Combining insights from Munich Re's 2024 AUW Survey and MIB analysis

In May 2025, Munich Re Life US and MIB EHR formed a strategic partnership to further accelerate the adoption of electronic medical data across life insurance underwriting. By leveraging the combined expertise of both organizations, we aim to enable carriers to make faster, more efficient, and confident underwriting decisions. This paper brings together insights from both organizations on the status of electronic health records (EHRs) in life underwriting.

We will explore findings related to the use of electronic medical data from Munich Re’s fourth biennial Accelerated Underwriting (AUW) Survey. The survey, conducted in the fall of 2024, shed light on key AUW market trends, including the use of EHRs. To enrich this discussion, MIB has provided additional EHR insights from its analysis, along with perspectives on what these findings mean for life insurance.

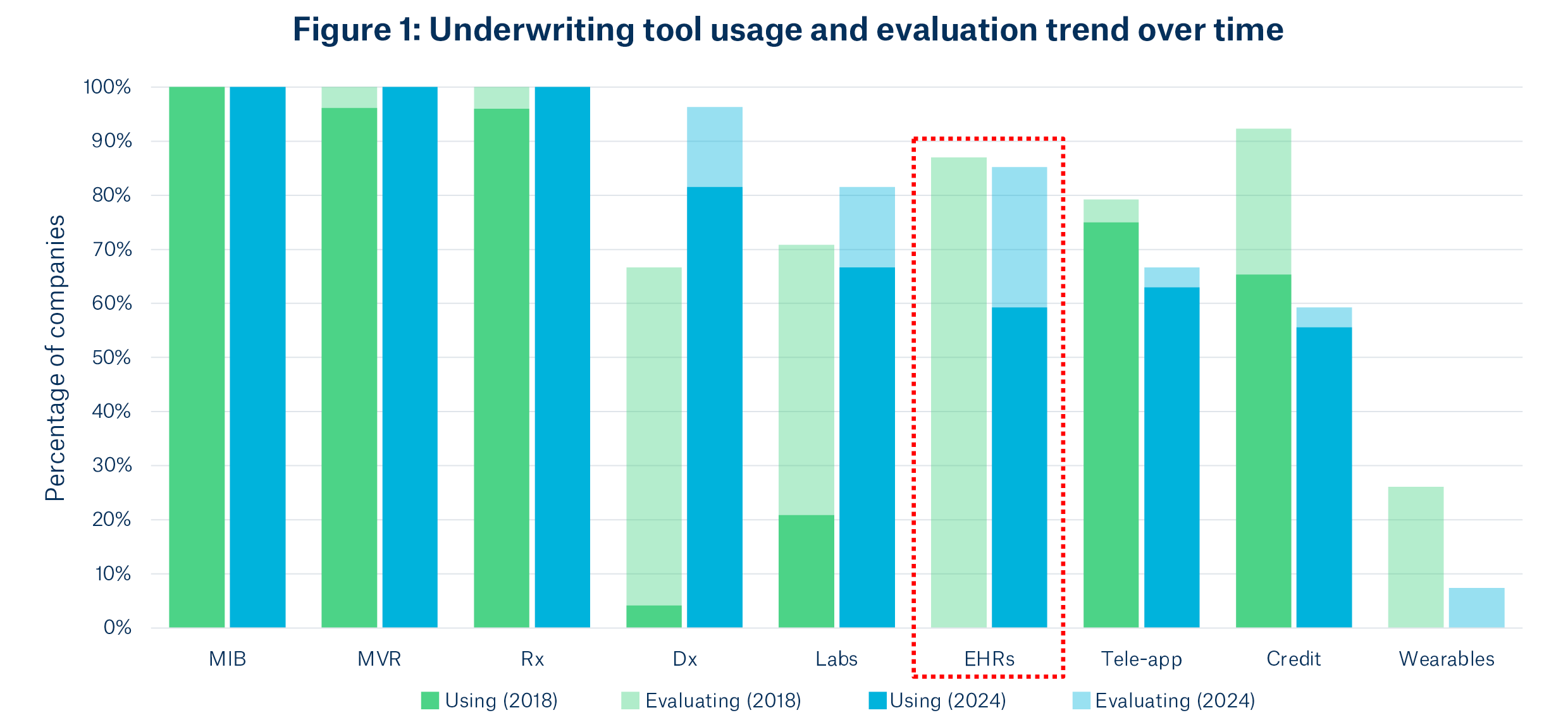

EHR adoption trends

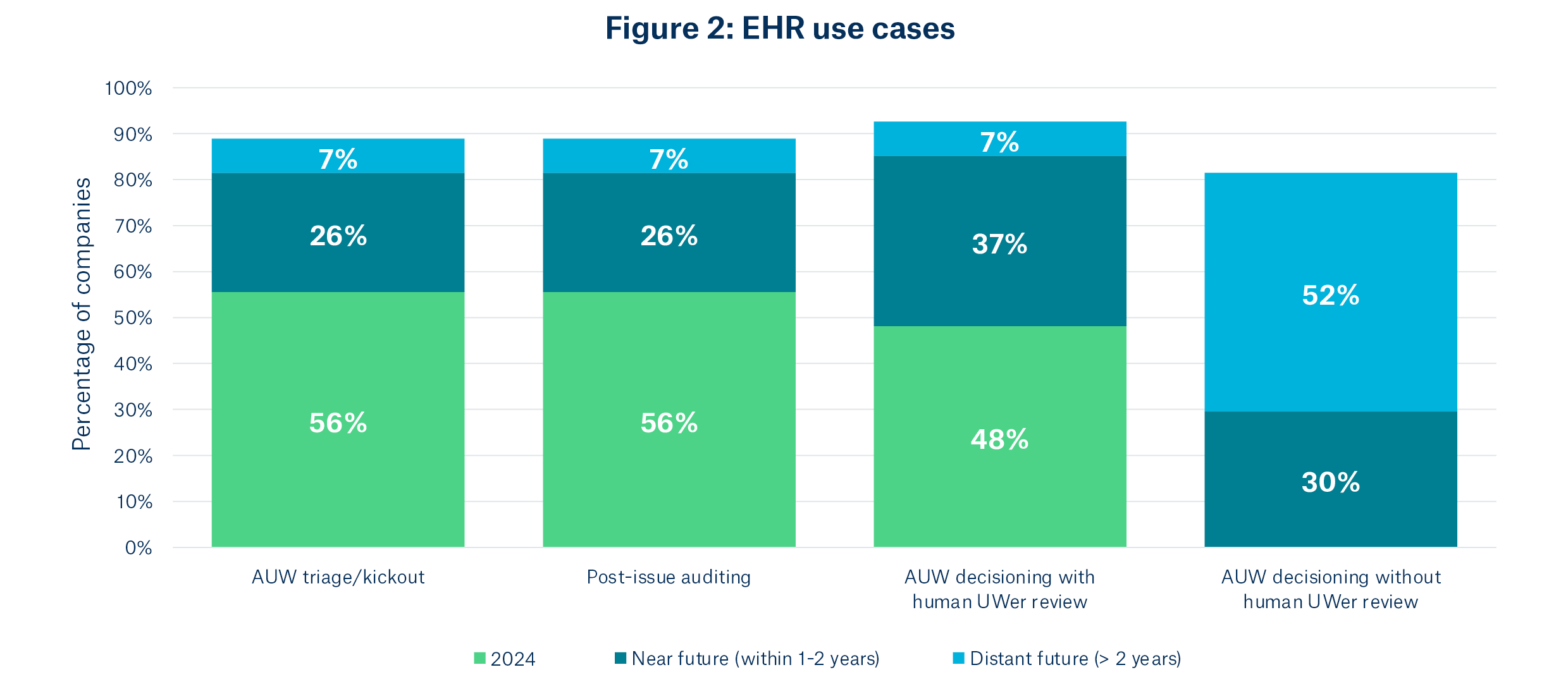

Use cases

One area where there appears to be a lack of progress in EHR usage is in AUW decisioning without human underwriter review. Automated EHR decisioning is clearly on the minds of many carriers, with over 80% of participants reporting this as a future plan, but fewer than half of those carriers consider this a near-term plan within the next 1-2 years.

Part of the reason carriers have yet to reach the stage of decisioning on EHRs without human review may be due to the format in which they are ingesting the data. The Munich Re survey asked the question, “What format does your company currently ingest EHRs and APSs for use in underwriting?” and found that the vast majority of carriers are ingesting these health records in the raw data format (i.e.; human readable PDF output), while a smaller subset of carriers are ingesting APSs and EHRs in a summarized and/or consolidated format. There is clearly a critical need for life insurance carriers to ingest applicant health data digitally within their underwriting processes. Digital ingestion streamlines access to relevant health information, reduces manual processing time and minimizes human errors, ultimately enhancing both customer experience and underwriting outcomes. As the industry continues to evolve, the ability to efficiently ingest and utilize EHR data may be a key differentiator for carriers seeking to remain competitive and responsive to changing market demands.2

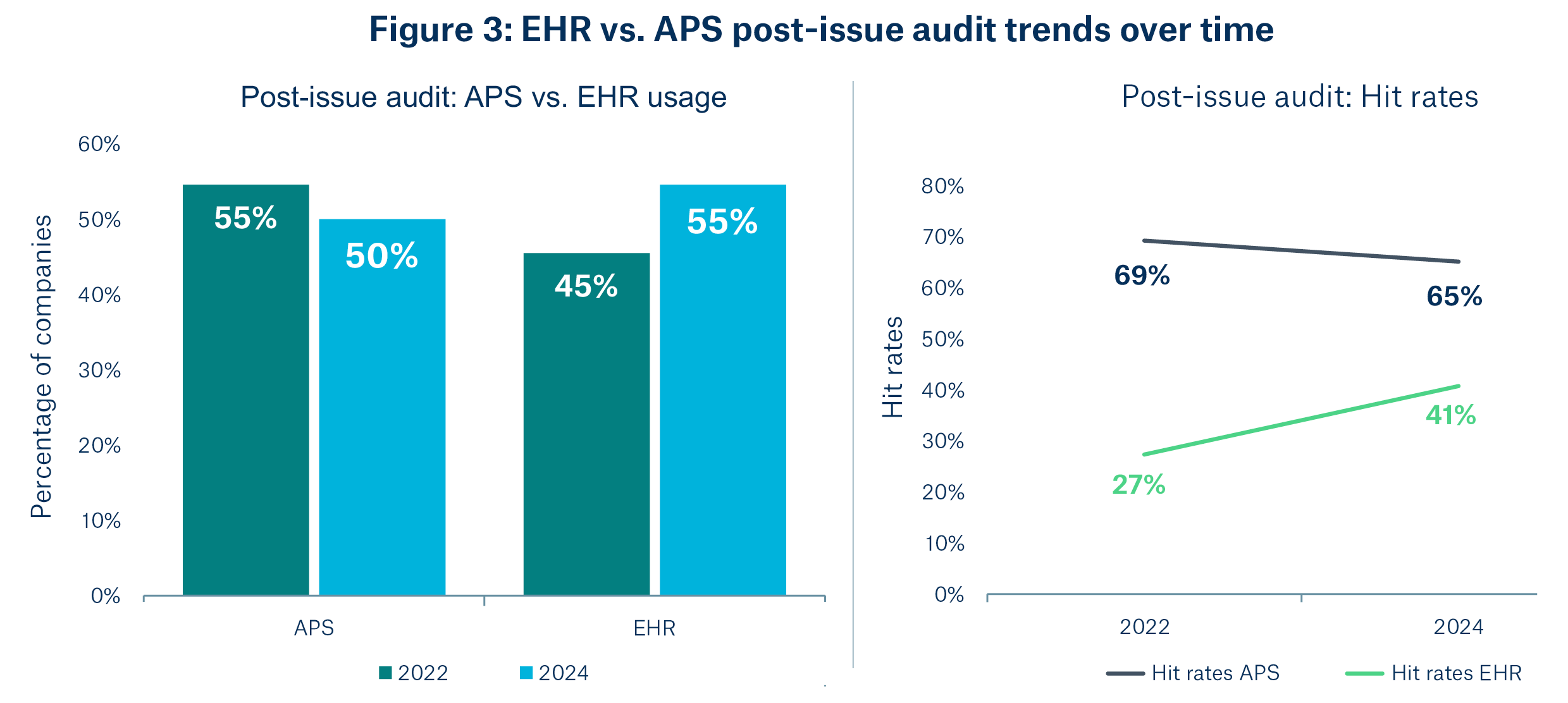

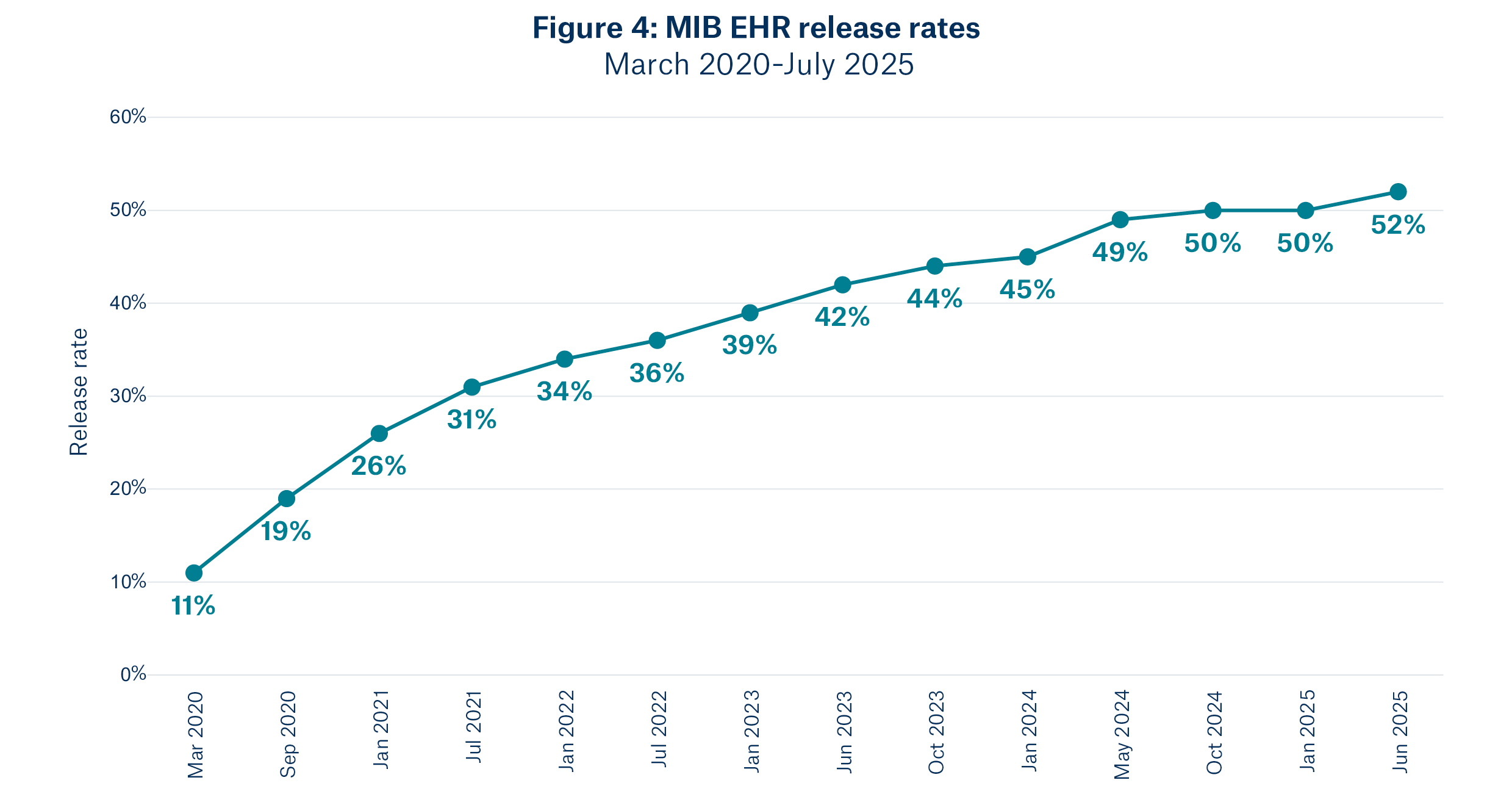

Hit rates have been a key consideration when it comes to incorporating EHRs into underwriting requirements and are often a barrier to more widespread EHR adoption in a front-end underwriting program.3 For that reason, many carriers start with EHRs in the post-issue audit environment, where EHRs are only needed for a fraction of policies. Despite EHRs currently having hit rates below that of APSs, the industry has seen steady progress with increasing EHR hit rates over time, correlating with increased EHR usage in post-issue audits compared to prior survey results, as shown in Figure 3 below.

Challenges and opportunities

Despite growing usage over the past several years, EHRs are still being used in AUW on an occasional basis more often than they are being used in routine underwriting, as confirmed in the 2024 survey results. In addition to the data format and hit rates, there are other challenges that limit EHRs from being utilized to their full potential.

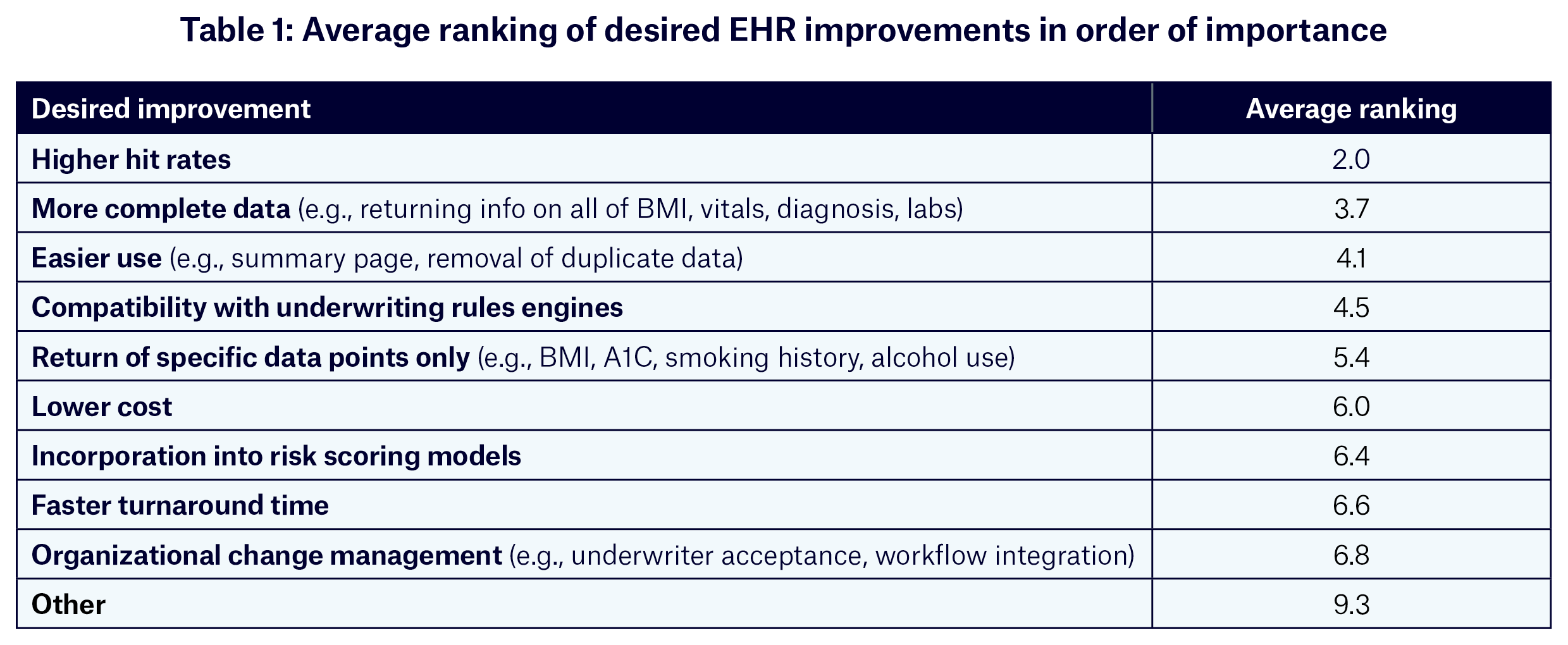

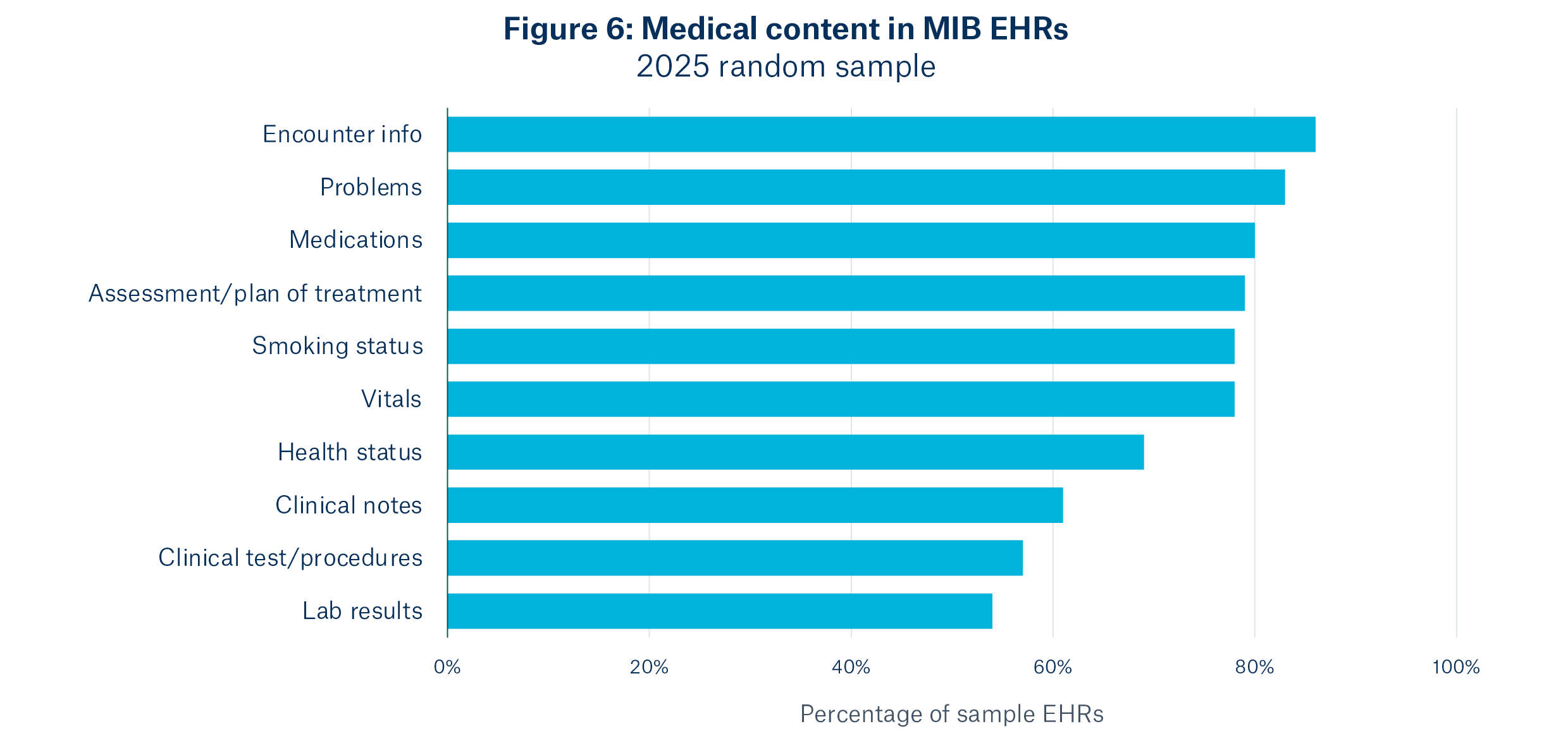

To understand these pain points in more detail, survey participants were asked to rank their desired EHR improvements in order of importance. Results confirmed that having higher hit rates, more complete data, and easier use of the data are still among the top desired EHR enhancements. See Table 1 for a full breakdown of desired EHR improvements based on average rankings provided by participants.

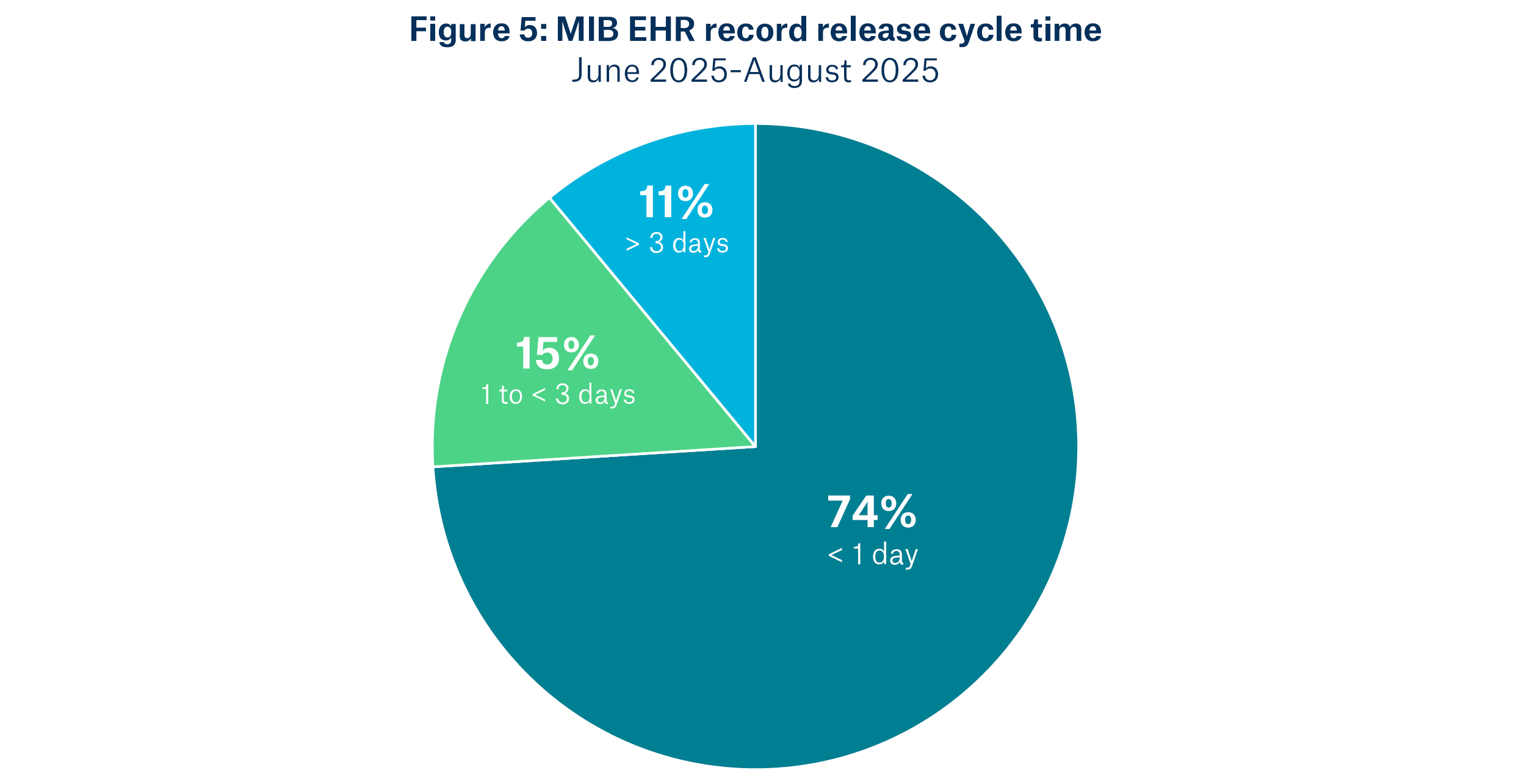

A number of these areas for improvement, including EHR hit (release) rates, data completeness, and turnaround time, will be examined in greater detail using MIB analysis later in this paper.

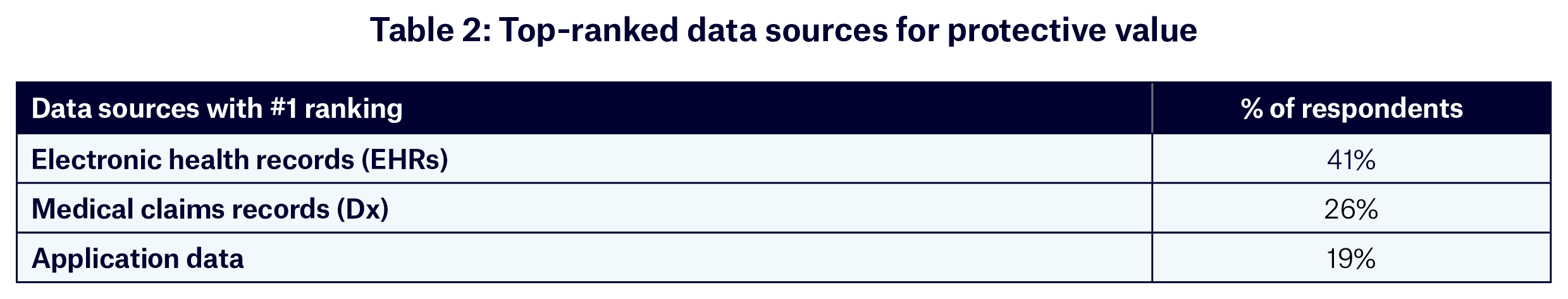

Despite these challenges, carriers seem to have an optimistic outlook on the value of EHRs, as evidenced by the survey participants’ ranking of the data sources in terms of protection against mortality slippage in an AUW program. EHRs received the most #1 protective rankings from over 40% of respondents who see EHRs as the top data source for providing the most protective value against mortality slippage, as shown in Table 2.

MIB data provides additional insight into survey trends

EHR adoption trends

Cycle times

Content quality

Looking ahead

The trends identified in the Munich Re 2024 AUW Survey, reinforced by MIB’s EHR data, underscore the transformative potential of electronic health records in accelerated underwriting. EHRs are driving greater efficiency, protective value, and customer-centricity in the life insurance industry. By leveraging comprehensive health data, carriers can make more informed decisions, reduce processing times, and enhance the overall customer experience.

Munich Re and MIB are committed to leading this evolution. As a global leader in reinsurance, Munich Re continues to set industry standards, driving advancements that shape the future of life insurance risk assessment. MIB brings industry expertise focused solely on improving underwriting, serving as a trusted industry partner to the insurance community for more than a century. By investing in advanced digital solutions and fostering industry-wide collaboration, we can enable new efficiencies, enhance protective value, and deliver superior outcomes for both insurers and policyholders.

References

Contact

Related Solutions

Newsletter

properties.trackTitle

properties.trackSubtitle