Bringing together insurance professionals who are supporting to drive the Asian energy transition

05/07/2025

properties.trackTitle

properties.trackSubtitle

In partnership with the Better Insurance Network, Munich Re Specialty hosted an evening of informative conversation and engaging networking during the SUSTAIN FESTIVAL in Singapore on March 25, 2025.

Hui Yun Boo, CEO and Head of Asia at Munich Re Specialty – Global Markets, Syndicate Asia kicked off the evening with a welcome note before handing over to Julian Richardson, Chief Underwriting Officer for Green Solutions at Munich Re Specialty – Global Markets.

Five decades of research into natural disasters

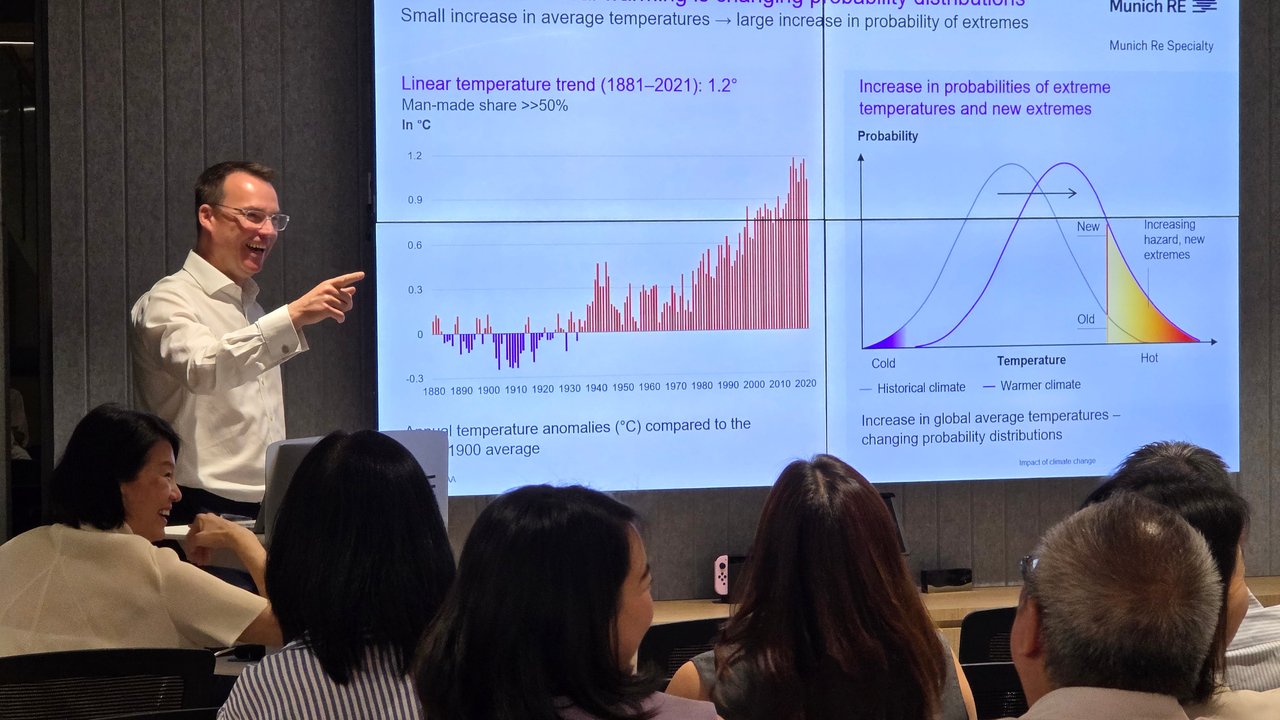

When the rising trend in both overall and insured natural disaster losses first emerged in the 1970s, Munich Re was quick to identify the greater need for expertise in this field. Since then, its experienced scientists and insurance experts have been analysing and assessing the full spectrum of natural hazards, ranging from cyclones, severe thunderstorms and floods to earthquakes and volcanic eruptions. Risk analyses reflecting the current state of scientific knowledge form the basis for risk models, the range of natural hazard covers for our clients and the development of innovative insurance solutions.

Among the wide array of Munich Re solutions on offer, the Syndicate has a growing Green Solutions portfolio designed to serve primary specialty insurance clients. One type of insurance solution, performance guarantees, can help improve the bankability and facilitate the upscaling of renewable energy and energy efficiency technologies like photovoltaic, wind, hydrogen or battery storage and carbon capture.

With annual average temperatures reaching around 1.5°C above pre-industrial levels for the first time, 2024 surpassed the previous record from 2023. This makes the past eleven years the warmest since the beginning of systematic record-keeping.

What is the landscape today?

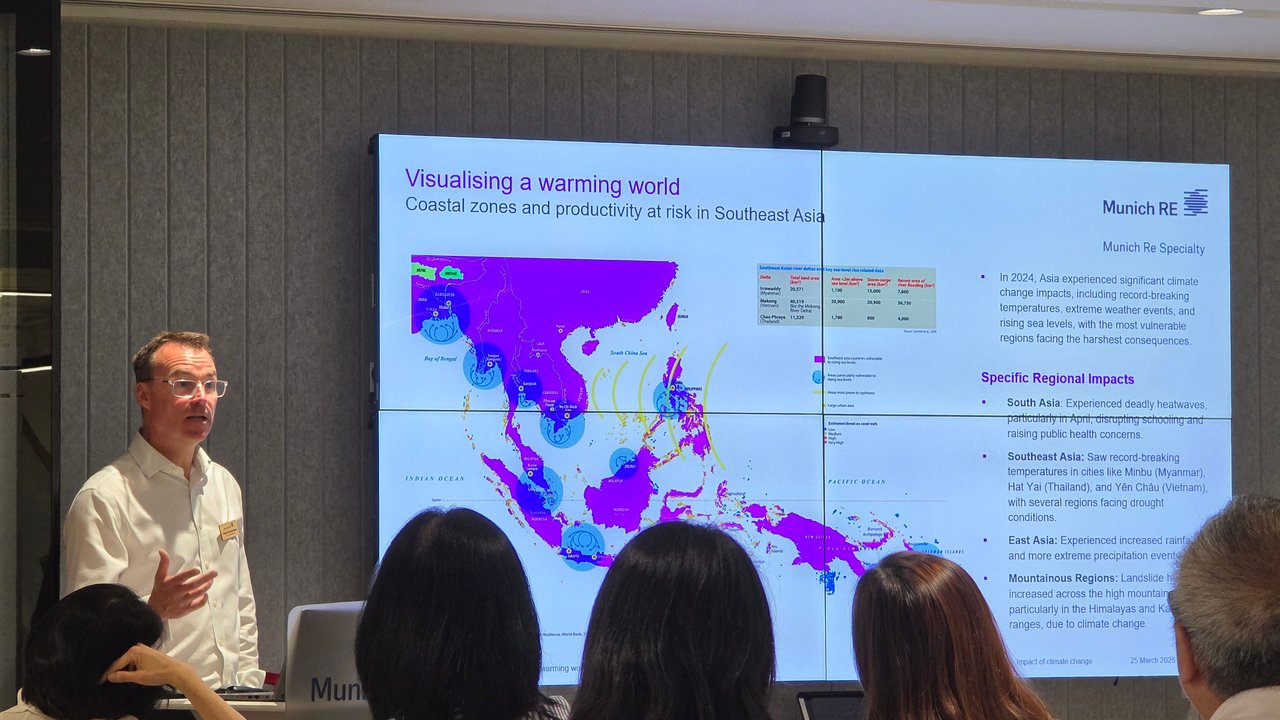

Bringing it closer to the region, he touched on specific regional impacts in Asia, such as deadly heatwaves in South Asia in April, record-breaking temperatures in cities like Minbu (Myanmar), Hat Yai (Thailand), and Ye Chau (Vietnam), and increased rainfall and more extreme precipitation events in East Asia.

Shifting the spotlight, Julian then spoke about the renewable energy market, which saw $1.1 trillion in investment in 2022 (source: Bloomberg). While the amount is substantial, a 4x increase in investment is still needed to make progress in the transition to net zero by 2050.

Climate Finance is a growth opportunity for us in this area, with total market value growing from $200 billion in 2018 to nearly $1 trillion in 2022 (source: Climate Policy Initiative).

In this regard, Munich Re Specialty is positioned to help, with specific business units in Renewable Energy, Green Tech Solutions, Blended Finance, Carbon and Natural Capital and parametric.

Engaging the market perspective

During an engaging panel session which followed Julian’s session, Sam Liu, Head of Renewable Energy, Natural Resources Asia, Willis Towers Watson Brokers, Keith Lee, Director, Natural Resources, Charles Taylor Adjusting and Zheng Hua Low, Technical Underwriter, Renewables, Munich Re Specialty, gave their views on the Asian energy transition from the Broker, Loss Adjuster and Specialty Insurance perspective.

The panellists each shared about their personal journeys into the renewable energy sector and what role they play in the energy transition journey in Asia.

The discussion then shifted to the kind of decarbonisation technologies they saw fit for deployment and ready to be scaled in named Asian markets - Solar, Battery Energy Storage System (BESS), Wind, Hydro, Geothermal, Hydrogen, Compress Natural Gas, as well as what areas the insurance industry look to “de-risk” from a developer, lenders perspective.

Finally, the conversation focused on challenges that are potentially hindering further acceleration of green energy projects, delving onto critical topic areas such as supply chains, original equipment manufacturers (OEMs), Power Purchase Agreements (PPAs), Grid stability, the influence of Natural Catastrophes, the pace of development of new technologies, and the importance of collaboration between all stakeholders.

To host the Better Insurance Network’s only in-person event for Asia during the inaugural Sustain Festival was a delight, and it was fantastic to bring together many of our partners who are committed and diligent professionals in the Asian insurance market. Munich Re Specialty has the expertise and stability aiming to provide solutions to support our clients in the energy transition journey, and I look forward to continue engaging with this community.

Explore the photos from the evening