properties.trackTitle

properties.trackSubtitle

About Sustainability at Munich Re

Munich Re adopts a forward-looking, prudent, and responsible approach to business. For more than 140 years, we have created long-term value by assuming a diverse range of risks along our insurance value chain. We are convinced that this business concept will continue to be successful in the future based on sustainable action.

In our endeavours to contribute to a sustainable tomorrow, we regard economic prosperity, resilience and technological progress as factors that are intrinsic to the creation of a just and sustainable society.

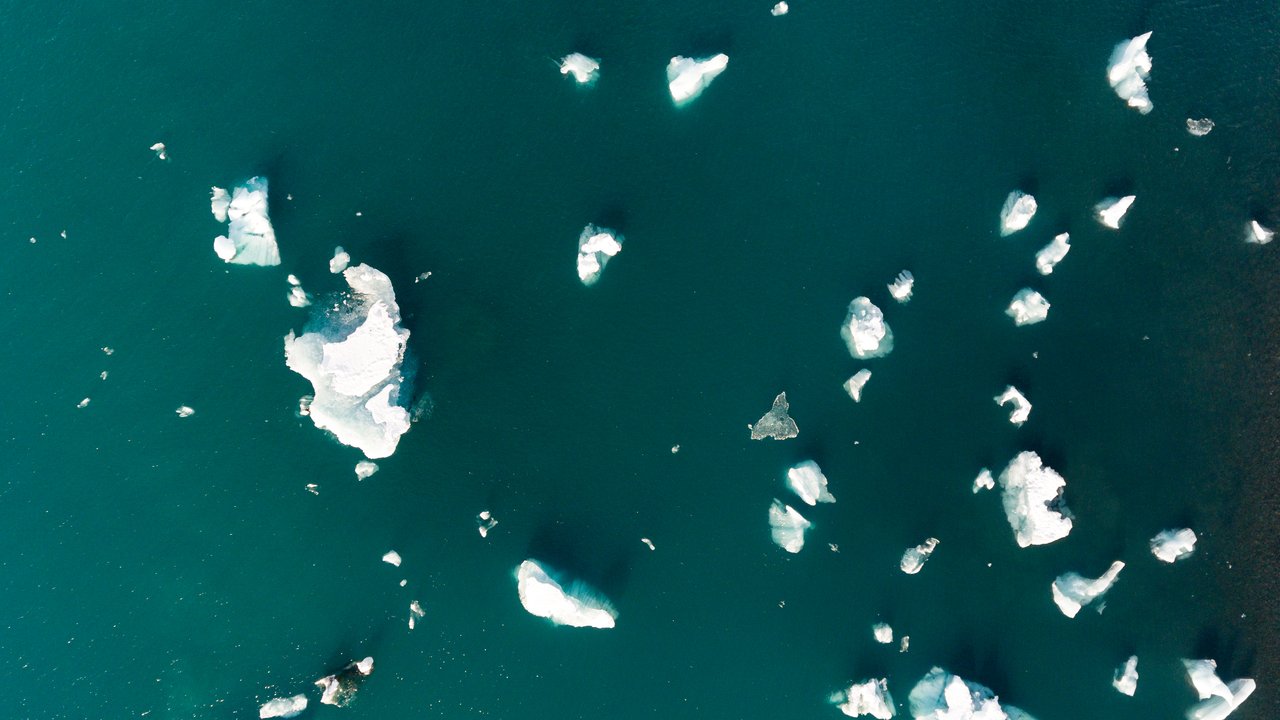

As an environmentally conscientious business, Munich Re has set medium-term decarbonisation targets for its investments, its (re)insurance business and its own operations. A complete overview and definition of all climate targets can be found here.

In the long term, Munich Re remains committed to reducing greenhouse gas emissions in its entire (re)insurance business and investment portfolio to net zero by 2050.

We have outlined our aspirations in our Munich Re "Group Ambition 2030".

Information on the achievement of our climate targets under Munich Re’s previous "Group Ambition 2025" can be found here.

Reinsurance and insurance are fundamentally social businesses. We live up to our social responsibility by giving people peace of mind, fostering resilience, and addressing climate change through gradually decarbonising our (re)insurance and investment portfolio to support a sustainable future.

Our sustainability topics

Contact our Sustainability team

Annual Report