Munich Re beats profit target and increases dividend

02/28/2020

Group

properties.trackTitle

properties.trackSubtitle

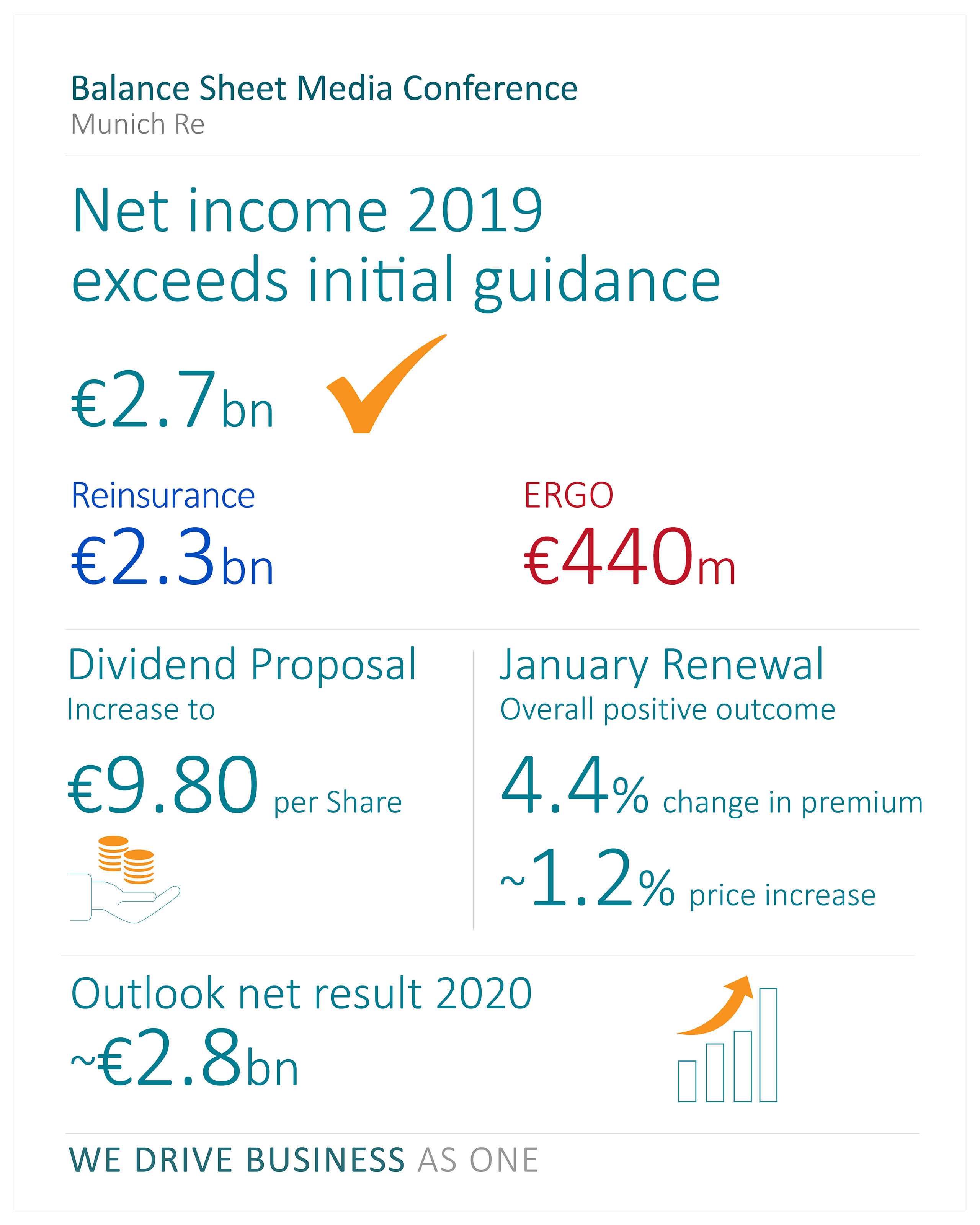

- Munich Re generated profits of €2.7bn in 2019, thus beating its original profit guidance by €200m

- Dividend to increase to €9.80 per share, subject to the approval of the Supervisory Board and the Annual General Meeting

- Share buy-backs to continue

- January renewals show premium growth (+4.4%) and rising prices (+1.2%)

- €217m profit in Q4 – good investment result, but very high major losses

- Munich Re has joined the “Net-Zero Asset Owner Alliance”, and will ensure its investments are climate-neutral by 2050

A higher dividend, new share buy-back programme, and profits beating the guidance: Munich Re delivers. On our journey to make Munich Re more profitable, more lean and more digital, we took a great step forwards in 2019. With this strategic progress, I am confident that we will reach the profit target of €2.8bn for 2020 that we set out in our multi-year ambition for 2018–2020.

Summary of the figures for the 2019 financial year

Munich Re generated a profit of €2,707m (2,275m)1 in the 2019 financial year, and €217m (238m) in Q4. The operating result was up on the previous year to €4,004m (3,725m), and the other non-operating result amounted to –€665m (–639m). The currency result totalled €73m (–39m); the tax ratio was 15.1%. Gross premiums written increased by 4.9% year on year to €51,457m.

At €30,576m, equity was significantly up on the level at the start of the year (€26,500m), due in particular to the good consolidated result and the increase in valuation reserves on fixed-interest securities and equities. The solvency ratio was around 237% at the end of the year (31.12.2018: 245%).

The balance sheet shows an annualised return on equity (RoE) of 9.2% in 2019.

Under its share buy-back programme, Munich Re repurchased 4.3 million of its shares in 2019, with a total value of €1.0bn.

Reinsurance: result of €2,268m

The reinsurance field of business contributed €2,268m (1,864m) to the consolidated result in the 2019 financial year, and the Q4 result was €116m (185m). The operating result amounted to €2,613m (2,464m). Gross premiums written increased to €33,807m (31,286m).

Life and health reinsurance business generated a profit of €706m (729m) in 2019. Premium income increased to €11,716m (10,849m). The technical result, including the result from business with non-significant risk transfer, was €456m (584m) in 2019, and €70m (165m) in Q4. Despite extraordinarily good growth in some markets, the target of €500m for the full year 2019 was narrowly missed. This was due in particular to negative loss experience in Australia, and a related consequential change in assumptions in disability business. Munich Re expects the technical result – including the result from business with non-significant risk transfer – to continue to climb in the future, and has increased its target for 2020 to €550m.

Property-casualty reinsurance contributed profits of €1,562m (1,135m) in 2019. Premium volume went up to €22,091m (20,437m). Due to high major losses, the combined ratio for the full year was 101.0% (99.4%) of net earned premiums, and in Q4 it was 112.5% (105.1%).

Major losses of over €10m each totalled €3,124m (2,152m) for the full year, and €1,462m (886m) for Q4. These figures include gains and losses from the settlement of major losses from previous years. Major-loss expenditure for the full year corresponds to 15.2% (11.6%) of net earned premiums, and was thus well above the long-term average expected value of 12%. Man-made large losses were comparatively high at €1,071m (896m), due in particular to aviation/space and fire losses. The impact of large losses from natural catastrophes was €2,053m (1,256m). The most expensive natural catastrophes for Munich Re in 2019 were the typhoons Hagibis (ca. €780m) and Faxai (ca. €530m).

In the 2019 financial year, reserves for basic claims from prior years totalling around €1,154m were released; this corresponds to 5.6% of net earned premiums. Munich Re still aims to set the amount of provisions for newly emerging claims at the very top end of the suitable estimation range, so that profits from the release of a portion of these reserves are possible at a later stage.

In the renewals as at 1 January 2020, Munich Re was able to increase written business volume to €10.6bn (+4.4%). Around half of property-casualty business was renewed, with a focus on Europe, the USA (mainly excluding nat cat) and global business.

In this context, price trends varied among the different market segments in line with different claims experience. In turn, prices rose – considerably in some instances – for reinsurance cover in regions and classes of business with high claims experience, with the Caribbean and aviation and space being two examples. Conversely, prices remained mostly stable in regions and classes of business with low claims experience – such as Europe and Asia (excluding Japan). Munich Re takes the different price trends into account when it underwrites policies. In the United States, for example, Munich Re has withdrawn from business that no longer met price expectations. All in all, prices for the Munich Re portfolio increased by 1.2%. This percentage is, as always, risk-adjusted. In other words, price increases will be offset if they are associated with increased risk and consequently elevated loss expectations.

Munich Re anticipates that the market environment will improve in the next renewal rounds in April and July, as treaties in regions with significant claims experience in 2019, such as Japan, will be up for renewal.

ERGO: result of €440m

The ERGO field of business of Munich Re generated profits of €440m (412m) in 2019, of which €101m (53m) was in Q4. ERGO thus exceeded its profit guidance of €400m and is well on track to meet the objectives of the ERGO Strategy Programme. Total premium income across all segments remained stable overall in 2019 at €18,880m (18,688m), despite international portfolio optimisation; gross premiums written amounted to €17,650m (17,778m).

The ERGO Property-casualty Germany segment reported a profit of €148m (45m), boosted by a much improved technical result. The ERGO International segment again reported a high result of €105m (103m). A very good operating result in particular had a positive effect, which offset the negative impact from the sale of non-German subsidiaries. ERGO Life and Health Germany reported a result of €187m (264m). In the previous year, the segment result had benefited significantly from one-off effects. ERGO’s operating result amounted to €1,391m (1,261m).

The combined ratios are at a very pleasing level. The Property-casualty Germany segment improved significantly to 92.3% (96.0%) due to operative improvements. The ratio in the International segment improved slightly to 94.3% (94.6%).

Investments: investment result of €7,737m

The Group's investment result (excluding insurance-related investments) increased in 2019 to €7,737m (6,526m). Despite low interest rates, regular income from investments went up slightly to €6,751m (6,586m). The high investment result benefited in part from high gains on the disposal of fixed-interest securities and equities. The balance of gains and losses on disposal excluding derivatives increased correspondingly to €2,779m (1,582m), thereby compensating for losses of €717m (+103m) in the derivatives result, mainly caused by market-related losses from equity derivatives.

Overall, the investment result represents a return of 3.2% on the average market value of the portfolio in 2019. The running yield was 2.8% and the yield on reinvestment was 2.1%. The equity ratio including equity-related derivatives rose to 6.4% as at 31 December 2019 (31.12.2018: 5.2%).

Total investments (excluding insurance-related investments) as at 31 December 2019 increased compared with the 2018 figure, with the carrying amount rising to €228,764m (216,852m) and the market value to €247,310m (231,876m).

The Group's asset manager is MEAG. As at 31 December 2019 – in addition to managing the Group’s own assets – MEAG managed third-party investments totalling €38.2bn (15.5bn). The significant year-on-year increase is largely due to a new mandate from an institutional client.

Institutional investors with managed assets of over US$ 4tn have joined together in the “Net-Zero Asset Owner Alliance”, under the leadership of the United Nations. The Alliance seeks to make investments climate-neutral by 2050 and thus to meet the aims of the Paris Climate Agreement to limit global warming to 1.5°C. Munich Re has joined this initiative and adopted the objective of making its investments climate-neutral by 2050.

Outlook for 2020: Group profit guidance of around €2.8bn

Munich Re aims to increase its profits to €2.8bn. Of this, around €2.3bn will be generated by the reinsurance field of business, and around €530m by the ERGO field of business.

The good result in 2019 and the planned improvements in earnings power for 2020 allow Munich Re to propose to both the Supervisory Board and the Annual General Meeting an increase in the dividend to €9.80 per share, and also to launch a further share buy-back programme with a volume of €1bn. The two measures constitute examples of Munich Re’s sustainable and shareholder-friendly capital repatriation policy.

In life and health reinsurance, the guidance for the technical result including the result from business with non-significant risk transfer is being raised to €550m. In property-casualty reinsurance, Munich Re aims to improve the combined ratio to around 97% in 2020. This reduction will be supported by a planned methodical change to cost allocation as from the first quarter, thereby lowering the ratio by 0.5–1.0%.

A combined ratio of around 92% is expected in the ERGO Property-casualty Germany segment, and around 94% in the ERGO International segment.

Munich Re anticipates a return on investment of around 3% for 2020.

Assuming exchange rates remain stable, Munich Re anticipates gross premiums written of around €52bn in the 2020 financial year, comprising gross premium of around €34bn in the reinsurance field of business and just over €17.5bn in the ERGO field of business.

As always, the projections are subject to major losses being within normal bounds, changes to provisions for outstanding claims and to our income statement not being impacted by severe fluctuations in the currency or capital markets, significant changes in the tax environment, or other one-off effects.

Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. The group consists of the reinsurance and ERGO business segments, as well as the capital investment company MEAG. Munich Re is globally active and operates in all lines of the insurance business. Since it was founded in 1880, Munich Re has been known for its unrivalled risk-related expertise and its sound financial position. It offers customers financial protection when faced with exceptional levels of damage – from the 1906 San Francisco earthquake through to the 2017 Atlantic hurricane season and to the California wildfires in 2018. Munich Re possesses outstanding innovative strength, which enables it to also provide coverage for extraordinary risks such as rocket launches, renewable energies, cyberattacks, or pandemics. The company is playing a key role in driving forward the digital transformation of the insurance industry, and in doing so has further expanded its ability to assess risks and the range of services that it offers. Its tailor-made solutions and close proximity to its customers make Munich Re one of the world’s most sought-after risk partners for businesses, institutions, and private individuals.

Disclaimer

This media release contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of our Company. The Company assumes no liability to update these forward-looking statements or to make them conform to future events or developments.

Further information

For media inquiries please contact:

/Straub_Stefan.jpg)

/Ziegler_Frank.jpg)

/Faith_Thoms.jpg)