Munich Re Group Ambition 2025

Scale. Shape. Succeed.

properties.trackTitle

properties.trackSubtitle

With our Munich Re Group Ambition 2025, we’ve created a strategy that is uniform across the Group – spanning reinsurance, primary insurance and asset management. We have committed ourselves to ambitious financial targets, and we will continue adding value for our shareholders, clients, staff and communities. The Munich Re Group Ambition 2025 will help us to elevate Munich Re to a new level of success.

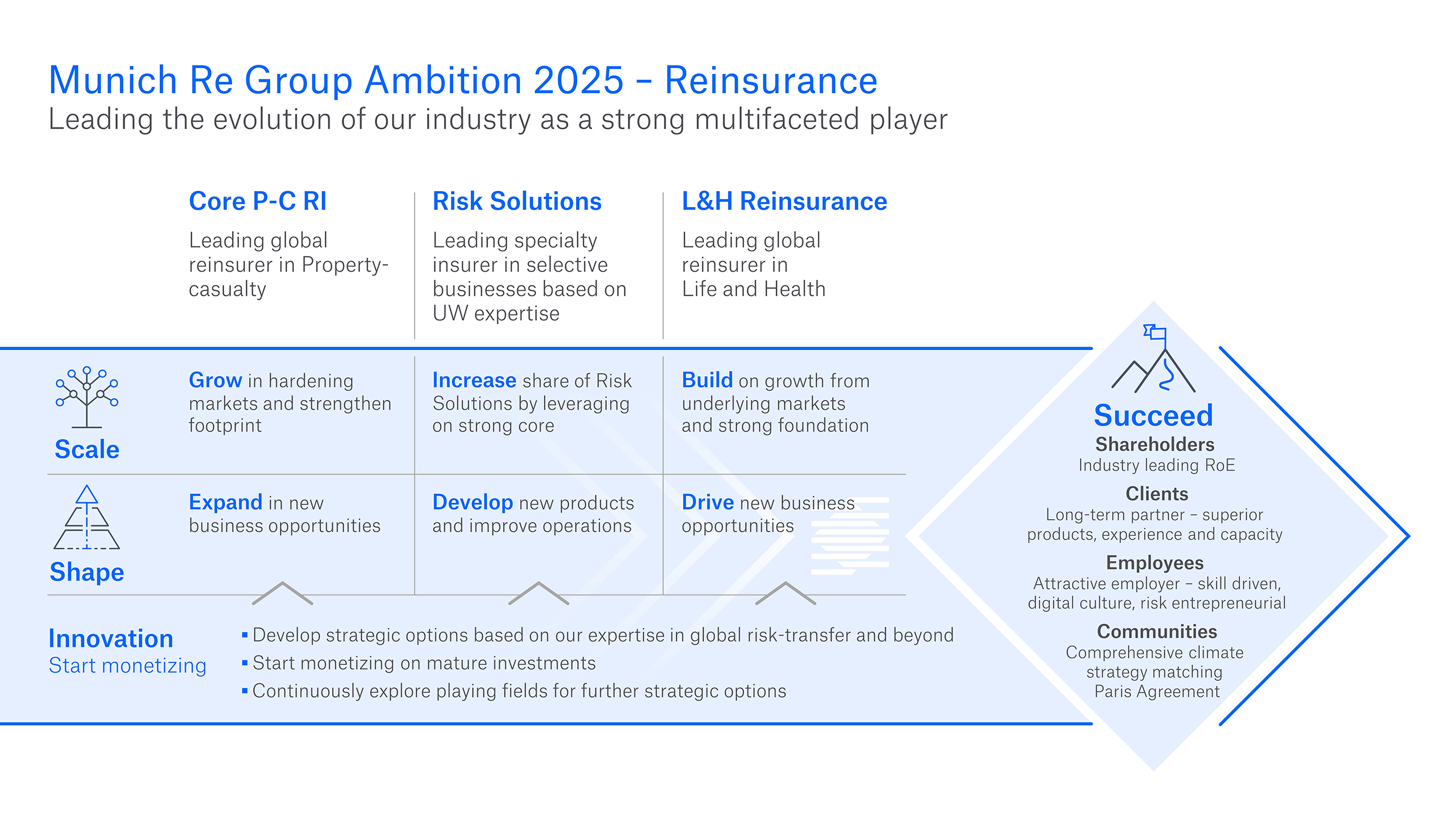

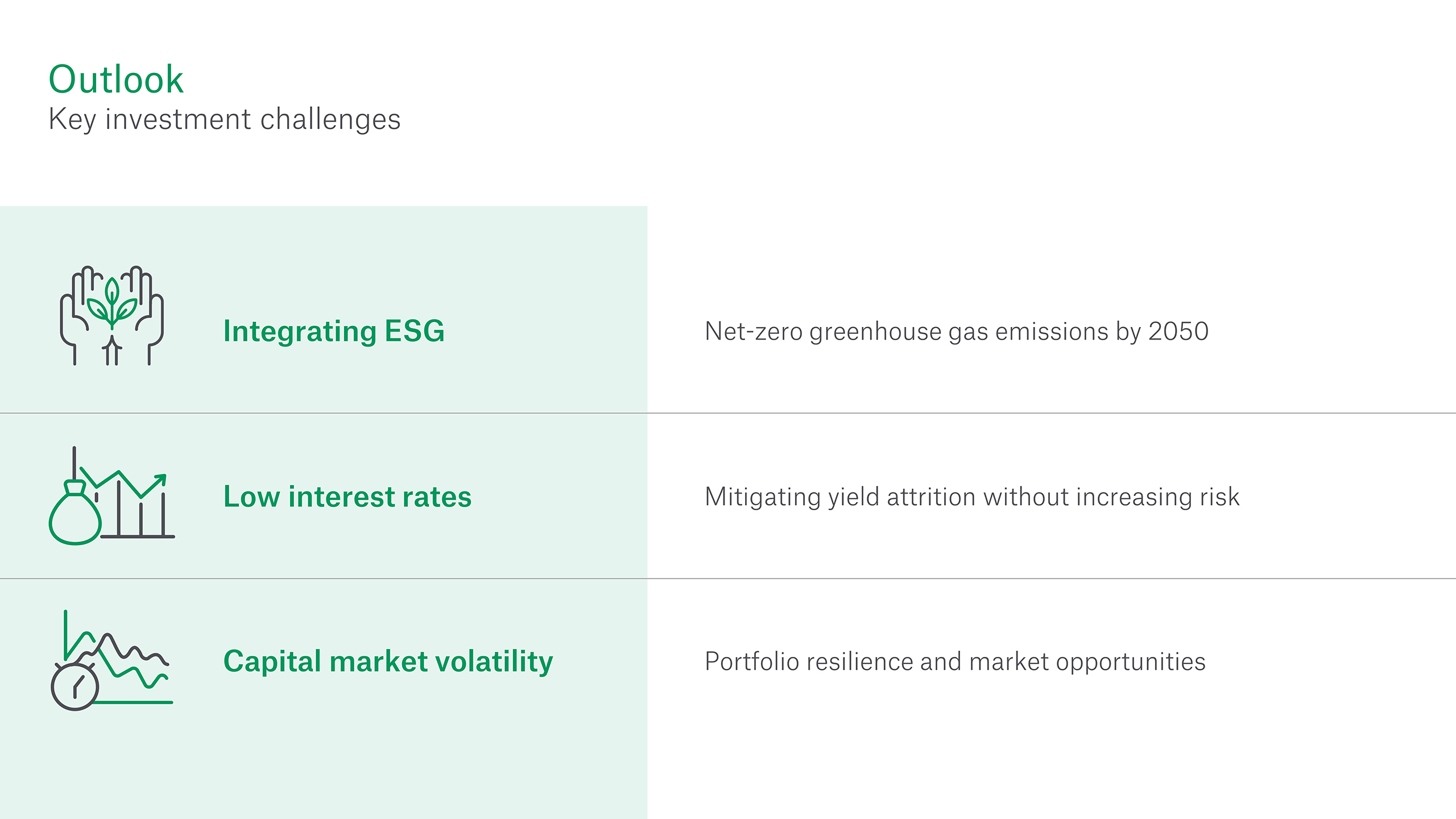

Scale, the first pillar in the triad, represents growth in the Group’s core business. There are opportunities for organic growth in reinsurance in particular owing to recent, significant improvements in market conditions. Munich Re will also grow profitably over the coming years in its Risk Solutions operating field, including in MR Specialty Insurance, HSB, and Munich Re Facultative & Corporate. In life and health reinsurance, there will be expansion in both traditional business, and the offerings for financial markets and longevity business. ERGO will further enhance its market position in Germany, while also achieving profitable growth – particularly beyond Germany, in B2B and through direct offers. In addition, ERGO prioritises the ongoing modernisation of its IT infrastructure. As for asset management, performance will be improved – thus mitigating the negative trends in bond yields caused by low interest rates.

Shape stands for Munich Re’s mission to develop new business models that span the entire value chain, in turn shaping markets. In this environment, innovative and digital solutions will give rise to additional business opportunities. This pillar also entails the continual scrutiny of innovative ideas and their scalability. Mature innovations such as cyber covers are already contributing to profits achieved as part of the Munich Re Group Ambition; other innovations, such as business models for the Internet of Things (IoT), will conversely play a role in the longer term. At ERGO, Shape will take the form of greater alignment with the hybrid customer business model; the transnational use of technological solutions at ERGO International; the development of new mobility and travel ecosystems; and the ongoing digitalisation of customer-driven and back-office processes.

Succeed symbolises the added value that Munich Re generates for all its stakeholders. For shareholders, this means the sustained financial success of their investments in Munich Re. Clients benefit from bespoke products. For staff, Succeed connotes appealing long-term employment and good career prospects. A particular priority concerns women in management: by 2025, 40% of managers below the Board of Management are to be women. Last but not least, the third pillar of Scale, Shape, Succeed refers to communities benefitting from, in particular, the Group’s ambitious climate protection targets in its asset management, (re)insurance business and in its own business operations.

What is success?

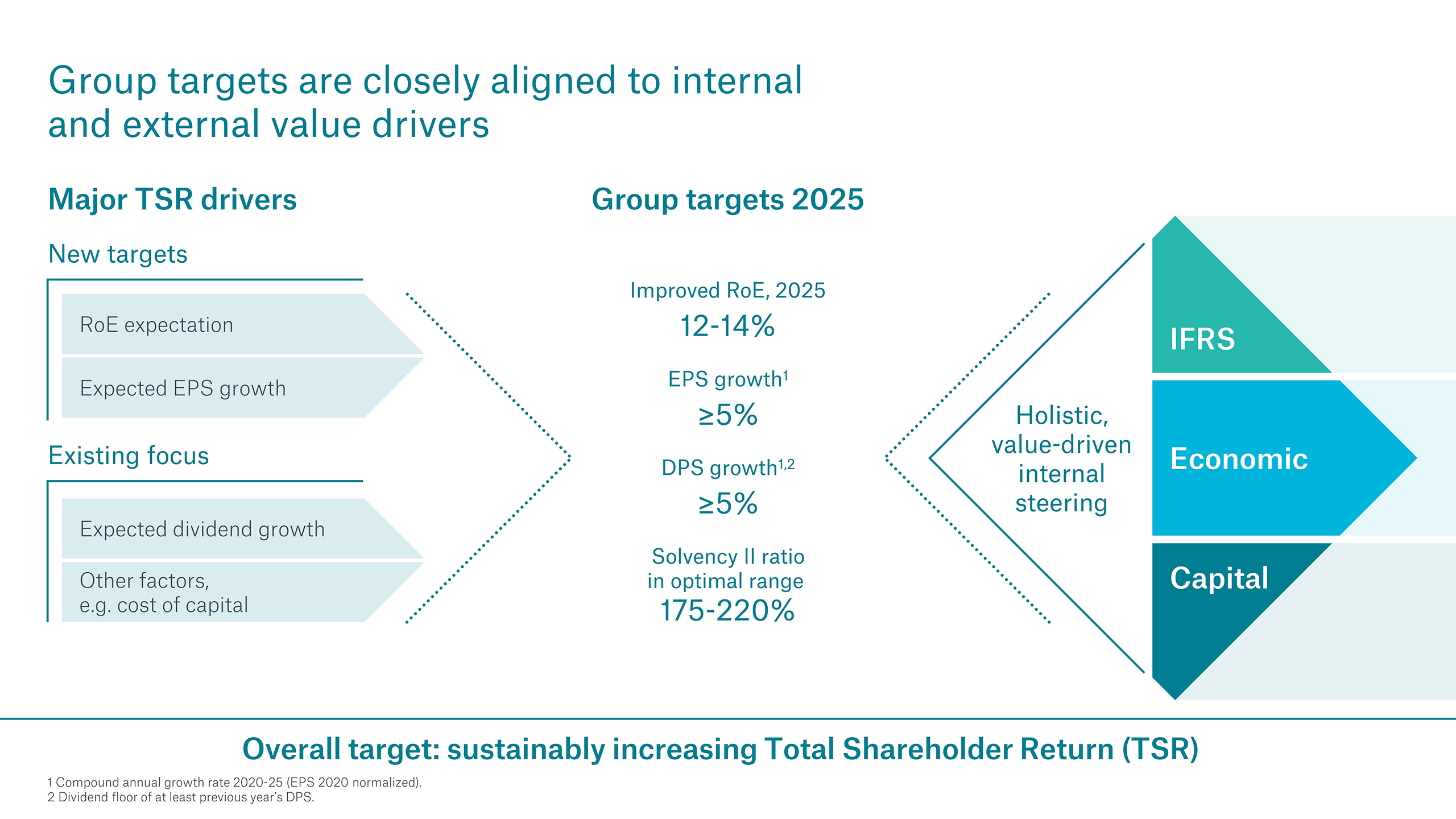

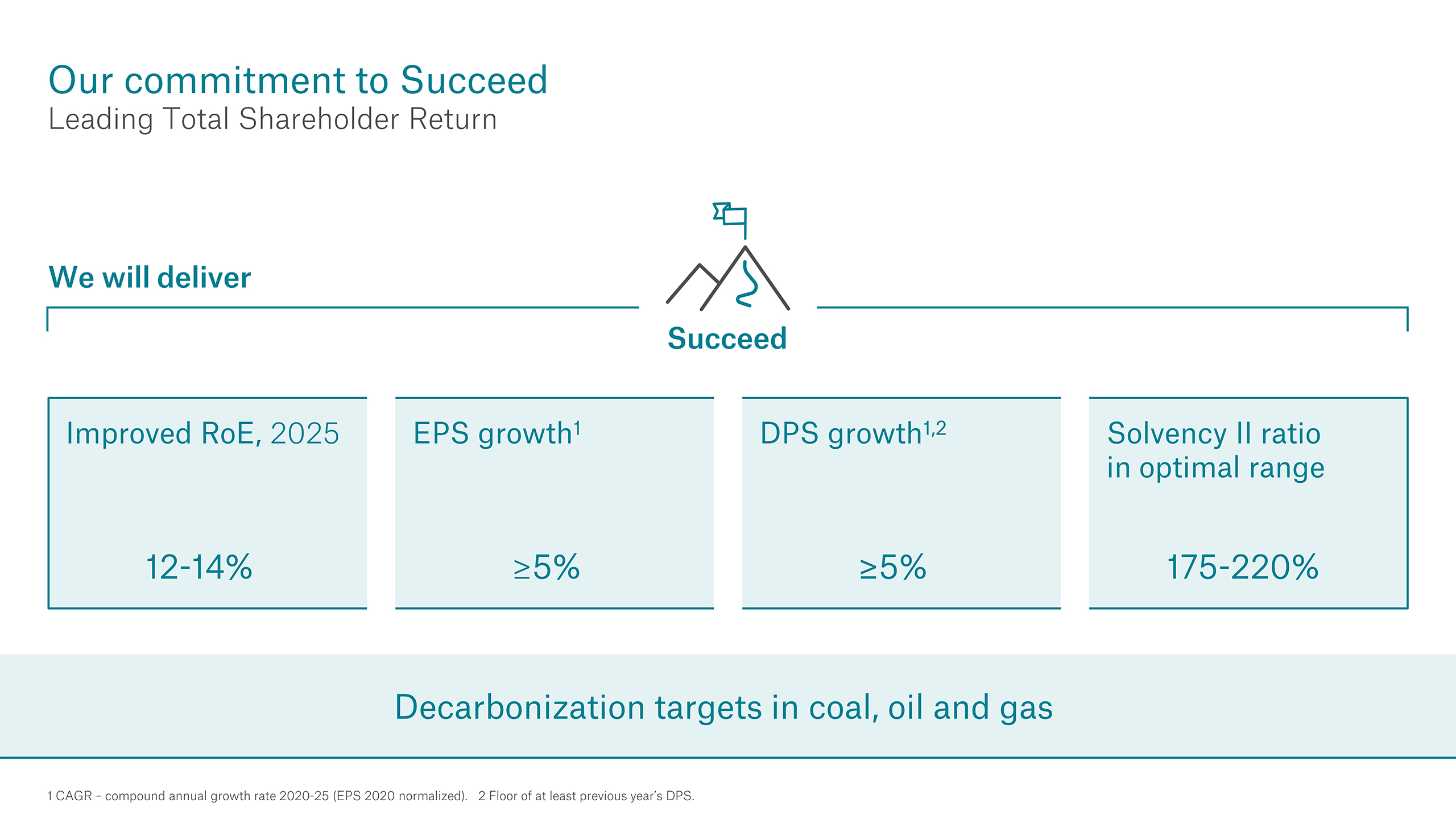

The success of the Munich Re Group Ambition 2025 will be measured using the following financial targets:

Munich Re aims to generate a high return on equity (RoE) between 12 and 14% by 2025. That would establish Munich Re as one of the best in its peer group. RoE increases will be fuelled by higher profitability, growth, and an RoI performance that will counteract the erosion of regular investment income caused by low interest rates.

Continued earnings growth will translate into higher earnings per share, which are set to increase annually by ≥5% on average by 2025.

The implicit dividend commitment of recent decades is now an explicit target of the Munich Re Group Ambition 2025. In “normal” years, the dividend per share is to rise by ≥5% on average, similarly to the increase in earnings per share. In years with unusually high claims expenditure, it is expected that the dividend per share will at least remain the same. As a result, the dividend per share will rise at a higher rate over the next five years than in the past five years, which saw an increase of 4.7% on average. The solvency ratio is to remain in the ideal corridor of 175–220%.

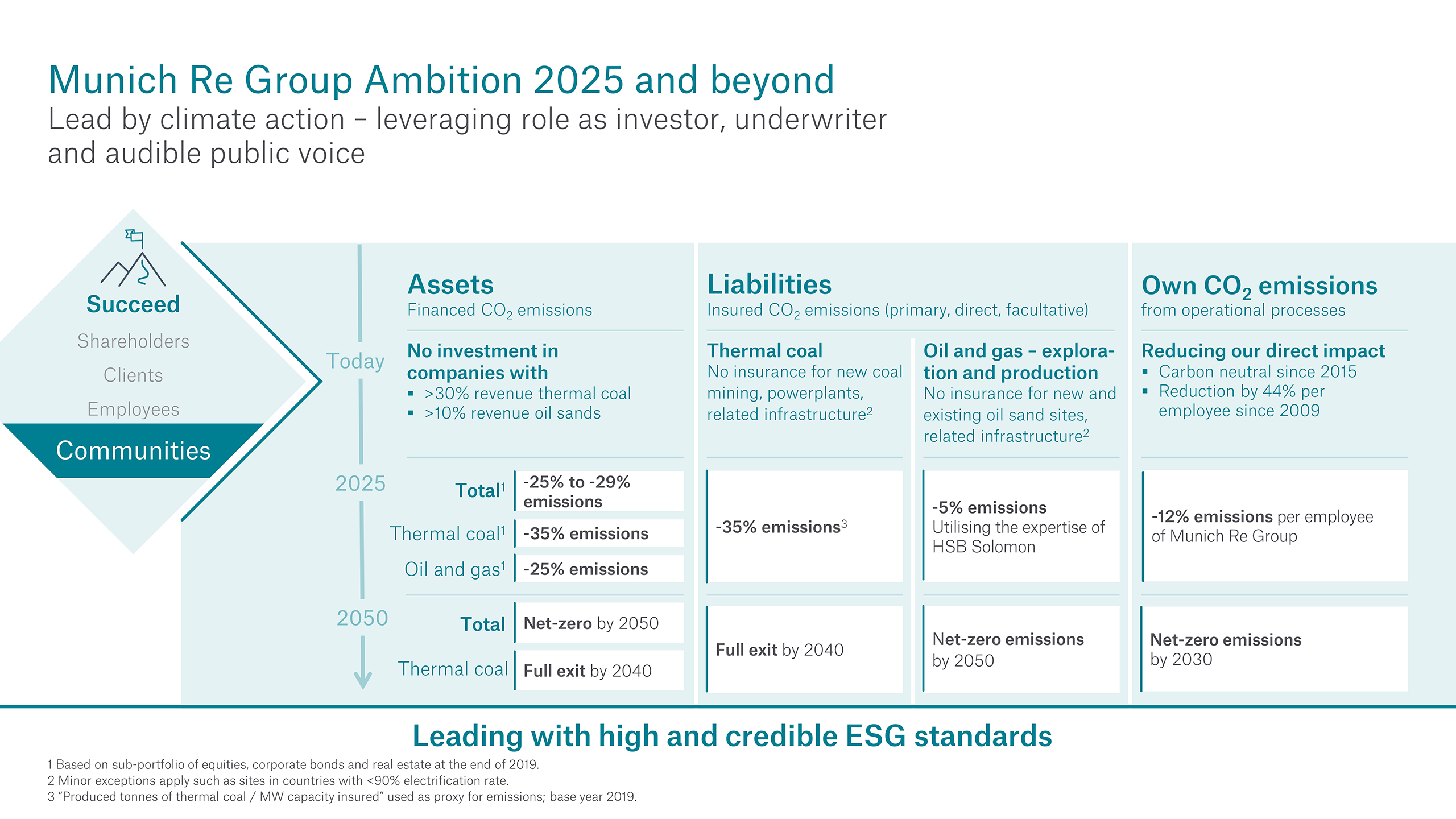

As an environmentally conscientious business, Munich Re endeavours to play its part in meeting the targets of the Paris Agreement. The Group has therefore set itself medium- and long-term decarbonisation targets for its investments, its (re)insurance transactions and its own business operations.

Our goal is to decarbonise our investment and (re)insurance portfolio, reaching net zero by 2050. We have committed to completely phase out the (re)insurance of thermal coal activities altogether in our primary insurance and facultative and direct (re)insurance business – and in our investment portfolio – by 2040. This includes reducing, in an intermediate step, our total scope 1 and 2 financed GHG emissions from listed equities, corporate bonds and direct real estate by 25% to 29% compared to the 2019 base year, by 2025.

In 2019, Munich Re stopped investing directly in listed companies that generate more than 30% of their earnings from thermal coal. Since 2021, companies that generate 15% to 30% of their earnings from thermal coal have also been excluded from our investment universe or, in individual cases, encouraged to reduce their greenhouse gases in the context of an engagement dialogue. Direct investments in listed companies that generate more than 10% of their earnings from oil sands are also excluded.

Munich Re set itself its own emissions-reduction targets in 2020 with respect to thermal coal and oil and gas production in our primary insurance and facultative and direct (re)insurance business. This also encompasses treaty-like business in the form of facultative facilities if it includes the option to decline individual risks. In an initial phase, we aim to reduce emissions from oil and gas production by 5% by 2025, compared to the base year 2019. Munich Re will also reduce its coal-related exposure in its direct and facultative insurance business by 35% Group-wide by 2025, compared to the base year 2019. Munich Re stopped insuring new coal-fired power plants and coal mines in 2018 – and oil sands sites in 2019.

Under the Munich Re Group Ambition 2025, we also set targets regarding our own GHG emissions from business operations. GHG emissions are to be reduced by 12% per employee between the base year 2019 and 2025. For the remaining, unavoided GHG emissions, we originally intended to transition from GHG neutrality to GHG net zero by 2030. Since the launch of Ambition 2025 back in 2020, the regulatory environment regarding the definition of the terms “neutrality” and “net zero” has been dynamically evolving. Therefore, we decided to no longer use these terms for our operational business processes in the context of Ambition 2025. Munich Re acquires and retires carbon credits in the amount of the GHG emissions from its own business operations. In this way, we aim to contribute to the achievement of international climate targets by providing financial support to certified climate protection projects.

€5,671m

consolidated result as per

31 Dec. 2024

€20.00

Dividend proposal per share

€60.8bn

Insurance revenue from insurance contracts issued