Munich Re Italia

We lead risk and change

Pioneers in risk management and digital transformation of the insurance industry since 1972

properties.trackTitle

properties.trackSubtitle

Munich Re Italia has expertise in the underwriting of facultative and treaty business Non-Life and Life, complex risks which require high capabilities such as NatCat and niche risks such as cyber and D&O.

In recent years Munich Re Italia has focused on innovation and digitalization, aiming not just on developing new products, but on transforming the entire insurance value chain: from sales to customer experience.

Our strategy

For Munich Re Group, Italy is one of the most important markets in Europe and here in Milan we offer reinsurance solutions, leveraging our strong local expertise and in-depth market knowledge.

Munich Re Italia accompanies future digital champions and existing reinsurance clients to discover and embrace new business models and digital propositions.

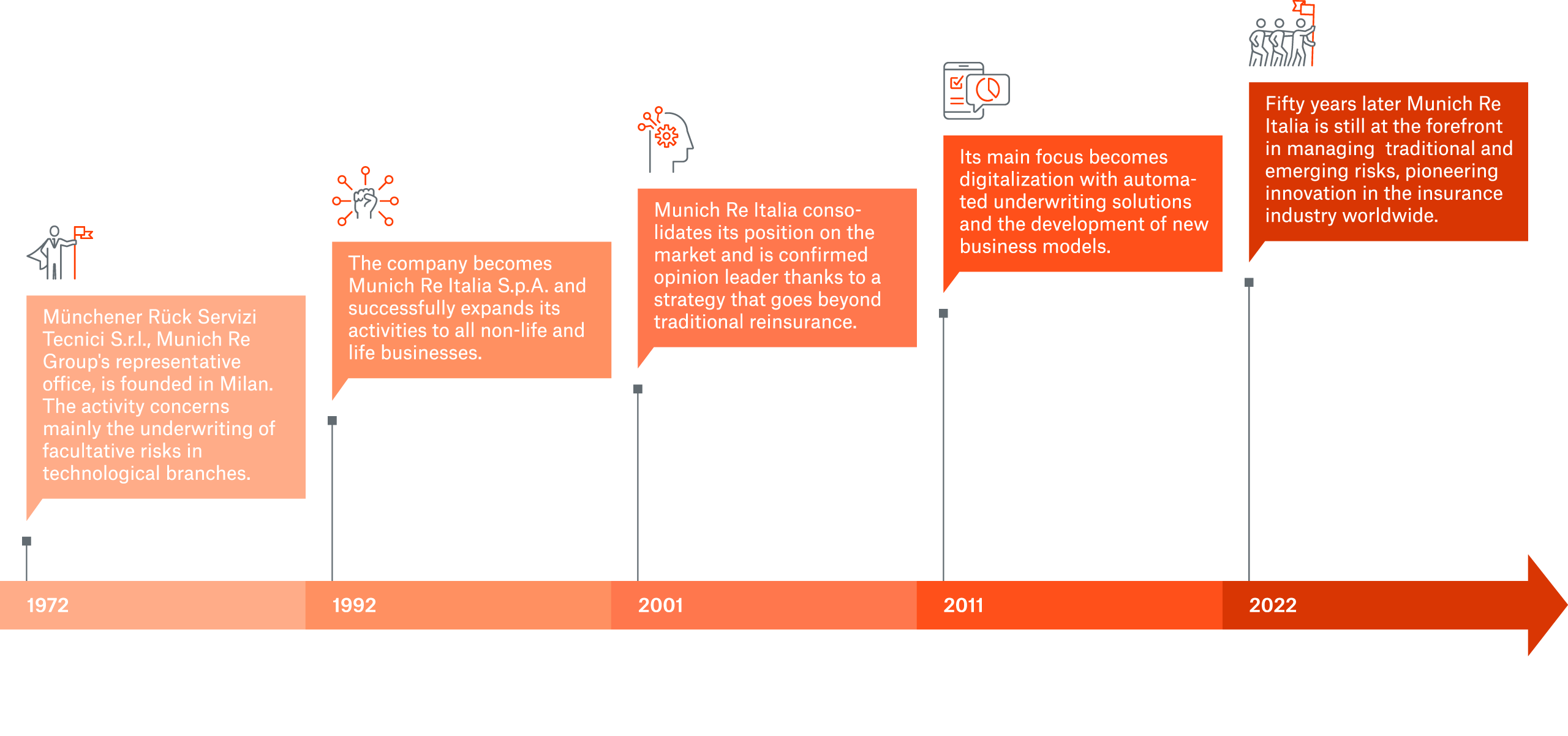

50 years of Munich Re Italia

In 1972 Munich Re Servizi Tecnici S.r.l. was founded in Milan as a representative office of Munich Re Group with the aim of being present and active in the Italian market.

For 50 years we have been at the forefront in managing traditional and emerging risks, pioneering innovation in the insurance industry worldwide.

Munich Re is a key reinsurance partner and trusted advisor to Unipol Group both for traditional reinsurance and ILS solutions. I am delighted to congratulate them on this 50 year milestone and to wish them many more years of continued success.

Munich Re's paradigmatic history in the world of reinsurance reinforces the value of our partnership, which sees the implementation of new technologies and the constant search for product innovation as the key factors for the future of the insurance industry.

Climate change

Climate change is causing an imbalance. In many parts of the world, natural catastrophes are hitting harder and more frequently than ever, impacting countless people – including those least able to recover.

For 50 years, Munich Re has taken a leadership role in combating climate change in order to contribute to a more sustainable world. Today, through credible expertise, innovative solutions, and climate commitments of our own, Munich Re is helping mitigate the risks of climate change, lessening the depletion of natural resources, and ensuring that underserved communities around the world are included in the quest for resiliency.