Thunderstorms, cyclones and heatwaves: the natural disaster figures for the first half of 2019

07/30/2019

Reinsurance

properties.trackTitle

properties.trackSubtitle

- Cyclones in Mozambique and India with high casualty numbers and losses in the billions of dollars once again illustrate the urgent need for improved resilience against the consequences of natural disasters.

- Tornadoes in the USA, severe thunderstorms in Europe and floods in Australia were the costliest natural disasters in industrialised countries.

- Due to random factors, overall global losses in the first six months were lower than the long-term average.

Cyclones in Mozambique and India with high casualty numbers and losses in the billions of dollars once again illustrate the urgent need for improved resilience against the consequences of natural disasters. Tornadoes in the USA, severe thunderstorms in Europe and floods in Australia were the costliest natural disasters in industrialised countries. Due to random factors, overall global losses in the first six months were lower than the long-term average.

Overview of natural disaster figures for the first half of 2019

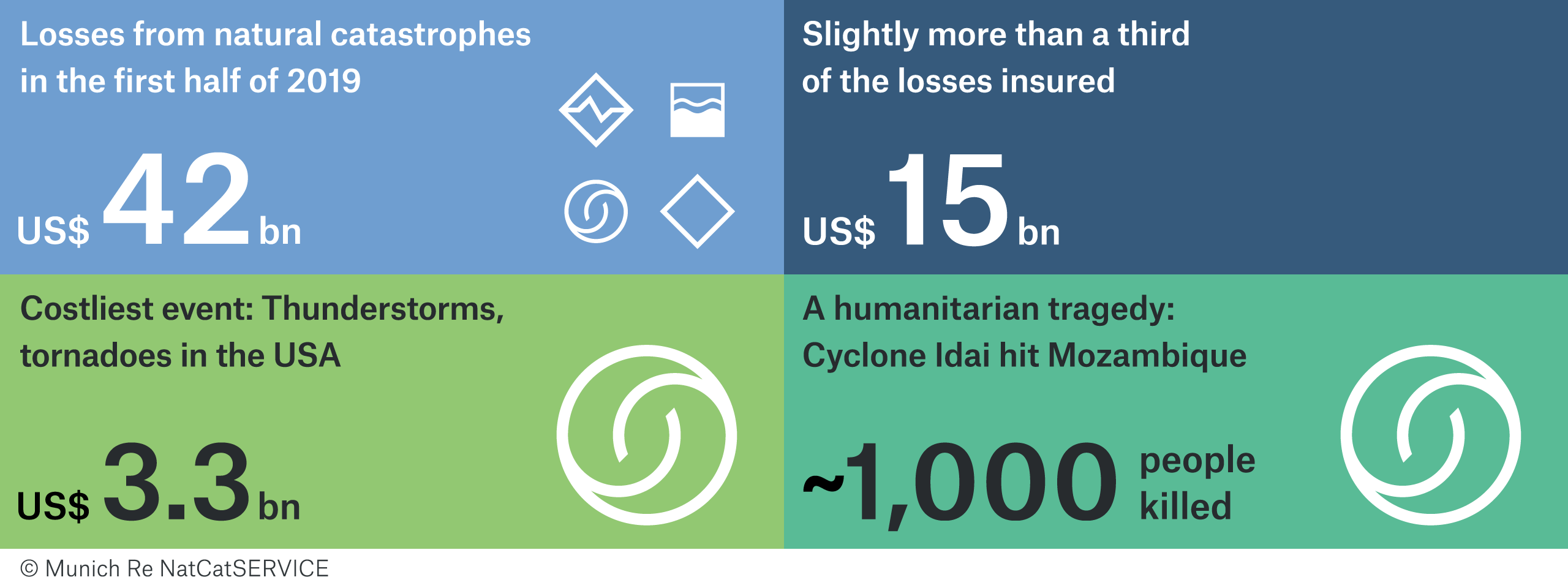

- A total of 370 loss events produced overall losses of US$ 42bn, which, after adjustment for inflation, is lower than the 30-year average of US$ 69bn. However, the losses from the severe floods in southeast China, which began in June and reportedly caused billions of dollars in damage, are not included in this figure.

- Insured losses came to US$ 15bn, which is below the long-term average of US$ 18bn. For many events, the insured portion of the overall economic loss was extremely small due to low insurance penetration in many of the affected countries.

- Around 4,200 people lost their lives in natural disasters. This figure is similar to that of the previous year (approximately 4,300). But at least the trend towards fewer casualties has continued, thanks to more effective protection measures: the 30-year average for the same half-year period is more than 27,000 fatalities.

- The deadliest disaster worldwide up to the end of June was Cyclone Idai, which swept across Mozambique, Malawi, Zimbabwe and South Africa from 9 to 14 March. More than 1,000 people were killed.

- In May, thunderstorms with tornadoes in the Midwestern US produced the heaviest losses, at US$ 3.3bn. The insured portion came to around US$ 2.5bn.

Billion-dollar losses in poorer countries – Partnerships needed

A striking feature of the loss statistics for the first half of 2019 is the high proportion of losses affecting poorer countries. Three of the five costliest disasters affected emerging and developing countries. These included a flood disaster in Iran (overall losses of US$ 2.5bn), and storm and flood losses from Cyclone Fani in India and Bangladesh in May (US$ 2.2bn).

Mozambique, one of the world’s poorest countries, was particularly hard hit. In March, Cyclone Idai made landfall near the port of Beira (500,000 inhabitants). With wind speeds of approximately 170 km/h, the storm wrecked a huge number of homes and buildings, most of which were quite simple structures. In addition, in combination with the heavy rainfall, the flood wave from the storm triggered flooding over the flat coastal terrain that extended far inland. Overall losses in Mozambique and neighbouring countries came to approximately US$ 2bn. The loss in Mozambique is equivalent to around one tenth of the country’s GDP – an enormous burden. By way of comparison: the Tohoku earthquake in Japan in 2011 caused direct losses of US$ 210bn, corresponding to roughly 3.4% of Japan’s GDP. Just a few weeks later, Mozambique was again hit by another cyclone, this time Cyclone Kenneth, which made landfall further north in a less populated area. Losses totalled around US$ 230m.

Ernst Rauch, Chief Climate and Geoscientist at Munich Re, had this to say: “In the Caribbean, for example, insurance solutions in cooperation with governments and development banks have been able to provide financial assistance before international aid programmes can get off the ground. A similar solution would also make sense for Mozambique. But it is absolutely essential to take more effective preventive measures in industrialised countries as well. We are working systematically at improving our analysis tools so that we can assess risks more accurately and then develop new solutions to allow us to assume risks.”

Numerous severe thunderstorms in USA

Heatwave and severe hailstorms in Europe

A combination of high temperatures with an intense heatwave over the last ten days of the month and severe thunderstorms with violent hailstorms produced heavy losses in Europe in June. As well as being very dry, the month was Germany’s hottest June since record-keeping began. The drought means that poor harvests are likely in parts of the European agricultural sector, since there was restricted growth for certain types of grain, as well as for potatoes and corn in various regions.

On top of the heat, there were severe thunderstorms and hailstorms, for example on Whit Monday (10 June) in Germany and neighbouring countries. The greater Munich area was particularly affected, experiencing hailstones of up to 6 centimetres in diameter. According to the Association of German Insurers (GDV), well over 100,000 claims were filed for vehicle and building damage respectively. The overall loss throughout Europe came to over €900m, of which more than 75% was insured due to the high insurance density for hail. Almost all of these losses were sustained in Germany.

At the start of July, there were further major hailstorms on the Adriatic coast in Italy and in Greece, with hailstones that were as big as oranges in some cases. Reliable loss estimates are not yet available.

Ernst Rauch commented as follows: “A number of scientific studies indicate that heatwaves are increasing due to climate change, and hailstorms as well according to the most recent studies. In view of the loss potentials and the increase in exposed assets, it is very important that insurers are aware of these changes. In any event, measures to reduce vulnerability to losses make good sense because we must assume that this trend will continue in the coming years and decades.”

Asia/Pacific: Flooding in Australia

Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. The group consists of the reinsurance and ERGO business segments, as well as the capital investment company MEAG. Munich Re is globally active and operates in all lines of the insurance business. Since it was founded in 1880, Munich Re has been known for its unrivalled risk-related expertise and its sound financial position. It offers customers financial protection when faced with exceptional levels of damage – from the 1906 San Francisco earthquake through to the 2017 Atlantic hurricane season and to the California wildfires in 2018. Munich Re possesses outstanding innovative strength, which enables it to also provide coverage for extraordinary risks such as rocket launches, renewable energies, cyberattacks, or pandemics. The company is playing a key role in driving forward the digital transformation of the insurance industry, and in doing so has further expanded its ability to assess risks and the range of services that it offers. Its tailor-made solutions and close proximity to its customers make Munich Re one of the world’s most sought-after risk partners for businesses, institutions, and private individuals.

Disclaimer

This media information contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of Munich Re. The company assumes no liability to update these forward-looking statements or to make them conform to future events or developments.