Climate Ambition & Reporting

properties.trackTitle

properties.trackSubtitle

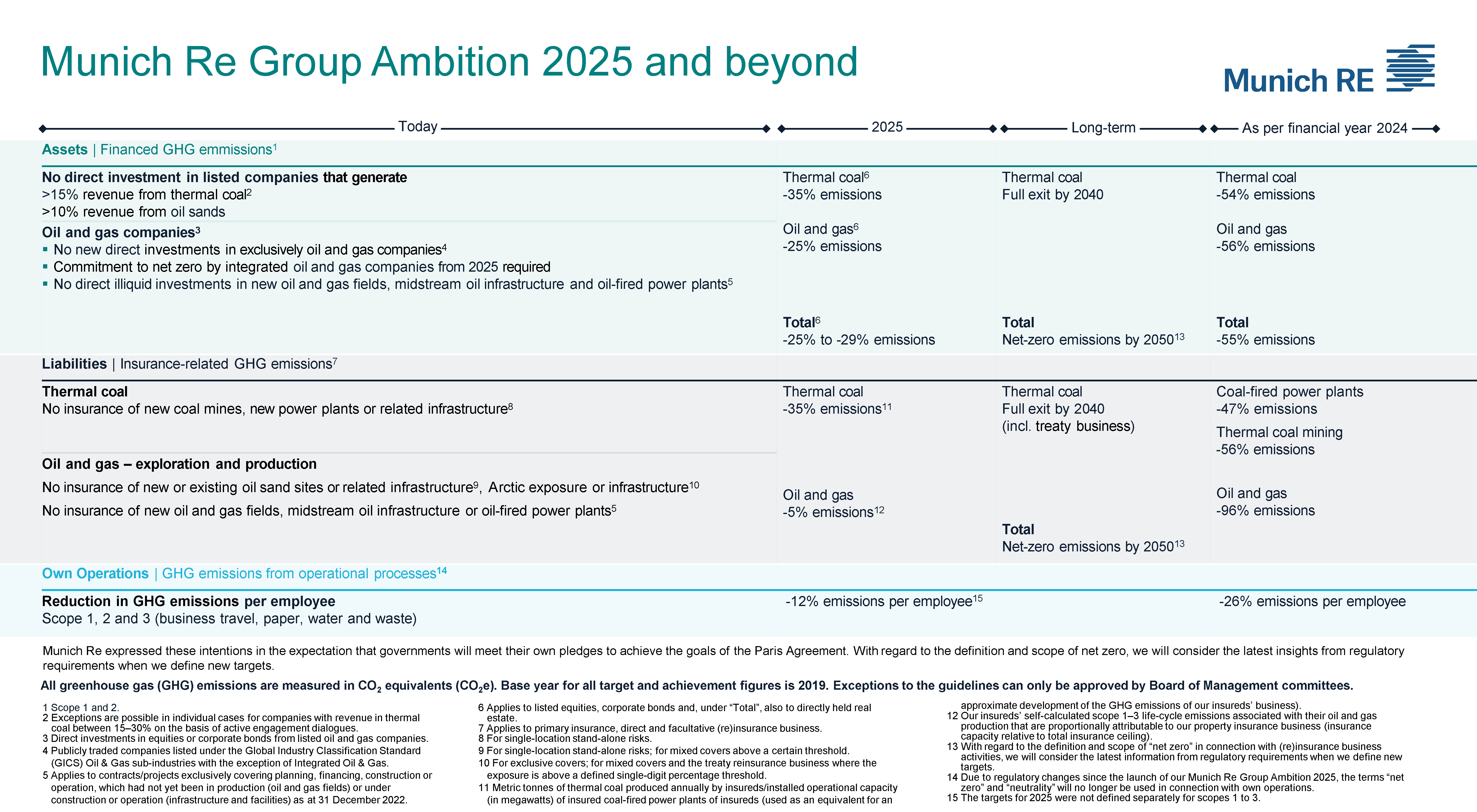

As part of our Munich Re Group Ambition 2025, we adopted a climate strategy that set out the initial targets for the Group to make our contribution to mitigating climate change in our Investments, our (Re)insurance business and our Own Operations. These targets were set in 2020 and will apply until the end of the 2025 financial year.

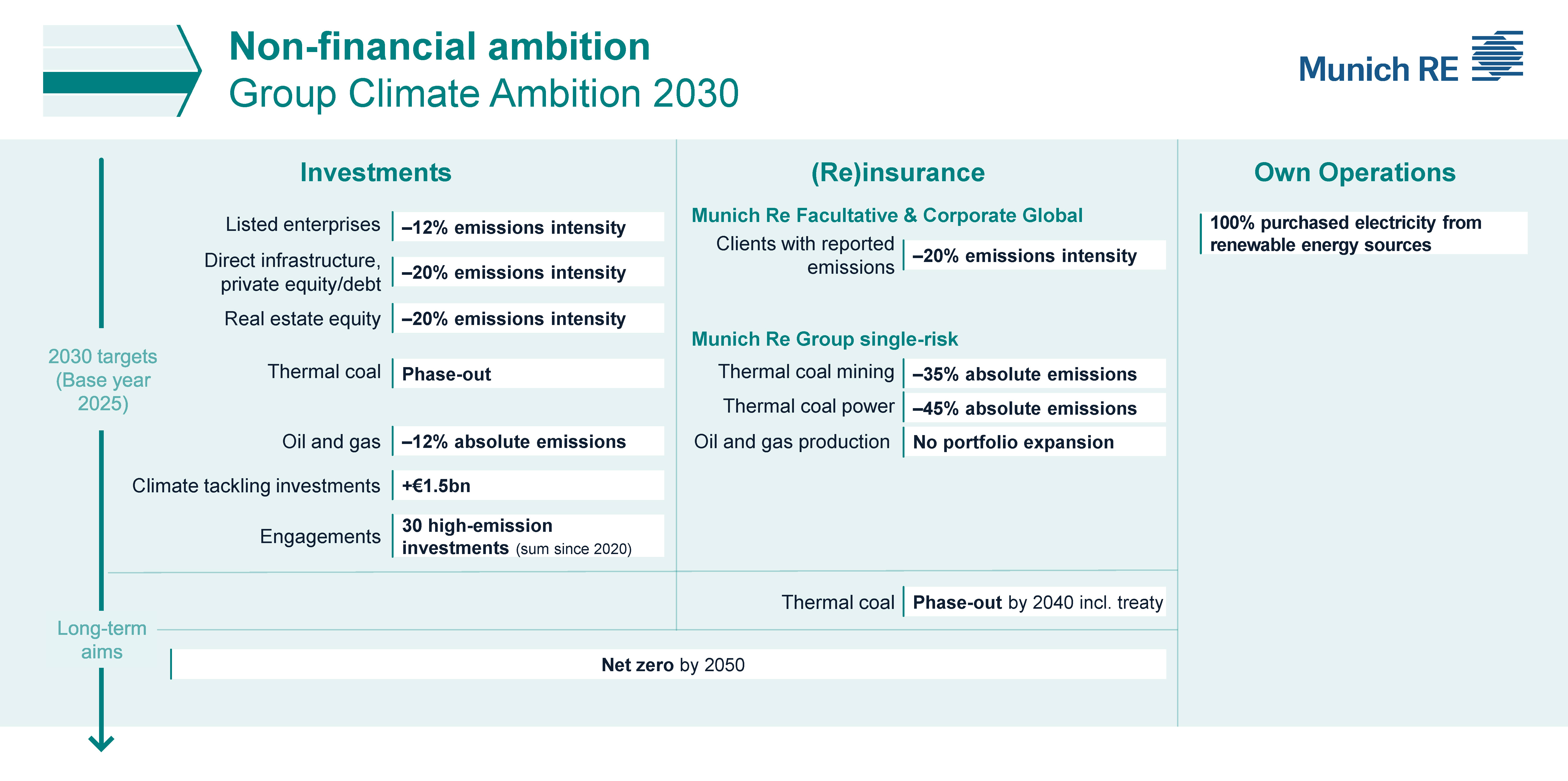

With our Munich Re Group Ambition 2030 and the new climate targets for the end of financial year 2030 we are consistently pursuing our climate strategy.

Climate Ambition 2030 for Munich Re Group

Climate Ambition 2030 applicable as of 2026

In the long term, Munich Re remains committed to reducing greenhouse gas emissions in its entire (re)insurance business and investment portfolio to net zero by 2050, thereby helping to achieve the goals of the Paris Agreement.

As part of Climate Ambition 2030, our current climate targets are being renewed or stepped up for the period up to the end of financial year 2030 and new targets are being introduced.

With regard to Investments, for example, the original plan to phase out thermal coal by 2040 is to be brought forward significantly and achieved by 2030.

On the (Re)insurance side, a new target for reducing emissions intensity in the Facultative & Corporate Global divisional unit is being introduced, among other things.

The Investment and (Re)insurance targets were adopted based on the latest methodological developments and the most recent climate science.

Munich Re expresses the following 2030 targets, as well as its long-term aims for 2040 and 2050, in the expectation that governments meet their own pledges to achieve the goals of the Paris Agreement.

Unless otherwise noted, 2025 is the base year for the 2030 targets; the target achievement in each case will be measured at the end of the year.

Climate Ambition 2030 in (Re)insurance

Our business conduct is driven by appropriate risk management and a holistic approach to achieving economic success and added value for the Group. We do this in our (re)insurance business in particular by having strong customer focus, by offering responsible solutions and by integrating sustainability aspects into our (re)insurance products and services.

Through our Climate Ambition 2030, we are continuing this pursuit, focusing our decarbonisation targets on the following three key areas:

- With our decarbonisation target we are pursuing a planned further reduction in portfolio emissions for insured thermal coal mining (–35% absolute emissions) and from thermal coal power (–45% absolute emissions).

The scope of this coal-related target (primary insurance as well as direct and facultative (re)insurance) remains unchanged from the 2025 climate ambition.

In the long term, we remain committed to phasing out the (re)insurance of thermal coal activities by 2040. This applies to primary- and reinsurance business (including treaty business) across the Munich Re Group.

- We are also continuing to pursue a target for insured oil and gas production. Due to the substantial overachievement of the Climate Ambition 2025 (–96% emissions by the end of FY 2024), we are adjusting this target to commit to no expansion of the remaining portfolio.

- We are introducing a new decarbonisation target based on Insurance-associated Emissions (IAE) in accordance with the Partnership for Carbon Accounting Financials (PCAF) methodology. It applies regardless of our clients’ industry classifications.

We are committing to reducing the greenhouse gas emissions intensity related to clients with reported emissions in our Facultative & Corporate Global Portfolio (–20% emissions intensity).

Our Facultative & Corporate Global divisional unit is part of Munich Re’s property-casualty reinsurance segment; accordingly, we are focusing this target on a segment that covers global large-risk direct and facultative (re)insurance business.

- Decarbonisation targets by 2030:

- Thermal coal mining: –35% absolute emissions

- Thermal coal power: –45% absolute emissions

- Oil and gas production: No portfolio expansion

- Munich Re Facultative & Corporate Global: –20% emissions intensity

- Long-term aims:

- Thermal coal: Phase-out by 2040 including treaty business

- Net zero by 2050

Climate Ambition 2030 in Investments

As a global investor, Munich Re is aware of its responsibility to conduct its activities sustainably and integrates sustainability criteria into its investment policy. As part of our new Climate Ambition 2030, we have also set ourselves climate targets for the next five years, until end of financial year 2030:

- The decarbonisation target for listed enterprises comprises equities and corporate bonds (excluding green bonds). Based on the reductions achieved to date, this results in a remaining reduction of –12% in emissions intensity.

- For the asset classes “direct investments in infrastructure” and “direct investments in private equity/debt”, we have set ourselves the target of achieving an overarching reduction in emission intensity of –20%.

- For real estate equity, we have set ourselves the target of reducing emissions intensity by –20%.

- With our target to phase out thermal coal (according to defined criteria), we are committed to divest all thermal coal investments held in listed equities and corporate bonds (excluding green bonds) and to cease to conduct new direct alternative investments in thermal coal by the end of 2030.

- The oil and gas decarbonisation target refers to equities and bonds (excluding green bonds). Based on the reductions achieved to date, we have set ourselves the target of a further –12% reduction in emissions.

- We have set ourselves the target of increasing our climate-tackling investments by €1.5bn by the end of 2030 compared to 2025. This target encompasses the asset classes of certified forestry, certified real estate and energy-related levers.

- Our engagement activities seek to establish dialogue with the companies represented in our investment portfolio with regard to their climate impact and strategies. By the end of 2030, our target is to have reached 30 active or completed engagements, calculated cumulatively since 2020. The engagement may relate to both liquid and illiquid investments.

- Decarbonisation targets by 2030:

- Listed enterprises: –12% emissions intensity

- Direct infrastructure, private equity/debt: –20% emissions intensity

- Real estate equity: –20% emissions intensity

- Thermal coal: Phase-out

- Oil and gas: –12% absolute emissions

- Climate-tackling investments by 2030: +€1.5bn

- Engagement target by 2030: 30 high-emission investments (total since 2020)

- Long-term aim: Net zero by 2050

Climate Ambition 2025, to be concluded by financial year 2025

Munich Re has already set out the first phase of its contribution to climate change mitigation. This phase includes the core elements of the Climate Ambition 2025, which are part of the overarching Munich Re Group Ambition 2025. The decarbonisation targets defined here are based on scientifically based scenarios.

Our previous decarbonisation targets (base year 2019) set under our Climate Ambition 2025 and their achievement in the 2024 financial year are shown in the chart below. We will publish details on final target achievement, based on our 2025 business figures, with the 2025 Group Annual Report (18. March 2026).

Climate-related disclosures

In its Group annual report for FY 2024, Munich Re has, for the first time, prepared a combined non-financial statement (p.59; ff.) under full application of the first set of the European Sustainability Reporting Standards (ESRS).

We also recognise the importance of information in reference with the Task Force on Climate-related Financial Disclosure (TCFD) and the International Sustainability Standards Board (ISSB):

Data sharing for analytical research focusing on enhancing adaptation to climate change

The EU taxonomy underpins that the financial sector is playing a key role in the climate transformation, as both investor and risk carrier. In that context it is also acknowledged that the insurance industry is in a leading position to contribute to climate change adaptation with its historic climate catastrophe loss data. For years Munich Re has been supporting the GDV data service for the natural catastrophe report. This report provides insights into natural catastrophe losses based on German insurers’ data and makes it available to all interested parties (please refer to gdv.de). Munich Re is moreover dedicated to support analytical research focusing on enhancing adaptation to climate change by the society in a region, country or internationally and to share relevant loss data requested for that purpose with public authorities, free of charge, in consideration of applicable laws and regulations. For requests covered by the Commission Delegated Regulation (EU) 2021/2139 supplementing Regulation (EU) 2020/852, Annex II, 10.1. Non-life insurance: underwriting of climate-related perils, 4. Data sharing; 10.2. Reinsurance, 4. Data sharing please contact EUTaxonomy-DataSharing-(Pool)