and

- the provision of innovative risk transfer solutions aimed at adapting to and mitigating climate change

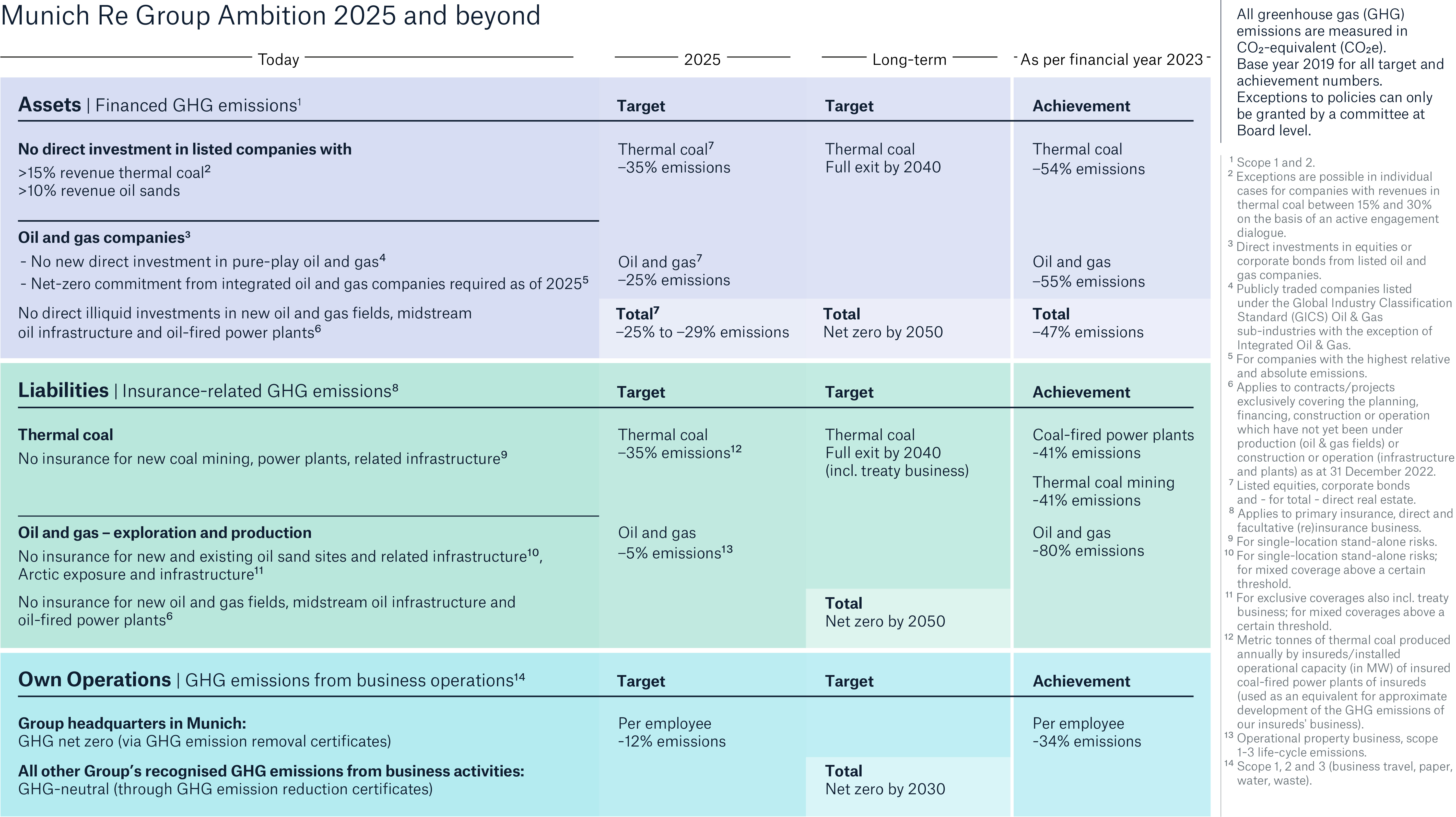

Our decarbonisation approach is a key part of our overall climate strategy and revolves around three core domains: assets, liabilities, and our own operations. Within our Ambition 2025 framework, we have established a series of targets to guide our decarbonisation journey until 2050, with significant milestones set for 2025.

In 2023, we already managed to overachieve our 2025 emission reduction targets related to assets, liabilities and own operations.

Sustainability in insurance

Our business is the acceptance and diversification of risks in primary insurance and reinsurance. We find leverage for sustainable action by appropriately managing the risks and combining economic success with added value for society.

By implementing ESG aspects in our underwriting guidelines, we aim to support the achievement of the Paris climate targets by insuring new, climate-friendly technologies and by making these technologies more attractive and financially viable for investors.

We have committed to transitioning our underwriting portfolio to net-zero GHG emissions by 2050. Our climate ambition 2025 is an important milestone on the way to achieving this commitment. In 2020, as part of our Munich Re Group Ambition 2025, we set ourselves GHG emission reduction targets for insurance of thermal coal, and oil and gas production in our primary insurance, facultative and direct (re)insurance business.

Responsible investment

Our business model as an insurer has a long-term focus. Sustainability criteria therefore play a key strategic role in investments. As a large asset owner and investor, Munich Re is aware of its responsibility and its effect on sustainability.

In 2020, we announced a climate commitment to be net zero by 2050, which has become an integral part of the Group Ambition 2025.

Munich Re set financed greenhouse gas (GHG) emissions targets related to investments in the asset classes of listed equities, corporate bonds and direct real estate. We will endeavour to reduce net financed GHG emissions in the asset classes mentioned above by 25–29% by 2025, compared to the base year 2019, as an intermediate step to achieving our ambition of net-zero emissions by 2050.

Environmental management

Munich Re adopted a holistic approach as part of the Munich Re Group Ambition 2025, and also takes into account the direct climate-related impacts of greenhouse gas (GHG) emissions from its own operations.

As part of our climate ambition, we aim to reduce our emissions by 12% per employee by 2025 compared to 2019, and ultimately become net zero in terms of GHG emissions from our own operations by 2030. We endeavour to offset the remaining, unavoided GHG emissions by purchasing certificates from projects that aim to reduce GHG emissions (“GHG-neutral”) or respectively remove GHGs from the atmosphere (“GHG net zero”).